Question

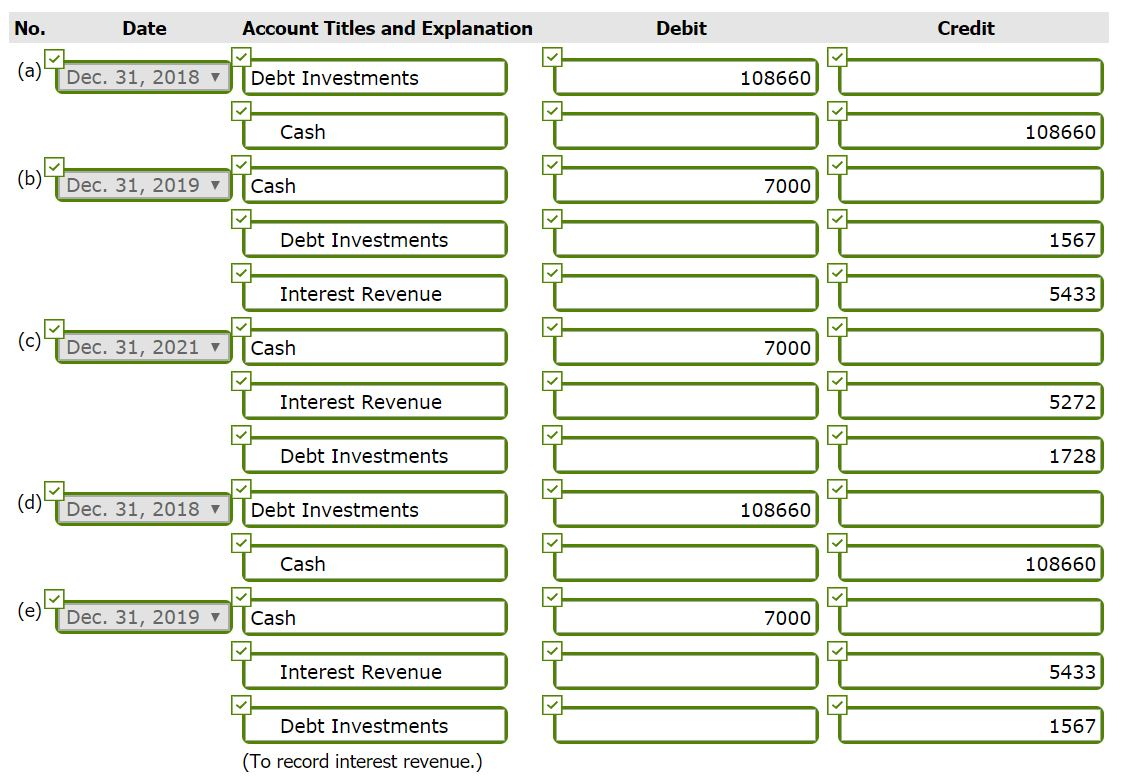

I only need help with the calculations 'To record adjustment' in part f. Presented below is an amortization schedule related to Spangler Companys 5-year, $100,000

I only need help with the calculations 'To record adjustment' in part f.

Presented below is an amortization schedule related to Spangler Companys 5-year, $100,000 bond with a 7% interest rate and a 5% yield, purchased on December 31, 2018, for $108,660.

| Date | Cash Received | Interest Revenue | Bond Premium Amortization | Carrying Amount of Bonds | ||||

|---|---|---|---|---|---|---|---|---|

| 12/31/18 | $108,660 | |||||||

| 12/31/19 | $7,000 | $5,433 | $1,567 | 107,093 | ||||

| 12/31/20 | 7,000 | 5,355 | 1,645 | 105,448 | ||||

| 12/31/21 | 7,000 | 5,272 | 1,728 | 103,720 | ||||

| 12/31/22 | 7,000 | 5,186 | 1,814 | 101,906 | ||||

| 12/31/23 | 7,000 | 5,094 | 1,906 | 100,000 |

The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end.

| 12/31/19 | 12/31/20 | 12/31/21 | 12/31/22 | 12/31/23 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Amortized cost | $107,093 | $105,448 | $103,720 | $101,906 | $100,000 | |||||

| Fair value | $106,500 | $107,500 | $105,650 | $103,000 | $100,000 |

| (a) | Prepare the journal entry to record the purchase of these bonds on December 31, 2018, assuming the bonds are classified as held-to-maturity securities. | |

| (b) | Prepare the journal entry related to the held-to-maturity bonds for 2019. | |

| (c) | Prepare the journal entry related to the held-to-maturity bonds for 2021. | |

| (d) | Prepare the journal entry to record the purchase of these bonds, assuming they are classified as available-for-sale. | |

| (e) | Prepare the journal entries related to the available-for-sale bonds for 2019. | |

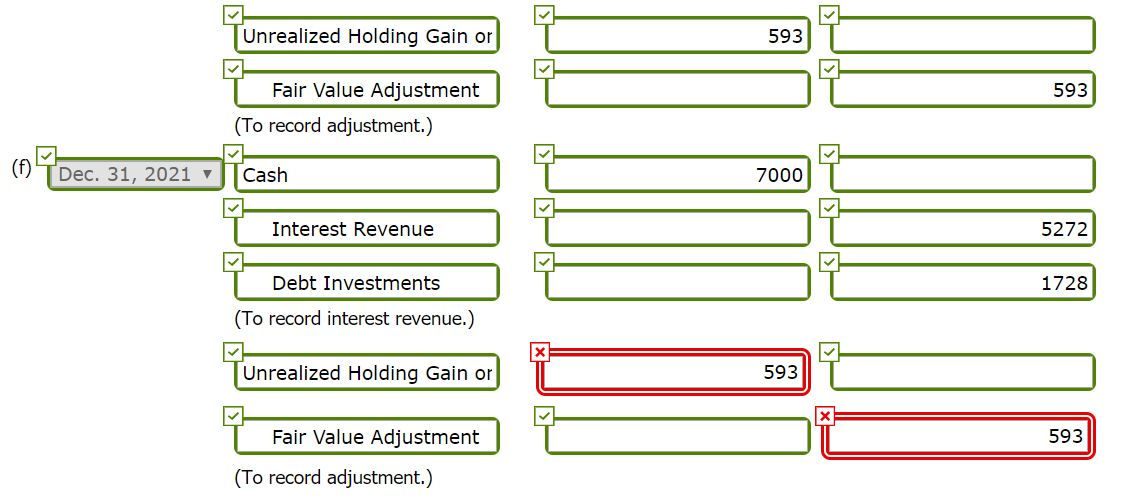

| (f) | Prepare the journal entries related to the available-for-sale bonds for 2021. |

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Note: $593 is incorrect

No. Date Account Titles and Explanation Debit Credit 1086601 (TDec. 31, 2018 Debt Investments T T Cash 108660 (b)*pec. 31, 2019 fash 7000 | Debt Investments 1567] Interest Revenue 5433 Dec. 31, 2021 v Cash 17000 |-- 1 Interest Revenue 5272 T Debt Investments 1728| Dec. 31, 2018, Debt Investments T 108660 T Cash 108660 Dec. 31, 2019 v Cash 7000 ] T Interest Revenue 15433 1567 Debt Investments (To record interest revenue.) Unrealized Holding Gain or 593 593 T Fair Value Adjustment (To record adjustment.) Dec. 31, 2021 Cash 7000 Interest Revenue 5272 | Debt Investments 1728 (To record interest revenue.) x= Unrealized Holding Gain or 593 Fair Value Adjustment 593 (To record adjustment.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started