I really need help finding the SUTA and FUTA taxes please!

FUTA tax rate is .6% with a wage limit of $7,000.00

SUTA tax rate is 3.4%

THANK YOU!

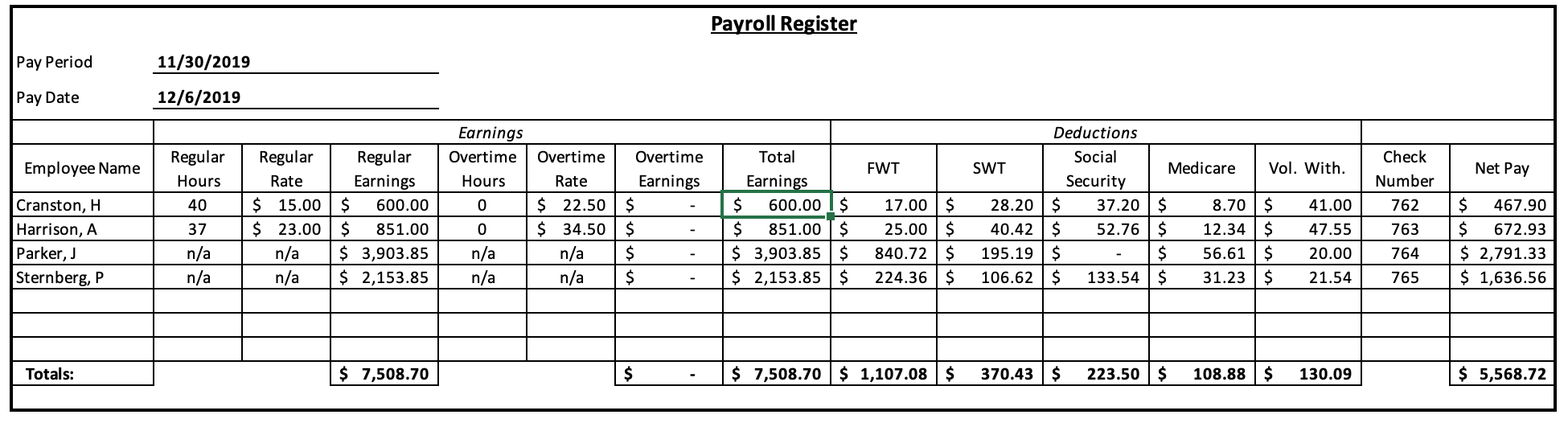

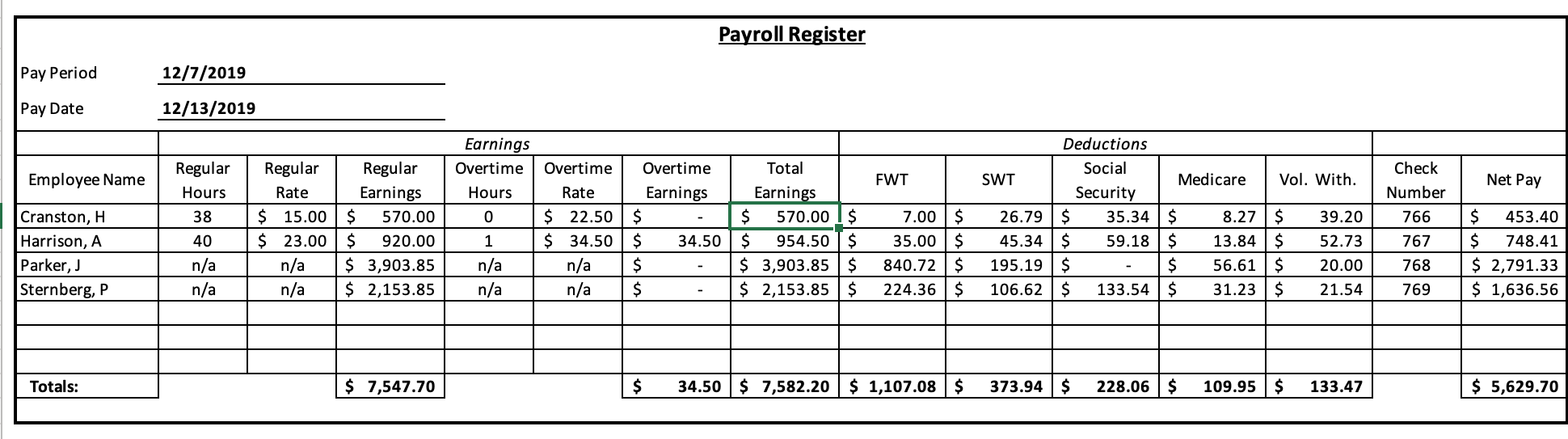

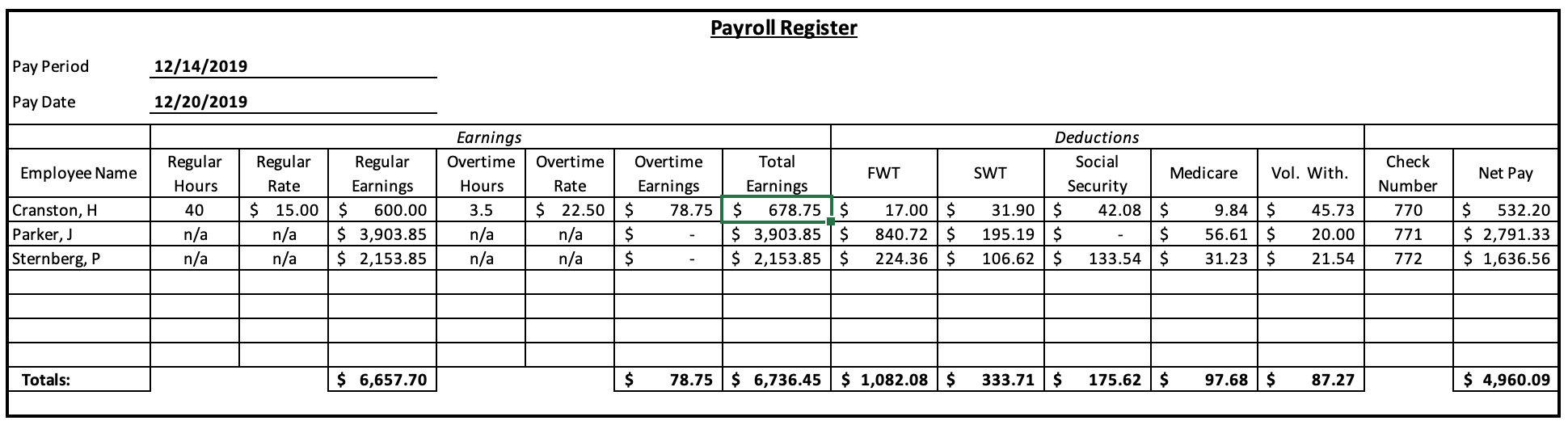

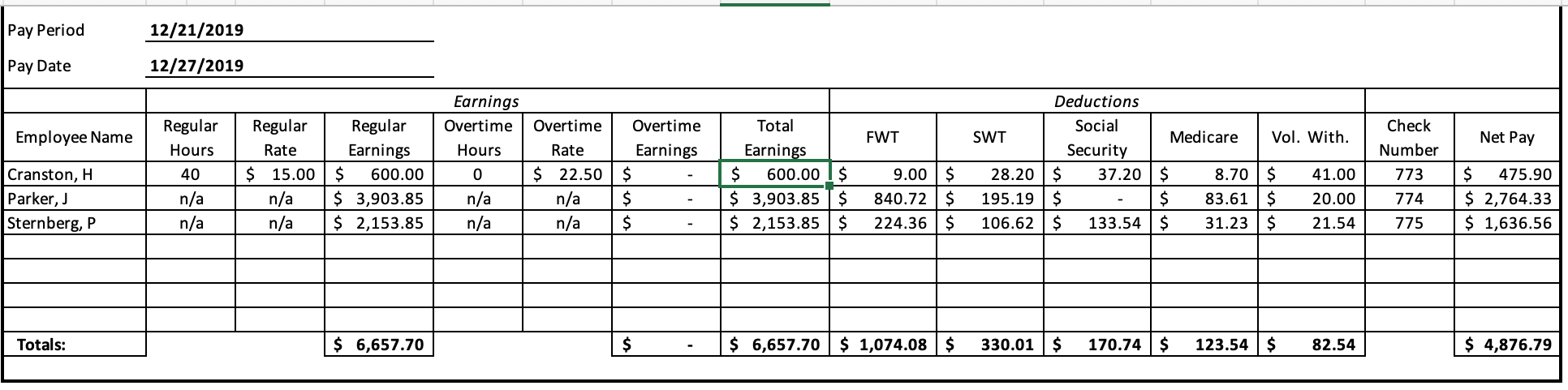

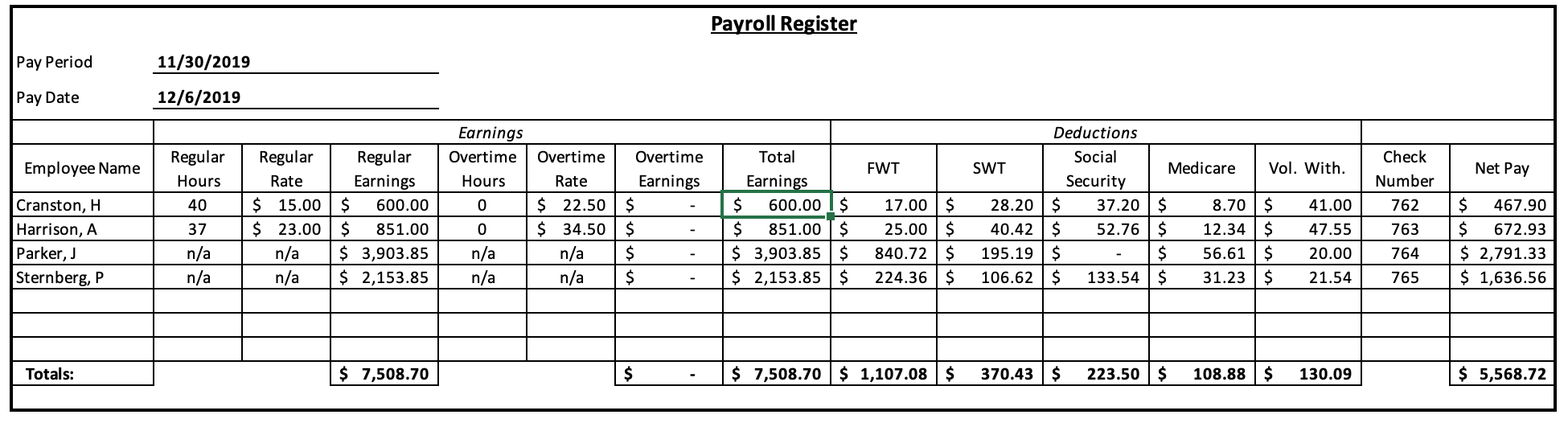

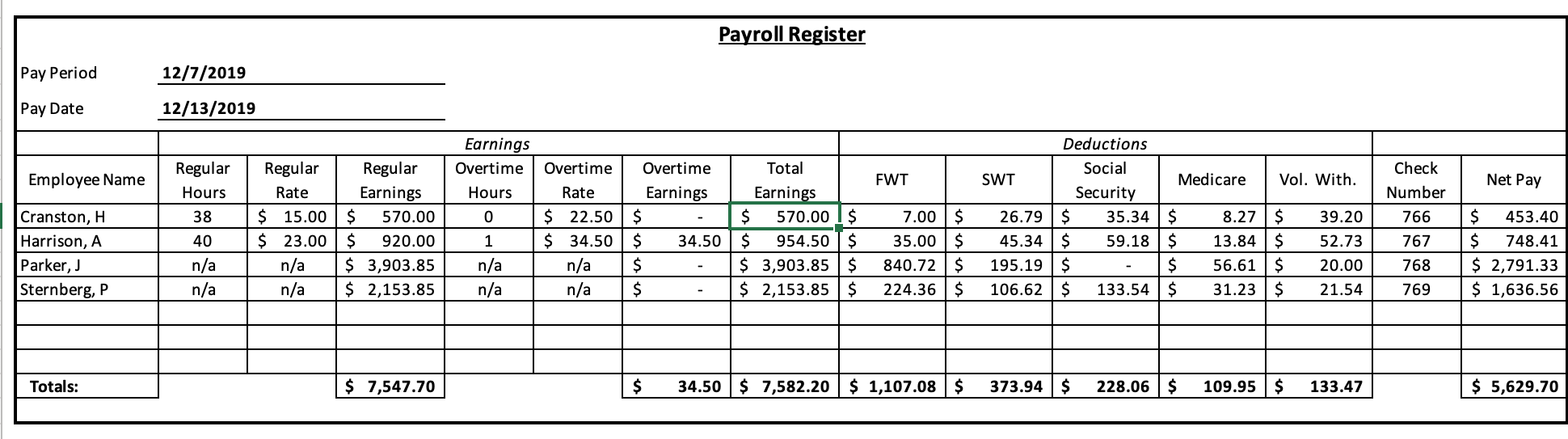

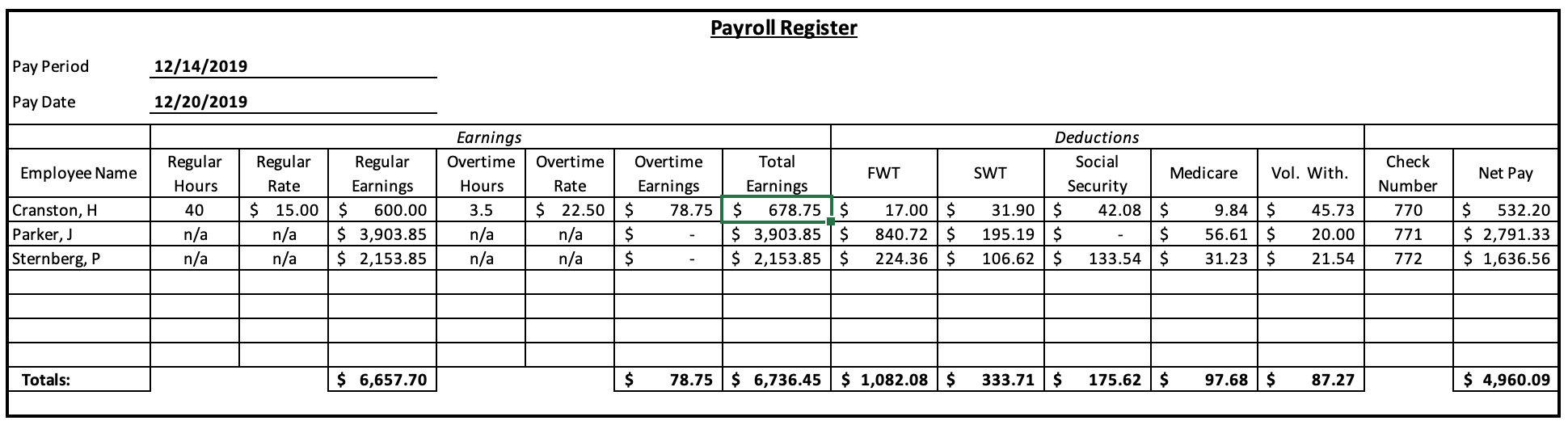

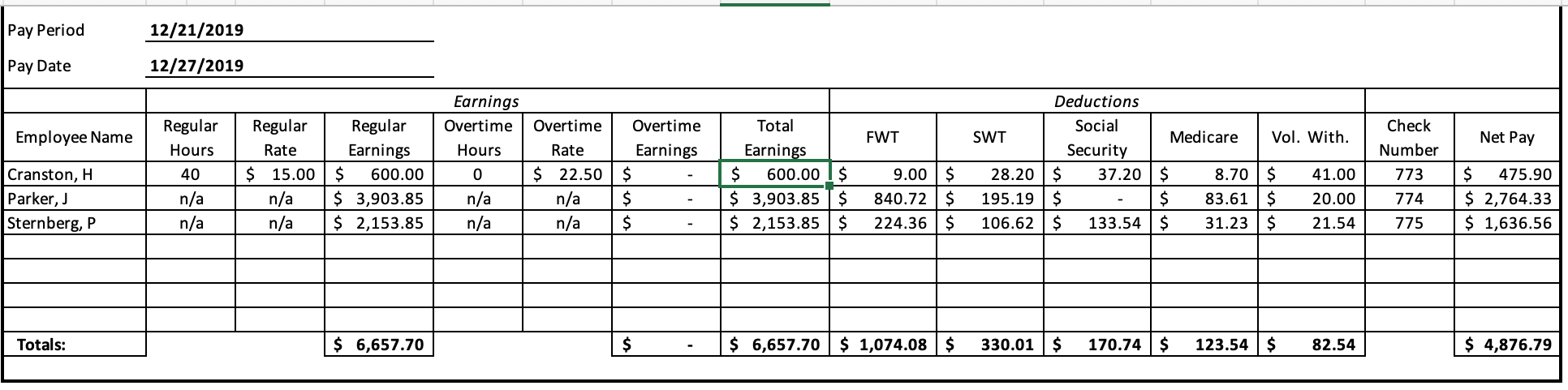

Payroll Register Pay Period 11/30/2019 Pay Date 12/6/2019 Regular Earnings Overtime Hours Total Employee Name FWT Net Pay Hours 40 0 Regular Rate $ 15.00 $ 23.00 n/a n/a Regular Earnings $ 600.00 $ 851.00 $ 3,903.85 $ 2,153.85 Cranston, H Harrison, A Parker, J Sternberg, P. Overtime Overtime Rate Earnings $ 22.50 $ $ 34.50 $ n/a $ n/a $ Check Number 762 763 0 Deductions Social SWT Medicare Vol. With. Security 28.20 $ 37.20 $ 8.70 $ 41.00 40.42 $ 52.76 $ 12.34 $ 47.55 195.19 $ $ 56.61 $ 20.00 106.62 $ 133.54 $ 31.23 $ 21.54 Earnings $ 600.00 $ $ 851.00 $ $ 3,903.85$ $ 2,153.85$ 37 n/a 17.00 $ 25.00 $ 840.72 $ 224.36 $ $ 467.90 $ 672.93 $ 2,791.33 $ 1,636.56 n/a 764 765 n/a n/a Totals: $ 7,508.70 $ $ 7,508.70 $ 1,107.08 $ 370.43 $ 223.50 $ 108.88 $ 130.09 $ 5,568.72 Payroll Register Pay Period 12/7/2019 Pay Date 12/13/2019 Employee Name Regular Hours FWT Net Pay Regular Rate $ 15.00 $ 23.00 38 Regular Earnings $ 570.00 $ 920.00 $ 3,903.85 $ 2,153.85 Cranston, H Harrison, A Parker, J Sternberg, P Earnings Overtime Hours 0 1 n/a n/a Overtime Rate $ 22.50 $ 34.50 n/a n/a Overtime Earnings $ $ 34.50 $ $ Total Earnings $ 570.00 $ $ 954.50 $ $ 3,903.85$ $ 2,153.85$ Deductions Social SWT Medicare Vol. With. Security 26.79$ 35.34 $ 8.27 $ 39.20 45.34 $ 59.18 $ 13.84 $ 52.73 195.19 $ $ 56.61 $ 20.00 106.62 $ 133.54 $ 31.23 $ 21.54 7.00 $ 35.00 $ 840.72 $ 224.36 $ 40 Check Number 766 767 768 $ 453.40 $ 748.41 $ 2,791.33 $ 1,636.56 n/a n/a n/a n/a 769 Totals: $ 7,547.70 $ 34.50 $ 7,582.20 $ 1,107.08 $ 373.94 $ 228.06 $ 109.95 $ 133.47 $ 5,629.70 Payroll Register Pay Period 12/14/2019 Pay Date 12/20/2019 Employee Name Regular Hours FWT Medicare Vol. With. Net Pay Earnings Overtime Hours 3.5 n/a Regular Rate $ 15.00 n/a n/a 40 Regular Earnings $ 600.00 $ 3,903.85 $ 2,153.85 Cranston, H Parker, J Sternberg, P Overtime Overtime Rate Earnings $ 22.50 $ 78.75 n/a $ n/a $ Deductions Social SWT Security 31.90$ 42.08 195.19 $ 106.62 $ 133.54 Total Earnings $ 678.75 l $ $ 3,903.85 $ $ 2,153.85$ 45.73 17.00 $ 840.72 $ 224.36 $ $ $ $ n/a n/a Check Number 770 771 772 9.84 $ 56.61 $ 31.23 $ 20.00 $ 532.20 $ 2,791.33 $ 1,636.56 n/a 21.54 Totals: $ 6,657.70 $ 78.75 $ 6,736.45 $ 1,082.08 $ 333.71 $ 175.62$ 97.68 $ 87.27 $ 4,960.09 Pay Period 12/21/2019 Pay Date 12/27/2019 Earnings Overtime Hours Employee Name FWT Net Pay Regular Hours 40 n/a n/a Regular Regular Rate Earnings $ 15.00 $ 600.00 n/a $ 3,903.85 n/a $ 2,153.85 Cranston, H Parker, J Sternberg, P Overtime Rate $ 22.50 n/a n/a 0 Overtime Earnings $ $ $ Deductions Social SWT Medicare Vol. With. Security 28.20$ 37.20$ 8.70 $ 41.00 195.19 $ $ 83.61 $ 20.00 106.62 $ 133.54 $ 31.23 $ 21.54 Total Earnings $ 600.00 $ $ 3,903.85$ $ 2,153.85$ Check Number 773 9.00 $ 840.72$ 224.36 $ n/a n/a 774 $ 475.90 $ 2,764.33 $ 1,636.56 775 Totals: $ 6,657.70 $ $ 6,657.70 $ 1,074.08 $ 330.01$ 170.74 $ 123.54 $ 82.54 $ 4,876.79