Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I really need help answering these questions with steps that are clear to understand, please. 10 QUESTION 13 An investor can design a risky portfolio

I really need help answering these questions with steps that are clear to understand, please.

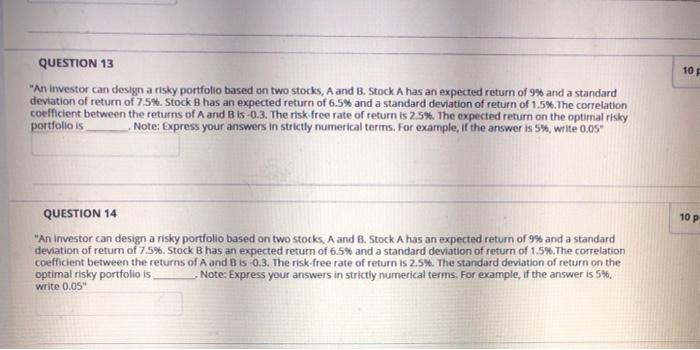

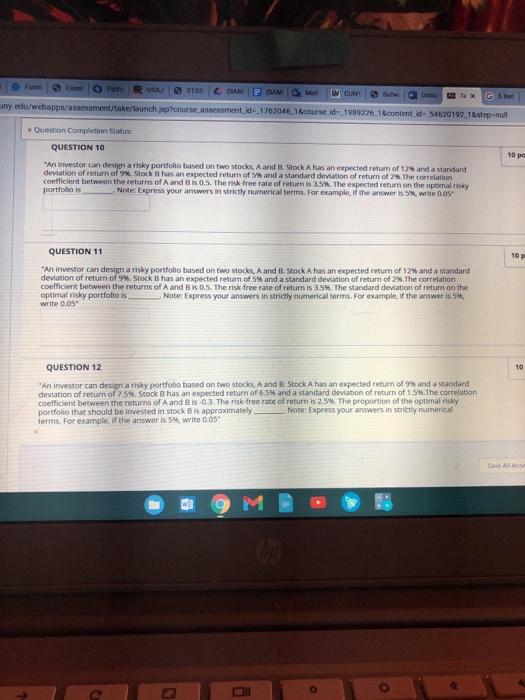

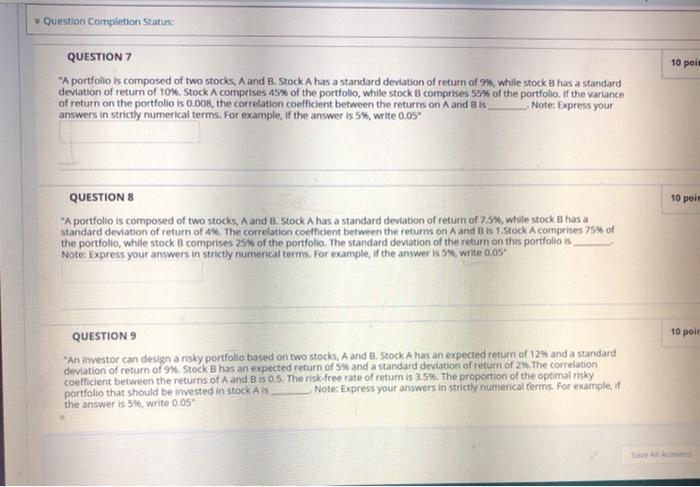

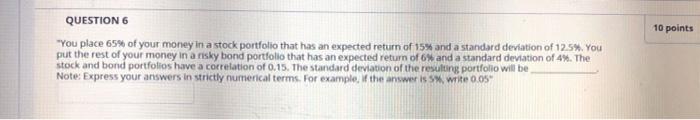

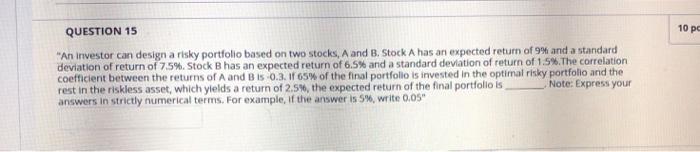

10 QUESTION 13 "An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 9% and a standard deviation of return of 7.5%. Stock B has an expected return of 6.5% and a standard deviation of return of 1.5%. The correlation coefficient between the returns of A and B is 0.3. The risk free rate of return is 2.5%. The expected return on the optimal risky portfolio is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0,05 10 P QUESTION 14 "An Investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 9% and a standard deviation of return of 75%. Stock B has an expected return of 6.5% and a standard deviation of return of 1.5%. The correlation coefficient between the returns of A and B is 0.3. The risk free rate of return is 2.5%. The standard deviation of return on the optimal risky portfolio is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%. write 0.05 0133 UM F MAM BV CAN De Tax 65 uny.edu/webapps/assessment/take/launchp/coursessment_id-170204616course id-1989226.1.content54620197 18tep null 10 po Question Completion Stati QUESTION 10 "An investor can design a risky portfolio based on two stocks, A and Stock A has an expected return of 12 and a standard deviation of return of Stock it has an expected return of and a standard deviation of return of the correlation coefficient between the returns of A and 180.5. The risk free rate of return is 1.5. The expected return on the optimalnky portfolio is Note Express your answers in strictly numerical terms. For example, if the awer write 0.05 QUESTION 11 10 "An investor can design a risky portfolio based on two stocks, A and B Stock A has an expected return of 12 and a standard deviation of return of 9. Stock Bhas an expected return of 5% and a standard deviation of return of 2.The correlation coefficient between the returns of A and B 0.5. The risk free rate of return is 3.5. The standard deviation of return on the optimal risky portfolio is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05 10 QUESTION 12 An investor can design a risky portfolio based on two stocks, A and B Stock A has an expected return of and a standard deviation of return of 75. Stock Bhas an expected return of 6.5 and a standard deviation of return of 15. The correlation coefficient between the returns of A and Bis-0.3. The risk free rate of return is 2. The proportion of the optimal risky portfolio that should be invested in stock B is approximately Note Express your answers in strictly numerical terms. For example, if the answer is 5% write 0.05 SARAW Question Completion Status 10 poll QUESTION 7 "A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 9%, while stock Bhas a standard deviation of return of 10%. Stock A comprises 45% of the portfolio, while stock 8 comprises 5% of the portfolio of the variance of return on the portfolio is 0.008, the correlation coefficient between the returns on A and B is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05 10 poir QUESTIONS "A portfolio is composed of two stocks, A and B. Stock A has a standard deviation of return of 7.5%, while stock Bhas a standard deviation of return of 4%. The correlation coefficient between the returns on A and Bis 1 Stock Acomprises 75% of the portfolio, while stock 8 comprises 25% of the portfolio The standard deviation of the return on this portfolio is Note: Express your answers in strictly numerical terms. For example, if the answer is 5% write O.OS 10 poir QUESTIONS "An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 12% and a standard deviation of return of 9%. Stock B has an expected return of 5% and a standard deviation of return of 2%. The correlation coefficient between the returns of A and B is 0.5. The risk free rate of return is 3.5%. The proportion of the optimal risky portfolio that should be invested in stock Ais Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05 Save Alle 10 points QUESTION 6 "You place 65% of your money in a stock portfolio that has an expected return of 15% and a standard deviation of 125%. You put the rest of your money in a risky bond portfolio that has an expected return of 6% and a standard deviation of 4%. The stock and bond portfolios have a correlation of 0.15. The standard deviation of the resulting portfolio will be Note: Express your answers in strictly numerical terms. For example, the answer is Swrite 0.05* 10 pc QUESTION 15 "An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 9% and a standard deviation of return of 75%. Stock Bhas an expected return of 6.5% and a standard deviation of return of 1.5%. The correlation coefficient between the returns of A and B is 0.3. If 65% of the final portfolio is invested in the optimal risky portfolio and the rest in the riskless asset, which yields a return of 2.5%, the expected return of the final portfolio is Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, write 0.05 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started