I really need help trying to formulate the right formulas to get the correct answers. thank you.

I really need help trying to formulate the right formulas to get the correct answers. thank you.

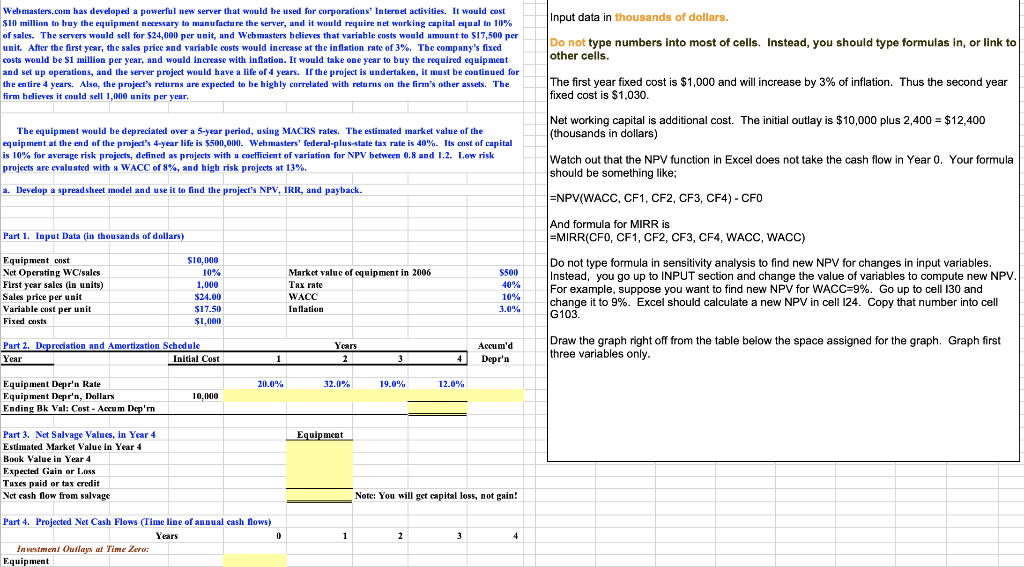

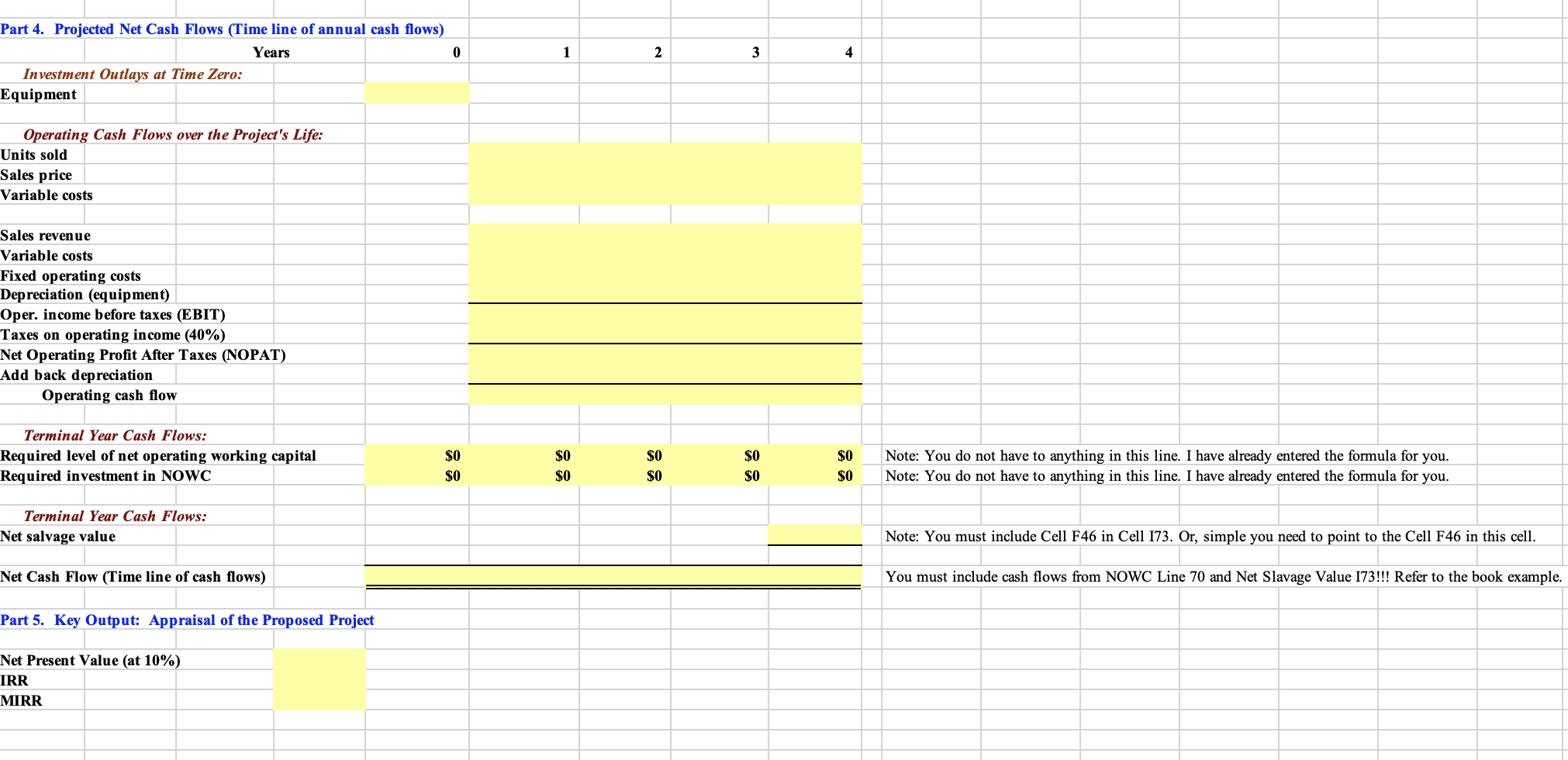

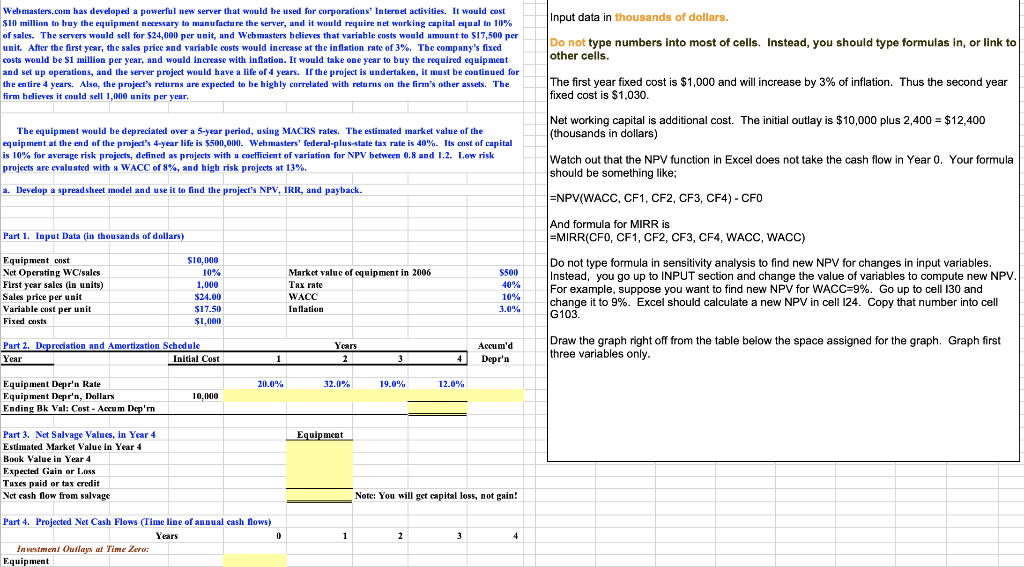

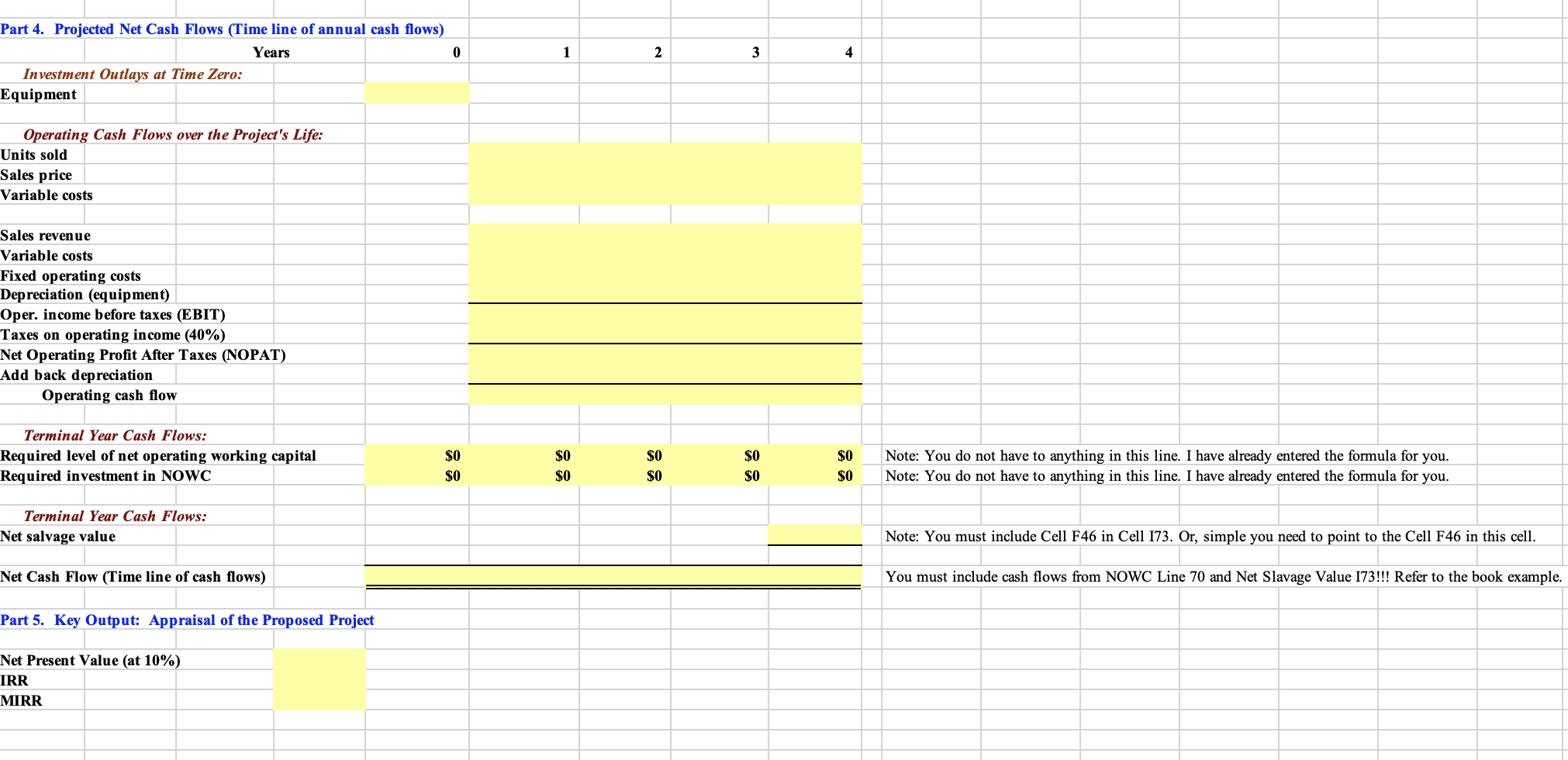

Input data in thousands of dollars. Webmasters.com has developed a powerful new server that would be used for corporations Internet activities. It would cost $10 million to buy the equipment necessary to manufucture the server, and it would require net working capital equal to 10% of sales. The servers would sel for 524,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After the first year, the sales price and variable costs would increase at the inflation rate of 3%. The company's fixed costs would be $1 million per year, and would increase with inflation. It would take one year to buy the required equipment and set up operations, and the server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets. The firm believes it could sell 1,000 units per year. Do not type numbers into most of cells. Instead, you should type formulas in, or link to other cells. The equipment would be depreciated over a 5-year period, using MACRS rates. The estimated market value of the equipment at the end of the projects 4-year life is $500,000. Webmasters' federal-plus-state tax rate is 40%. Its cost of capital is 10% for average risk projects, defined as projects with a coefficient of variation for NPV between 0.8 and 1.2. Low risk projects are evaluated with a WACC of 8%, and high risk projects at 13%. a. Develop a spreadsheet model and use it to find the project's NPV, IRR, and payback. The first year fixed cost is $1,000 and will increase by 3% of inflation. Thus the second year fixed cost is $1,030. Net working capital is additional cost. The initial outlay is $10,000 plus 2,400 = $12,400 (thousands in dollars) Watch out that the NPV function in Excel does not take the cash flow in Year 0. Your formula should be something like: =NPV(WACC, CF1, CF2, CF3, CF4) - CFO - And formula for MIRR is =MIRR(CFO, CF1, CF2, CF3, CF4, WACC, WACC) Do not type formula in sensitivity analysis to find new NPV for changes in input variables. Instead, you go up to INPUT section and change the value of variables to compute new NPV. For example, suppose you want to find new NPV for WACC=9%. Go up to cell 130 and change it to 9%. Excel should calculate a new NPV in cell 124. Copy that number into cell G103. Part 1. laput Data (in thousands of dollars) Equipment cont Net Operating WCsales First year sales (In units) Sales price per unit Variable cost per unit Fixed costs $10,000 10% 1,000 $24.00 $17.50 $1,000 Market value of quipment in 2006 Tax rate WACC Inflation $500 40% 10% 3.0% Years Part 2. Depreciation and Amortization Schedule Year Initial Cost Accum'a Depr'n Draw the graph right off from the table below the space assigned for the graph. Graph first three variables only 1 1 2 3 4 20.0% 32.0% 19.0% 12.0% Equipment Deprin Rate Equipment Deprin, Dellars Ending Bk Val: Cost - Accum Dep'rn 10,000 Equipment Part 3. Net Salvage Values, In Year 4 Estimated Market Value in Year 4 Book Value in Year 4 Expected Gain or Loss Taxes paid or tax credit Net cash flow from salvage Note: You will get capital loss, not gain! 0 1 1 2 3 4 Part 4. Projected Net Cash Flows (Time line of annual cash flows) Years Investment Owilayar Time Zero: Equipment 0 1 2 3 4 Part 4. Projected Net Cash Flows (Time line of annual cash flows) Years Investment Outlays at Time Zero: Equipment Operating Cash Flows over the Project's Life: Units sold Sales price Variable costs Sales revenue Variable costs Fixed operating costs Depreciation (equipment) Oper. income before taxes (EBIT) Taxes on operating income (40%) Net Operating Profit After Taxes (NOPAT) Add back depreciation Operating cash flow Terminal Year Cash Flows: Required level of net operating working capital Required investment in NOWC $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Note: You do not have to anything in this line. I have already entered the formula for you. Note: You do not have to anything in this line. I have already entered the formula for you. Terminal Year Cash Flows: Net salvage value Note: You must include Cell F46 in Cell 173. Or, simple you need to point to the Cell F46 in this cell. Net Cash Flow (Time line of cash flows) You must include cash flows from NOWC Line 70 and Net Slavage Value 173!!! Refer to the book example. Part 5. Key Output: Appraisal of the Proposed Project Net Present Value (at 10%) IRR MIRR

I really need help trying to formulate the right formulas to get the correct answers. thank you.

I really need help trying to formulate the right formulas to get the correct answers. thank you.