Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I posted the answers but i don't know how to get them Example 1/2 The industry has just earned $5B The discount rate is 5%

I posted the answers but i don't know how to get them

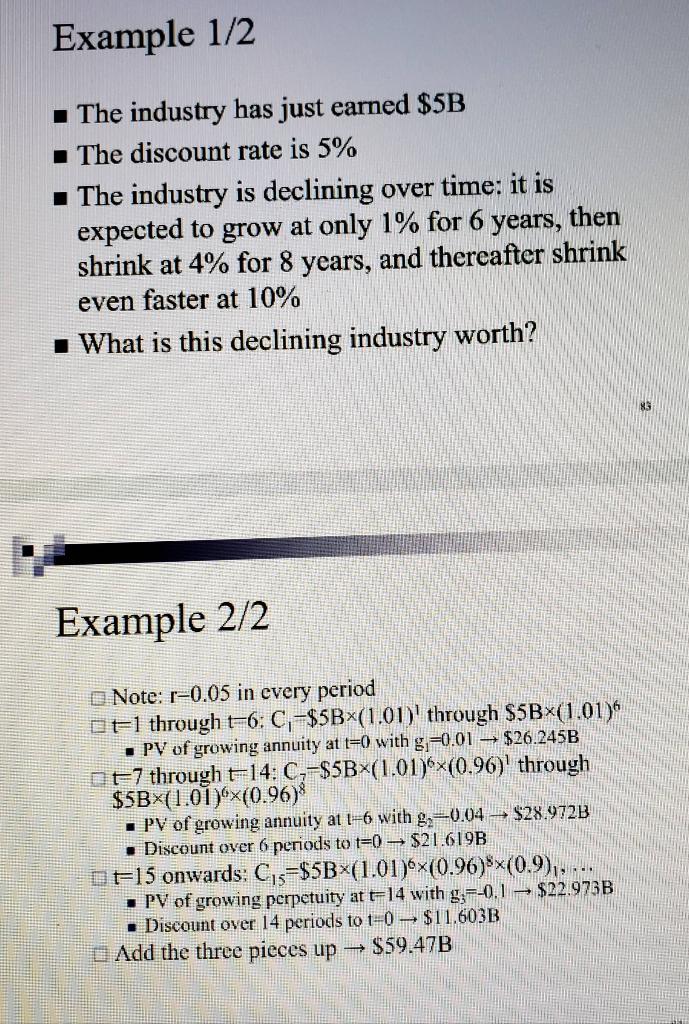

Example 1/2 The industry has just earned $5B The discount rate is 5% . The industry is declining over time: it is expected to grow at only 1% for 6 years, then shrink at 4% for 8 years, and thereafter shrink even faster at 10% . What is this declining industry worth? Example 2/2 Note: r-0.05 in every period DF1 through t-6: C, -$5B (1.01) through $5Bx(1.01) - PV of growing annuity at t=0 with g;=0.01 $26.245B DE7 through t14: C =$5BX(1.01)x(0.96) through $5BX(1.01)x(0.96) - PV of growing annuity at 1-6 with g=0.04 $28.972B Discount over 6 periods to t=0) $21.619B DE15 onwards: C15=$5Bx(1.01)6x(0.96)8x(0.9),, PV of growing perpetuity at t-14 with g;=-0.1 - $22.976B Discount over 14 periods to t=0 $11.603B Add the three pieces up + $59.47BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started