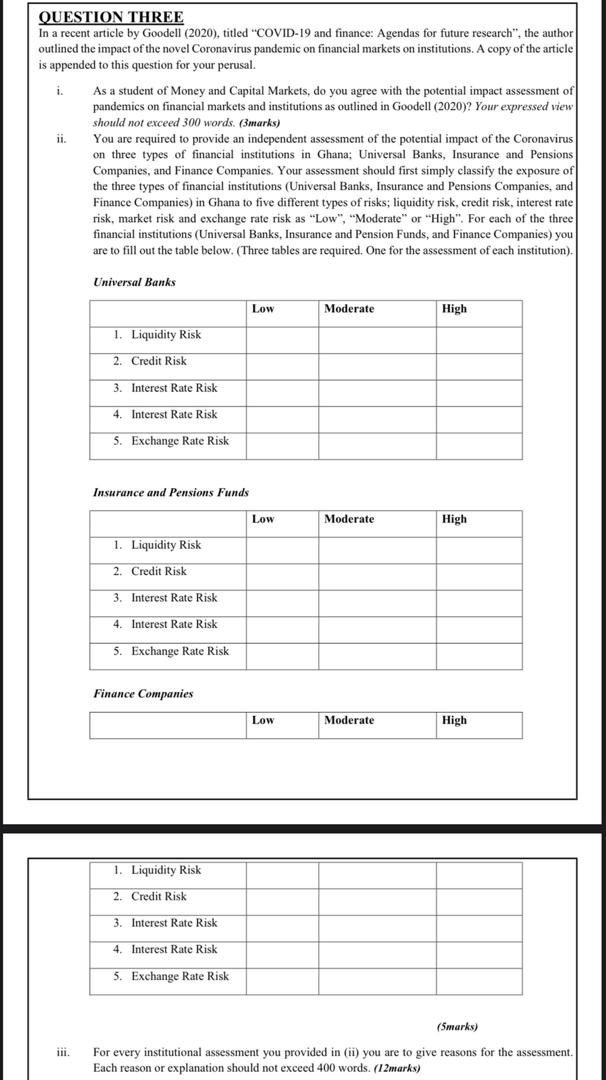

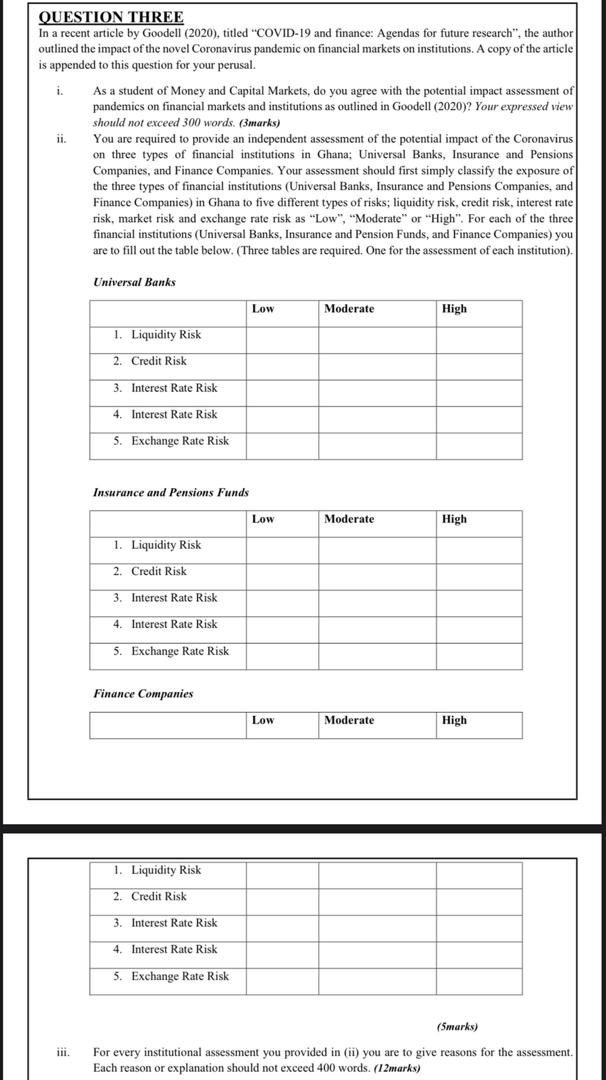

i. QUESTION THREE In a recent article by Goodell (2020), titled "COVID-19 and finance: Agendas for future research", the author outlined the impact of the novel Coronavirus pandemic on financial markets on institutions. A copy of the article is appended to this question for your perusal. As a student of Money and Capital Markets, do you agree with the potential impact assessment of pandemics on financial markets and institutions as outlined in Goodell (2020)? Your expressed view should not exceed 300 words. (marks) You are required to provide an independent assessment of the potential impact of the Coronavirus on three types of financial institutions in Ghana: Universal Banks, Insurance and Pensions Companies and Finance Companies. Your assessment should first simply classify the exposure of the three types of financial institutions (Universal Banks, Insurance and Pensions Companies, and Finance Companies) Ghana to five different types of risks; liquidity risk, credit risk, interest rate risk, market risk and exchange rate risk as "Low", "Moderate" or "High". For each of the three financial institutions (Universal Banks, Insurance and Pension Funds, and Finance Companies) you are to fill out the table below. (Three tables are required. One for the assessment each institution). ii. Universal Banks Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Insurance and Pensions Funds Low Moderate High 1. Liquidity Risk 2 Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Finance Companies Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk (5marks) iii. For every institutional assessment you provided in (ii) you are to give reasons for the assessment. Each reason or explanation should not exceed 400 words. (12marks) i. QUESTION THREE In a recent article by Goodell (2020), titled "COVID-19 and finance: Agendas for future research", the author outlined the impact of the novel Coronavirus pandemic on financial markets on institutions. A copy of the article is appended to this question for your perusal. As a student of Money and Capital Markets, do you agree with the potential impact assessment of pandemics on financial markets and institutions as outlined in Goodell (2020)? Your expressed view should not exceed 300 words. (marks) You are required to provide an independent assessment of the potential impact of the Coronavirus on three types of financial institutions in Ghana: Universal Banks, Insurance and Pensions Companies and Finance Companies. Your assessment should first simply classify the exposure of the three types of financial institutions (Universal Banks, Insurance and Pensions Companies, and Finance Companies) Ghana to five different types of risks; liquidity risk, credit risk, interest rate risk, market risk and exchange rate risk as "Low", "Moderate" or "High". For each of the three financial institutions (Universal Banks, Insurance and Pension Funds, and Finance Companies) you are to fill out the table below. (Three tables are required. One for the assessment each institution). ii. Universal Banks Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Insurance and Pensions Funds Low Moderate High 1. Liquidity Risk 2 Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk Finance Companies Low Moderate High 1. Liquidity Risk 2. Credit Risk 3. Interest Rate Risk 4. Interest Rate Risk 5. Exchange Rate Risk (5marks) iii. For every institutional assessment you provided in (ii) you are to give reasons for the assessment. Each reason or explanation should not exceed 400 words. (12marks)