i really need aome help with this qustion

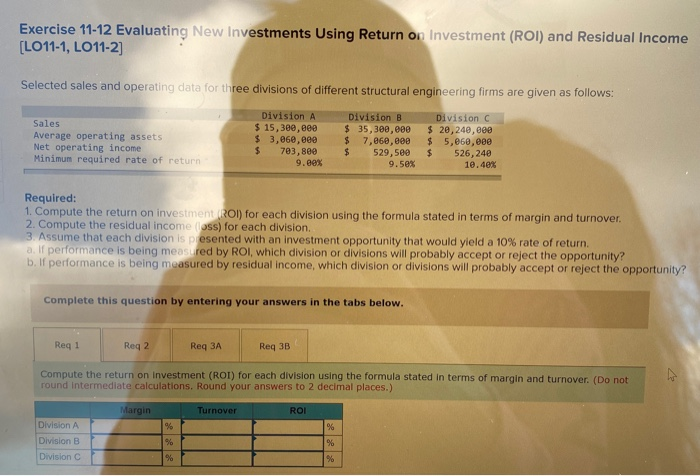

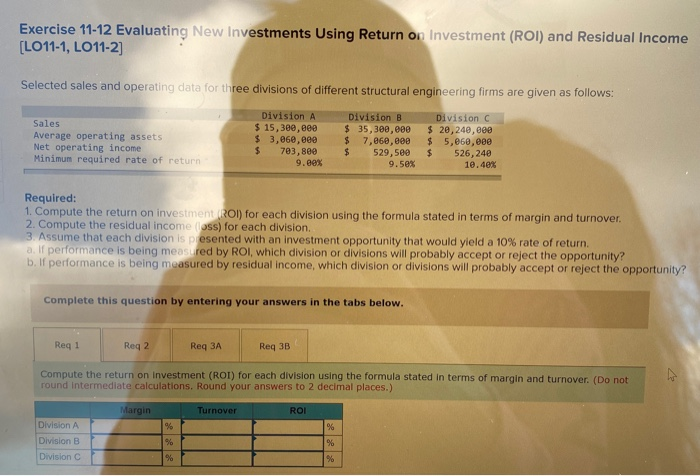

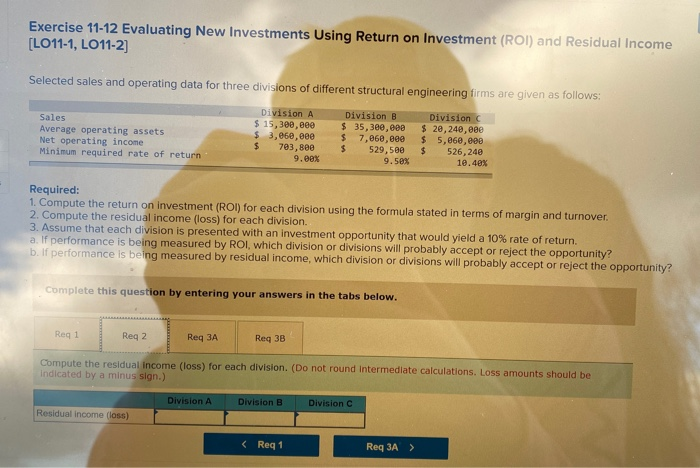

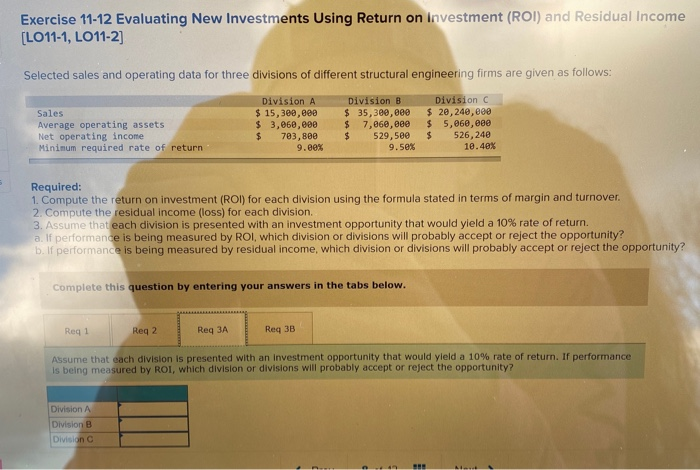

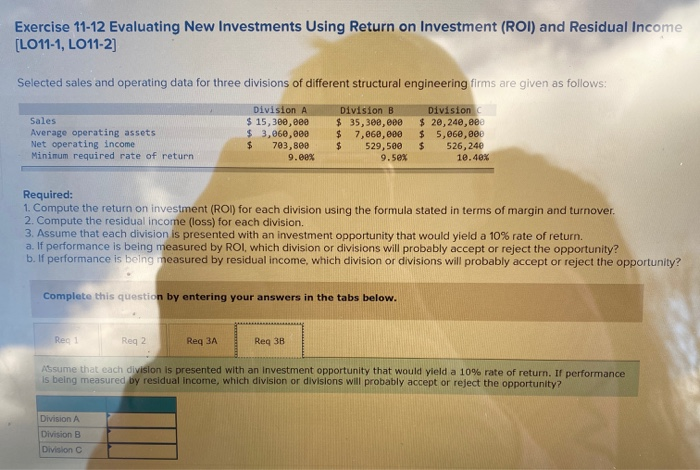

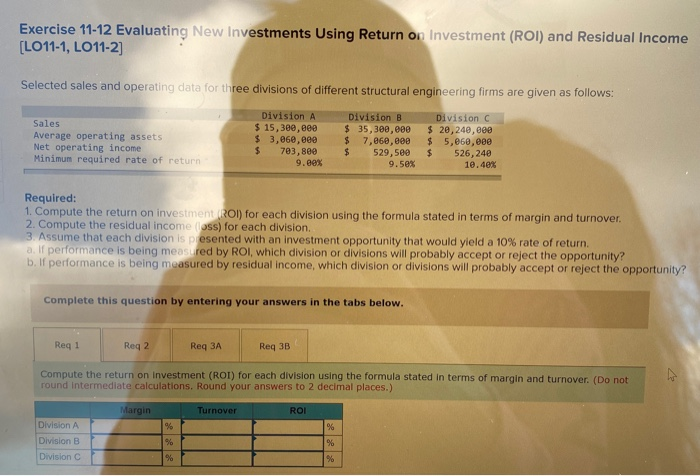

Exercise 11-12 Evaluating New Investments Using Return on Investment (ROI) and Residual Income [LO11-1, LO11-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum required rate of return Division A $ 15,3ee, eee $ 3,06e, eee $ 703,800 9.sex Division B $ 35,300,eee $ 7,060,000 $ 529,500 9.50% Division C $2e, 248,888 $ 5,060,000 $ 526,240 10.40% Required: 1. Compute the return on investment Rol) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income ass) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 10% rate of return. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Reg 1 Req 3A Req 3B Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Margin Turnover ROI Division A Division B Division C Exercise 11-12 Evaluating New Investments Using Return on Investment (ROI) and Residual Income [LO11-1, LO11-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum required rate of return Division A $ 15,300,eee $ 3, e60, eee $ 703, Bee 9.00% Division B $ 35, 3ee,eee $ 7,060,000 $ 529,500 9.5ex Division $20, 240, eee $ 5,060,00 $ 526,240 10.4ex Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 10% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Rea 1 Reg 2 Reg 3A Reg 3B Compute the residual income (loss) for each division. (Do not round Intermediate calculations. Loss amounts should be indicated by a minus sign.) Division A Division B Division C Residual income (los) Exercise 11-12 Evaluating New Investments Using Return on investment (ROI) and Residual Income [LO11-1, LO11-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum required rate of return Division A $ 15,300,eee $ 3,e6e,eee $ 793,899 9.ee% Division B $ 35,3ee,eee $ 7,860,000 $ 529,5ee 9.50% Division C $ 29, 240,000 $ 5,060, $ 526,240 10.4ex Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 10% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or relect the opportunity? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req 3A Req 3B Assume that each division is presented with an investment opportunity that would yield a 10% rate of return. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity Division Division B Diviac Exercise 11-12 Evaluating New Investments Using Return on Investment (ROI) and Residual Income [LO11-1, LO11-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Sales Average operating assets Net operating income Minimum required rate of return Division A $ 15,300,000 $ 3,060,000 $ 783,800 9.Ben Division B $ 35,3ee,eee $ 7,060,000 $ 529,500 9.sex Division $ 20,240, eee $ 5,060,000 $ 526,240 10.40% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 10% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Complete this question by entering your answers in the tabs below. Reg 2 Req 3A Req 38 Assume that each division is presented with an investment opportunity that would yield a 10% rate of return. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity? Division A Division B Division C