Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i submitted the incorrect question before, this is the exhibit 2 and the solution for question 3. please help me with question 4 Pembina Oil

i submitted the incorrect question before, this is the exhibit 2 and the solution for question 3. please help me with question 4

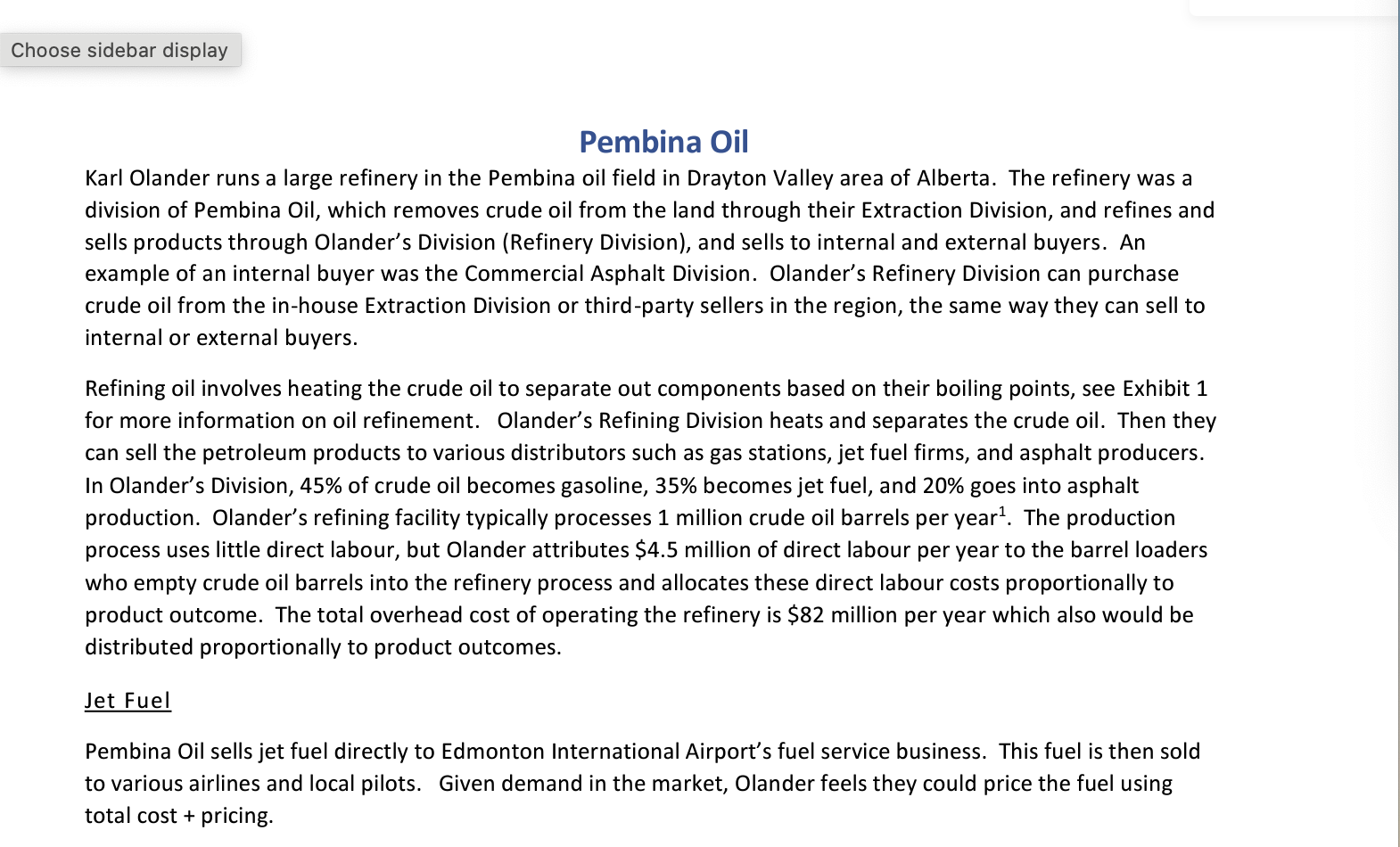

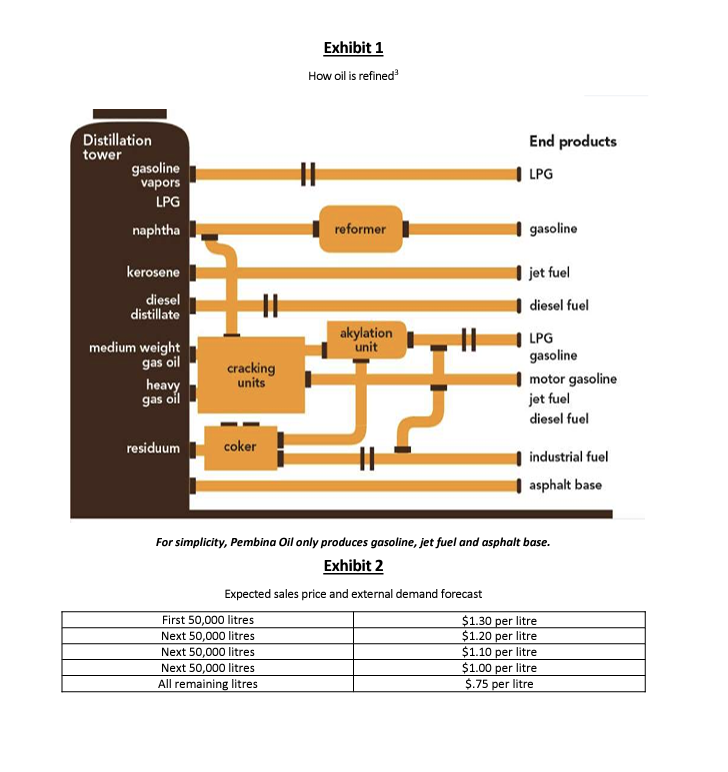

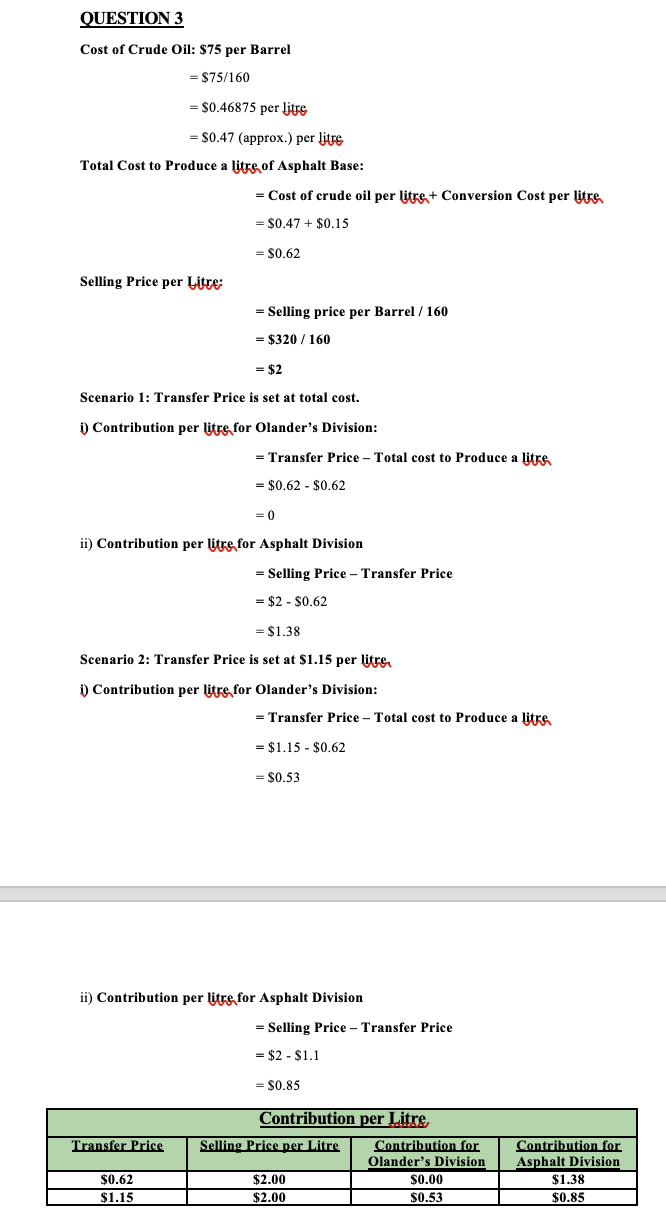

Pembina Oil Karl Olander runs a large refinery in the Pembina oil field in Drayton Valley area of Alberta. The refinery was a division of Pembina Oil, which removes crude oil from the land through their Extraction Division, and refines and sells products through Olander's Division (Refinery Division), and sells to internal and external buyers. An example of an internal buyer was the Commercial Asphalt Division. Olander's Refinery Division can purchase crude oil from the in-house Extraction Division or third-party sellers in the region, the same way they can sell to internal or external buyers. Refining oil involves heating the crude oil to separate out components based on their boiling points, see Exhibit 1 for more information on oil refinement. Olander's Refining Division heats and separates the crude oil. Then they can sell the petroleum products to various distributors such as gas stations, jet fuel firms, and asphalt producers. In Olander's Division, 45% of crude oil becomes gasoline, 35% becomes jet fuel, and 20% goes into asphalt production. Olander's refining facility typically processes 1 million crude oil barrels per year 1. The production process uses little direct labour, but Olander attributes $4.5 million of direct labour per year to the barrel loaders who empty crude oil barrels into the refinery process and allocates these direct labour costs proportionally to product outcome. The total overhead cost of operating the refinery is $82 million per year which also would be distributed proportionally to product outcomes. Jet Fuel Pembina Oil sells jet fuel directly to Edmonton International Airport's fuel service business. This fuel is then sold to various airlines and local pilots. Given demand in the market, Olander feels they could price the fuel using total cost + pricing. For simplicity, Pembina Oil only produces gasoline, jet fuel and asphalt base. Exhibit 2 Expected sales price and external demand forecast Cost of Crude Oil: \$75 per Barrel =$75/160=$0.46875perlitre=$0.47(approx.)perlitre Total Cost to Produce a litge of Asphalt Base: =Costofcrudeoilperlitre+ConversionCostperlitge=$0.47+$0.15=$0.62 Selling Price per Litre: =SellingpriceperBarrel/160=$320/160=$2 Scenario 1: Transfer Price is set at total cost. i) Contribution per litce for Olander's Division: =TransferPriceTotalcosttoProducealitre=$0.62$0.62=0 ii) Contribution per litge for Asphalt Division =SellingPriceTransferPrice=$2$0.62=$1.38 Scenario 2: Transfer Price is set at $$1.15 per litre i) Contribution per litrefor Olander's Division: =TransferPriceTotalcosttoProduceabitge=$1.15$0.62=$0.53 Assuming your answers to Question 3 are correct and using Exhibit 2, make a recommendation of how much asphalt base should be sold in-house and at what priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started