Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i really need help worh this one Suppose the returns on Asset Y are normally distributed. The average annual return for this asset over 50

i really need help worh this one

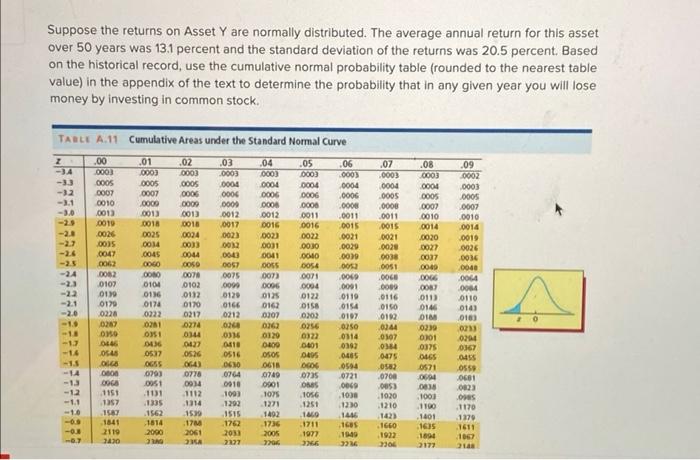

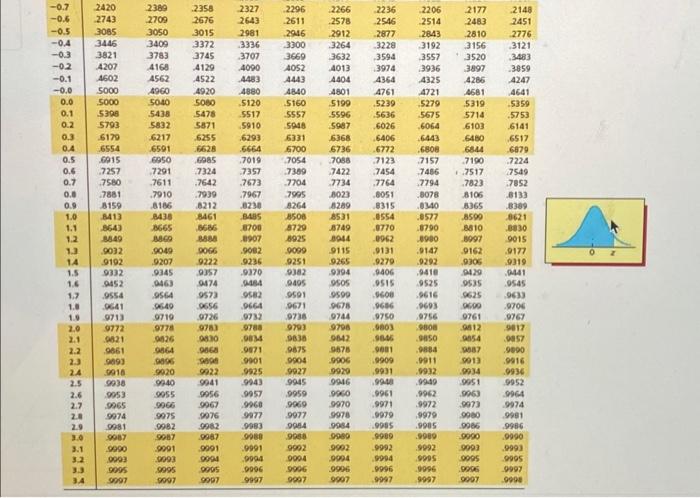

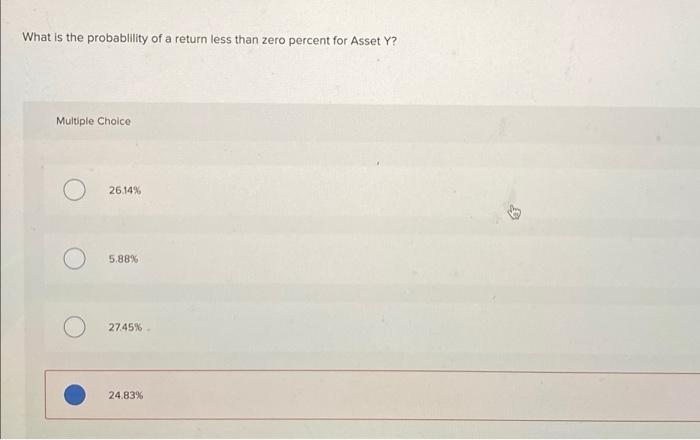

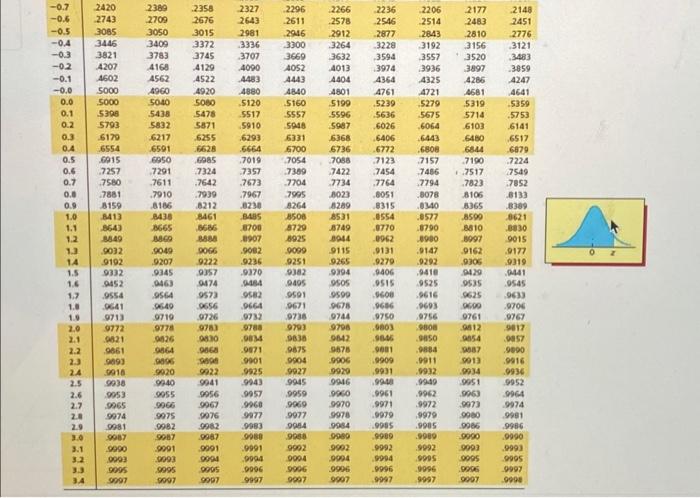

Suppose the returns on Asset Y are normally distributed. The average annual return for this asset over 50 years was 13.1 percent and the standard deviation of the returns was 20.5 percent Based on the historical record, use the cumulative normal probability table (rounded to the nearest table value) in the appendix of the text to determine the probability that in any given year you will lose money by investing in common stock. .08 .09 2000 SOOO 0003 9000 5000 6000 6000 OOO .07 0003 0004 0005 0000 0011 0015 0021 0020 0038 1100 0003 0004 0005 0002 0010 0014 0020 0027 0037 0040 0007 .0010 0014 SCOO TOO 6100 SCOO 0029 0045 OPO 0059 0051 0080 600 TABLE A 11 Cumulative Areas under the Standard Normal Curve .00 .01 .02 .03 .04 .05 -3A .06 0003 0003 0003 .0003 0003 0003 -3.3 000) 0005 0005 0004 0004 0004 0004 -32 0007 0007 0006 0006 0006 -3.1 0006 0010 0000 0000 0000 0013 001) 001) 0012 0012 0011 0010 0018 0018 0017 0016 0016 -23 0015 0026 0024 002) 0023 0022 -27 .0021 0033 0012 -26 0031 0030 0047 0044 0043 0041 -25 .000 0062 ODGO 0050 0057 DOSS 0054 -24 0082 0070 0075 007) 0071 -23 0107 0104 0102 0096 -22 0004 0136 0132 0120 0125 0122 0119 0170 017 0120 0166 0162 -20 0158 0154 0226 0222 0212 0212 0307 0202 -1.6 0287 0201 0274 0262 0256 0250 050 0316 0120 0322 -13 0436 0437 0410 -14 0392 OS 0526 0516 0405 0465 OG 064) OCSO 0618 0800 0504 0793 0776 0764 0749 0721 -13 0051 0934 0910 Ons -12 1151 .1131 1112 1093 1056 1030 1357 .1335 1314 1292 1271 1251 12.30 -10 1580 1562 1539 1492 1446 -0. 1841 1814 17M 1762 1736 -1711 168s -0 2119 2000 2061 2033 2005 1977 1949 2007 2016 3266 9000 1900 6800 9000 6610 0116 0150 0192 0944 0107 2010 0026 0036 0040 0044 0044 0110 014 0169 0233 0294 0367 0087 0113 0146 OM 0239 0201 0375 NO ISO TEO PIEO BOTO soso LORO PRO 0537 5910 0455 50 090 6550 SOLO 300 1050 6900 0475 0582 0700 0053 1020 1210 1023 0681 0823 1075 5000 0571 0694 0638 1003 1190 1401 165 1894 2172 SISI ORI 0991 1170 1370 1611 1067 21 OCTE NEC VEC 1922 2306 SRCE 2420 2743 3065 3446 3821 4207 4602 5000 5000 2296 2611 2946 3300 3660 4052 2236 2546 2877 3228 3594 3974 4364 4761 2206 2514 2843 3192 3557 9E6E A443 4840 2177 2483 2810 3156 3520 3897 4286 4681 5319 5714 6103 6480 6844 7190 5239 BOES 2389 2709 3050 3409 3783 4168 4562 4960 5040 .5438 5832 6217 6591 6950 7291 .7611 .7910 .8186 14.30 3665 GO .9049 9207 2358 2676 3015 3372 3745 4129 4522 4920 5080 5478 5871 6255 .6628 Gas 7324 -7642 .7939 .8212 8461 0686 888 3066 9222 9357 04174 9573 0656 9726 9783 0830 4325 4721 5279 5675 .6064 6443 .6808 7157 7486 7794 .8078 LISE 2327 2643 2981 3336 3707 4090 4483 4880 5120 5517 5910 .6293 6664 7019 7357 .7673 .7967 .8230 3405 3700 1907 9002 .9235 9370 9454 9582 9664 9732 9788 08M .9071 2148 2451 2776 3121 3483 .3859 4247 4641 .5359 .5753 .6141 .6517 6879 .7224 7549 -7852 .8133 8389 0621 7823 8105 od -0.7 -0.6 -0.5 -0.4 -0.3 -02 -0.1 -0.0 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.0 0.9 1.0 1.1 1.2 13 14 1.5 1.6 1.7 1.0 1.0 2.0 2.1 2.2 2.3 24 2.5 2.6 2.7 20 2.9 3.0 3.1 5636 .6026 .6406 .6772 .7123 7454 .7764 .8051 .8315 0554 0770 0962 .9131 .9279 9.406 OVEO 5909 be 5793 6170 6554 6015 .7257 7580 7881 8159 8413 864) 3849 9032 9192 9332 2052 9554 0641 9713 9772 0821 9861 9093 5918 9938 9053 9965 9974 0981 2266 2578 2912 3264 3632 4013 4404 4801 5199 -5596 5987 6368 6736 7088 7422 7734 8023 8289 8531 .8749 3014 9115 9265 9994 9505 9590 0678 9744 9796 9642 9678 9906 9920 9916 9960 9970 9978 19984 9989 9992 5160 5557 5948 6331 6700 7054 7389 7704 7905 8264 8508 8729 8925 9000 9251 982 0405 9501 0671 0738 979) 98.38 9675 0904 9927 9945 OEBE . .8577 .6790 0980 9147 9292 9410 9525 9616 SVEO SI56 0463 9564 0640 9710 9770 0026 9864 9096 9015 9177 9319 2441 9545 9633 9706 9767 9017 0857 9090 9750 9803 9605 9001 .8500 8810 3997 9162 9305 9429 9535 9625 6.90 9761 9812 0854 9687 9013 9934 9951 5963 .9073 9000 9986 I 2996 ws 1066 6066 9166 9925 9943 .9957 6566 9756 9800 9050 9884 .9911 .9932 99.49 .9962 9972 9979 9905 9922 9941 9056 9967 9076 9982 9020 9940 9955 9964 9075 9982 9087 9001 9093 9995 .9934 9952 9964 9974 9981 0966 9931 99,00 9961 9971 9979 9905 9989 9969 9977 0984 9950 9866 6005 0006 9001 9977 9983 9980 9991 9994 9096 9997 2066 -9992 .9992 9000 TE 0093 9994 5665 5600 1000 5006 0904 9906 1666 9666 9990 .9993 9995 9997 9990 5606 9666 9996 9997 3.A 9997 9997 2006 9997 9997 9907 What is the probability of a return less than zero percent for Asset Y? Multiple Choice 26.14% 5.88% 27,45% 24.83%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started