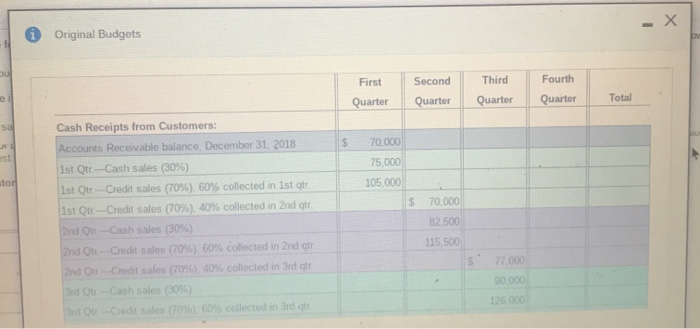

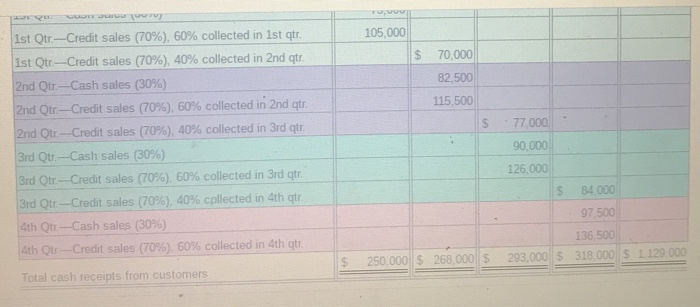

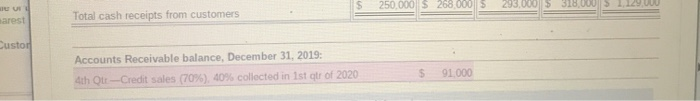

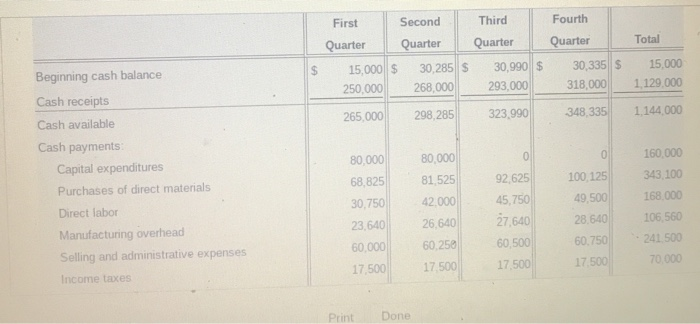

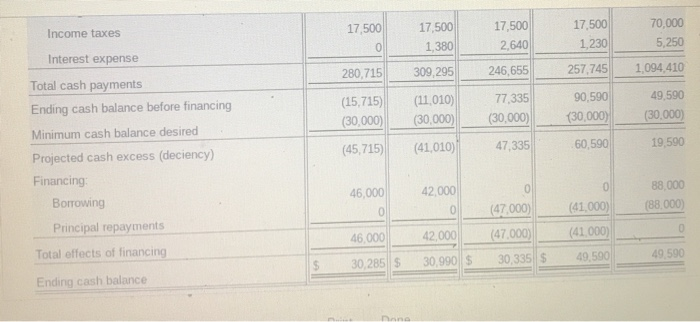

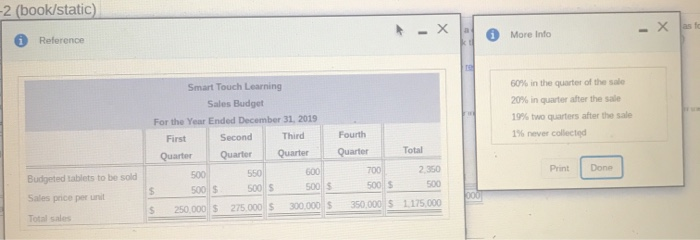

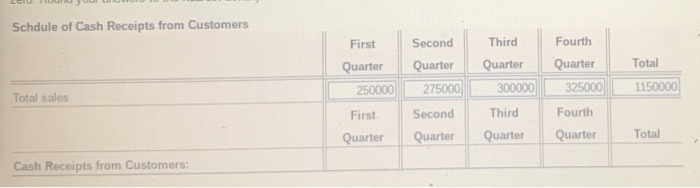

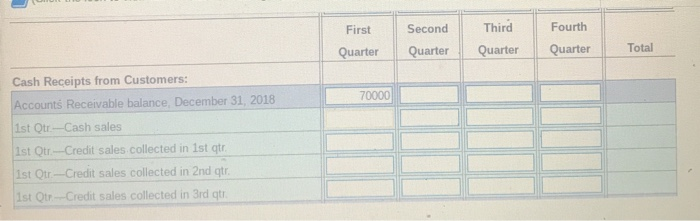

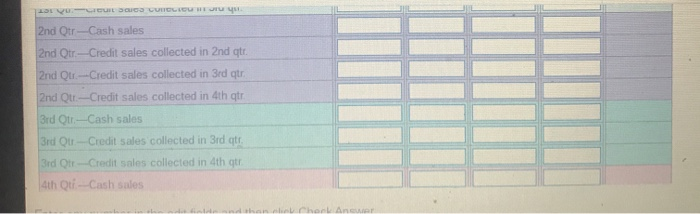

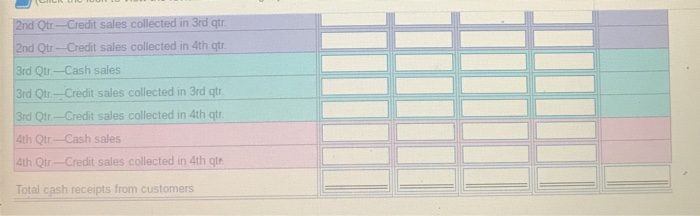

i Original Budgets First Second Third Fourth Quarter Quarter Quarter Quarter Total st 70.000 75.000 105,000 tor Cash Receipts from Customers: Accounts Receivable balance. December 31, 2018 1st Qtr-Cash sales (30%) 1st Out Credit sales (70%), 60% collected in 1st at 1st Qur-Credit sales (70%), 40% collected in 2nd qtr. 2nd Qu ---Cash sales (30%) 2nd Out - Credit sales (70%), 60% collected in 2nd qur 2nd Credit sales (70%), 40% collected in 3rd at 3rd Qu Cash sales (30%) Brdou - Creditsas (70%) 0 collected in 3rd att 70,000 82.500 115,500 77.000 126 000 er or 105,000 $ 70,000 82,500 115,500 $ 1st Qtr.-Credit sales (70%), 60% collected in 1st qtr. 1st Qtr-Credit sales (70%), 40% collected in 2nd qtr. 2nd Qur-Cash sales (30%) 2nd Qir-Credit sales (70%). 60% collected in 2nd qtr. 2nd Qir--Credit sales (70%), 40% collected in 3rd qtr. 3rd Qur. - Cash sales (30%) 3rd Qtr.-Credit sales (70%), 60% collected in 3rd qtr. 3rd Qtr - Credit sales (70%), 40% collected in 4th qtr. 4th Qtr-Cash sales (30%) 4th Qur-Credit sales (70%), 60% collected in 4th qtr. Total cash receipts from customers 77,000 90,000 126,000 $ 84.000 97,500 136,500 318.000 250,000 $268.000 $ 293,000 $ 250,000 $268.00 TU arest Total cash receipts from customers Custoi Accounts Receivable balance, December 31, 2019: 4th Qu --Credit sales (70%), 40% collected in 1st que of 2020 $ 91,000 Fourth Quarter Total Third Quarter 30,990$ 293,000 323,990 Beginning cash balance First Second Quarter Quarter 15,000$ 30,285 $ 250,000 268,000 265,000 298,285 30,335 $ 318.000 348,335 15,000 1.129.000 1.144.000 Cash receipts Cash available Cash payments Capital expenditures Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses Income taxes 80,000 68,825 30,750 23,640 60,000 17,500 80,000 81,525 42.000 26,640 60,250 17.500 0 92,625 45,750 27,640 60,500 0 100,125 49,500 28,640 60.750 17.500 160.000 343.100 168.000 106,560 - 241.500 70.000 17,500 Print Done Income taxes 17,500 17,500 1,380 17,500 2,640 246,655 70,000 5,250 Interest expense 280,715 309,295 1.094,410 Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (deciency) 17,500 1,230 257,745 90,590 (30.000) 60,590 (15,715) (30,000) (45,715) (11.010) (30,000) (41,010) 77,335 (30,000) 47,335 49,590 (30,000) 19,590 Financing Borrowing 46,000 42,000 88,000 (88,000) (47,000) (41.000) Principal repayments 46,000 42,000 (47.000) (41000) Total effects of financing 30.285 $ 49 590 30,990 $ 30,335 $ 49,590 Ending cash balance -2 (book/static) - X * as to -X More Info i Reference 60% in the quarter of the sale 20% in quarter after the sale 19% two quarters after the sale 1% never collected Smart Touch Learning Sales Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter 500 550 500 $ 500S 500 5 250.000 $ 275.000 $ 300.000 $ Fourth Quarter Total 700 Print Done 500S Budgeted tablets to be sold Sales price per unit 2.350 500 1175.000 350,000 $ Total sales Schdule of Cash Receipts from Customers First Quarter 250000 Second Quarter 275000) Third Quarter 300000 Fourth Quarter 325000 Total 1150000 Total sales First Second Quarter Third Quarter Fourth Quarter Quarter Total Cash Receipts from Customers: First Second Quarter Third Quarter Fourth Quarter Quarter Total 70000 Cash Receipts from Customers: Accounts Receivable balance, December 31, 2018 1st Qtr-Cash sales Ist Otr --Credit sales collected in 1st qtr. Ist Otr --Credit sales collected in 2nd qtr. Ist Otr-Credit sales collected in 3rd qtr. TSL VUUGU SO LELUHU 2nd Qtr-Cash sales 2nd Qtr.---Credit sales collected in 2nd qtr. 2nd Q.-Credit sales collected in 3rd qtr 2nd Qu-Credit sales collected in 4th qtr 3rd Qur-Cash sales 3rd Qui - Credit sales collected in 3rd qtr. 3rd Q ---Credit sales collected in 4th qtr 4th Qti --Cash sales CILI U TUUM IU 2nd Otr-Credit sales collected in 3rd qtr. 2nd Qtr --Credit sales collected in 4th qtr. 3rd Qur-Cash sales 3rd Qir ---Credit sales collected in 3rd qtr. 3rd Qtr --Credit sales collected in 4th qtr. 4th Qtr-Cash sales 4th Qir. ---Credit sales collected in 4th qtr. Total cash receipts from customers i Original Budgets First Second Third Fourth Quarter Quarter Quarter Quarter Total st 70.000 75.000 105,000 tor Cash Receipts from Customers: Accounts Receivable balance. December 31, 2018 1st Qtr-Cash sales (30%) 1st Out Credit sales (70%), 60% collected in 1st at 1st Qur-Credit sales (70%), 40% collected in 2nd qtr. 2nd Qu ---Cash sales (30%) 2nd Out - Credit sales (70%), 60% collected in 2nd qur 2nd Credit sales (70%), 40% collected in 3rd at 3rd Qu Cash sales (30%) Brdou - Creditsas (70%) 0 collected in 3rd att 70,000 82.500 115,500 77.000 126 000 er or 105,000 $ 70,000 82,500 115,500 $ 1st Qtr.-Credit sales (70%), 60% collected in 1st qtr. 1st Qtr-Credit sales (70%), 40% collected in 2nd qtr. 2nd Qur-Cash sales (30%) 2nd Qir-Credit sales (70%). 60% collected in 2nd qtr. 2nd Qir--Credit sales (70%), 40% collected in 3rd qtr. 3rd Qur. - Cash sales (30%) 3rd Qtr.-Credit sales (70%), 60% collected in 3rd qtr. 3rd Qtr - Credit sales (70%), 40% collected in 4th qtr. 4th Qtr-Cash sales (30%) 4th Qur-Credit sales (70%), 60% collected in 4th qtr. Total cash receipts from customers 77,000 90,000 126,000 $ 84.000 97,500 136,500 318.000 250,000 $268.000 $ 293,000 $ 250,000 $268.00 TU arest Total cash receipts from customers Custoi Accounts Receivable balance, December 31, 2019: 4th Qu --Credit sales (70%), 40% collected in 1st que of 2020 $ 91,000 Fourth Quarter Total Third Quarter 30,990$ 293,000 323,990 Beginning cash balance First Second Quarter Quarter 15,000$ 30,285 $ 250,000 268,000 265,000 298,285 30,335 $ 318.000 348,335 15,000 1.129.000 1.144.000 Cash receipts Cash available Cash payments Capital expenditures Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses Income taxes 80,000 68,825 30,750 23,640 60,000 17,500 80,000 81,525 42.000 26,640 60,250 17.500 0 92,625 45,750 27,640 60,500 0 100,125 49,500 28,640 60.750 17.500 160.000 343.100 168.000 106,560 - 241.500 70.000 17,500 Print Done Income taxes 17,500 17,500 1,380 17,500 2,640 246,655 70,000 5,250 Interest expense 280,715 309,295 1.094,410 Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (deciency) 17,500 1,230 257,745 90,590 (30.000) 60,590 (15,715) (30,000) (45,715) (11.010) (30,000) (41,010) 77,335 (30,000) 47,335 49,590 (30,000) 19,590 Financing Borrowing 46,000 42,000 88,000 (88,000) (47,000) (41.000) Principal repayments 46,000 42,000 (47.000) (41000) Total effects of financing 30.285 $ 49 590 30,990 $ 30,335 $ 49,590 Ending cash balance -2 (book/static) - X * as to -X More Info i Reference 60% in the quarter of the sale 20% in quarter after the sale 19% two quarters after the sale 1% never collected Smart Touch Learning Sales Budget For the Year Ended December 31, 2019 First Second Third Quarter Quarter Quarter 500 550 500 $ 500S 500 5 250.000 $ 275.000 $ 300.000 $ Fourth Quarter Total 700 Print Done 500S Budgeted tablets to be sold Sales price per unit 2.350 500 1175.000 350,000 $ Total sales Schdule of Cash Receipts from Customers First Quarter 250000 Second Quarter 275000) Third Quarter 300000 Fourth Quarter 325000 Total 1150000 Total sales First Second Quarter Third Quarter Fourth Quarter Quarter Total Cash Receipts from Customers: First Second Quarter Third Quarter Fourth Quarter Quarter Total 70000 Cash Receipts from Customers: Accounts Receivable balance, December 31, 2018 1st Qtr-Cash sales Ist Otr --Credit sales collected in 1st qtr. Ist Otr --Credit sales collected in 2nd qtr. Ist Otr-Credit sales collected in 3rd qtr. TSL VUUGU SO LELUHU 2nd Qtr-Cash sales 2nd Qtr.---Credit sales collected in 2nd qtr. 2nd Q.-Credit sales collected in 3rd qtr 2nd Qu-Credit sales collected in 4th qtr 3rd Qur-Cash sales 3rd Qui - Credit sales collected in 3rd qtr. 3rd Q ---Credit sales collected in 4th qtr 4th Qti --Cash sales CILI U TUUM IU 2nd Otr-Credit sales collected in 3rd qtr. 2nd Qtr --Credit sales collected in 4th qtr. 3rd Qur-Cash sales 3rd Qir ---Credit sales collected in 3rd qtr. 3rd Qtr --Credit sales collected in 4th qtr. 4th Qtr-Cash sales 4th Qir. ---Credit sales collected in 4th qtr. Total cash receipts from customers