I

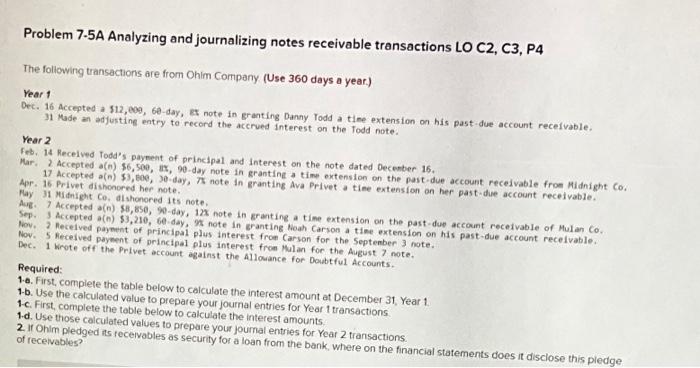

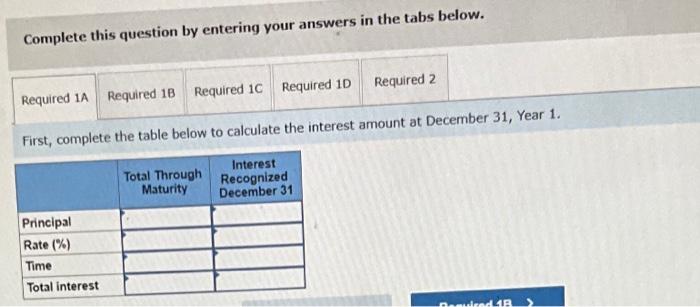

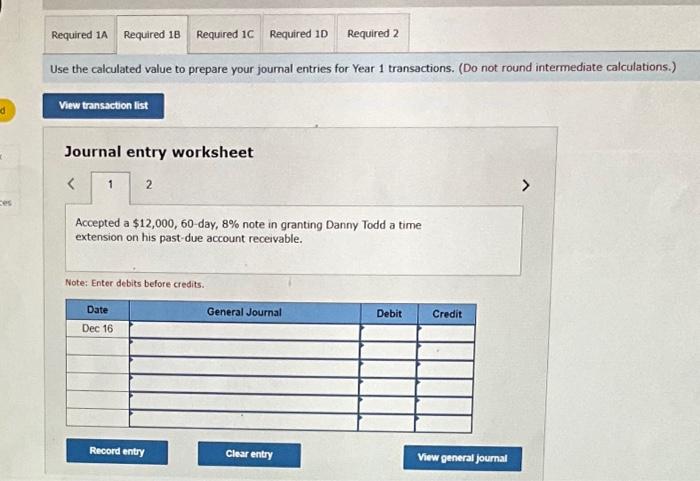

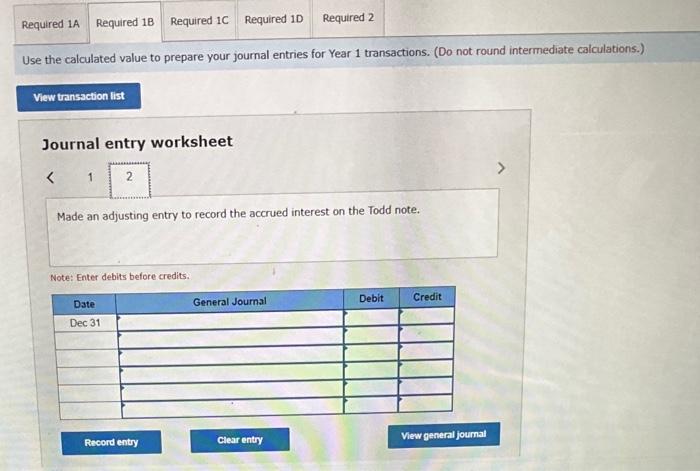

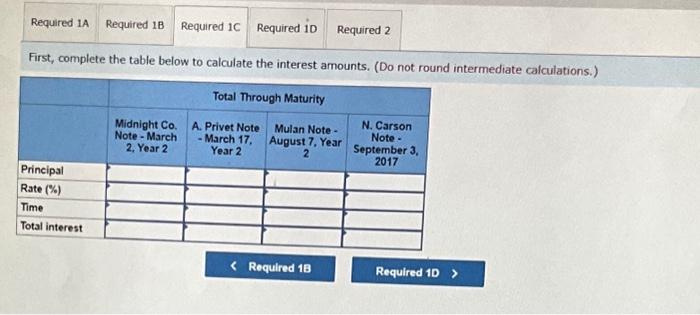

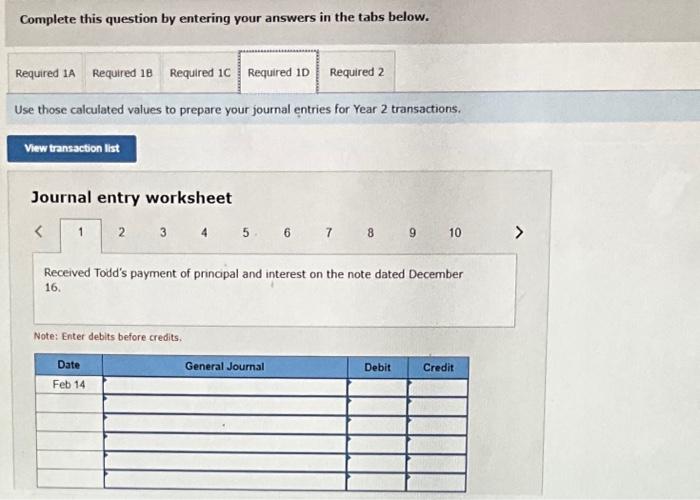

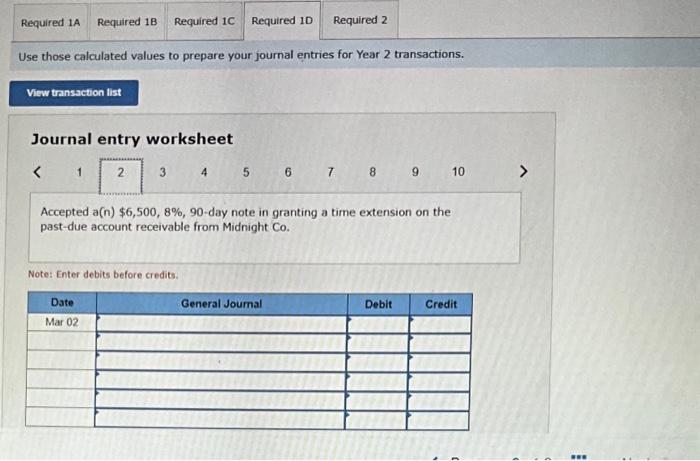

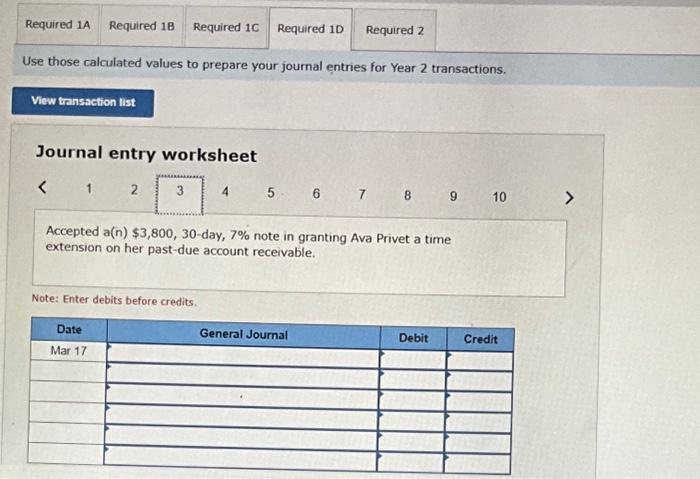

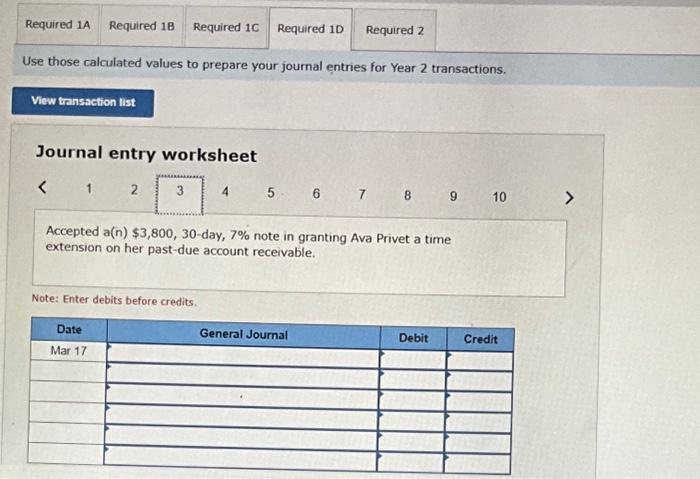

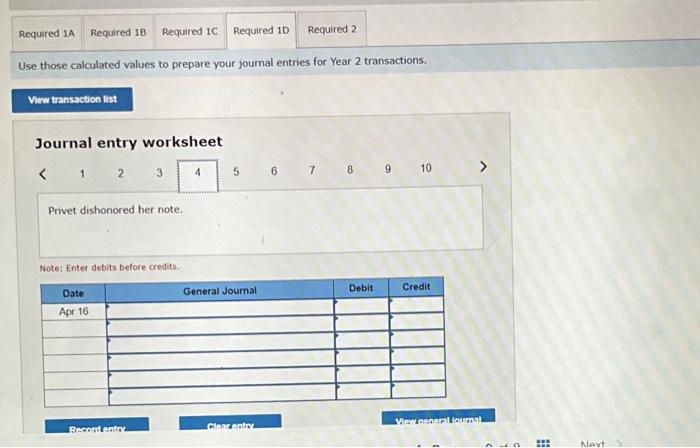

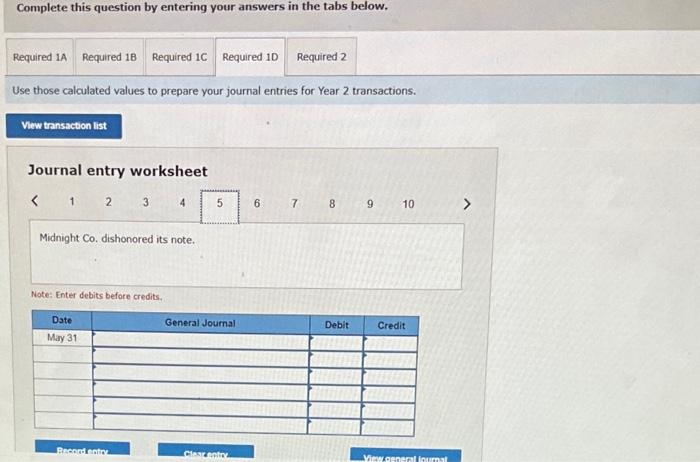

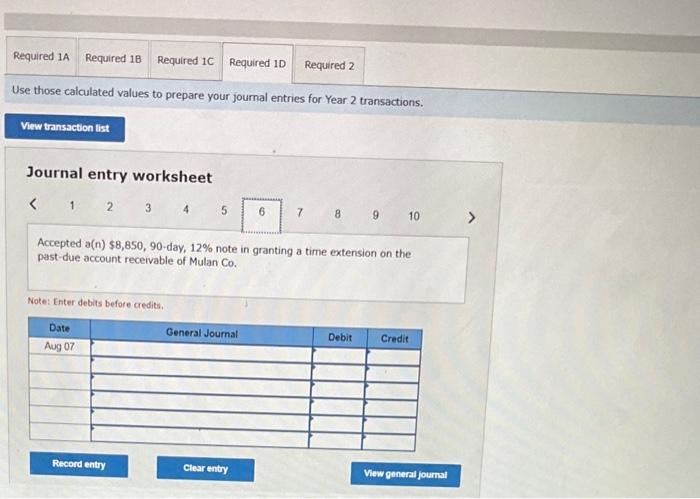

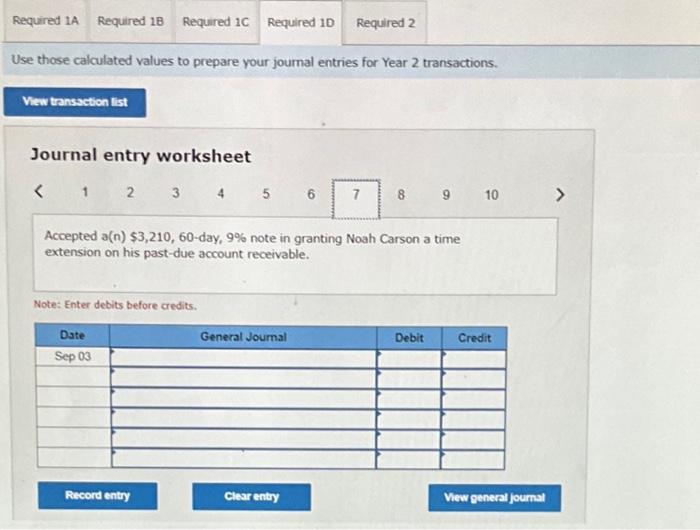

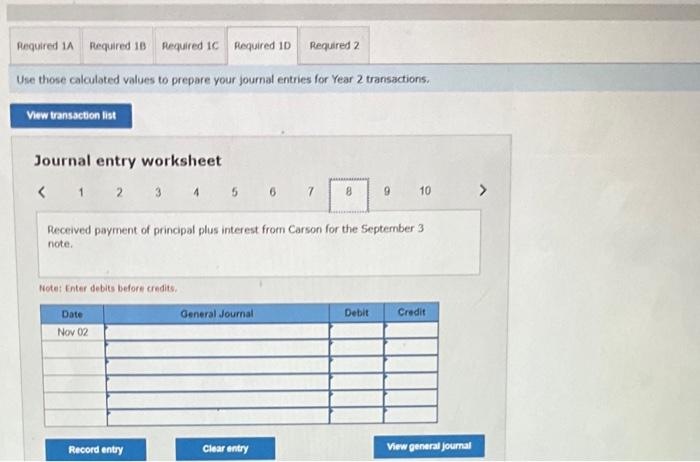

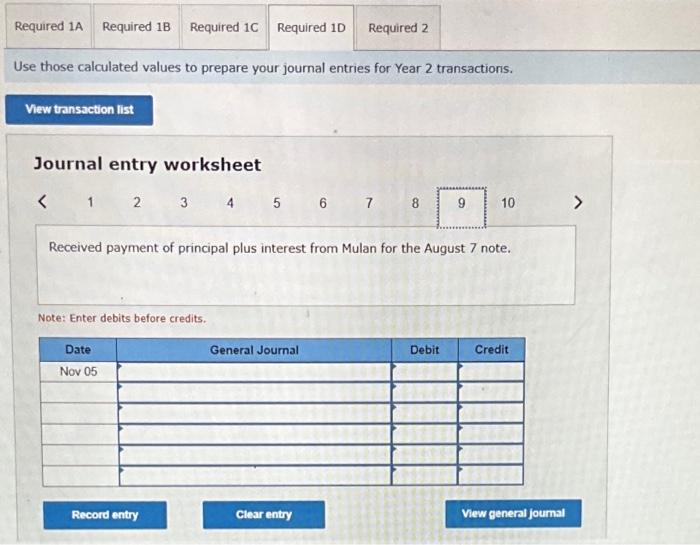

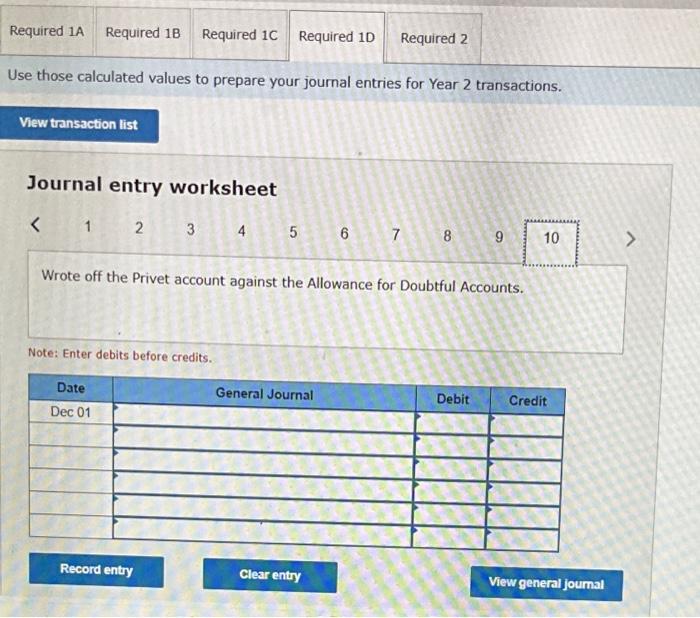

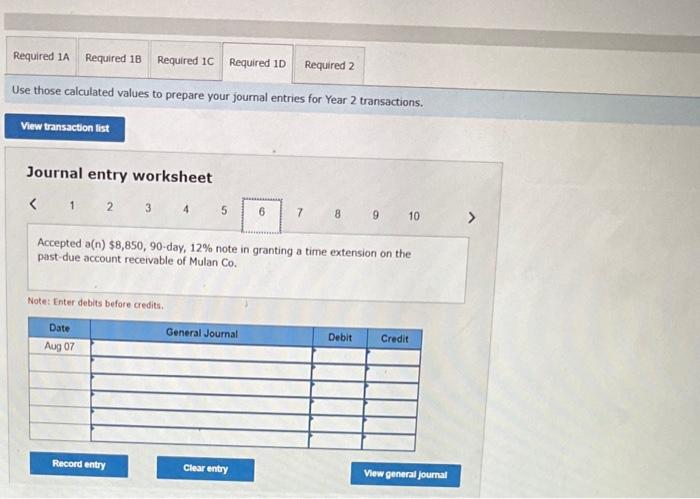

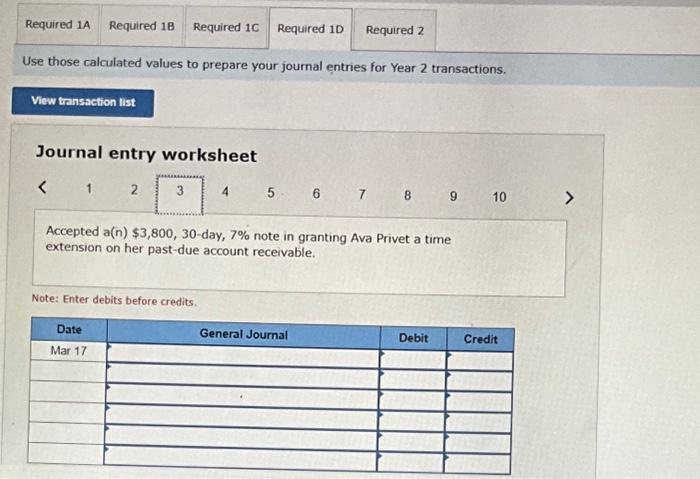

Problem 7.5A Analyzing and journalizing notes receivable transactions LO C2, C3, P4 The foliowing transactions are from Ohim Company (Use 360 days a year) Year 1 Dec. 16 Accepted a 512,e09, 6e-day, 8 note in granting Danny Todd a tine extension on his past-due account receivable. 31 Made an adjustine entry to recond the accrued interest on the fodd note. Year 2 Fibs, 14 Received tood's payment of principal and interest on the note dated Decenber 16 . Har. 2 Accepted a(n) 56,500 , ix, 90-day note in granting a time extension on the past-due account receivable from hidnight Co. 17 Accepted a(n) 53, Eae, 30-day, note in granting Ava Privet a time extension on her past-due account receivable. Alay 31 Midnight C0, dishonored its note. Aug. 7 Acrepted a(n) 88,850,90-day, 12x note in granting a time extension on the past-due account recelvable of Mulan Co. Sep. I Accepted a(n) 53,210, 6e-day, note in branting a hoah Carson a time extension on his past-due account recelvable. Hov. 5 feceived paywent of principal plus interest from Carson for the September 3 note. Dec. 1 krote off the Privet account against the Allouance for foe the August 7 note. Required: 1.a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions 1-c. First, complete the table below to calculate the interest amounts 1.d. Use those calculated values to prepare your joumal entries for Year 2 transactions. 2. If Ohim pledge of receivables? Complete this question by entering your answers in the tabs below. First, complete the table below to calculate the interest amount at December 31 , Year 1 . Use the calculated value to prepare your journal entries for Year 1 transactions. (Do not round intermediate calculations.) Journal entry worksheet Accepted a $12,000,60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. Note; Enter debits before credits. Ise the calculated value to prepare your journal entries for Year 1 transactions. (Do not round intermediate calculations.) Journal entry worksheet Made an adjusting entry to record the accrued interest on the Todd note. Note: Enter debits before credits. First, complete the table below to calculate the interest amounts. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Use those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet Received Todd's payment of prinopal and interest on the note dated December 16. Note: Enter debits before credits. Jse those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 678910 Accepted a(n) $6,500,8%,90-day note in granting a time extension on the past-due account receivable from Midnight Co. Note: Enter debits before credits. Use those calculated values to prepare your journal entries for Year 2 transactions. Journal entry worksheet 5=678910 Accepted a(n) $3,800,30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Note: Enter debits before credits. Use those calculated values to prepare your joumal entries for Year 2 transactions. Journal entry worksheet