Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I Q1. There is an independent project of Ocean CO. (corporation) requires calculating Internal Rate of Return. This project cash outflow is $90,000 and

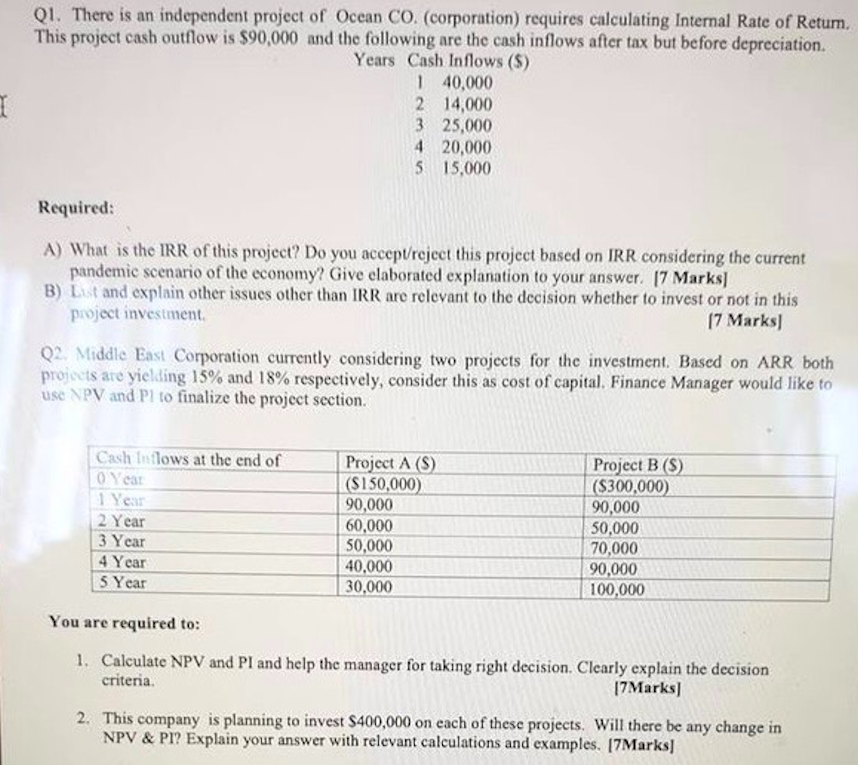

I Q1. There is an independent project of Ocean CO. (corporation) requires calculating Internal Rate of Return. This project cash outflow is $90,000 and the following are the cash inflows after tax but before depreciation. Years Cash Inflows (S) 1 40,000 2 14,000 3 25,000 4 20,000 5 15,000 Required: A) What is the IRR of this project? Do you accept/reject this project based on IRR considering the current pandemic scenario of the economy? Give elaborated explanation to your answer. [7 Marks] B) List and explain other issues other than IRR are relevant to the decision whether to invest or not in this project investment. [7 Marks] Q2. Middle East Corporation currently considering two projects for the investment. Based on ARR both projects are yielding 15% and 18% respectively, consider this as cost of capital. Finance Manager would like to use NPV and Pl to finalize the project section. Cash Inflows at the end of 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year Project A (S) ($150,000) 90,000 60,000 50,000 40,000 30,000 Project B (S) ($300,000) 90,000 50,000 70,000 90,000 100,000 You are required to: 1. Calculate NPV and PI and help the manager for taking right decision. Clearly explain the decision criteria. [7Marks] 2. This company is planning to invest $400,000 on each of these projects. Will there be any change in NPV & PI? Explain your answer with relevant calculations and examples. [7Marks]

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Internal Rate of Return IRR Calculation and Decision To calculate the IRR of the project we need to find the discount rate that makes the present value of the cash inflows equal to the initial cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started