Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I posted the first part in picture 3 as reference to the question but i only need the first two pictures answers! Thank you! a)

I posted the first part in picture 3 as reference to the question but i only need the first two pictures answers! Thank you!

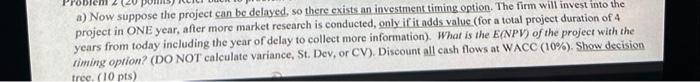

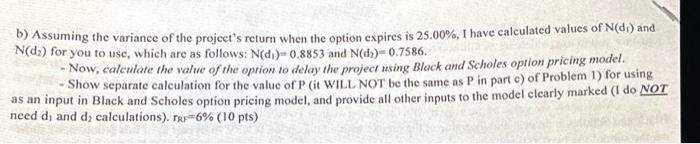

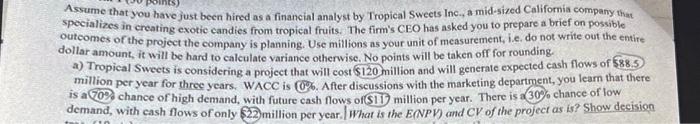

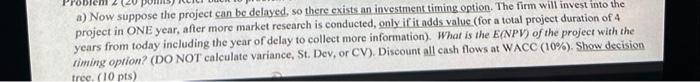

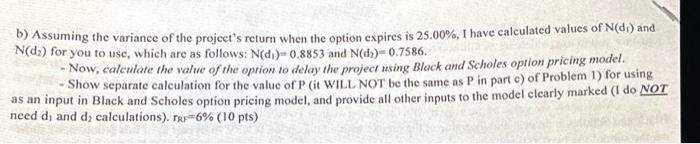

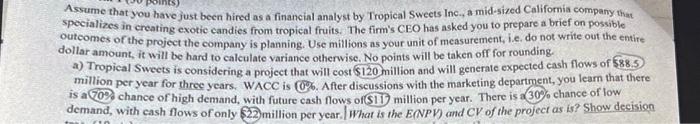

a) Now suppose the project can be delayed, so there exists an investment timing option. The firm will invest into the project in ONE year, after more market researeh is conducted, only if it adds value (for a total project duration of 4 years from today including the year of delay to collect more information). What is the E(NPV) of the project with the riming oprion? (DO NOT calculate variance, St. Dev, or CV). Discount all cash flows at WACC (10\%). Show decision b) Assuming the variance of the project's return when the option expires is 25.00%,I have calculated values of N(d1) and N(d2) for you to use, which are as follows: N(d1)=0.8853 and N(d2)=0.7586 - Now, calculate the value of the option to delay the project using Black and Scholes option pricing model. - Show separate calculation for the value of P (it WILL NOT be the same as P in part c) of Problem 1) for using as an input in Black and Scholes option pricing model, and provide all other inputs to the model clearly marked (I do NOT need d1 and d2 calculations). r2=6%(10pts) Assume that you have just been hired as a financial analyst by Tropical Sweets Inc., a mid-sized California company that specializes in creating exotic candies from tropical fruits. The firm's CEO has asked you to prepare a brief on possible outeomes of the project the company is planning. Use millions as your unit of measurement, l.e. do not write out the entire dollar amount, it will be hard to calculate variance otherwise. No points will be taken off for rounding. a) Tropical Sweets is considering a project that will cost $120 million and will generate expected cash flows of 588.5 . million per year for three years. WACC is 006 . After discussions with the marketing department, you leam that there is a(709) chance of high demand, with future cash flows of (S11) million per year. There is a 30%. chance of low demand, with cash flows of only (22) million per year. What is the E(NPV) and CV of the project as is? Show decision

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started