Answered step by step

Verified Expert Solution

Question

1 Approved Answer

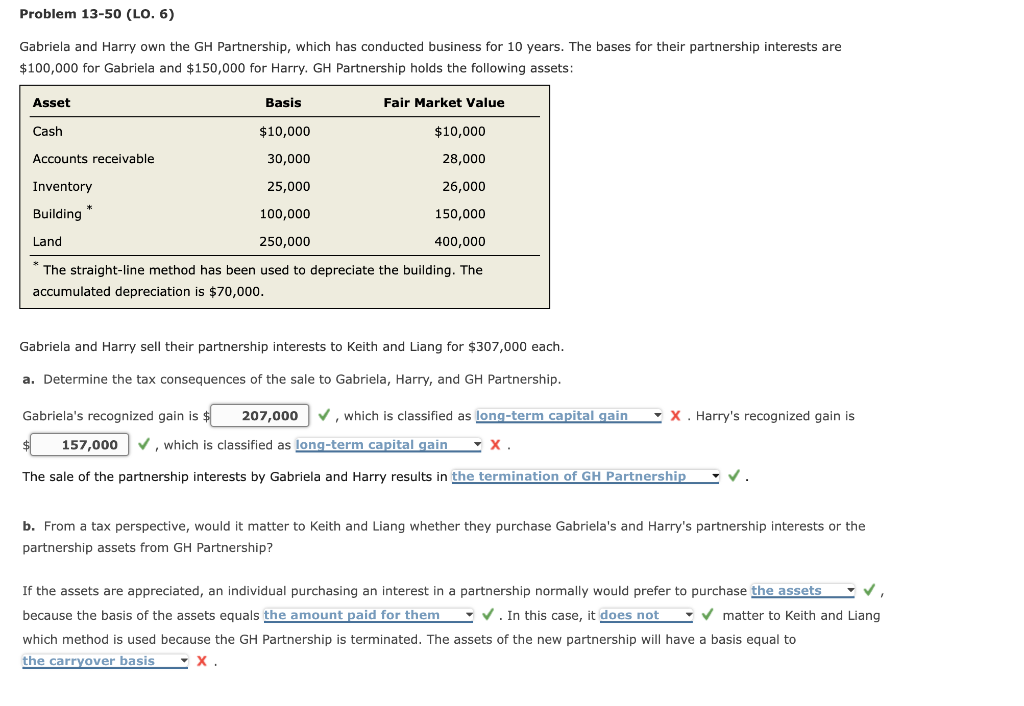

I only need help with the incorrect answers in part a Gabriela's recognized gain is $207,000, which is classified as ____? Drop down options: -a

I only need help with the incorrect answers in part a

Gabriela's recognized gain is $207,000, which is classified as ____? Drop down options:

-a long-term capital gain

-ordinary income

-a part long-term capital gain and part ordinary income

Harry's recognized gain is $157,000, which is classified as ____? Drop down options:

-a long-term capital gain

-ordinary income

-a part long-term capital gain and part ordinary income

Gabriela and Harry own the GH Partnership, which has conducted business for 10 years. The bases for their partnership interests are $100,000 for Gabriela and $150,000 for Harry. GH Partnership holds the following assets: Gabriela and Harry sell their partnership interests to Keith and Liang for $307,000 each. a. Determine the tax consequences of the sale to Gabriela, Harry, and GH Partnership. Gabriela's recognized gain is $, which is classified as X. Harry's recognized gain is , which is classified as . The sale of the partnership interests by Gabriela and Harry results in ! b. From a tax perspective, would it matter to Keith and Liang whether they purchase Gabriela's and Harry's partnership interests or the partnership assets from GH Partnership? If the assets are appreciated, an individual purchasing an interest in a partnership normally would prefer to purchase because the basis of the assets equals . In this case, it matter to Keith and Liang which method is used because the GH Partnership is terminated. The assets of the new partnership will have a basis equal to X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started