Question

I only need you to work on the very, very last consolidated journal entry of Part A of Required for the above question and/or word

I only need you to work on the very, very last consolidated journal entry of Part A of Required for the above question and/or word problem. The dollar amounts that you must refer to is found on the sentences that are located below the Unadjusted Trial Balance. I am begging you all not to work on any other consolidated journal entry associated with Part A. except for the very last consolidated journal entry.

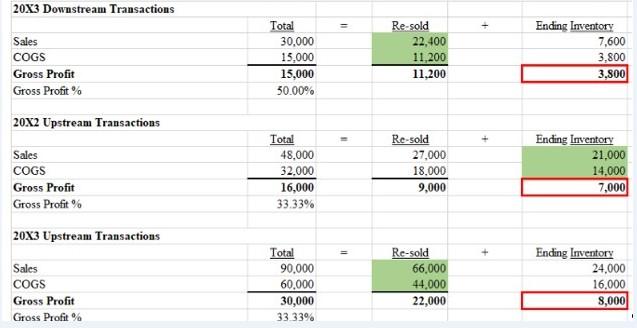

What must I do mathematically and what dollar amounts must I use to get $11,200 and $3,800?

What must I do mathematically and what dollar amounts must I use to get $44,000 and $16,000?

What must I do mathematically and what dollar amounts must I use to get $18,000 and $14,000?

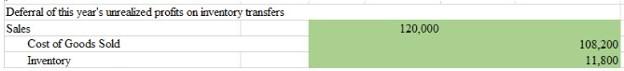

What do I do mathematically and what dollar amounts do I use to get and calculate $108,200 that is associated with Cost of good sold and $11,800 that is associated with Inventory, which appears in the journal entry above?

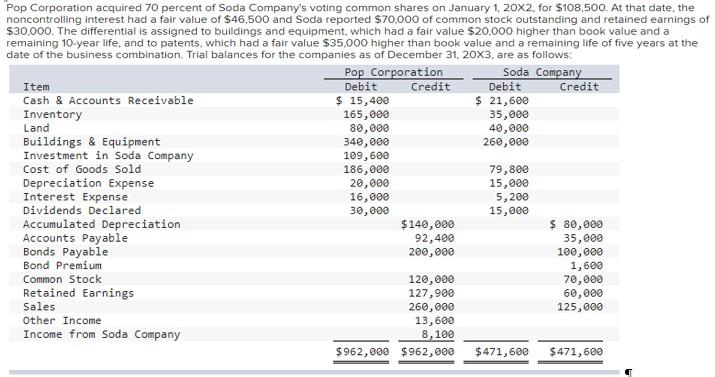

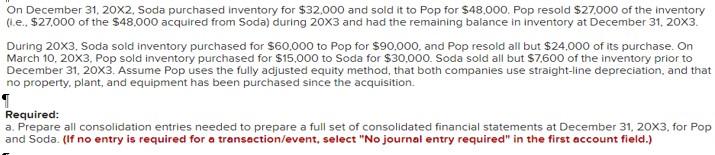

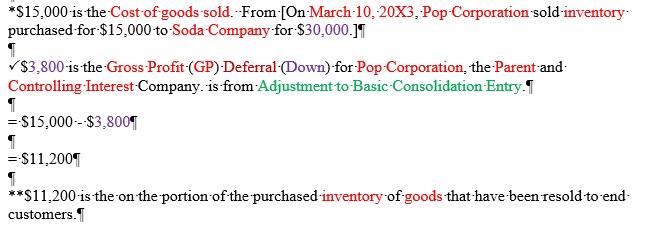

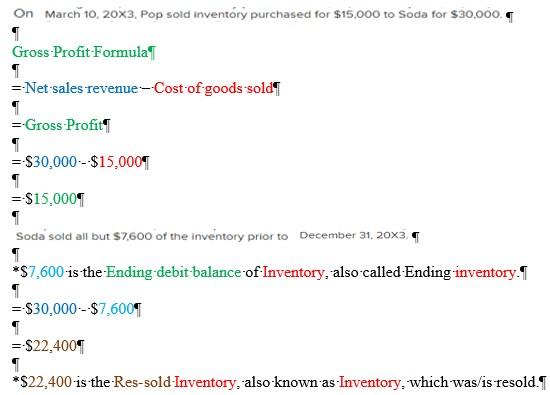

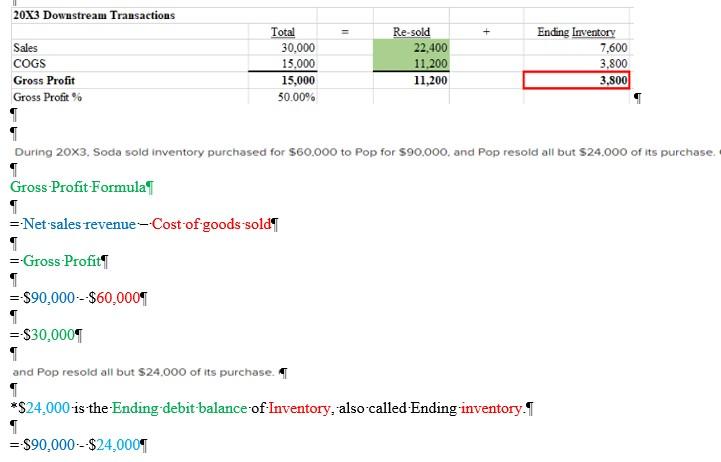

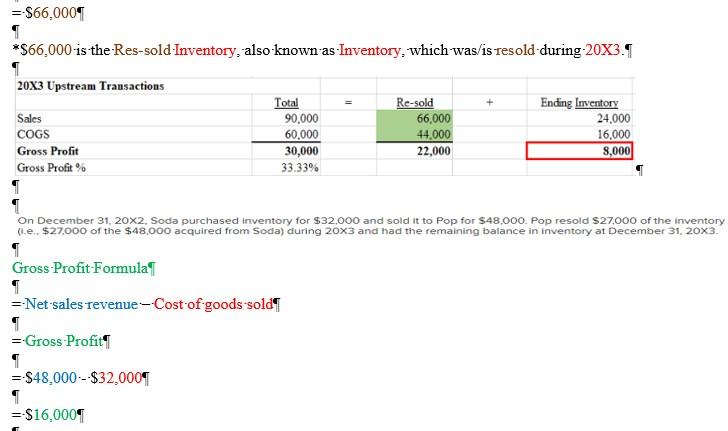

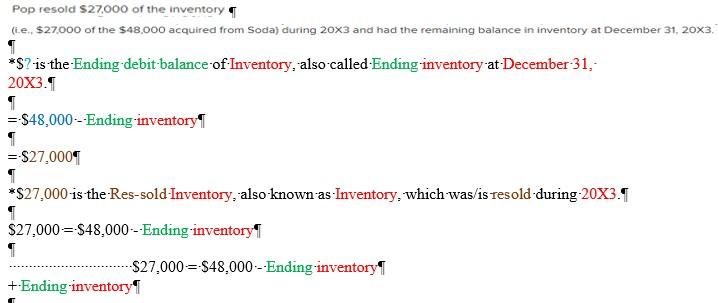

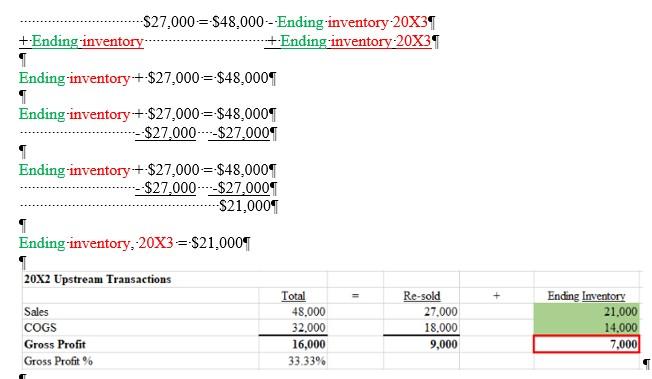

Pop Corporation acquired 70 percent of Soda Company's voting common shares on January 1, 20x2.for $108,500. At that date, the noncontrolling interest had a fair value of $46,500 and Soda reported $70,000 of common stock outstanding and retained earnings of $30,000. The differential is assigned to buildings and equipment, which had a fair value $20,000 higher than book value and a remaining 10-year life, and to patents, which had a fair value $35,000 higher than book value and a remaining life of five years at the date of the business combination. Trial balances for the companies as of December 31, 20X3, are as follows: Pop Corporation Soda Company Item Debit Credit Debit Credit Cash & Accounts Receivable $ 15,400 $ 21,600 Inventory 165,000 35,000 Land 80,000 40,000 Buildings & Equipment 340,000 260,000 Investment in Soda Company 109,600 Cost of Goods Sold 186,000 79,800 Depreciation Expense 20,000 15,000 Interest Expense 16,000 5,200 Dividends Declared 30,000 15,000 Accumulated Depreciation $140,000 $ 80,000 Accounts Payable 92,400 35,000 Bonds Payable 200,000 100,000 Bond Premium 1,600 Common Stock 120,000 70,000 Retained Earnings 127,900 60,000 Sales 260,000 125,000 Other Income 13,600 Income from Soda Company 8,100 $962,000 $962,000 $471,600 $471,600 On December 31, 20x2. Soda purchased inventory for $32,000 and sold it to Pop for $48.000. Pop resold $27.000 of the inventory (Le.. $27,000 of the $48.000 acquired from Soda) during 20x3 and had the remaining balance in inventory at December 31, 20X3. During 20X3. Soda sold inventory purchased for $60,000 to Pop for $90.000, and Pop resold all but $24.000 of its purchase. On March 10, 20X3. Pop sold inventory purchased for $15,000 to Soda for $30,000. Soda sold all but $7.600 of the inventory prior to December 31, 20X3. Assume Pop uses the fully adjusted equity method, that both companies use straight-line depreciation, and that no property, plant, and equipment has been purchased since the acquisition 1 Required: a. Prepare all consolidation entries needed to prepare a full set of consolidated financial statements at December 31, 20X3, for Pop and Soda. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) *$15,000 is the Cost of goods sold. From [On-March 10, 20X3, Pop Corporation-sold-inventory purchased for $15,000 to-Soda Company for $30,000.11 $3,800 is the-Gross-Profit-(GP)-Deferral (Down) for Pop-Corporation, the Parent and Controlling Interest Company. is-from-Adjustment to Basic Consolidation Entry. I =-$15,000-$3,8009 = $11,2009 **$11,200 is the on the portion of the purchased-inventory of goods that have been resold to-end- customers. On March 10. 2003, Pop sold inventory purchased for $15,000 to Soda for $30,000. Gross Profit-Formular =-Net sales revenue--Cost-of goods soldf 1 =-Gross Profit =-$30,000 ---$15,0009 =-$15,0001 Soda sold all but $2,600 of the inventory prior to December 31, 20x3. *$7,600 is the Ending debit balance of Inventory, also called-Ending inventory. I =-$30,000-$7,6009 =-$22,4001 *$22,400 is the Res-sold Inventory, also known as Inventory, which was/is resold. I 20X3 Downstream Transactions + Sales COGS Gross Profit Gross Profit % Total 30,000 15.000 15,000 50.00% Re-sold 22,400 11.200 11,200 Ending Inventory 7.600 3,800 3,800 During 20X3. Soda sold inventory purchased for $60,000 to Pop for $90,000, and Pop resold all but $24.000 of its purchase. Gross Profit Formula =-Net-sales revenue--Cost-of goods sold =-Gross Profit =-$90,000 ---$60,000 = $30,0001 1 and Pop resold all but $24.000 of its purchase 1 *$24.000 is the Ending debit balance of Inventory, also called-Ending inventory. I =-$90,000 ---$24,0009 =-$66,0001 *$66,000 is the Res-sold-Inventory, also known as Inventory, which was/is resold during 20X3.1 20x3 Upstream Transactions Sales COGS Gross Profit Gross Profit % Total 90.000 60,000 30,000 33.33% Re-sold 66,000 44.000 22,000 Ending Inventory 24,000 16,000 8,000 On December 31, 20x2. Soda purchased Inventory for $32,000 and sold it to Pop for $48.000. Pop resold S27,000 of the inventory (1.e. $27,000 of the $48 acquired from Soda) during 20x3 an the rer aining be nce inventory at December 31, 20X3. ha Gross-Profit Formula =-Net-sales revenue--Cost of goods soldf =-Gross Profit 1 =-$48,000-$32,000 =-$16,0001 Pop resold $27,000 of the inventory (i.e., $27.000 of the $48,000 acquired from Soda) during 20x3 and had the remaining balance in inventory at December 31, 20x3. *$? is the Ending debit-balance of Inventory, also called Ending inventory at December 31, 20x3.1 =-$48,000---Ending-inventory = $27,000 *$27,000 is the-Res-sold-Inventory, also known as Inventory, which was/is resold-during-20X3.1 $27,000 = $48,000 ---Ending inventory $27,000 = $48,000---Ending inventory +Ending inventory --$27,000=-548,000---Ending inventory-20x39 +Ending-inventory +Ending-inventory-20X3 Ending-inventory+$27,000-=-$48.000 1 Ending-inventory+-$27,000-=$48,0009 --$27.000-----$27,000 Ending-inventory+-$27,000=-$48,000 --$27,000 --- $27,0001 $21,0001 Ending inventory, 20X3 =$21,0009 1 20x2 Upstream Transactions Sales COGS Gross Profit Gross Profit % Total 48.000 32.000 16,000 33.33% Re-sold 27,000 18.000 9,000 Ending Inventory 21.000 14.000 7.000 20X3 Downstream Transactions Sales COGS Gross Profit Gross Profit % Total 30,000 15,000 15,000 50.00% Re-sold 22,400 11,200 11,200 Ending Inventory 7,600 3,800 3,800 20x2 Upstream Transactions Sales COGS Gross Profit Gross Profit % Total 48,000 32.000 16,000 33.33% Re-sold 27,000 18.000 9,000 Ending Inventory 21,000 14.000 7,000 20x3 Upstream Transactions Sales COGS Gross Profit Gross Profit % Total 90,000 60.000 30,000 33.33% Re-sold 66,000 44,000 22,000 Ending Inventory 24,000 16.000 8,000 120.000 Deferral of this year's unrealized profits on inventory transfers Sales Cost of Goods Sold Inventory 108,200 11,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started