Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I really need help answering these two questions from this case: 1. Calculate the total manufacturing and distribution costs if the widgets are assembled in

I really need help answering these two questions from this case:

1. Calculate the total manufacturing and distribution costs if the widgets are assembled in the three locations.

2. What are the major cost factors at each location that create the differences in your calculations?

I dont know what part of the case is needed, please answer step by step. Thank you so much!

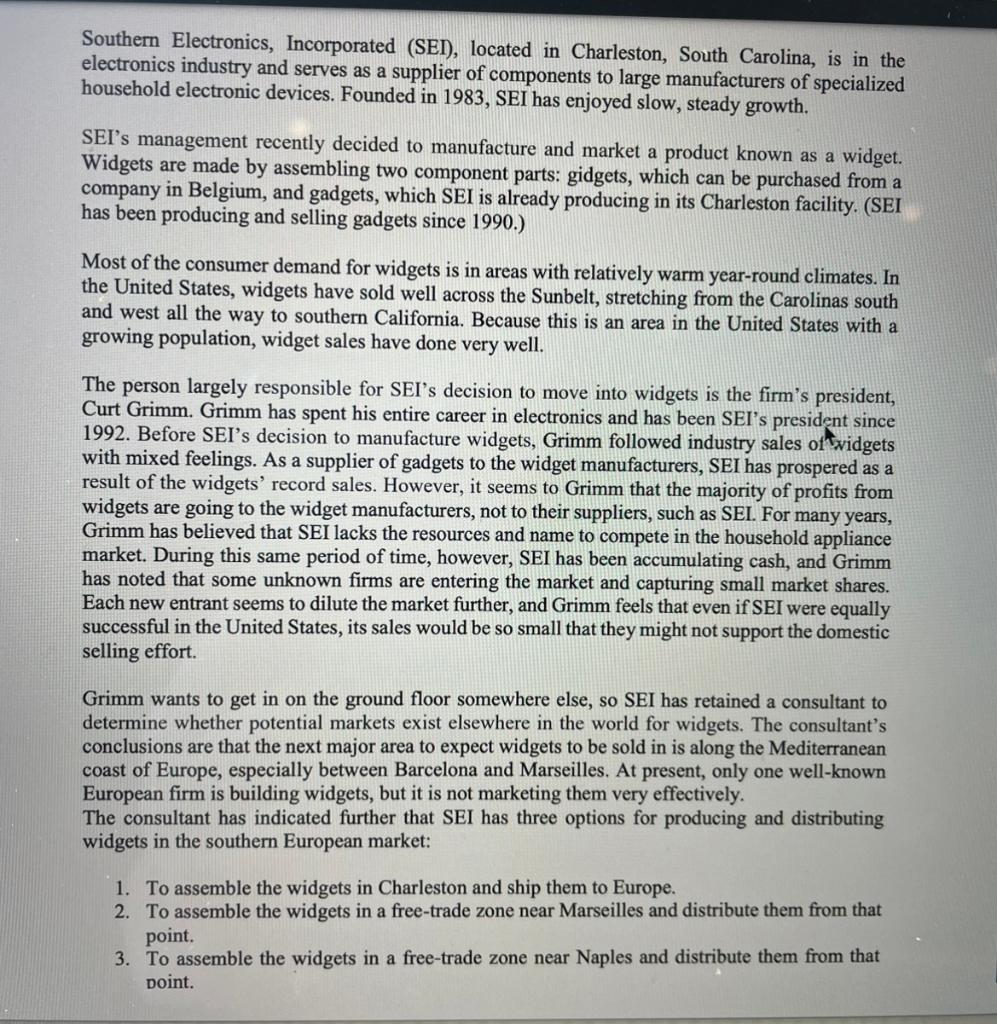

Southern Electronics, Incorporated (SEI), located in Charleston, South Carolina, is in the electronics industry and serves as a supplier of components to large manufacturers of specialized household electronic devices. Founded in 1983, SEI has enjoyed slow, steady growth. SEI's management recently decided to manufacture and market a product known as a widget. Widgets are made by assembling two component parts: gidgets, which can be purchased from a company in Belgium, and gadgets, which SEI is already producing in its Charleston facility. (SEI has been producing and selling gadgets since 1990.) Most of the consumer demand for widgets is in areas with relatively warm year-round climates. In the United States, widgets have sold well across the Sunbelt, stretching from the Carolinas south and west all the way to southern California. Because this is an area in the United States with a growing population, widget sales have done very well. The person largely responsible for SEI's decision to move into widgets is the firm's president, Curt Grimm. Grimm has spent his entire career in electronics and has been SEI's president since 1992. Before SEI's decision to manufacture widgets, Grimm followed industry sales of sidgets 2 with mixed feelings. As a supplier of gadgets to the widget manufacturers, SEI has prospered as a result of the widgets' record sales. However, it seems to Grimm that the majority of profits from widgets are going to the widget manufacturers, not to their suppliers, such as SEI. For many years, market. During this same period of time, however, SEI has been accumulating cash, and Grimm has noted that some unknown firms are entering the market and capturing small market shares. Each new entrant seems to dilute the market further, and Grimm feels that even if SEI were equally successful in the United States, its sales would be so small that they might not support the domestic selling effort. Grimm wants to get in on the ground floor somewhere else, so SEI has retained a consultant to determine whether potential markets exist elsewhere in the world for widgets. The consultant's conclusions are that the next major area to expect widgets to be sold in is along the Mediterranean coast of Europe, especially between Barcelona and Marseilles. At present, only one well-known European firm is building widgets, but it is not marketing them very effectively. The consultant has indicated further that SEI has three options for producing and distributing widgets in the southern European market: 1. To assemble the widgets in Charleston and ship them to Europe. 2. To assemble the widgets in a free-trade zone near Marseilles and distribute them from that point. 3. To assemble the widgets in a free-trade zone near Naples and distribute them from that point. SEI's directors have given Grimm approval to establish a widget-manufacturing site wherever he chooses. Now, Grimm was holding a meeting to brief two of his key staff on the consultant's report and the directors' decision. Present were his production manager, Philip Evers, and his distribution manager, Robert Windle. Evers has been with SEI for nine years after receiving his degree from Maryland in logistics and transportation. Windle was in college during the early 1960 s and was then drafted into the U.S. Army. After his army service he took a job with SEI, and he became distribution manager four years ago. Windle had the first question: "The report mentions 'freetrade zones' a number of times. How exactly do they function?'" Grimm answered, "Sometimes they're called foreign trade zones. What they are is an area of land, usually near a seaport or an airport, where goods have not moved through customs. If we ship components to a free-trade zone at Naples, for example, they don't pass through Italian customs. Only if we decide to ship them or our completed products inland (say, to Rome, do we have to import them into Italy. Even then, we might pay lower Italian import duties than if the goods were manufactured offshore. If we want to ship goods assembled in our Naples free-trade zone to France, we pay only French import duties." Evers then asked a question: "If we assemble widgets in Europe, does that mean we're not going to crack into the U.S. domestic market? Do we know how to manufacture and sell overseas? Wouldn't it be easier to sell here first in the United States, where we know what we're doing, than to expand overseas?" Grimm took off his glasses, pondered for a moment, and answered, "Your question is good, almost too good. Using perfect hindsight, we should have started building our own widgets ten years ago and selling them here. But for reasons that seemed good then, we never did. Today, several dozen widget manufacturers, many with well-known brikyd names, have cut up the U.S. market into so many shares I doubt that many are making a profit. Indeed, that might be our position today, had we entered the domestic market a decade ago. We'd be stuck supporting a huge domestic distribution network while the Japanese march in and steal sales." Grimm baused and then continued: "We're not here today to deal with what might have been. In Grimm paused and then continued: "We're not here today to deal with what might have been. In terms of the domestic market we've missed the brass ring. However, our cash position is good, and if we are ever going to make money now from the production of widgets it'll be in some new overseas market. Our directors concur. But thanks for your question, Phil; I'm glad we got the domestio market issue out on the table. Now, let's move on!" The three then discussed various aspects of the consultant's report. Finally, Grimm asked, "Do you have suggestions about how we should implement these recommendations?" Evers responded, "It'll be most advantageous to assemble widgets where labor costs are the lowest." "Pardon my interruption, Phil!" exclaimed Windle. "But there's a whole host of considerations that must be examined, for instance, transportation rates, insurance, import duties, and free trade zone costs." "All right, already," retorted Phil. "Next time, let me finish my sentence. I know there are other costs besides labor. Lord knows, no staff meeting around here is complete until you start complaining about them." Grimm frowned and said, "I want the two of you to work together and figure out the costs of the three alternatives. If you can't agree on what costs to include, see me." Bob and Phil spent much of the next two weeks working on the assignment. Surprisingly, they disagreed very little, with the exception of one point, which was Phil's continued assertion that SEI should be in a position to enter into the domestic E.S. market for widgets. Grimm was consulted, and he said unequivocally, "Probably not." After thirty-seven transatlantic phone calls, several meetings with the consultant (who had been retained by Grimm for some additional work with respect to developing overseas manufacturing costs), several phone calls from the trade press that had heard rumors of SEI's move, two After thirty-seven transatlantic phone calls, several meetings with the consultant (who had been retained by Grimm for some additional work with respect to developing overseas manufacturing costs), several phone calls from the trade press that had heard rumors of SEI's move, two disagreements with Mr. Stickler in accounting about the priority that their work deserved on SEI's mainframe computer, and five requests from Japanese and Korean widget manufacturers to be allowed to tour SEI's new widget-manufacturing plant, wherever it might be, Phil and Bob completed their assignment. They projected the annual demand for the widgets that SEI would build to be 26,000 units in Marseilles (for the French market) and 42,000 units in Barcelona (for the Spanish market). The labor costs per unit for assembly would be Charleston, \$7.00; Marseilles, \$6.50; and Naples, \$6.25. Component and product weights are gidgets, 65 pounds; gadgets, 35 pounds; and assembled widgets, 100 pounds. The purchase price of the components would be gidgets, FOB Brussels, $32 per unit, and gadgets, FOB Charleston, $36 per unit (this is SEI's usual price to any customer with annual purchases in the range of 50,000 to 75,000 units). Freight rates are the same per CWT (100 pounds) for gidgets, gadgets and widgets. Rates, per CWT, are As just given, these rates also include insurance on the shipment as it moves from port to port (or on land within Europe). For purposes of this case, assume that import duties are based on the total product cost (the cost of inputs, labor, and assembling). The duty rates are based on the value of the item at the time of import and vary by country. The duty rate for Spain is 4 percent; for France, 8 percent; for the United States, 10 percent. Southern Electronics, Incorporated (SEI), located in Charleston, South Carolina, is in the electronics industry and serves as a supplier of components to large manufacturers of specialized household electronic devices. Founded in 1983, SEI has enjoyed slow, steady growth. SEI's management recently decided to manufacture and market a product known as a widget. Widgets are made by assembling two component parts: gidgets, which can be purchased from a company in Belgium, and gadgets, which SEI is already producing in its Charleston facility. (SEI has been producing and selling gadgets since 1990.) Most of the consumer demand for widgets is in areas with relatively warm year-round climates. In the United States, widgets have sold well across the Sunbelt, stretching from the Carolinas south and west all the way to southern California. Because this is an area in the United States with a growing population, widget sales have done very well. The person largely responsible for SEI's decision to move into widgets is the firm's president, Curt Grimm. Grimm has spent his entire career in electronics and has been SEI's president since 1992. Before SEI's decision to manufacture widgets, Grimm followed industry sales of sidgets 2 with mixed feelings. As a supplier of gadgets to the widget manufacturers, SEI has prospered as a result of the widgets' record sales. However, it seems to Grimm that the majority of profits from widgets are going to the widget manufacturers, not to their suppliers, such as SEI. For many years, market. During this same period of time, however, SEI has been accumulating cash, and Grimm has noted that some unknown firms are entering the market and capturing small market shares. Each new entrant seems to dilute the market further, and Grimm feels that even if SEI were equally successful in the United States, its sales would be so small that they might not support the domestic selling effort. Grimm wants to get in on the ground floor somewhere else, so SEI has retained a consultant to determine whether potential markets exist elsewhere in the world for widgets. The consultant's conclusions are that the next major area to expect widgets to be sold in is along the Mediterranean coast of Europe, especially between Barcelona and Marseilles. At present, only one well-known European firm is building widgets, but it is not marketing them very effectively. The consultant has indicated further that SEI has three options for producing and distributing widgets in the southern European market: 1. To assemble the widgets in Charleston and ship them to Europe. 2. To assemble the widgets in a free-trade zone near Marseilles and distribute them from that point. 3. To assemble the widgets in a free-trade zone near Naples and distribute them from that point. SEI's directors have given Grimm approval to establish a widget-manufacturing site wherever he chooses. Now, Grimm was holding a meeting to brief two of his key staff on the consultant's report and the directors' decision. Present were his production manager, Philip Evers, and his distribution manager, Robert Windle. Evers has been with SEI for nine years after receiving his degree from Maryland in logistics and transportation. Windle was in college during the early 1960 s and was then drafted into the U.S. Army. After his army service he took a job with SEI, and he became distribution manager four years ago. Windle had the first question: "The report mentions 'freetrade zones' a number of times. How exactly do they function?'" Grimm answered, "Sometimes they're called foreign trade zones. What they are is an area of land, usually near a seaport or an airport, where goods have not moved through customs. If we ship components to a free-trade zone at Naples, for example, they don't pass through Italian customs. Only if we decide to ship them or our completed products inland (say, to Rome, do we have to import them into Italy. Even then, we might pay lower Italian import duties than if the goods were manufactured offshore. If we want to ship goods assembled in our Naples free-trade zone to France, we pay only French import duties." Evers then asked a question: "If we assemble widgets in Europe, does that mean we're not going to crack into the U.S. domestic market? Do we know how to manufacture and sell overseas? Wouldn't it be easier to sell here first in the United States, where we know what we're doing, than to expand overseas?" Grimm took off his glasses, pondered for a moment, and answered, "Your question is good, almost too good. Using perfect hindsight, we should have started building our own widgets ten years ago and selling them here. But for reasons that seemed good then, we never did. Today, several dozen widget manufacturers, many with well-known brikyd names, have cut up the U.S. market into so many shares I doubt that many are making a profit. Indeed, that might be our position today, had we entered the domestic market a decade ago. We'd be stuck supporting a huge domestic distribution network while the Japanese march in and steal sales." Grimm baused and then continued: "We're not here today to deal with what might have been. In Grimm paused and then continued: "We're not here today to deal with what might have been. In terms of the domestic market we've missed the brass ring. However, our cash position is good, and if we are ever going to make money now from the production of widgets it'll be in some new overseas market. Our directors concur. But thanks for your question, Phil; I'm glad we got the domestio market issue out on the table. Now, let's move on!" The three then discussed various aspects of the consultant's report. Finally, Grimm asked, "Do you have suggestions about how we should implement these recommendations?" Evers responded, "It'll be most advantageous to assemble widgets where labor costs are the lowest." "Pardon my interruption, Phil!" exclaimed Windle. "But there's a whole host of considerations that must be examined, for instance, transportation rates, insurance, import duties, and free trade zone costs." "All right, already," retorted Phil. "Next time, let me finish my sentence. I know there are other costs besides labor. Lord knows, no staff meeting around here is complete until you start complaining about them." Grimm frowned and said, "I want the two of you to work together and figure out the costs of the three alternatives. If you can't agree on what costs to include, see me." Bob and Phil spent much of the next two weeks working on the assignment. Surprisingly, they disagreed very little, with the exception of one point, which was Phil's continued assertion that SEI should be in a position to enter into the domestic E.S. market for widgets. Grimm was consulted, and he said unequivocally, "Probably not." After thirty-seven transatlantic phone calls, several meetings with the consultant (who had been retained by Grimm for some additional work with respect to developing overseas manufacturing costs), several phone calls from the trade press that had heard rumors of SEI's move, two After thirty-seven transatlantic phone calls, several meetings with the consultant (who had been retained by Grimm for some additional work with respect to developing overseas manufacturing costs), several phone calls from the trade press that had heard rumors of SEI's move, two disagreements with Mr. Stickler in accounting about the priority that their work deserved on SEI's mainframe computer, and five requests from Japanese and Korean widget manufacturers to be allowed to tour SEI's new widget-manufacturing plant, wherever it might be, Phil and Bob completed their assignment. They projected the annual demand for the widgets that SEI would build to be 26,000 units in Marseilles (for the French market) and 42,000 units in Barcelona (for the Spanish market). The labor costs per unit for assembly would be Charleston, \$7.00; Marseilles, \$6.50; and Naples, \$6.25. Component and product weights are gidgets, 65 pounds; gadgets, 35 pounds; and assembled widgets, 100 pounds. The purchase price of the components would be gidgets, FOB Brussels, $32 per unit, and gadgets, FOB Charleston, $36 per unit (this is SEI's usual price to any customer with annual purchases in the range of 50,000 to 75,000 units). Freight rates are the same per CWT (100 pounds) for gidgets, gadgets and widgets. Rates, per CWT, are As just given, these rates also include insurance on the shipment as it moves from port to port (or on land within Europe). For purposes of this case, assume that import duties are based on the total product cost (the cost of inputs, labor, and assembling). The duty rates are based on the value of the item at the time of import and vary by country. The duty rate for Spain is 4 percent; for France, 8 percent; for the United States, 10 percentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started