Question

I only need the answer for question number three please. below is the text format of the same question just incase if the pics aren't

I only need the answer for question number three please. below is the text format of the same question just incase if the pics aren't clear enough.

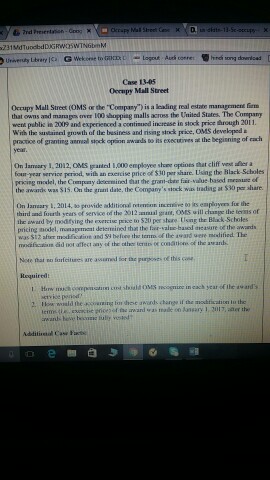

Occupy Mall Street Occupy Mall Street (OMS or the Company) is a leading real estate management firm that owns and manages over 100 shopping malls across the United States. The Company went public in 2009 and experienced a continued increase in stock price through 2011. With the sustained growth of the business and rising stock price, OMS developed a practice of granting annual stock option awards to its executives at the beginning of each year.

On January 1, 2012, OMS granted 1,000 employee share options that cliff vest after a four-year service period, with an exercise price of $30 per share. Using the Black-Scholes pricing model, the Company determined that the grant-date fair-value-based measure of the awards was $15. On the grant date, the Companys stock was trading at $30 per share.

On January 1, 2014, to provide additional retention incentive to its employees for the third and fourth years of service of the 2012 annual grant, OMS will change the terms of the award by modifying the exercise price to $20 per share. Using the Black-Scholes pricing model, management determined that the fair-value-based measure of the awards was $12 after modification and $9 before the terms of the award were modified. The modification did not affect any of the other terms or conditions of the awards.

Note that no forfeitures are assumed for the purposes of this case.

Required:

1. How much compensation cost should OMS recognize in each year of the awards service period?

2. How would the accounting for these awards change if the modification to the terms (i.e., exercise price) of the award was made on January 1, 2017, after the awards have become fully vested?

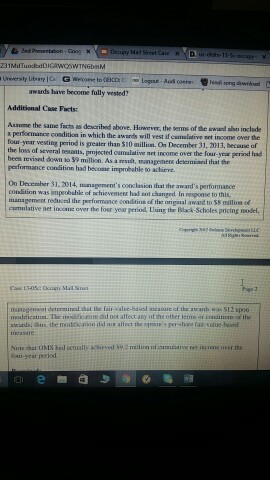

Additional Case Facts:

Assume the same facts as described above. However, the terms of the award also include a performance condition in which the awards will vest if cumulative net income over the four-year vesting period is greater than $10 million. On December 31, 2013, because of the loss of several tenants, projected cumulative net income over the four-year period had been revised down to $9 million. As a result, management determined that the performance condition had become improbable to achieve.

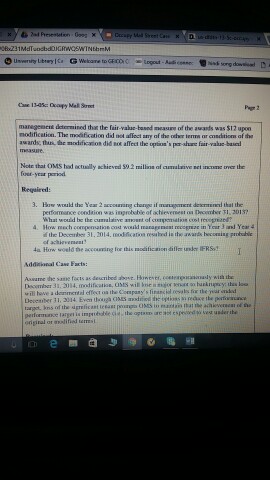

On December 31, 2014, managements conclusion that the awards performance condition was improbable of achievement had not changed. In response to this, management reduced the performance condition of the original award to $8 million of cumulative net income over the four-year period. Using the Black-Scholes pricing model, Case 13-05c: Occupy Mall Street Page 2 Copyright 2012 Deloitte Development LLC All Rights Reserved. management determined that the fair-value-based measure of the awards was $12 upon modification. The modification did not affect any of the other terms or conditions of the awards; thus, the modification did not affect the options per-share fair-value-based measure.

Note that OMS had actually achieved $9.2 million of cumulative net income over the four-year period.

Required: 3. How would the Year 2 accounting change if management determined that the performance condition was improbable of achievement on December 31, 2013? What would be the cumulative amount of compensation cost recognized?

Case 13-05 onrupy Mall Street occupy Mall street oMs or the is a leading real estate management firm "Company") sappiag malls across the United States. The Company that owns and manape public in 2008 and experienced aeontinued increase instock price through 20 with the sustained growth of de business andnsing Price, CMS developed praotoe of granting annwal spokoption awards its executives at the beginning of each 2012. oMEs Earleed looo employee that cliff w ater Nhare. Using the Black Scholes exercise price of S30pr prking monedel, the cnmpany determined trant obre fair value based mranuse the award was sis. On the graai dale, the company's rttck was trading at S30pa 204, provide additional rtrnimm imenive 00 employm for the third and fourth years or service of the 2012 aanual gear. ONES Price S20 per stere determined that basol tieasure awards. d by modrying the term of the award ueve mudified The $12 after modificaiue aid Sg mmifieraian aid anect any of the dhe terns conathore of the award forfeitures are assumed for far purpose this cas4 Required each year of the as aud Case 13-05 onrupy Mall Street occupy Mall street oMs or the is a leading real estate management firm "Company") sappiag malls across the United States. The Company that owns and manape public in 2008 and experienced aeontinued increase instock price through 20 with the sustained growth of de business andnsing Price, CMS developed praotoe of granting annwal spokoption awards its executives at the beginning of each 2012. oMEs Earleed looo employee that cliff w ater Nhare. Using the Black Scholes exercise price of S30pr prking monedel, the cnmpany determined trant obre fair value based mranuse the award was sis. On the graai dale, the company's rttck was trading at S30pa 204, provide additional rtrnimm imenive 00 employm for the third and fourth years or service of the 2012 aanual gear. ONES Price S20 per stere determined that basol tieasure awards. d by modrying the term of the award ueve mudified The $12 after modificaiue aid Sg mmifieraian aid anect any of the dhe terns conathore of the award forfeitures are assumed for far purpose this cas4 Required each year of the as aud

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started