Answered step by step

Verified Expert Solution

Question

1 Approved Answer

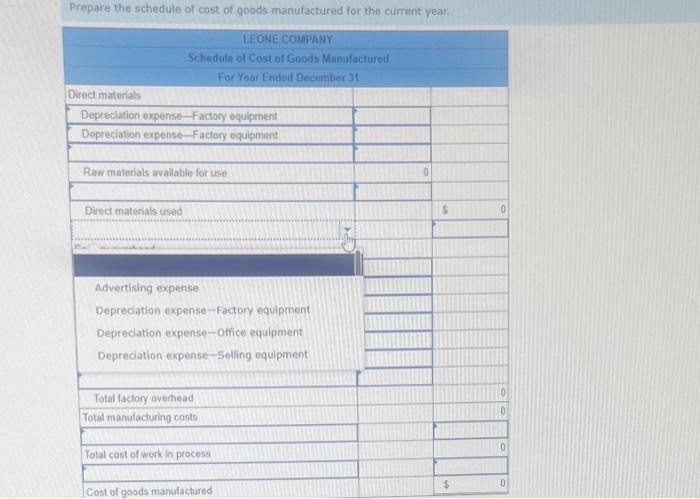

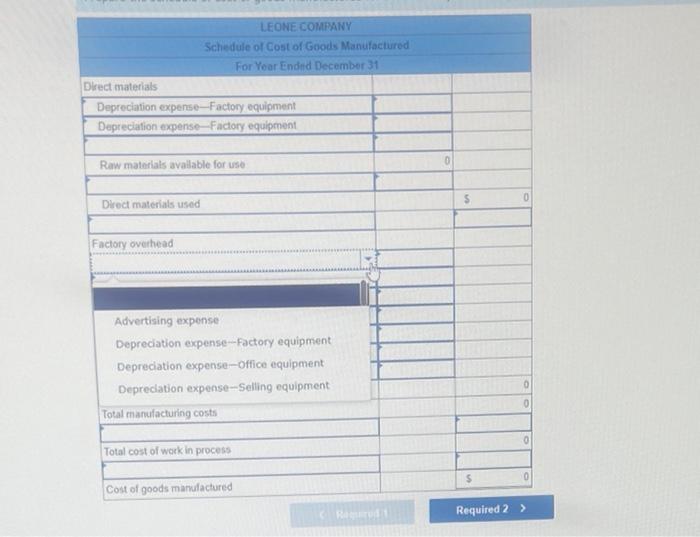

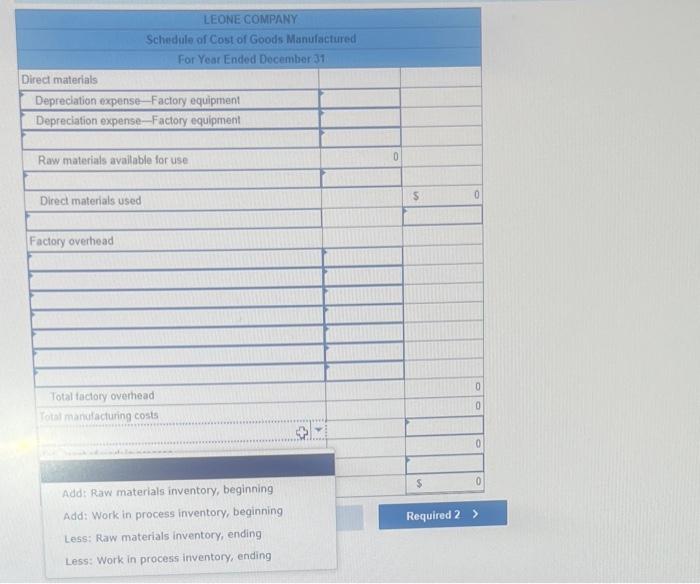

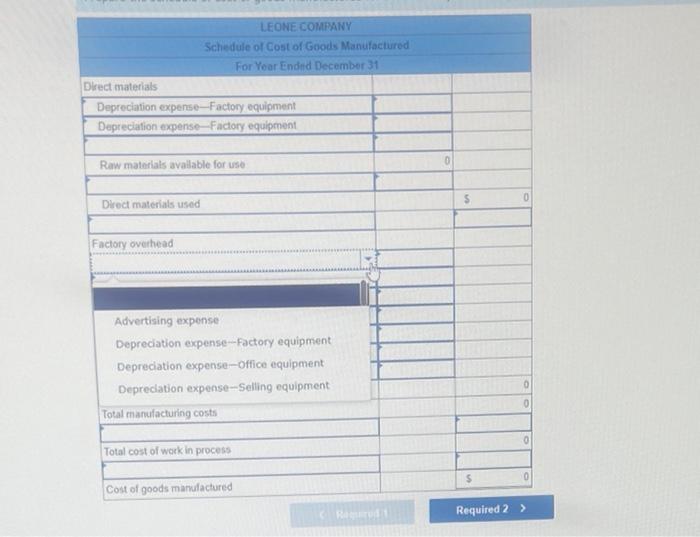

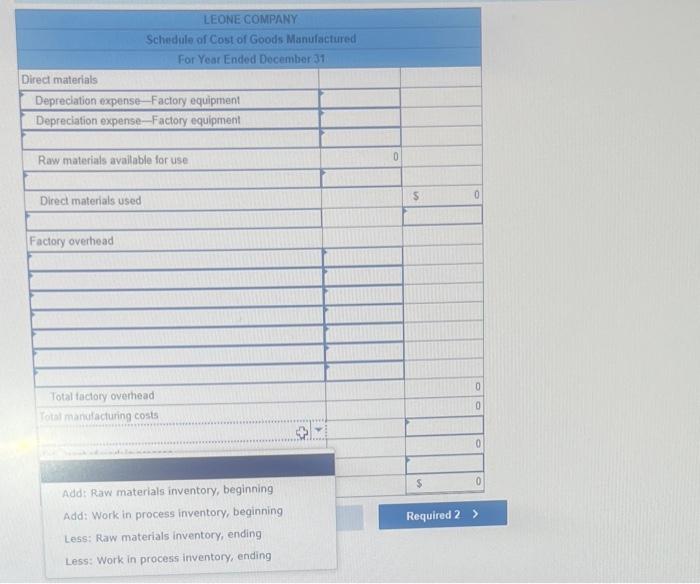

I shown the drop down options for each one. some of them have same choices i need to know what to put. i have shown

I shown the drop down options for each one. some of them have same choices

i need to know what to put. i have shown drop down options. i also need know what numbers to put! this is plenty of info

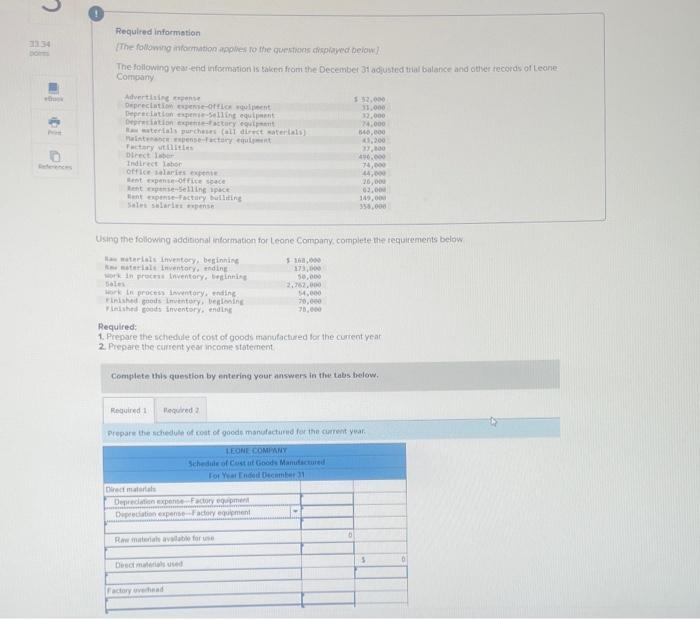

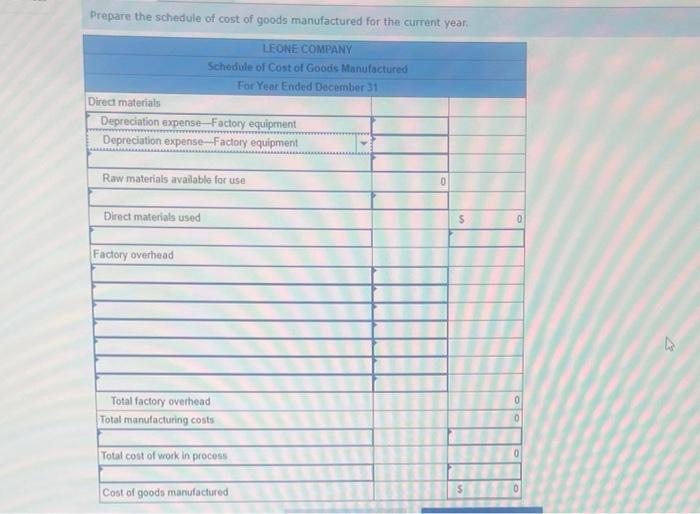

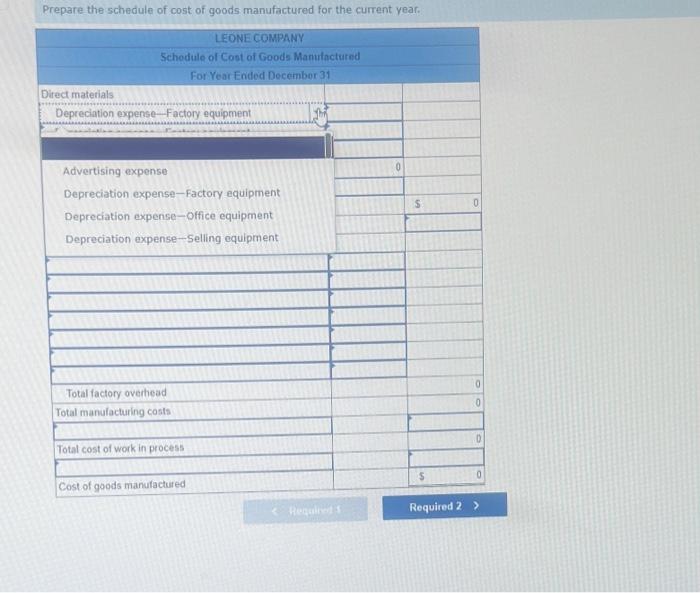

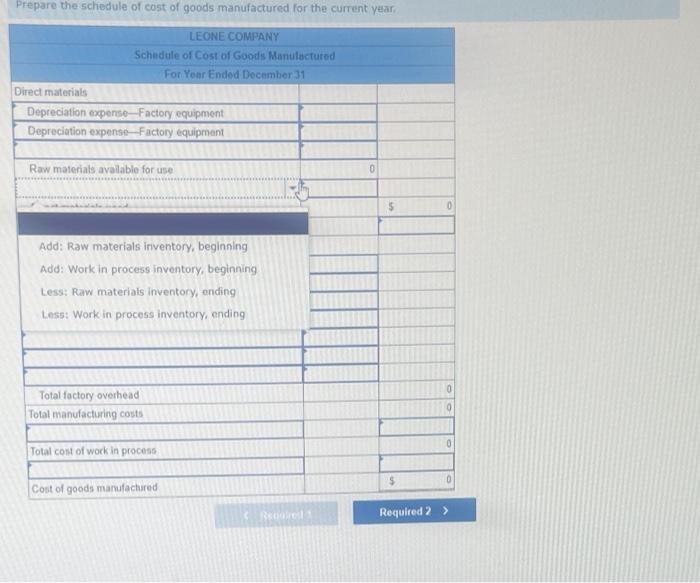

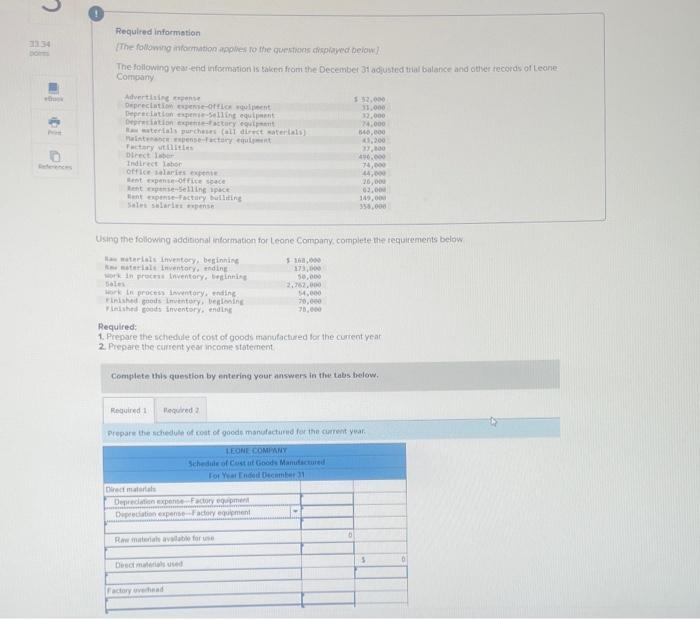

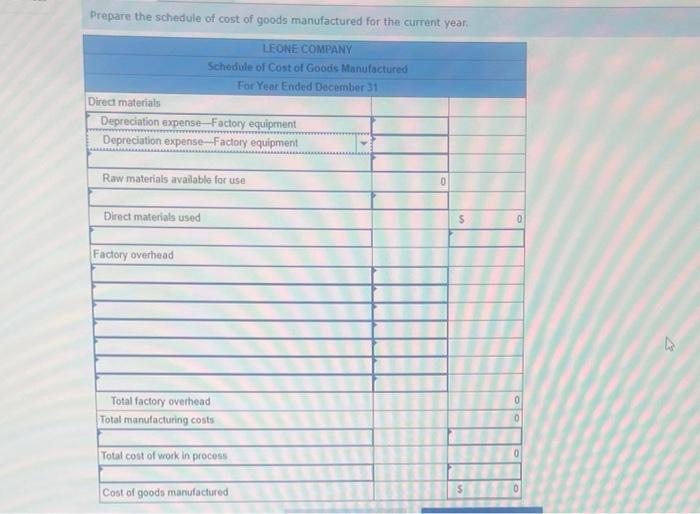

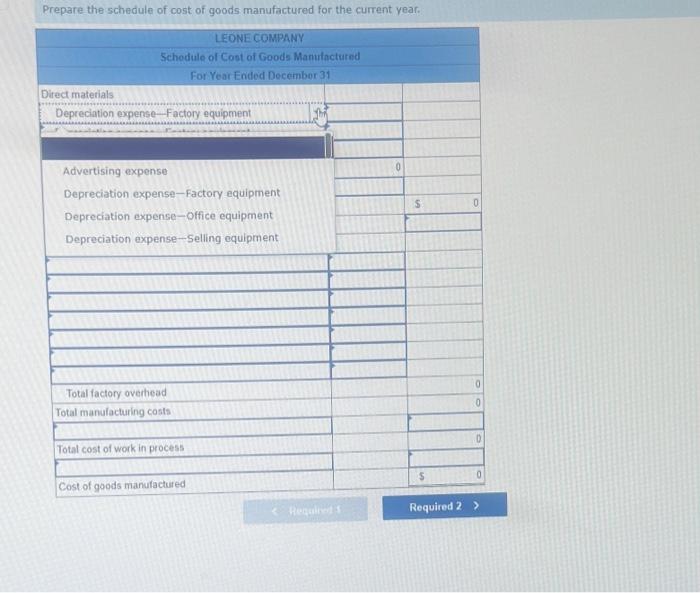

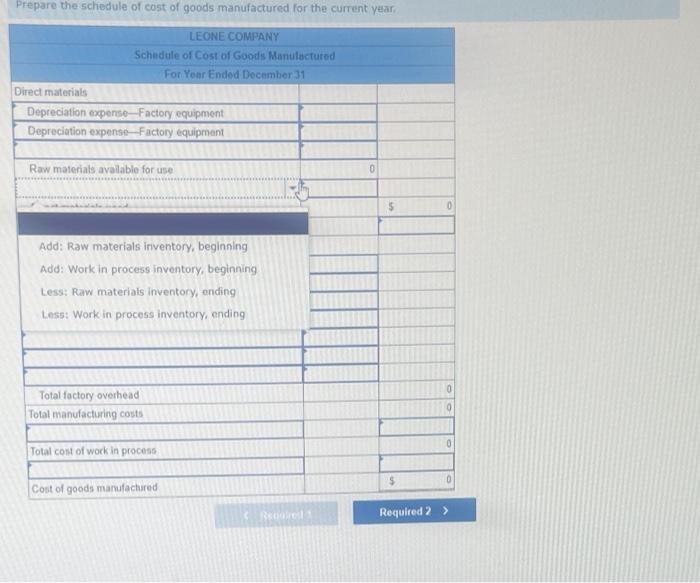

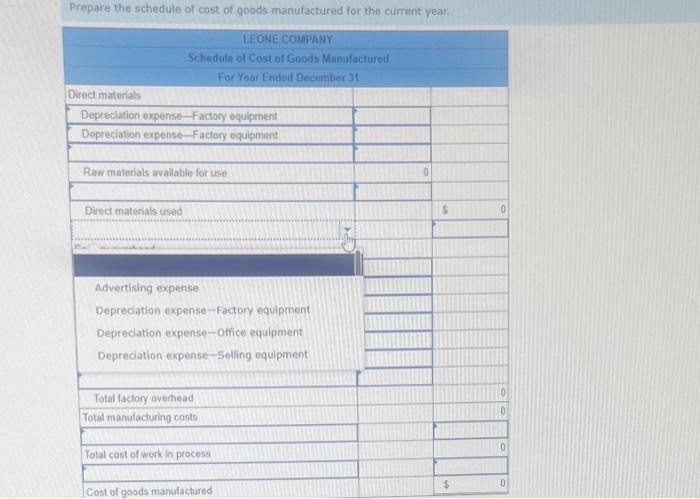

Required information [The folloming inkomation apphes fo the quechoas dingiayed beiow? The following yeat end information is taken from the December 3t adfusted tial balance and other tecosas of LeareCompainy. Using the following acditional information for Leone Company, complete the requiremeris below Required: 1. Prepare the schedule of cost of goods manufacfired for the current year 2. Prepare the current year income statement Complete this question by entering your nnswers in thw tabs helow. Drepare the sotwedult of coat of goode manufacturnd far the current yoar. Premare the sichartula of conet of manadia Prepare the schedule of cost of goods manufactured for the current year. Prepare the 5 chiedule of enst of annde manufarturad for tha cuarnant uasi Prepare the schedule of cost of goods manufactured for the current year. L.ENNE COMPANY Scheduln of Cost of Goods Manuiactured For Year Ended Docember 31 Direct materials LEONE COMIYNY Schedule of Cost of Goods Manufactured Required 2> LEONE COMPANY Schedule of Cost of Goods Manufactured For Year Ended December 31 Direct materials Depreciation expense - Factory equipment Depreciation expense-Factory equipment Raw materials available for use Direct materials used Factory overhead [ a 8 Total factory overhead Total mandlacturing costs Add: Raw materials inventory, beginning Add: Work in process inventory, beginning Less: Raw materials inventory, ending Less: Work in process inventory, ending Required information [The folloming inkomation apphes fo the quechoas dingiayed beiow? The following yeat end information is taken from the December 3t adfusted tial balance and other tecosas of LeareCompainy. Using the following acditional information for Leone Company, complete the requiremeris below Required: 1. Prepare the schedule of cost of goods manufacfired for the current year 2. Prepare the current year income statement Complete this question by entering your nnswers in thw tabs helow. Drepare the sotwedult of coat of goode manufacturnd far the current yoar. Premare the sichartula of conet of manadia Prepare the schedule of cost of goods manufactured for the current year. Prepare the 5 chiedule of enst of annde manufarturad for tha cuarnant uasi Prepare the schedule of cost of goods manufactured for the current year. L.ENNE COMPANY Scheduln of Cost of Goods Manuiactured For Year Ended Docember 31 Direct materials LEONE COMIYNY Schedule of Cost of Goods Manufactured Required 2> LEONE COMPANY Schedule of Cost of Goods Manufactured For Year Ended December 31 Direct materials Depreciation expense - Factory equipment Depreciation expense-Factory equipment Raw materials available for use Direct materials used Factory overhead [ a 8 Total factory overhead Total mandlacturing costs Add: Raw materials inventory, beginning Add: Work in process inventory, beginning Less: Raw materials inventory, ending Less: Work in process inventory, ending Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started