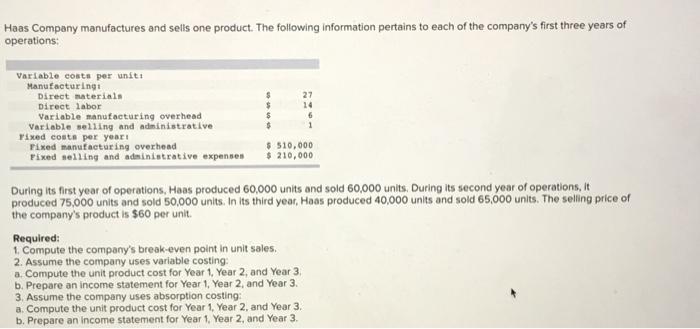

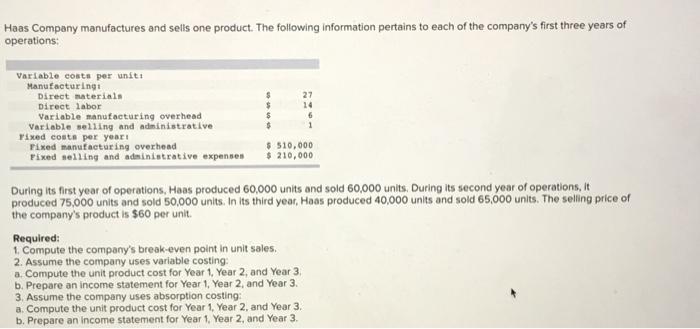

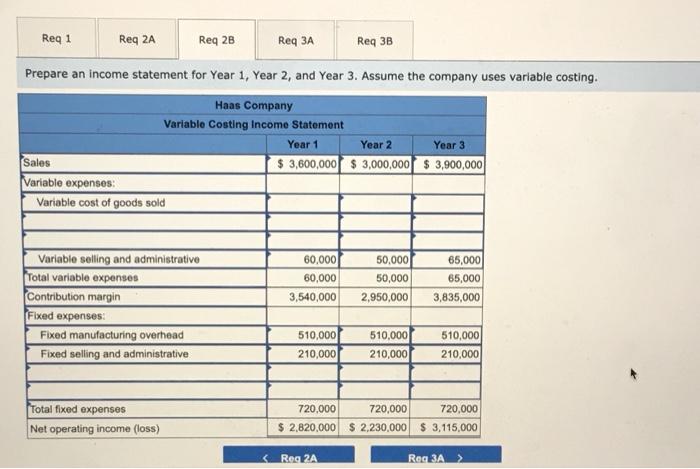

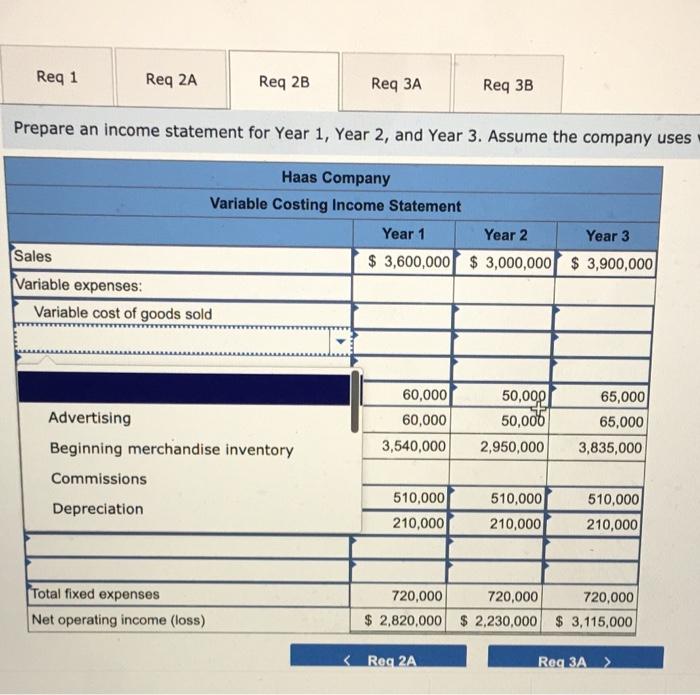

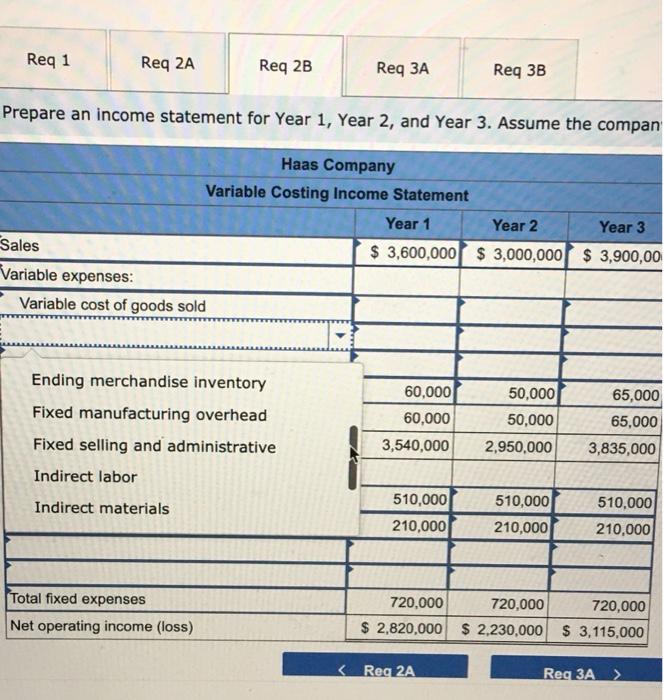

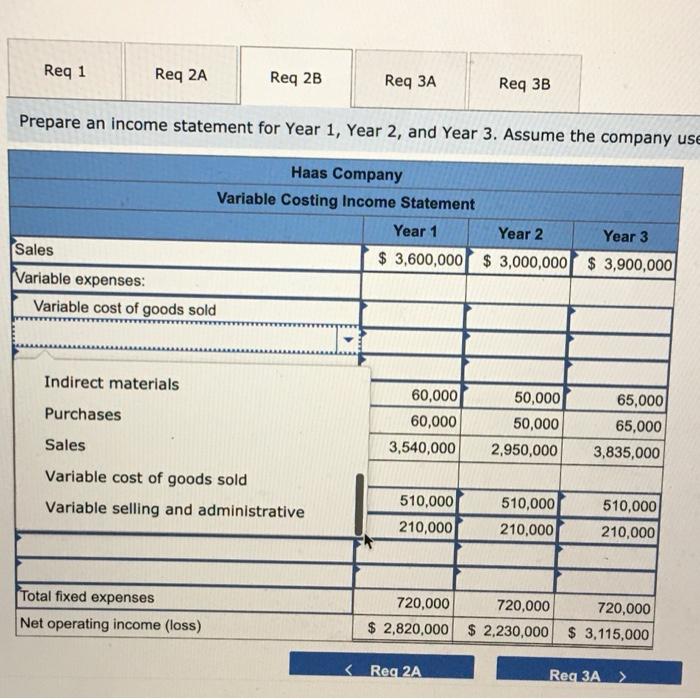

I only need requirement 2B! Fill in what is missing from the terms that are given. Use the format that is given. Show the entire Income statement

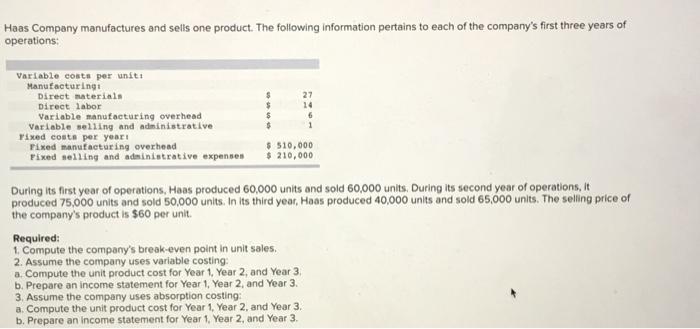

Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations: Variable costs per unit: Manufacturing Direct materiais Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year Fixed manufacturing overhead Fixed selling and administrative expenses $ 510,000 $ 210,000 During its first year of operations, Hans produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 75,000 units and sold 50,000 units. In its third year, Hoas produced 40,000 units and sold 65.000 units. The selling price of the company's product is $60 per unit. Required: 1. Compute the company's break-even point in unit sales. 2. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 Year 2, and Year 3 b. Prepare an income statement for Year 1 Year 2, and Year 3. 3. Assume the company uses absorption costing a. Compute the unit product cost for Year 1 Year 2, and Year 3 b. Prepare an income statement for Year 1 Year 2, and Year 3 Req1 Reg 2A Reg 28 Req Req 3B Prepare an income statement for Year 1 Year 2, and Year 3. Assume the company uses variable costing. Haas Company Variable Costing Income Statement Year 1 Year 2 Year 3 Sales $ 3,600,000 $3,000,000 $ 3,900,000 Variable expenses Variable cost of goods sold 60.000 60,000 3,540,000 50,000 50,000 2,950,000 65,000 65,000 3,835,000 Variable selling and administrative Total variable expenses Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative 510,000 210,000 510,000 210,000 510,000 210,000 Total fixed expenses Net operating income (loss) 720,000 720,000 720,000 $ 2,820,000 $2,230,000 $ 3.115,000 Reg 2A Reg 3A > Reg 1 Req 2A Req 2B Req Req 3B Prepare an income statement for Year 1, Year 2, and Year 3. Assume the company uses Haas Company Variable Costing Income Statement Year 1 Year 2 Year 3 Sales $ 3,600,000 $ 3,000,000 $ 3,900,000 Variable expenses: Variable cost of goods sold Advertising Beginning merchandise inventory Commissions 60,000 60,000 3,540,000 50,000 50,006 2,950,000 65,000 65,000 3,835,000 Depreciation 510,000 210,000 510,000 210,000 510,000 210,000 Total fixed expenses Net operating income (loss) 720,000 720,000 720,000 $ 2,820,000 $ 2,230,000 $ 3,115,000 Req 1 Req 2A Req 2B Req Req 3B Prepare an income statement for Year 1, Year 2, and Year 3. Assume the compan Haas Company Variable Costing Income Statement Year 1 Year 2 Year 3 Sales $ 3,600,000 $ 3,000,000 $ 3,900,00 Variable expenses: Variable cost of goods sold Ending merchandise inventory Fixed manufacturing overhead Fixed selling and administrative 60,000 60,000 3,540,000 50,000 50,000 2,950,000 65,000 65,000 3,835,000 Indirect labor Indirect materials 510,000 210,000 510,000 210,000 510,000 210,000 Total fixed expenses 720,000 720,000 720,000 $ 2,820,000 $ 2.230,000 $ 3.115,000 Net operating income (loss) Reg 2A Reg 3A > Req 1 Req 2A Req 2B Req Req 3B Prepare an income statement for Year 1, Year 2, and Year 3. Assume the company use Haas Company Variable Costing Income Statement Year 1 Year 2 Year 3 Sales $ 3,600,000 $ 3,000,000 $ 3,900,000 Variable expenses: Variable cost of goods sold Indirect materials Purchases 60,000 60,000 3,540,000 50,000 50,000 2,950,000 65,000 65,000 3,835,000 Sales Variable cost of goods sold Variable selling and administrative 510,000 210,000 510,000 210,000 510,000 210,000 Total fixed expenses Net operating income (loss) 720,000 720,000 720,000 $ 2,820,000 $ 2.230,000 $ 3,115,000