Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I posted the background (Q#2) in additional information Question 3 (1 point) Based on the question above, assume that the value of F is $1

I posted the background (Q#2) in additional information

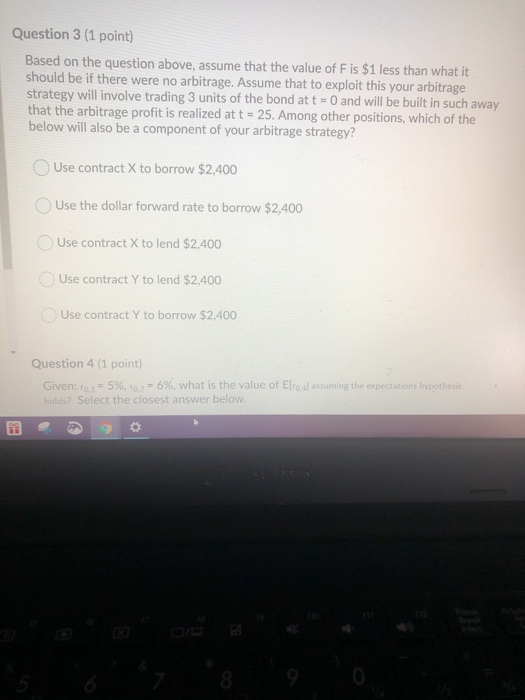

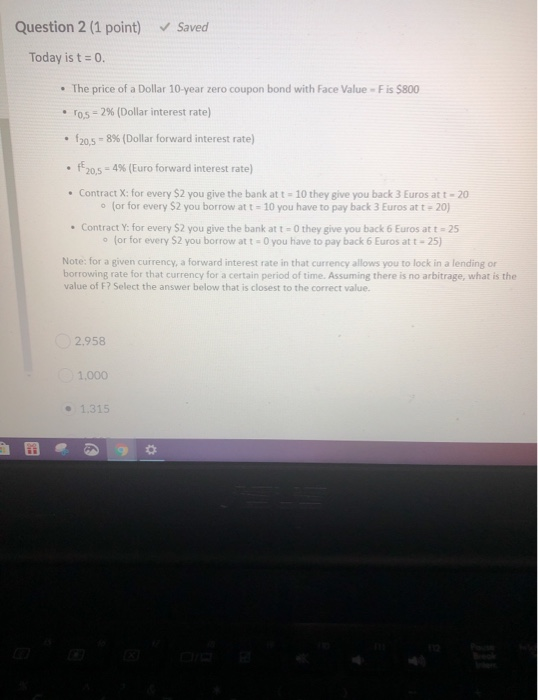

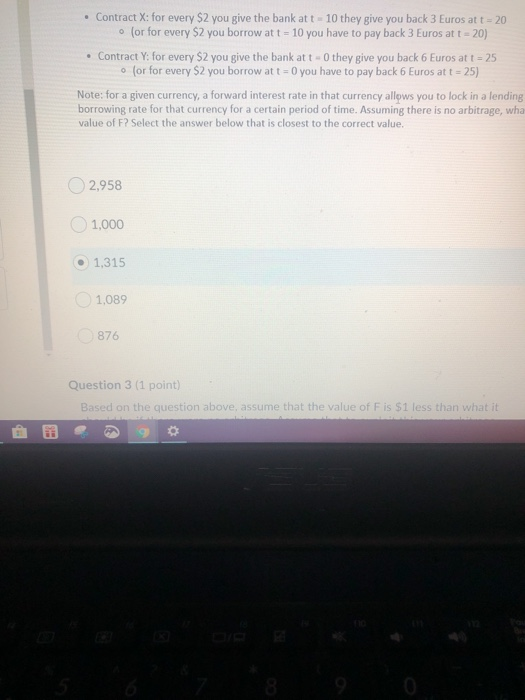

Question 3 (1 point) Based on the question above, assume that the value of F is $1 less than what it should be if there were no arbitrage. Assume that to exploit this your arbitrage strategy will involve trading 3 units of the bond att = 0 and will be built in such away that the arbitrage profit is realized at t = 25. Among other positions, which of the below will also be a component of your arbitrage strategy? Use contract X to borrow $2,400 Use the dollar forward rate to borrow $2,400 Use contract X to lend $2,400 Use contract Y to lend $2,400 Use contract Y to borrow $2,400 Question 4 (1 point) Given: 10, = 5%, 10,7 = 6%, what is the value of Elro,al assuming the expectations hypothesis holds? Select the closest answer below. 18 Question 2 (1 point) Saved Today is t = 0. The price of a Dollar 10-year zero coupon bond with Face Value - Fis $800 10,5 = 2% (Dollar interest rate) . . f20,5 = 8% (Dollar forward interest rate) . +20,5 = 4% (Euro forward interest rate) Contract X: for every $2 you give the bank at t = 10 they give you back 3 Euros at t - 20 (or for every $2 you borrow at t = 10 you have to pay back 3 Euros att-20) Contract Y: for every S2 you give the bank att - Othey give you back 6 Euros att - 25 o for for every S2 you borrow at t = 0 you have to pay back 6 Euros at t - 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending or borrowing rate for that currency for a certain period of time. Assuming there is no arbitrage, what is the value of F? Select the answer below that is closest to the correct value. 2.958 1.000 1.315 Contract X: for every $2 you give the bank att - 10 they give you back 3 Euros at t = 20 o (or for every $2 you borrow at t = 10 you have to pay back 3 Euros at t = 20) Contract Y: for every $2 you give the bank att - they give you back 6 Euros at t = 25 o for for every $2 you borrow at t = 0 you have to pay back 6 Euros at t = 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending borrowing rate for that currency for a certain period of time. Assuming there is no arbitrage, wha value of F? Select the answer below that is closest to the correct value. 2,958 1,000 1,315 1,089 876 Question 3 (1 point) Based on the question above, assume that the value of F is $1 less than what it 9 Question 3 (1 point) Based on the question above, assume that the value of F is $1 less than what it should be if there were no arbitrage. Assume that to exploit this your arbitrage strategy will involve trading 3 units of the bond att = 0 and will be built in such away that the arbitrage profit is realized at t = 25. Among other positions, which of the below will also be a component of your arbitrage strategy? Use contract X to borrow $2,400 Use the dollar forward rate to borrow $2,400 Use contract X to lend $2,400 Use contract Y to lend $2,400 Use contract Y to borrow $2,400 Question 4 (1 point) Given: 10, = 5%, 10,7 = 6%, what is the value of Elro,al assuming the expectations hypothesis holds? Select the closest answer below. 18 Question 2 (1 point) Saved Today is t = 0. The price of a Dollar 10-year zero coupon bond with Face Value - Fis $800 10,5 = 2% (Dollar interest rate) . . f20,5 = 8% (Dollar forward interest rate) . +20,5 = 4% (Euro forward interest rate) Contract X: for every $2 you give the bank at t = 10 they give you back 3 Euros at t - 20 (or for every $2 you borrow at t = 10 you have to pay back 3 Euros att-20) Contract Y: for every S2 you give the bank att - Othey give you back 6 Euros att - 25 o for for every S2 you borrow at t = 0 you have to pay back 6 Euros at t - 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending or borrowing rate for that currency for a certain period of time. Assuming there is no arbitrage, what is the value of F? Select the answer below that is closest to the correct value. 2.958 1.000 1.315 Contract X: for every $2 you give the bank att - 10 they give you back 3 Euros at t = 20 o (or for every $2 you borrow at t = 10 you have to pay back 3 Euros at t = 20) Contract Y: for every $2 you give the bank att - they give you back 6 Euros at t = 25 o for for every $2 you borrow at t = 0 you have to pay back 6 Euros at t = 25) Note: for a given currency, a forward interest rate in that currency allows you to lock in a lending borrowing rate for that currency for a certain period of time. Assuming there is no arbitrage, wha value of F? Select the answer below that is closest to the correct value. 2,958 1,000 1,315 1,089 876 Question 3 (1 point) Based on the question above, assume that the value of F is $1 less than what it 9 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started