Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I posted part one for context, i already completed this part . I do not need help with Part one I need help with part

I posted part one for context, i already completed this part . I do not need help with Part one I need help with part 2 which is

YOU ARE NOW READY TO CONTINUE WITH PART II

- Prepare adjusting journal entries using the following information

- As of Sept. 30th the company owed one of the employees $200 of pay, which will be paid to her during the first week of October.

- There were only $300 of supplies left at the end of the period.

- The company had a bill from the utilities company for the use of the utilities for the month of September, in the amount of $150 for the month of September. They plan to pay the bill in October.

- The company received a note receivable from a customer on Sept. 11th that you already recorded with the other September transactions. Assume by the end of September the customer owes $10 in interest, but he will pay the full interest and principal when the two month term of the note ends in November.

- Prepare an adjusted trial balance

- Prepare closing entries

- Prepare financial statements

- Assuming the company uses reversing entries, prepare reversing entries for the first day of the new period ( October 1st

please answer questions 1-5 only The pictures i posted will help with part 2 . do part 2 only

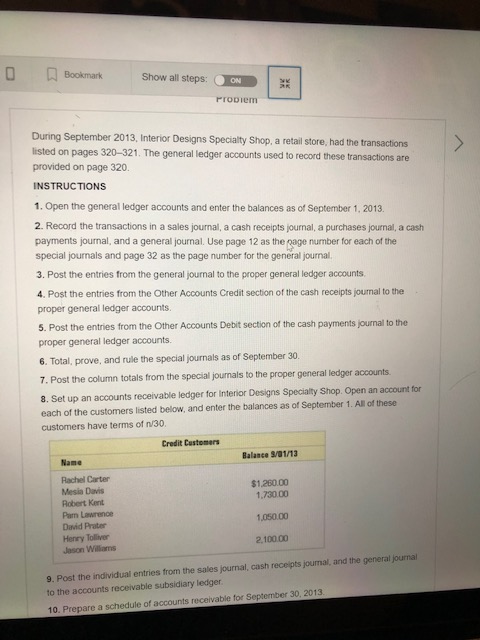

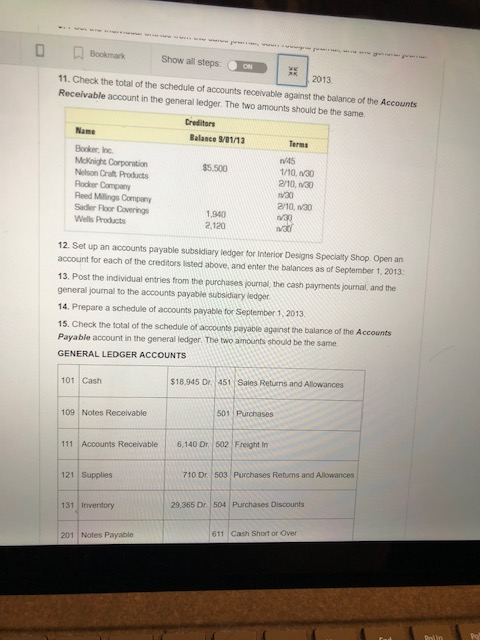

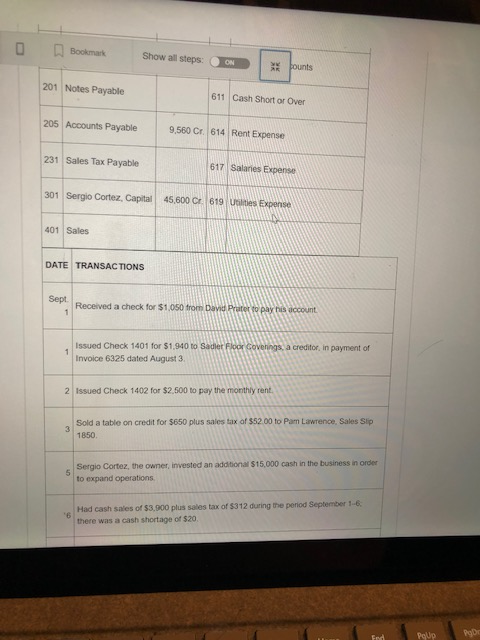

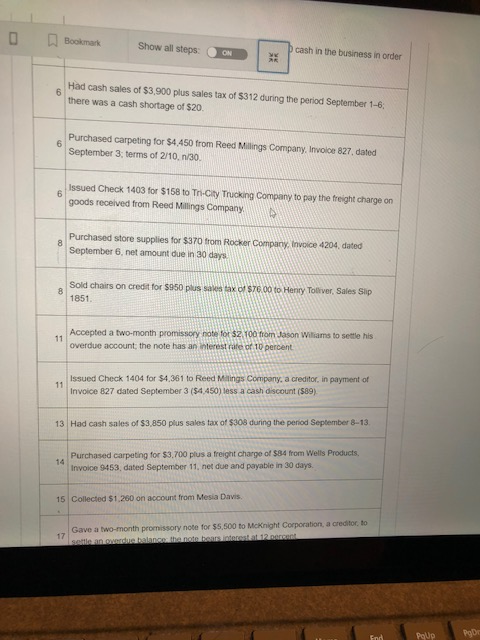

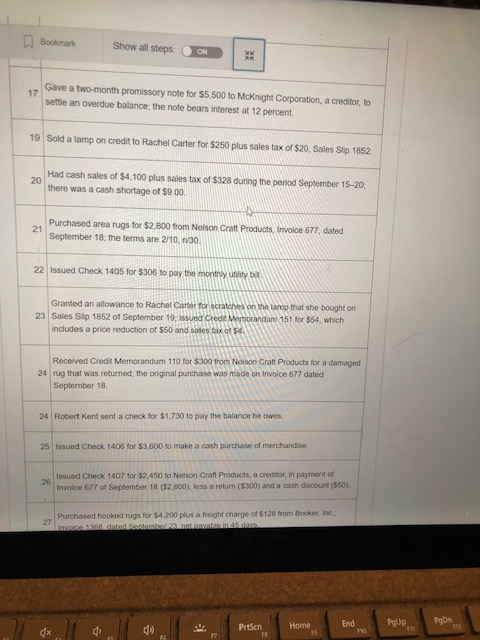

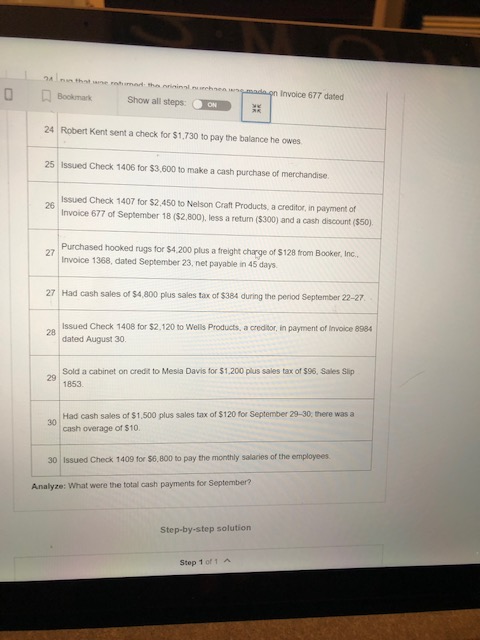

Bookmark Show all steps: ProDiem 2013, Interior Designs Specialty Shop, a retail store, had the transactions listed on pages 320-321. The general ledger accounts used to record these transactions are provided on page 320. INSTRUCTIONS 1. Open the general ledger accounts and enter the balances as of September 1, 2013. 2. Record the transactions in a sales journal, a cash receipts journal, a purchases journal, a cash payments journal, and a general journal. Use page 12 as the page number for each of the special journals and page 32 as the page number for the general journal 3. Post the entries from the general journal to the proper general ledger accounts. 4. Post the entries from the Other Accounts Credit section of the cash receipts journal to the proper general ledger accounts. 5. Post the entries from the Other Accounts Debit section of the cash payments journal to the proper general ledger accounts. 6. Total, prove, and rule the special journals as of September 30. 7. Post the column totals from the special journals to the proper general ledger accounts 8. Set up an accounts receivable ledger for Interior Designs Specialty Shop. Open an account for each of the customers listed below, and enter the balances as of September 1. All of these customers have terms of n/30 Credit Customers Name Balance 3/81/13 Rachel Carter Mesia Davis Robert Kent Pam Lawrence David Prater Henry Tolliver Jason Willams $1,260.00 1.730.00 1,050.00 2,100.00 9. Post the individual entries from the sales journal, cash receipts jounal, and the general journal to the accounts receivable subsidiary ledger 10. Prepare a schedule of accounts receivable for September 30, 2013 D Bookmark Show all steps ON 2013 11. Check the total of the schedule of accounts receivable against the balance of the Accounts Receivable account in the general ledger. The two amounts should be the same. Creditors Name Balance 9/01/13 Terms Booker, Inc Mcknight Corporation Nelson Craft Products Rocker Company Reed Milings Company Sadler Floor Coverings Wells Products $5,500 1/10, n/30 2/10, n/30 2/10, n/30 1,940 2.120 12. Set up an accounts payable subsidiary ledger for Interior Designs Speclality Shop. Open an account for each of the creditors listed above, and enter the balances as of September 1, 2013. 13. Post the individual entries from the purchases journal, the cash payments journal, and the general journal to the accounts payable subsidiary ledger 14. Prepare a schedule of accounts payable for Septenber 1,2013. 15. Check the total of the schedule of accounts peyable against the balance of the Accounts Payable account in the general ledger. The two amounts should be the same GENERAL LEDGER ACCOUNTS 101 Cash $18,945 Dr. 451 Saies Returns and Allowances 501 Purchases 109 Notes Receivable 111 Accounts Receivable 6,140 Dr. 502 Freight In 121 Supplies 131 Invenitory 710 Dr 503 Purchases Retums and Allowances 29,365 Dr 504 Purchases Discounts 611 Cash Short or Over 201 Notes Payable D Bookmark Showall steps:N Show all steps: ON ounts 201 Notes Payable 205 Accounts Payable9,560 Cr. 614 Rent Expense 231 Sales Tax Payablke 301 Sergio Cortez,Caital45600 Cr 619 Utalities Expense 611 Cash Short or Over 617 Salaries Expense 401 Sales DATE TRANSACTIONS Received a check for $1.05o trom David Prater to Pay s account Issued Check 1401 for $1,940 to Sadlet Floor Govenings, a creditor, in payment of Invoice 6325 dated August 3 2 Issued Check 1402 for $2,500 to pay the monthly rent. Sold a table on credit for $650 plus sales tax of $5200 to Pam Lawrence, Sales Slip 1850 Sergio Cortez, the owner, invested an addltional $15,000 cash in the business in order to expand operations Had cash sales of $3,900 plus sales tax of $312 during the period September 1-6 there was a cash shortage of $20 6 PcUp D Bookmark Show all steps:XK cash in the business in order Had cash sales of $3,900 plus sales tax of $312 during the period September 1-6 there was a cash shortage of $20. Purchased carpeting for $4,450 from Reed Millings Company, Involoe 827, dated September 3, terms of 2/10, n/30. Issued Check 1403 for $158 to Tri-City Trucking Company to pay the freight charge on goods received from Reed Mllings Company Purchased store supplies for $370 from Rocker Company, Invoice 4204, dated September 6, net amount due in 30 daye Sold chairs on credit for $950 plus sas ax of $76 00 to Henty Tolliver, Sales Sip 1851 Accepted a two-month promissory note for $2 100 from Jason Wiliams to settle his overdue account, the note has an interest rate of 10 percent . Issued Check 1404 for $4,361 to Reed Milings Company, a creditor, in payment of Invoice 827 dated September 3 ($4,450) less a cash discount ($89) 13 Had cash sales of $3,850 plus sales tax of $308 during the period September 8-13 14 Purchased carpeting for $3.700 plus a treight charge of $84 from Wells Products Invoice 9453, dated September 11, net due and payable in 30 days. 15 Collected $1,260 on account from Mesia Davis. .Gave a two-month promissory note for $5,500 to McKnight Corporation, a creditor, to 17 Bookmark Show all steps. 17 Gave a two-month promissory note for $5,500 to McKnight Corporation, a creditor, to settle an overdue balance; the note bears interest at 12 percent 19 Sold a lamp on credit to Rachel Carter for $250 plus sales tax of $20, Sales Slip 1852 Had cash sales of $4,100 plus sales tax of $328 during the period September 15-20 there was a cash shortage of $9.00 20 Purchased area rugs for $2.800 from Neison Craft Products, irvoice 677, dated September 18; the terms are 2/10. n/30 21 22 Issued Check 1405 for $306 to pay the monthy unlity b Granted an allowance to Rachel 23 Sales Sip 1852 of September 19: issued Credt Memoranduna 151 for $54. which ncludes a price reduction of $50 and sales tx Received Credit Memorandum 110 for $300 trom Nelson Craft Products for a damaged September 18 24 rug that was returned the original purchase was made on Invoice 677 dated 24 Robert Kent sent a check for $1,730 to pay the balance he owes 25 Issued Check 1408 for $3,600 to make a cash purchase of merchandise Issued Check 1407 for $2.450 to Nelson Craft Products, a creditor, in payment of Invoice 677 of September 18 ($2.800), less a return ($300) and a cash discount ($50) 26 Purchased hooked rugs for $4.200 plus a freight charge of $128 trom Booker, Inc. 27 Home End dx do nl nurchnea nmada-on Invoice 677 dated 0 Bookmark Show all steps: 24 Robert Kent sent a check for $1,730 to pay the balance he owes 25 Issued Check 1406 for $3,600 to make a cash purchase of merchandise Issued Check 1407 for $2.450 to Nelson Craft Products, a creditor, in payment of Invoice 677 of September 18 ($2.800), less a return ($300) and a cash discount ($50) 26 Purchased hooked rugs for $4.200 plus a freight charge of $128 from Booker,Inc. Invoice 1368, dated September 23, net payable in 45 days 27 27 Had cash sales of $4,800 plus sales tax of $384 during the period September 22-27 Issued Check 1408 for $2,120 to Welis Products, a creditor, in payment of Invoice 8984 dated August 30 28 Sold a cabinet on credit to Mesia Davis tor $1,200 plus sales tax of $96, Sales Slip 1853 29 Had cash sales of $1.500 plus sales tax of $120 for September 29-30, there was a cash overage of $10 30 30 Issued Check 1409 for $6,800 to pay the monthly salaries of the employees Analyze: What were the total cash payments for September? Step-by-step solution Step 1 of 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started