Question

I seriously need help with this accounting assignment.I am not sure what information goes on which sheet but my main concern is with the last

I seriously need help with this accounting assignment.I am not sure what information goes on which sheet but my main concern is with the last 7 tabs of the excel spreadsheet. I really appreciate any and all assistance. Thank you in advance.

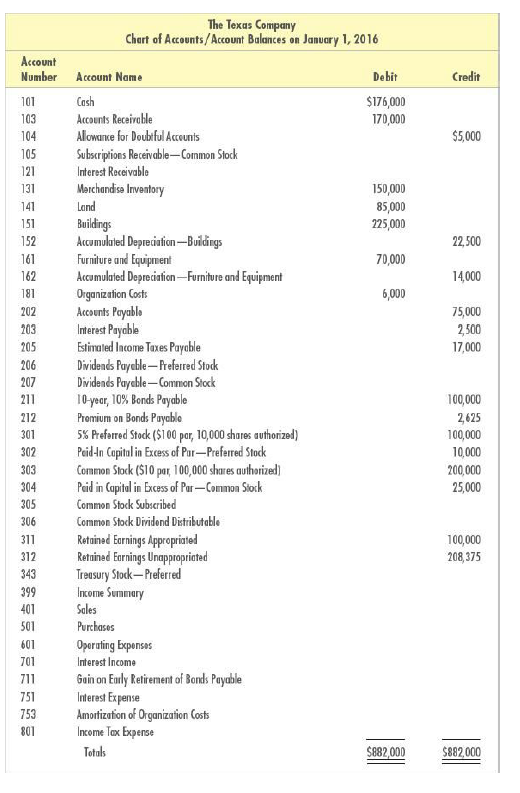

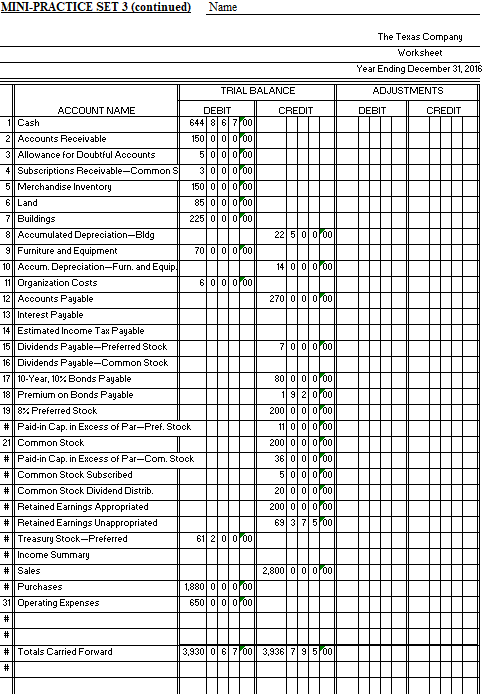

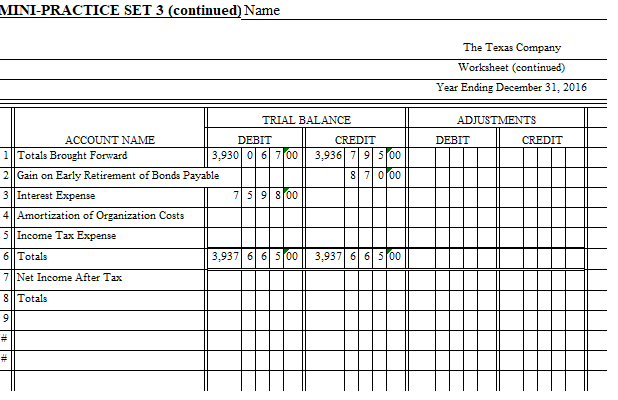

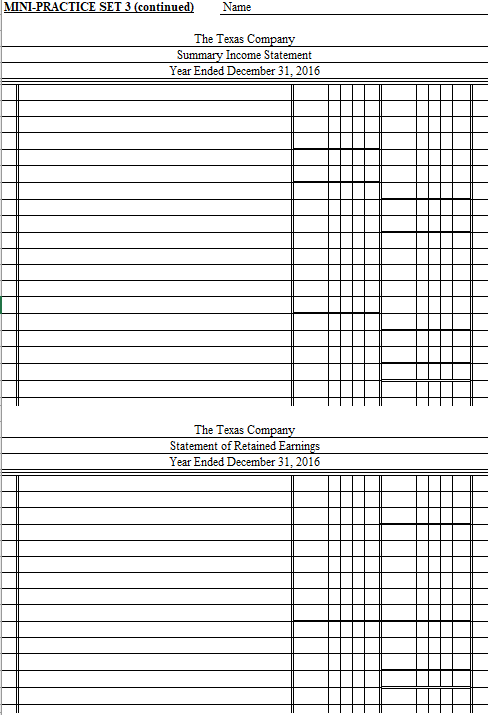

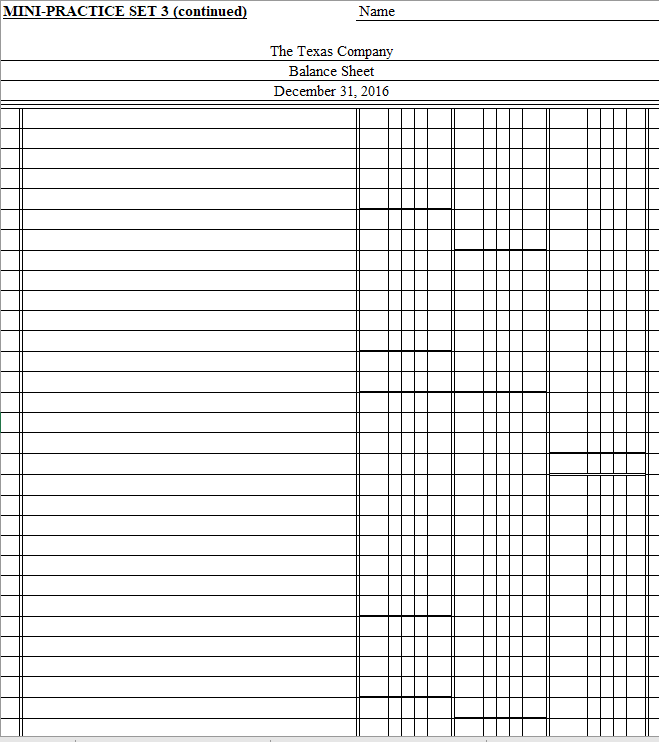

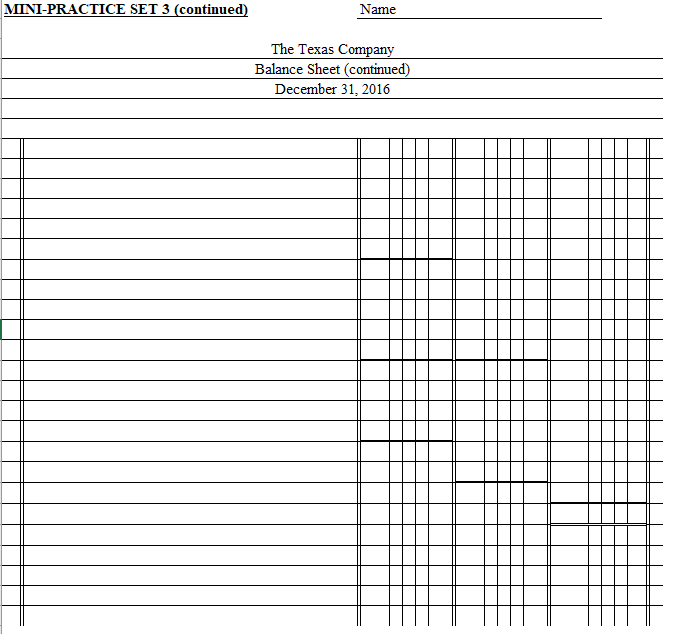

MiniPractice Set 3 Corporation Accounting Cycle The Texas Company This project will give you an opportunity to apply your knowledge of accounting principles and procedures to a corporation. You will handle the accounting work of The Texas Company for 2016. INTRODUCTION The chart of accounts and account balances of The Texas Company on January 1, 2016, are shown on the next page. Texas does not use reversing entries. INSTRUCTIONS Round all computations to the nearest whole dollar. 1. Open the general ledger accounts and enter the balances for January 1, 2016. Obtain the necessary figures from the trial balance. 2. Analyze the transactions on the pages that follow, and record them in the general journal. Use 1 as the number of the first journal page. 3. Post the journal entries to the general ledger accounts. 4. Prepare a worksheet for the year ended December 31, 2016. 5. Prepare a summary income statement for the year ended December 31, 2016. 6. Prepare a statement of retained earnings for the year ended December 31, 2016. 7. Prepare a balance sheet as of December 31, 2016. 8. Journalize and post the adjusting entries as of December 31, 2016. 9. Journalize and post the closing entries as of December 31, 2016. Analyze: Assume that the firm declared and issued a 3:1 stock split of common stock in 2016. What is the effect on total par value?

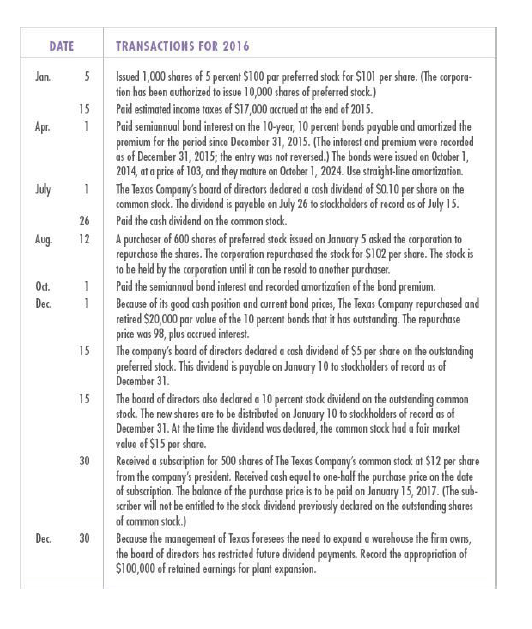

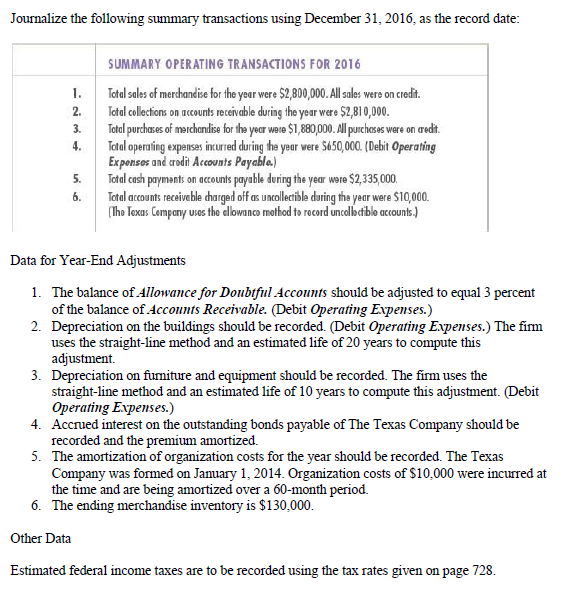

2 The Texas Company Chart of Accounts/Account Balances on January 1, 2016 Account Number Account Name Debit Credit $176,000 170,000 103 104 105 121 131 Cash Accounts Receivable Alowanke for Doubrful Accounis Subscriphions RealComon Stock nterest Receivable Marchandise Inventory Land $5,000 150,000 85,000 225,000 152 161 162 181 Accumulaled Deprection-Buidings Furniture and Equipment Accomulaied Depreciation- Furniture and Equipment Organization Costs 22,500 70,000 14,000 6,000 202 counts Payabla 203 Interest Payable 205 206 207 Estima ted Income Taxes Payable Dividends Payeble-Preferred Stock Dividends Payeble-Common Stock 10-year, 10% Bonds Payable 75,000 500 17,000 100,000 2,625 100,000 10,000 200,000 25,000 212 mium on Bonds Payable 5% Preferred Stock ($100 par, 10,000 shares authorized) Peid-In Capitul in Excess of Pur-Preferred Stock Comon Stock ($10 par, 100,000 shares authorized) Peid in Capital in Excess of Par-o Stok Common Stock Subscribed Common Stock Dividond Distributabl 302 303 304 305 306 311 etained Earnings Appropriated 312 343 399 401 501 601 701 711 in on Enly Retirement of Bonds Payable 751 100,000 208,375 Retained Earnings Unapproprio Treasury Stock-Preferred Incorme Sunmary Sales Purchases Operating Expenses Interest Income Interest Expense Amortization of Income Tax Expense Costs 801 Totals 882,000 882,000 DATE TRANSACTIONS FOR 2016 Jan Issued 1,000 shares of 5 percent $100 par preferred stock for S1O1 per share. The corpora- tion has been cuthorized to issue 10,000 shares of preferred stock) 15 Peid estimated income taxes ef $17,000 accrued at the end of 2015 Apr.Pid inst on the 10-year, 10 percent bendspaable and amortized the premium for the period since Decomber 31, 2015. (Tho intorest and premium vwere recordod as of December 31, 2015; the entry was not reversed.) The bonds were isued en Octaber 1, 2014 ata price of 103, and they mature on Odteber 1, 2024. Use striht-line amortization. July The Texas Company's board of directors dedardcsh dividend of 0.10 per shore on the common stock. Tho dividond is payeblo en July 26 to stockhalders of record as of July 15 26 Paid the cash dividend on the common stock 12 A purchaser of 600 shares of preferred stoc issed on January 5 asked the corporation to repurchase the shares. The corperaion repurchased the stock for $102 per share. The stock is to he held by the corporation until it can be resold toanther purchaser Ug. 0d.Pi thema bod interest end recorded anortizatien of the bondpremium. Dec Because of it good cash position and current bon prices, The Texas Campany repurchased and retired $20,000 par value of the 10 percent bonds that it has outstanding. The repurchase price was 98, plus acrued interes. The company's board of directors declaredoosh dividend of $5 per share on the outstanding preferred stock. This dividend is puyable on Janwary 10 to stockholders of record us of December 31 15 15 The board of directors aso declared e 10 pertent stodk dividend on the outstending commo stock. The new shares are to be distributed on January 10 to stockholders of record as of December 31. At thetime the dividend wos declared, the common stock had a foir market velue of S15 por share. 30 Received a subsaription for 500 shares of The Texas Company's common stock at $12 per share the company's president. Received cash euelto one-half the purchase price on the date of subscription. The balance of the purchase price is to be paid on January 15, 2017.(The sub- scriber will not be enfited to the stock dividend previoesly declared on the outstanding shares of common slock.) Dec 3Because the mnegemeat of Texas foresees the need to expand e worehouse the firm owns, the board of diredors has restricted future dividend peyments Record the appropriation of $100,000 of retained earnings for plant expansion. Journalize the following summary transactions using December 31, 2016, as the record date SUMMARY OPERATING TRANSACTIONS FOR 2016 . Total sales of merchandise for the year were $2,800,000. All sales were on credt 2. otal cellections on accounts receivable during the year were $2,810,000 3. Total purchases of merchandise for the year e $1,880,000.All purchases were on aredt 4 Total operating expenses incured during the year vere S650,000.(Deit Operating Expensos and crodit Accounts Payable) Total cash payments on accounts payable dering the year were $2,335,000 6 Tatal accounts receiveble charged off as uncollecible during the year were $10,000 Tho Texas Company uses the dlowanco mothod to record uncolbctiblo accounts,) Data for Year-End Adjustments 1. The balance of Allowance for Doubtful Accounts should be adjusted to equal 3 percent of the balance of Accounts Receivable. (Debit Operating Evpenses.) Depreciation on the buildings should be recorded. (Debit Operating Expenses.) The firm uses the straight-line method and an estimated life of 20 years to compute this adjustment. Depreciation on furniture and equipment should be recorded. The firm uses the straight-line method and an estimated life of 10 years to compute this adjustment. (Debit Operating Eipenses.) Accrued interest on the outstanding bonds payable of The Texas Company should be recorded and the The amortization of organization costs for the year should be recorded. The Texas Company was formed on January 1, 2014. Organization costs of $10,000 were incurred at the time and are being amortized over a 60-month period. 2. 3. 4. premium amortized. 5. 6. The ending merchandise inventory is $130,000 Other Data Estimated federal income taxes are to be recorded using the tax rates given on page 72*8 MINI-PRAC continue Name The Texas Company worksheet Year Ending December 31, 2016 TRIAL BALANCE ADJUSTMENTS AcCOUNT NAME DEBIT 6441 8 7 00 150 000 00 CREDIT DEBIT CREDIT Cash 2Accounts Receivable 3Allowance for Doubtful Accounts 4Subscriptions Receivable-Common 5 Merchandise Inventory 6 Land 7Buildings 300 0 00 150 000 00 225000 00 8 Accumulated Depreciation-Bldg 9 Furniture and Equipment 10Accum. Depreciation-Furn. and Equip 70 000 00 4 0 0 0 00 Organization Costs 12Accounts Payable 13 Interest Payable 14 Estimated Income Ta Payable 15Dividends Payable-Preferred Stoclk 16Dividends Payable-Common Stock 60 0 0/00 27000 00 70 0 000 10-Year, 10% Bonds Payable 18 Premium on Bonds Payable 19| 8% Preferred Stock # || Paid-in Cap. in Excess of Par-Pref. Stock 21| Common Stock # || Paid-in Cap. in Excess of Par-Com. Stock # Common Stock Subscribed # Common Stock Dividend Distrib # Retained Earnings Appropriated # Retained Earnings Unappropriated # Treasury Stock-Preferred # 11 Income Summary # Sales # 11 Purchases 31Operating Expenses 9 2 0 00 200 0 00 200 0 00 200 0 00 61 2 0 0 00 1880 000 00 650 000 00 # Totals Carried Forward 3,930 06 0 3,93679 5 00 ADJUSTED TRIAL BALANCE NCOME STATEMENT CREDIT CREDIT NI-PRACTICE SET 3 (continued) Name The Texas Company Worksheet (continued) Year Ending December 31,2016 ADJUSTMENTS 1 ITotals Brought Forward 3,930 06 700 3,93679500 Gain on Early Retirement of Bonda Payable 3 Interest Expense 4Amortization of Organization Costs 5 Income Tax Expense 6 Totals 7 Net Income After Tax 759800 3,937 6 6 500 3,937 66 500 Totals MINI-PRACTICE SET 3 (continued) ADJUSTED TRIAL BALANCEINCOME STATEMENT BALANCE SHEET CREDITDEBIT CREDIT SET 3 (continue Name The Texas C Income Statement Year Ended December 31, 2016 The Texas C Statement of Retained Earnings Year Ended December 31, 2016 -PRACTICE SET 3 (continued) Name The Texas Company Balance Sheet December 31, 2016 -PRACTICE SET 3 (continued) Name The Texas Company Balance Sheet (continued) December 31, 2016 2 The Texas Company Chart of Accounts/Account Balances on January 1, 2016 Account Number Account Name Debit Credit $176,000 170,000 103 104 105 121 131 Cash Accounts Receivable Alowanke for Doubrful Accounis Subscriphions RealComon Stock nterest Receivable Marchandise Inventory Land $5,000 150,000 85,000 225,000 152 161 162 181 Accumulaled Deprection-Buidings Furniture and Equipment Accomulaied Depreciation- Furniture and Equipment Organization Costs 22,500 70,000 14,000 6,000 202 counts Payabla 203 Interest Payable 205 206 207 Estima ted Income Taxes Payable Dividends Payeble-Preferred Stock Dividends Payeble-Common Stock 10-year, 10% Bonds Payable 75,000 500 17,000 100,000 2,625 100,000 10,000 200,000 25,000 212 mium on Bonds Payable 5% Preferred Stock ($100 par, 10,000 shares authorized) Peid-In Capitul in Excess of Pur-Preferred Stock Comon Stock ($10 par, 100,000 shares authorized) Peid in Capital in Excess of Par-o Stok Common Stock Subscribed Common Stock Dividond Distributabl 302 303 304 305 306 311 etained Earnings Appropriated 312 343 399 401 501 601 701 711 in on Enly Retirement of Bonds Payable 751 100,000 208,375 Retained Earnings Unapproprio Treasury Stock-Preferred Incorme Sunmary Sales Purchases Operating Expenses Interest Income Interest Expense Amortization of Income Tax Expense Costs 801 Totals 882,000 882,000 DATE TRANSACTIONS FOR 2016 Jan Issued 1,000 shares of 5 percent $100 par preferred stock for S1O1 per share. The corpora- tion has been cuthorized to issue 10,000 shares of preferred stock) 15 Peid estimated income taxes ef $17,000 accrued at the end of 2015 Apr.Pid inst on the 10-year, 10 percent bendspaable and amortized the premium for the period since Decomber 31, 2015. (Tho intorest and premium vwere recordod as of December 31, 2015; the entry was not reversed.) The bonds were isued en Octaber 1, 2014 ata price of 103, and they mature on Odteber 1, 2024. Use striht-line amortization. July The Texas Company's board of directors dedardcsh dividend of 0.10 per shore on the common stock. Tho dividond is payeblo en July 26 to stockhalders of record as of July 15 26 Paid the cash dividend on the common stock 12 A purchaser of 600 shares of preferred stoc issed on January 5 asked the corporation to repurchase the shares. The corperaion repurchased the stock for $102 per share. The stock is to he held by the corporation until it can be resold toanther purchaser Ug. 0d.Pi thema bod interest end recorded anortizatien of the bondpremium. Dec Because of it good cash position and current bon prices, The Texas Campany repurchased and retired $20,000 par value of the 10 percent bonds that it has outstanding. The repurchase price was 98, plus acrued interes. The company's board of directors declaredoosh dividend of $5 per share on the outstanding preferred stock. This dividend is puyable on Janwary 10 to stockholders of record us of December 31 15 15 The board of directors aso declared e 10 pertent stodk dividend on the outstending commo stock. The new shares are to be distributed on January 10 to stockholders of record as of December 31. At thetime the dividend wos declared, the common stock had a foir market velue of S15 por share. 30 Received a subsaription for 500 shares of The Texas Company's common stock at $12 per share the company's president. Received cash euelto one-half the purchase price on the date of subscription. The balance of the purchase price is to be paid on January 15, 2017.(The sub- scriber will not be enfited to the stock dividend previoesly declared on the outstanding shares of common slock.) Dec 3Because the mnegemeat of Texas foresees the need to expand e worehouse the firm owns, the board of diredors has restricted future dividend peyments Record the appropriation of $100,000 of retained earnings for plant expansion. Journalize the following summary transactions using December 31, 2016, as the record date SUMMARY OPERATING TRANSACTIONS FOR 2016 . Total sales of merchandise for the year were $2,800,000. All sales were on credt 2. otal cellections on accounts receivable during the year were $2,810,000 3. Total purchases of merchandise for the year e $1,880,000.All purchases were on aredt 4 Total operating expenses incured during the year vere S650,000.(Deit Operating Expensos and crodit Accounts Payable) Total cash payments on accounts payable dering the year were $2,335,000 6 Tatal accounts receiveble charged off as uncollecible during the year were $10,000 Tho Texas Company uses the dlowanco mothod to record uncolbctiblo accounts,) Data for Year-End Adjustments 1. The balance of Allowance for Doubtful Accounts should be adjusted to equal 3 percent of the balance of Accounts Receivable. (Debit Operating Evpenses.) Depreciation on the buildings should be recorded. (Debit Operating Expenses.) The firm uses the straight-line method and an estimated life of 20 years to compute this adjustment. Depreciation on furniture and equipment should be recorded. The firm uses the straight-line method and an estimated life of 10 years to compute this adjustment. (Debit Operating Eipenses.) Accrued interest on the outstanding bonds payable of The Texas Company should be recorded and the The amortization of organization costs for the year should be recorded. The Texas Company was formed on January 1, 2014. Organization costs of $10,000 were incurred at the time and are being amortized over a 60-month period. 2. 3. 4. premium amortized. 5. 6. The ending merchandise inventory is $130,000 Other Data Estimated federal income taxes are to be recorded using the tax rates given on page 72*8 MINI-PRAC continue Name The Texas Company worksheet Year Ending December 31, 2016 TRIAL BALANCE ADJUSTMENTS AcCOUNT NAME DEBIT 6441 8 7 00 150 000 00 CREDIT DEBIT CREDIT Cash 2Accounts Receivable 3Allowance for Doubtful Accounts 4Subscriptions Receivable-Common 5 Merchandise Inventory 6 Land 7Buildings 300 0 00 150 000 00 225000 00 8 Accumulated Depreciation-Bldg 9 Furniture and Equipment 10Accum. Depreciation-Furn. and Equip 70 000 00 4 0 0 0 00 Organization Costs 12Accounts Payable 13 Interest Payable 14 Estimated Income Ta Payable 15Dividends Payable-Preferred Stoclk 16Dividends Payable-Common Stock 60 0 0/00 27000 00 70 0 000 10-Year, 10% Bonds Payable 18 Premium on Bonds Payable 19| 8% Preferred Stock # || Paid-in Cap. in Excess of Par-Pref. Stock 21| Common Stock # || Paid-in Cap. in Excess of Par-Com. Stock # Common Stock Subscribed # Common Stock Dividend Distrib # Retained Earnings Appropriated # Retained Earnings Unappropriated # Treasury Stock-Preferred # 11 Income Summary # Sales # 11 Purchases 31Operating Expenses 9 2 0 00 200 0 00 200 0 00 200 0 00 61 2 0 0 00 1880 000 00 650 000 00 # Totals Carried Forward 3,930 06 0 3,93679 5 00 ADJUSTED TRIAL BALANCE NCOME STATEMENT CREDIT CREDIT NI-PRACTICE SET 3 (continued) Name The Texas Company Worksheet (continued) Year Ending December 31,2016 ADJUSTMENTS 1 ITotals Brought Forward 3,930 06 700 3,93679500 Gain on Early Retirement of Bonda Payable 3 Interest Expense 4Amortization of Organization Costs 5 Income Tax Expense 6 Totals 7 Net Income After Tax 759800 3,937 6 6 500 3,937 66 500 Totals MINI-PRACTICE SET 3 (continued) ADJUSTED TRIAL BALANCEINCOME STATEMENT BALANCE SHEET CREDITDEBIT CREDIT SET 3 (continue Name The Texas C Income Statement Year Ended December 31, 2016 The Texas C Statement of Retained Earnings Year Ended December 31, 2016 -PRACTICE SET 3 (continued) Name The Texas Company Balance Sheet December 31, 2016 -PRACTICE SET 3 (continued) Name The Texas Company Balance Sheet (continued) December 31, 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started