Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I. Prepare journal entries for the following chronological transactions which took place during 2021. a. On September 1, collected $12,000 of rent on our

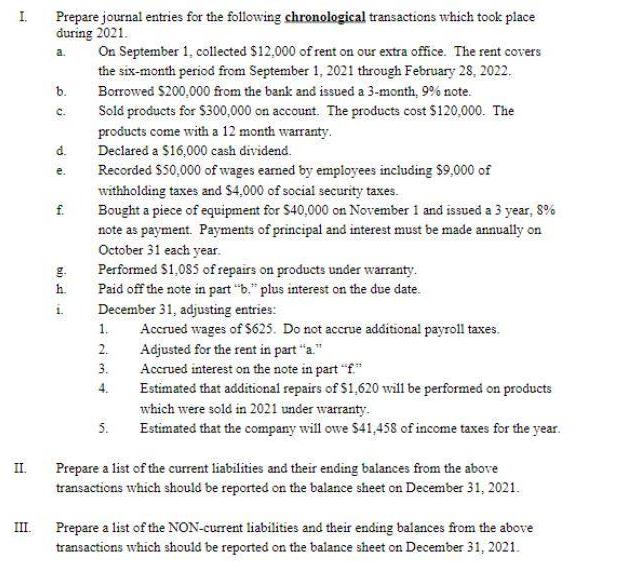

I. Prepare journal entries for the following chronological transactions which took place during 2021. a. On September 1, collected $12,000 of rent on our extra office. The rent covers the six-month period from September 1, 2021 through February 28, 2022. Borrowed $200,000 from the bank and issued a 3-month, 9% note. b. C. Sold products for $300,000 on account. The products cost $120,000. The products come with a 12 month warranty. d. Declared a $16,000 cash dividend. e. Recorded $50,000 of wages earned by employees including $9,000 of withholding taxes and $4,000 of social security taxes. f. Bought a piece of equipment for $40,000 on November 1 and issued a 3 year, 8% note as payment. Payments of principal and interest must be made annually on October 31 each year. g. Performed $1,085 of repairs on products under warranty. h. Paid off the note in part "b." plus interest on the due date. December 31, adjusting entries: i. 1. Accrued wages of $625. Do not accrue additional payroll taxes. Adjusted for the rent in part "a." 2. 3. Accrued interest on the note in part "f" 4. Estimated that additional repairs of $1,620 will be performed on products which were sold in 2021 under warranty. 5. Estimated that the company will owe $41,458 of income taxes for the year. II. Prepare a list of the current liabilities and their ending balances from the above transactions which should be reported on the balance sheet on December 31, 2021. III. Prepare a list of the NON-current liabilities and their ending balances from the above transactions which should be reported on the balance sheet on December 31, 2021. H bi)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Step by Step Solution Answer I Journal entries Date Account Titles Debit Credit a Cash 12000 Rent Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started