i really need help!! follow the directions

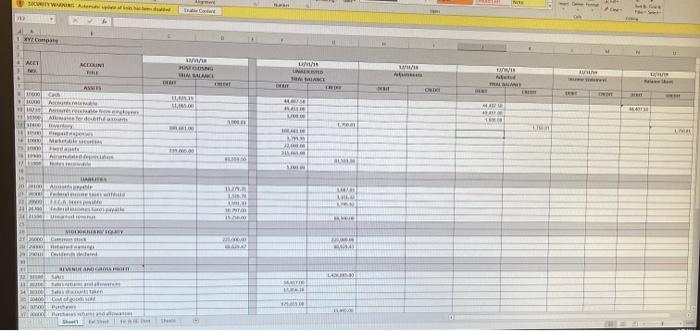

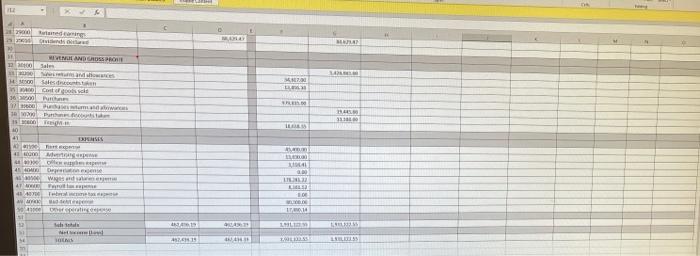

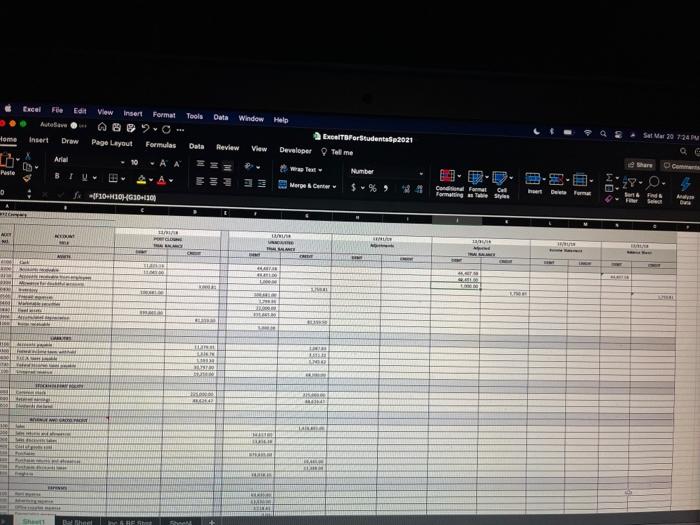

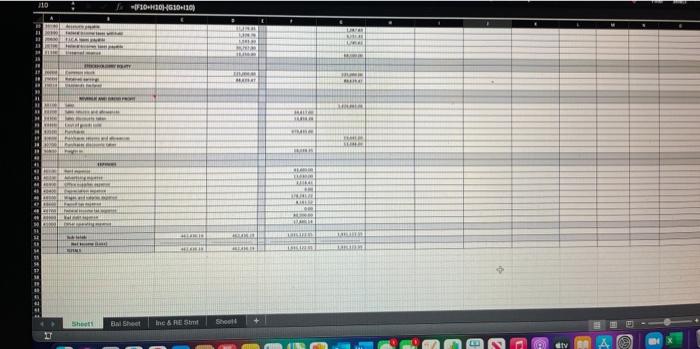

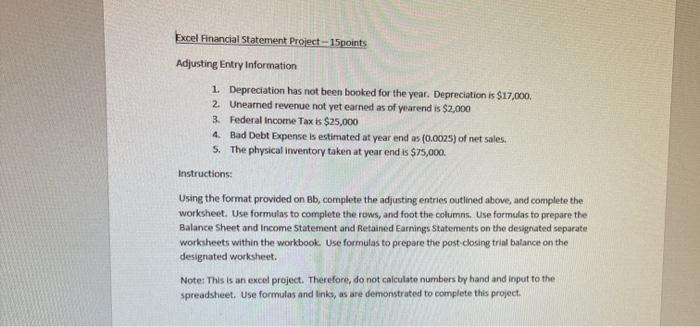

Excel Financial Statement Project - 15 points Adjusting Entry Information 1. Depreciation has not been booked for the year. Depreciation is $17,000. 2. Uneamed revenue not yet earned as of yearend is $2,000 3. Federal Income Tax is $25,000 4. Bad Debt Expense is estimated at year end as (0.0025) of net sales. S. The physical inventory taken at year end is $75,000. Instructions: Using the format provided on Bb, complete the adjusting entries outlined above, and complete the worksheet. Use formulas to complete the rows, and foot the columns. Use formulas to prepare the Balance Sheet and income Statement and Retained Earnings Statements on the designated separate worksheets within the workbook. Use formulas to prepare the post.closing trial balance on the designated worksheet. Note: This is an excel project. Therefore, do not calculate numbers by hand and input to the spreadsheet. Use formules and links, as are demonstrated to complete this project SH CE + VIC MET ACERIN BUS IMI WHITE BIAN LED AME w HIER FL th, w Adam LE WY M. TI ENTE 1 .. MORE 4 IN HINE SAS LLO WORTH MIVELANDCRUS al EVE 7.00 Hool Cost of 360 LE HD TP. 11.10 OF w AL AW 41 4340700 LIL LE 1.0 4 She WS 432. 19 BASED LIELS Edit View Insert Format Tools Auto Data Window Help BoltForStudentai2021 Review Developer Tal me Home Insert Draw Page Layout Formulas Data Q L- Arla 19 AA Peste Number AA E-9. 3-3-3- Merge Cente $% Con Form 0 If 30.1010-620-30 Cell wat we forma F S De RE I MI RUDE 1 A CRIME w THE SEL INT LE RE BAND LIR 1 pel OTI -F10-1201-4610-301 1 - BE 10 H H w HT HEHE MT H M 18 P WE WIRE O 15 M LI IS TER IRUN us Shot East inc & S Shell Excel Financial Statement Project - 15 points Adjusting Entry Information 1. Depreciation has not been booked for the year. Depreciation is $17,000. 2. Uneamed revenue not yet earned as of yearend is $2,000 3. Federal Income Tax is $25,000 4. Bad Debt Expense is estimated at year end as (0.0025) of net sales. S. The physical inventory taken at year end is $75,000. Instructions: Using the format provided on Bb, complete the adjusting entries outlined above, and complete the worksheet. Use formulas to complete the rows, and foot the columns. Use formulas to prepare the Balance Sheet and income Statement and Retained Earnings Statements on the designated separate worksheets within the workbook. Use formulas to prepare the post.closing trial balance on the designated worksheet. Note: This is an excel project. Therefore, do not calculate numbers by hand and input to the spreadsheet. Use formules and links, as are demonstrated to complete this project SH CE + VIC MET ACERIN BUS IMI WHITE BIAN LED AME w HIER FL th, w Adam LE WY M. TI ENTE 1 .. MORE 4 IN HINE SAS LLO WORTH MIVELANDCRUS al EVE 7.00 Hool Cost of 360 LE HD TP. 11.10 OF w AL AW 41 4340700 LIL LE 1.0 4 She WS 432. 19 BASED LIELS Edit View Insert Format Tools Auto Data Window Help BoltForStudentai2021 Review Developer Tal me Home Insert Draw Page Layout Formulas Data Q L- Arla 19 AA Peste Number AA E-9. 3-3-3- Merge Cente $% Con Form 0 If 30.1010-620-30 Cell wat we forma F S De RE I MI RUDE 1 A CRIME w THE SEL INT LE RE BAND LIR 1 pel OTI -F10-1201-4610-301 1 - BE 10 H H w HT HEHE MT H M 18 P WE WIRE O 15 M LI IS TER IRUN us Shot East inc & S Shell