Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I posted this question earlier also but no one is replying. Please answer this Options for 1st blank are 15.70% 8.30% 16.30% 13.00% Options for

I posted this question earlier also but no one is replying. Please answer this

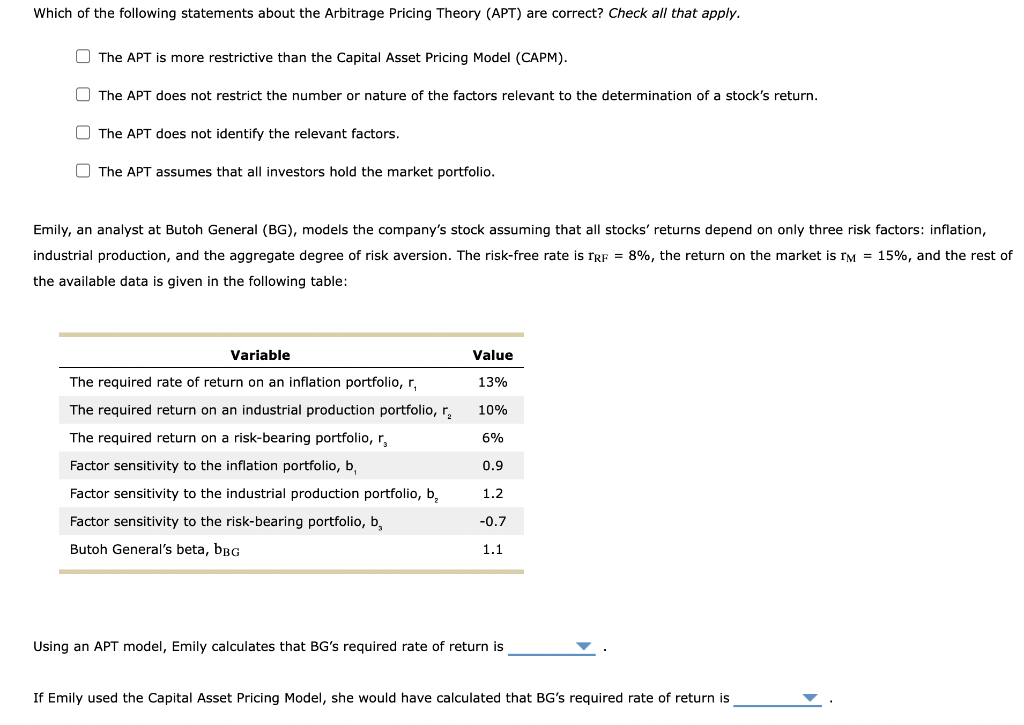

Options for 1st blank are 15.70% 8.30% 16.30% 13.00%

Options for 1st blank are 15.70% 8.30% 16.30% 13.00%

Options for 2nd blank are -7.70% 16.30%. 0.30%. 15.70%

Which of the following statements about the Arbitrage Pricing Theory (APT) are correct? Check all that apply. The APT is more restrictive than the Capital Asset Pricing Model (CAPM). The APT does not restrict the number or nature of the factors relevant to the determination of a stock's return. O The APT does not identify the relevant factors. The APT assumes that all investors hold the market portfolio. Emily, an analyst at Butoh General (BG), models the company's stock assuming that all stocks' returns depend on only three risk factors: inflation, industrial production, and the aggregate degree of risk aversion. The risk-free rate is FRF = 8%, the return on the market is IM = 15%, and the rest of the available data is given in the following table: Variable Value 13% 10% 6% The required rate of return on an inflation portfolio, r, The required return on an industrial production portfolio, r, The required return on a risk-bearing portfolio, r, Factor sensitivity to the inflation portfolio, b, Factor sensitivity to the industrial production portfolio, b, Factor sensitivity to the risk-bearing portfolio, b, Butoh General's beta, bBG 0.9 1.2 -0.7 1.1 Using an APT model, Emily calculates that BG's required rate of return is If Emily used the Capital Asset Pricing Model, she would have calculated that BG's required rate of return isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started