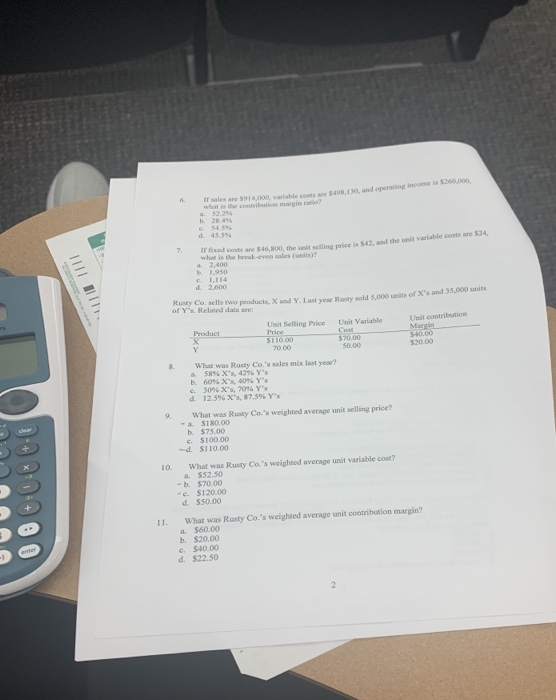

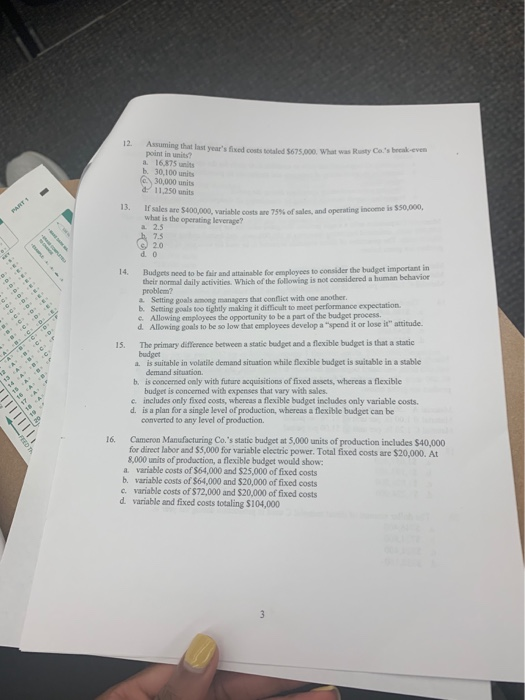

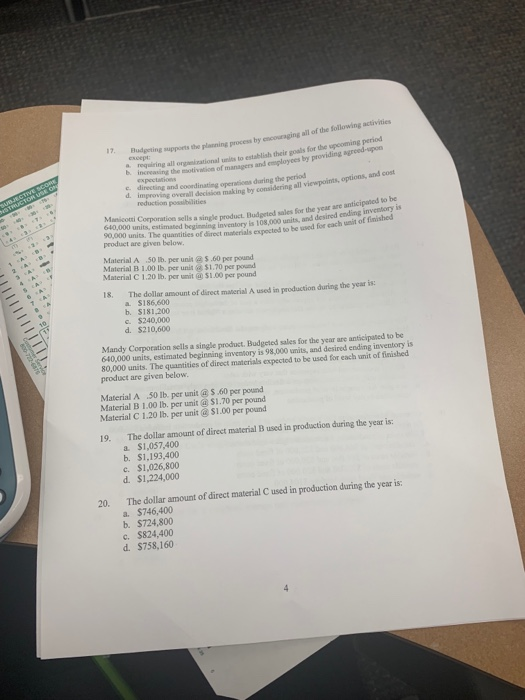

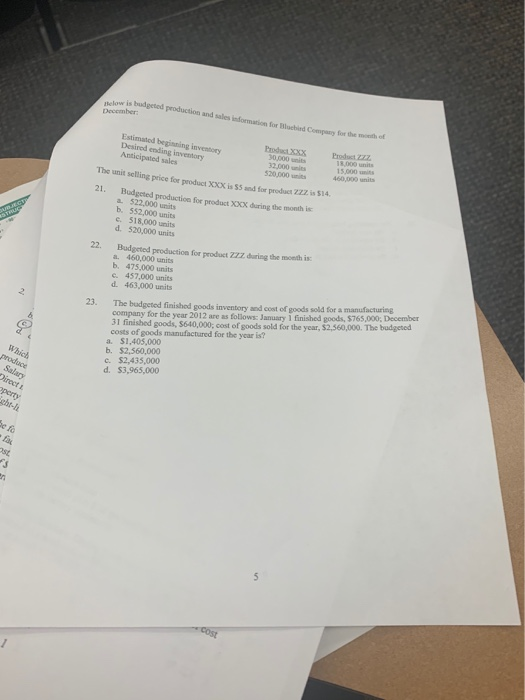

I sales ane $914,000, variable costs ave $40s,130, and operasing income is $260,000 b. 28.4% dL 45.5% If fixed od costs are $46,800, the unit selling price is S42, and the unit variable costs ane $24 what is the beeak-even sales (units)? a. 2,400 b 1.950 c 1,114 d. 2,600 Rusty Co. sells two peoducts, X and Y. Last year Rusty sold 5,000 units of X's and 35,000 units of Y's. Related data are Unit Selling Price Unit Variable Unit contribution S110.00 50.00 $20.00 8 What was Rusty Co.'s sales mix last yeor? 58% X%, 42% Y's 60% X's, 40% Y's 30% X's, 70% Y's 12.5% X's, 87.5% Y's a. b. d 9. What was Rusity Co's weighted average unit selling price? , a $180.00 b. $75.00 c. $100.00 d. $110.00 O. What was Rusty Co.'s weighted average unit variable cosr? a. $52.50 b. $70.00 e$120.00 d. $50.00 What was Rusty Co.'s weighted average unit contribution margin? a. $60.00 b. $20.00 e. $40.00 d. $22.50 12. Assuming that last year's fixed costs totaled $675,000. What was Rusty Cos break-ever a. 16,875 unit b. 30,100 units 30,000 units 11,250 units 13. lfsales are S400,000, variable costs are 75% of sales, and operating income is what is the operating leverage? a 2.5 550,000, 7.5 14. Budgets need to be fair and attainable for employees to consider the budget importani their normal daily activities. Which of the following is not considered a human behavioe problem? a Setting goals b. Setting goals too tightly making it difficult to meet performance expectation e. Allowing employees the opportunity to be a part of the budget process. d. Allowing goals to be so low that employees develop a "spend it or lose it" attitude. s among managers that conflict with one another The primary difference between a static badget and a flexible budget is that a static budget a is suitable in volatile demand situation while flexible budget is suitable in a stable 15. demand situation. b. is concemed only with future acquisitions of fixod assets, whereas a flexible budget is concerned with expenses that vary with sales c includes only fixed costs, whereas a flexible budget includes only variable costs. d. is a plan for a single level of production, whereas a flexible budget can be converted to any level of production. 16. Cameron Manufacturing Co.'s static budget at 5,000 units of production includes $40,000 for direct labor and $5,000 for variable electric power. Total fixed costs are $20,000. At 8,000 units of production, a flexible budget would show: a. variable costs of $64,000 and $25,000 of fixed costs b. variable costs of $64,000 and $20,000 of fixed costs c. variable costs of $72,000 and $20,000 of fixed costs d variable and fixed costs totaling $104,000 17. by Budgeting supports the the planning process by encouraging all of the following activities the upeoming period requiring all organizational units to establish their goals for a. veeasine the miotivatios of managers and employees by providing agreed-upon e directing and coordinating operatioes daring the period d. improving all viewpoints, options, and cost atioe sells a single product Budprted sales for the year are anticipated to be 640,000 units, estimated 90,000 units. Thg inventory is 108,000 units, and desired ending inve ect materials expocted to be used for each unit of finished product are given below Material A 50 Ib. per unit @$.60 per pound Material B 1.00 lb. per unit @ $1.70 per pound Material C 1.20 lb. per unit $1.00 per pound 18. The dollar amount of direct material A used in production during the year is a. $186,600 b. $181,200 c. $240,000 d. $210,600 Mandy Corporation sells a single product. Budgeted sales for the year are anticipated to be 640,000 units, estimated beginning inventory is 98,000 units, and desired ending inventory is 80,000 units, The quantities of direct materials expectod to be used for each wnit of finished product are given below Material A 50 lb per unit $.60 per pound Material B 1.00 lb. per unit$1.70 per pound Material 1.20 per unit @ S1.00per pound 19. The dollar anount of direct material B used in production during the year is: a $1,057,400 b. $1,193.400 c$1,026,800 d. $1,224,000 The dollar amount of direct material C used in production during the year is: a. $746,400 b. $724,800 c. $824,400 20. d. $758,160 f ttelo w is budgeted production and sales information for Bluebird Company for the month ef beginning inventory Product ZZZ Desired ending inventory Anticipated sales 18,000 units 2.00 0,000 unils 0,000 units 520,000 unit The unit selling price for product XXX is s5 and for product ZZZ is 514 21. Budgeted production for product X00X during the month is a 522,000 units b. 552,000 units e. 518,000 units d. 520,000 units 22. Budgeted production for product ZzZ. during the moeth is a. 460,000 units b. 475,000 units c. 457,000 units d. 463,000 units company for the year 2012 are as follows: January 1 finished goods, 31 finished goods, $640,000, cost of goods sold for the year, $2,560,000. The $765,000 December budgeted 23. The budgeted finishod goods inventory and cost of goods sold for a manufacturing costs of goods manufactured for the year is? a. $1,405,000 b. $2,560,000 c. $2,435,000 d. $3,965,000 7:581 Southern University and A&M College Today 6:49 PM Edit Which of t