i provided the trial balance, question 3 and question 3`s memo. PLEASE DO QUESTION 4

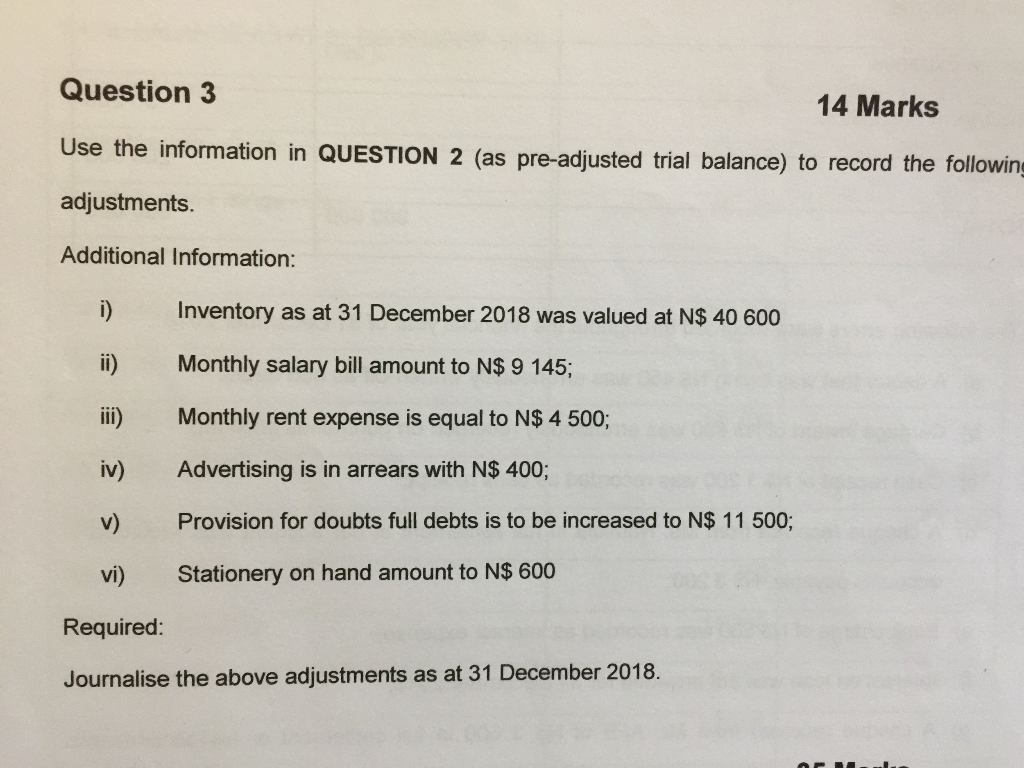

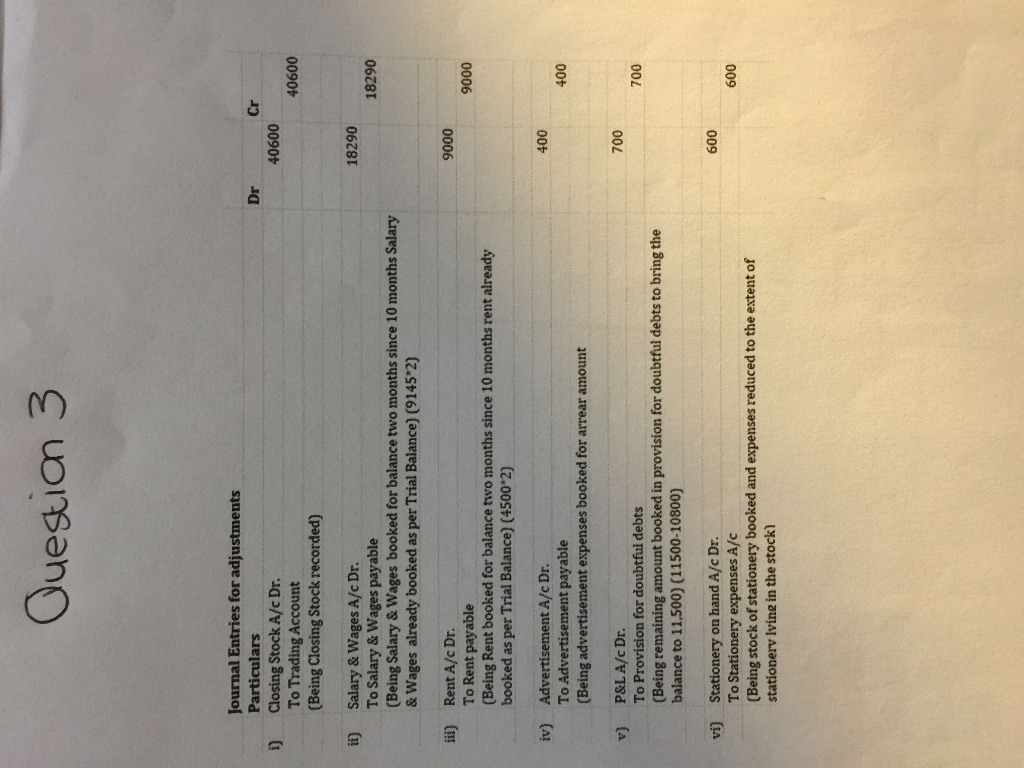

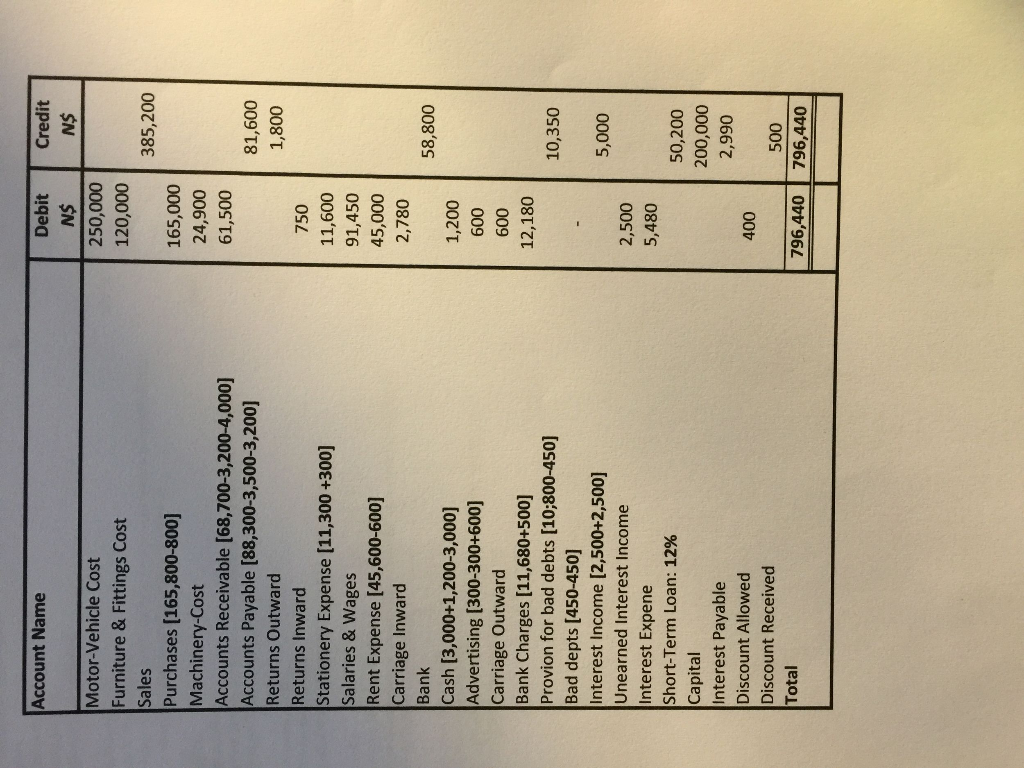

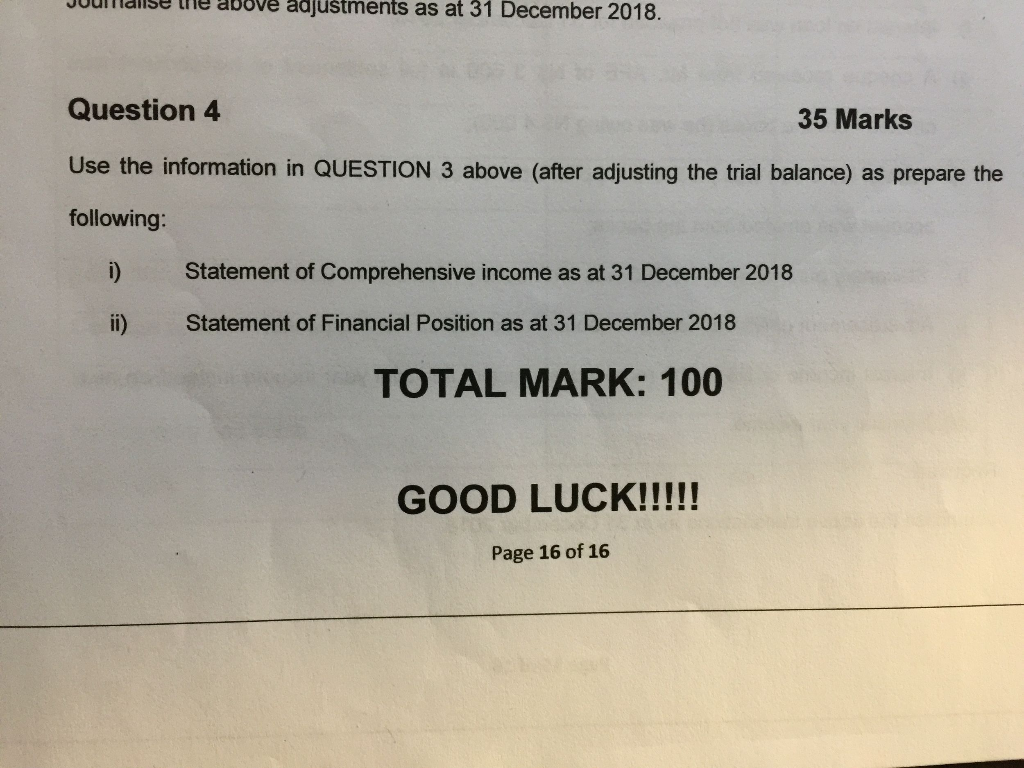

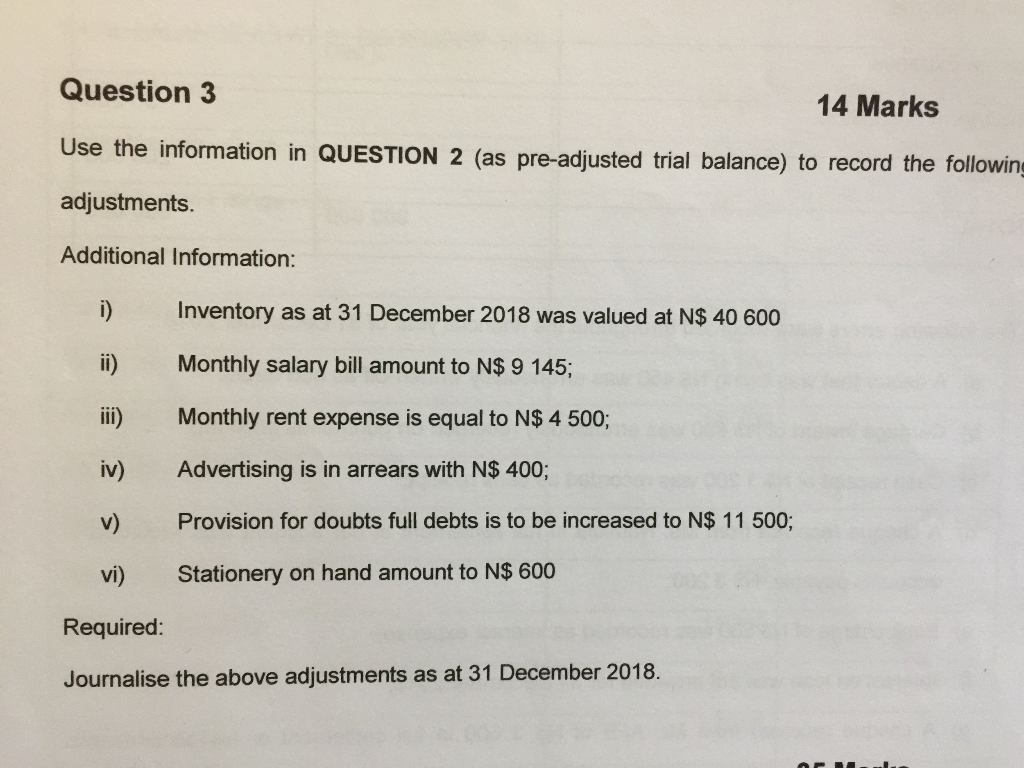

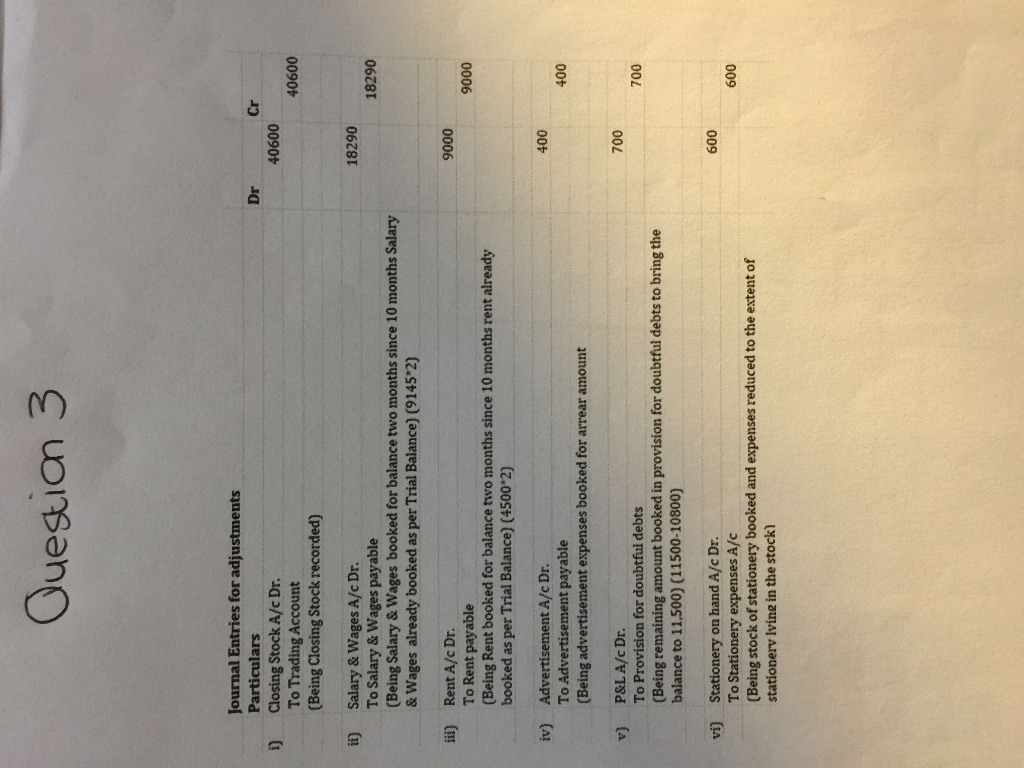

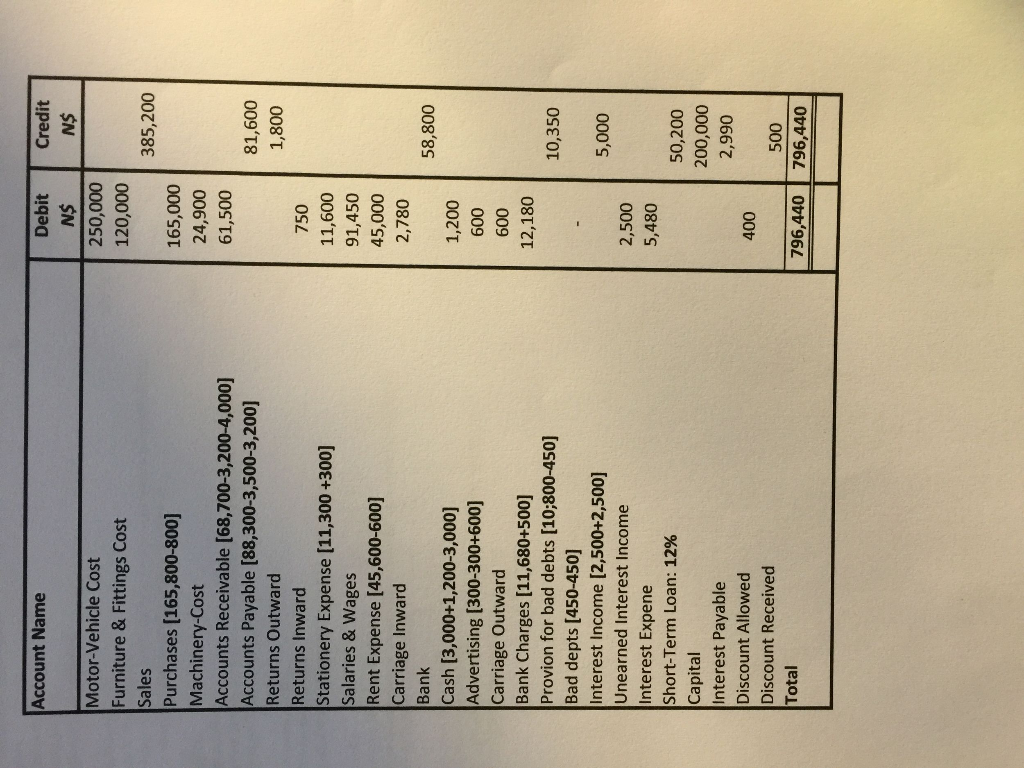

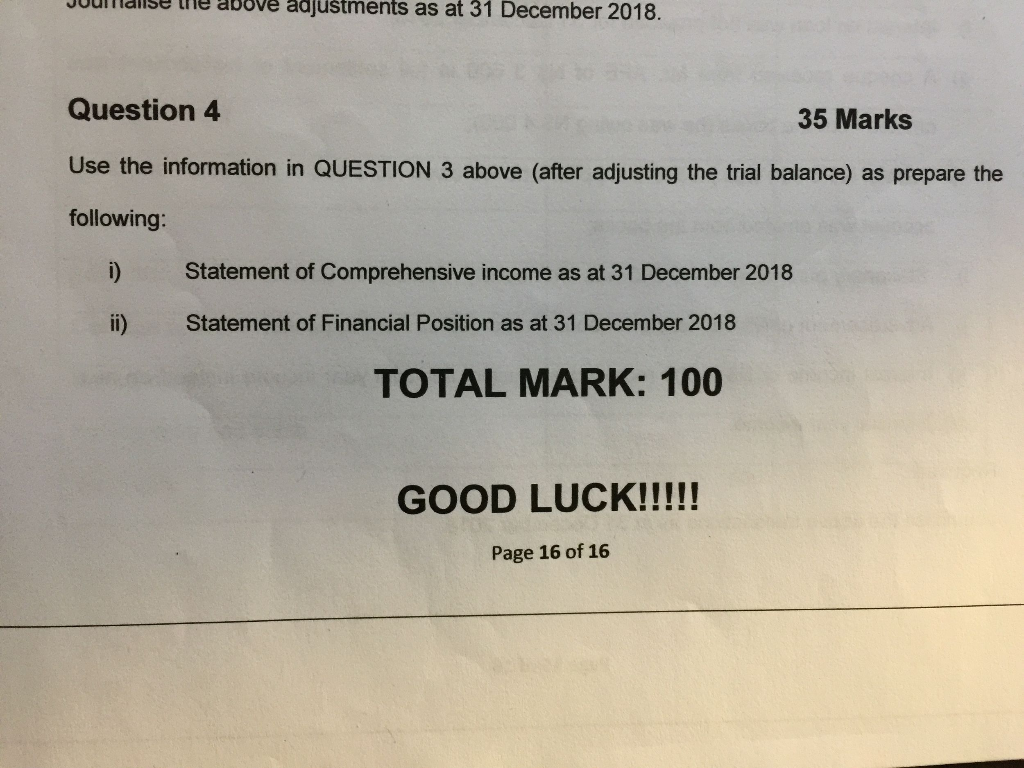

Question 3 Use the information in QUESTION 2 (as pre-adjusted trial balance) to record the following adjustments Additional Information: 14 Marks i) Inventory as at 31 December 2018 was valued at N$ 40 600 li) Monthly salary bill amount to N$ 9 145; i) Monthly rent expense is equal to N$ 4 500; iv) Advertising is in arrears with N$ 400; v) Provision for doubts full debts is to be increased to N$ 11 500; vi) Stationery on hand amount to N$ 600 Required Journalise the above adjustments as at 31 December 2018. Ouegian 3 Journal Entries foradjustments Dr Cr Particulars 40600 i) Closing Stock A/c Dr. 40600 To Trading Account (Being Closing Stock recorded) 18290 Salary & Wages A/c Dr. To Salary & Wages payable (Being Salary & Wages booked for balance two months since 10 months Salary & Wages already booked as per Trial Balance) (9145 2) ii) 18290 9000 9000 Rent A/c Dr. To Rent payable (Being Rent booked for balance two months since 10 months rent already booked as per Trial Balance) (4500*2) iii) 400 400 iv) Advertisement A/c Dr To Advertisement payable (Being advertisement expenses booked for arrear amount 700 100 v) P&LA/c Dr. To Provision for doubtful debts (Being remaining amount booked in provision for doubtful debts to bring the balance to 11,500) (11500-10800) 600 vi) Stationery on hand A/c Dr To Stationery expenses A/c (Being stock of stationery booked and expenses reduced to the extent of stationerv Iving in the stockl Account Name Debit Credit Motor-Vehicle Cost Furniture & Fittings Cost Sales Purchases [165,800-800] Machinery-Cost Accounts Receivable [68,700-3,200-4,000] Accounts Payable [88,300-3,500-3,200] Returns Outward Returns Inward Stationery Expense [11,300 +300] Salaries & Wages Rent Expense [45,600-600] Carriage Inward Bank Cash [3,000+1,200-3,000] Advertising [300-300+600] Carriage Outward Bank Charges [11,680+500] Provion for bad debts [10,800-450] Bad depts [450-450] Interest Income [2,500+2,500] Unearned Interest Income Interest Expene Short-Term Loan: 12% Capital Interest Payable Discount Allowed Discount Received Total 250,000 120,000 385,200 165,000 24,900 61,500 81,600 1,800 750 11,600 91,450 45,000 2,780 58,800 1,200 600 600 12,180 10,350 5,000 2,500 5,480 50,200 200,000 2,990 400 500 796,440 796,440 Juulllaise the above adjustments as at 31 December 2018. Question 4 Use the information in QUESTION 3 above (after adjusting the trial balance) as prepare the following 35 Marks i) Statement of Comprehensive income as at 31 December 2018 i) Statement of Financial Position as at 31 December 2018 TOTAL MARK: 100 Page 16 of 16 Question 3 Use the information in QUESTION 2 (as pre-adjusted trial balance) to record the following adjustments Additional Information: 14 Marks i) Inventory as at 31 December 2018 was valued at N$ 40 600 li) Monthly salary bill amount to N$ 9 145; i) Monthly rent expense is equal to N$ 4 500; iv) Advertising is in arrears with N$ 400; v) Provision for doubts full debts is to be increased to N$ 11 500; vi) Stationery on hand amount to N$ 600 Required Journalise the above adjustments as at 31 December 2018. Ouegian 3 Journal Entries foradjustments Dr Cr Particulars 40600 i) Closing Stock A/c Dr. 40600 To Trading Account (Being Closing Stock recorded) 18290 Salary & Wages A/c Dr. To Salary & Wages payable (Being Salary & Wages booked for balance two months since 10 months Salary & Wages already booked as per Trial Balance) (9145 2) ii) 18290 9000 9000 Rent A/c Dr. To Rent payable (Being Rent booked for balance two months since 10 months rent already booked as per Trial Balance) (4500*2) iii) 400 400 iv) Advertisement A/c Dr To Advertisement payable (Being advertisement expenses booked for arrear amount 700 100 v) P&LA/c Dr. To Provision for doubtful debts (Being remaining amount booked in provision for doubtful debts to bring the balance to 11,500) (11500-10800) 600 vi) Stationery on hand A/c Dr To Stationery expenses A/c (Being stock of stationery booked and expenses reduced to the extent of stationerv Iving in the stockl Account Name Debit Credit Motor-Vehicle Cost Furniture & Fittings Cost Sales Purchases [165,800-800] Machinery-Cost Accounts Receivable [68,700-3,200-4,000] Accounts Payable [88,300-3,500-3,200] Returns Outward Returns Inward Stationery Expense [11,300 +300] Salaries & Wages Rent Expense [45,600-600] Carriage Inward Bank Cash [3,000+1,200-3,000] Advertising [300-300+600] Carriage Outward Bank Charges [11,680+500] Provion for bad debts [10,800-450] Bad depts [450-450] Interest Income [2,500+2,500] Unearned Interest Income Interest Expene Short-Term Loan: 12% Capital Interest Payable Discount Allowed Discount Received Total 250,000 120,000 385,200 165,000 24,900 61,500 81,600 1,800 750 11,600 91,450 45,000 2,780 58,800 1,200 600 600 12,180 10,350 5,000 2,500 5,480 50,200 200,000 2,990 400 500 796,440 796,440 Juulllaise the above adjustments as at 31 December 2018. Question 4 Use the information in QUESTION 3 above (after adjusting the trial balance) as prepare the following 35 Marks i) Statement of Comprehensive income as at 31 December 2018 i) Statement of Financial Position as at 31 December 2018 TOTAL MARK: 100 Page 16 of 16