Answered step by step

Verified Expert Solution

Question

1 Approved Answer

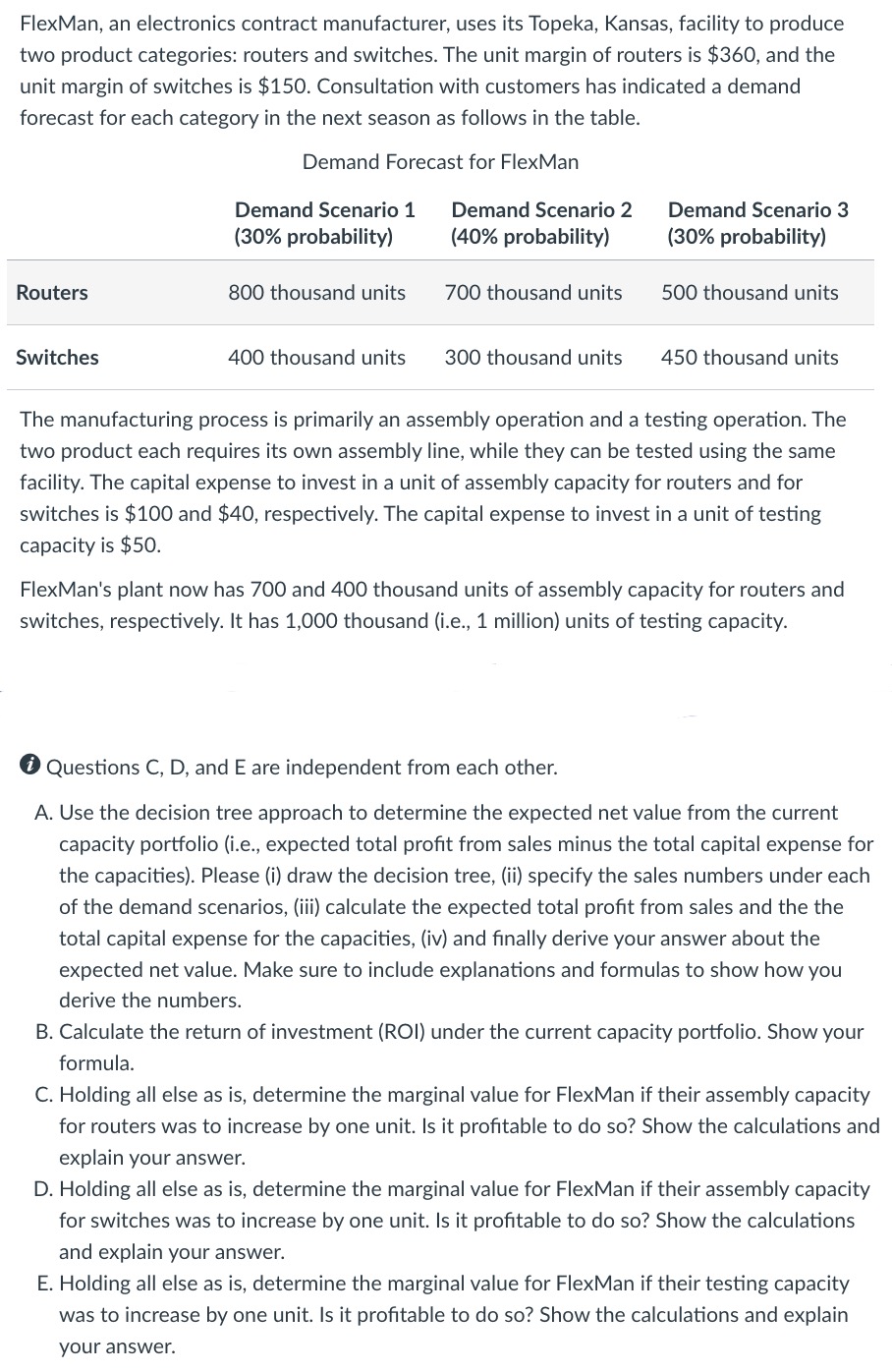

( i ) Questions C , D , and E are independent from each other. A . Use the decision tree approach to determine the

i Questions C D and E are independent from each other.

A Use the decision tree approach to determine the expected net value from the current

capacity portfolio ie expected total profit from sales minus the total capital expense for

the capacities Please i draw the decision tree, ii specify the sales numbers under each

of the demand scenarios, iii calculate the expected total profit from sales and the the

total capital expense for the capacities, iv and finally derive your answer about the

expected net value. Make sure to include explanations and formulas to show how you

derive the numbers.

B Calculate the return of investment ROI under the current capacity portfolio. Show your

formula.

C Holding all else as is determine the marginal value for FlexMan if their assembly capacity

for routers was to increase by one unit. Is it profitable to do so Show the calculations and

explain your answer.

D Holding all else as is determine the marginal value for FlexMan if their assembly capacity

for switches was to increase by one unit. Is it profitable to do so Show the calculations

and explain your answer.

E Holding all else as is determine the marginal value for FlexMan if their testing capacity

was to increase by one unit. Is it profitable to do so Show the calculations and explain

your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started