Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement : a)Calculate the lease liability b)Prepare a lease schedule On 1 July 2023, Ringwood Ltd entered into a non-cancellable lease contract to lease office

Requirement :

a)Calculate the lease liability

b)Prepare a lease schedule

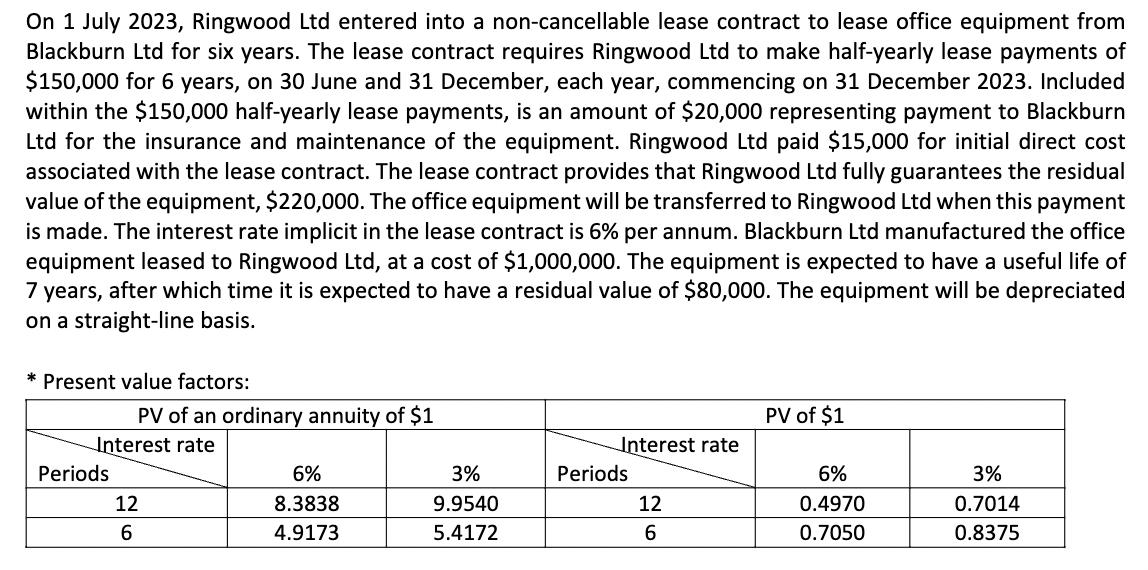

On 1 July 2023, Ringwood Ltd entered into a non-cancellable lease contract to lease office equipment from Blackburn Ltd for six years. The lease contract requires Ringwood Ltd to make half-yearly lease payments of $150,000 for 6 years, on 30 June and 31 December, each year, commencing on 31 December 2023. Included within the $150,000 half-yearly lease payments, is an amount of $20,000 representing payment to Blackburn Ltd for the insurance and maintenance of the equipment. Ringwood Ltd paid $15,000 for initial direct cost associated with the lease contract. The lease contract provides that Ringwood Ltd fully guarantees the residual value of the equipment, $220,000. The office equipment will be transferred to Ringwood Ltd when this payment is made. The interest rate implicit in the lease contract is 6% per annum. Blackburn Ltd manufactured the office equipment leased to Ringwood Ltd, at a cost of $1,000,000. The equipment is expected to have a useful life of 7 years, after which time it is expected to have a residual value of $80,000. The equipment will be depreciated on a straight-line basis. * Present value factors: PV of an ordinary annuity of $1 Interest rate Periods 12 6 6% 8.3838 4.9173 3% 9.9540 5.4172 Interest rate Periods 12 6 PV of $1 6% 0.4970 0.7050 3% 0.7014 0.8375

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Lease Liability The lease liability is the present value of the minimum lease payments over the leas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started