Answered step by step

Verified Expert Solution

Question

1 Approved Answer

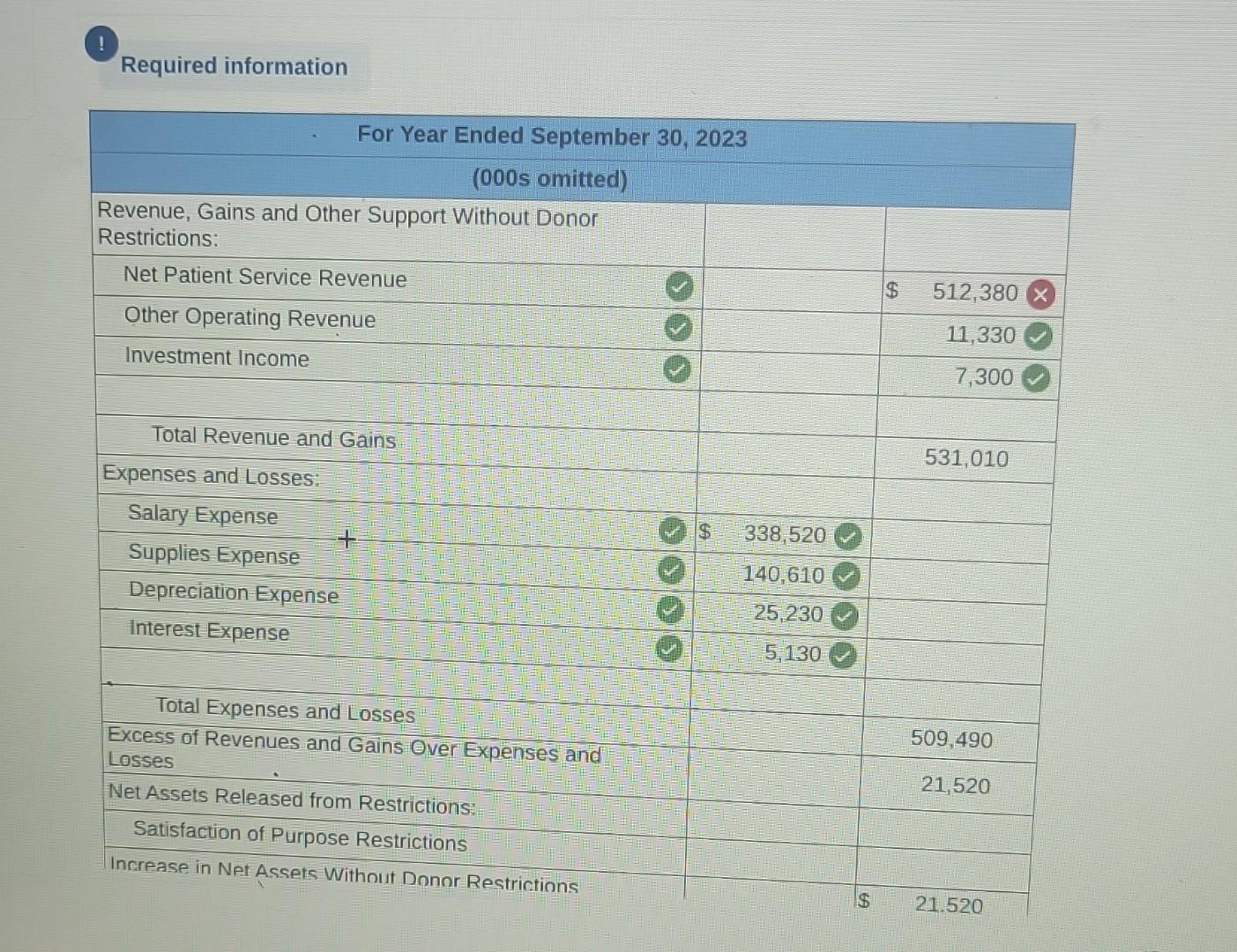

I subtracted my 1,063360 - 550, 980 like I should but it's not right? also need the run through and working of the rest. preferably

I subtracted my 1,063360 - 550, 980 like I should but it's not right? also need the run through and working of the rest. preferably with explanations

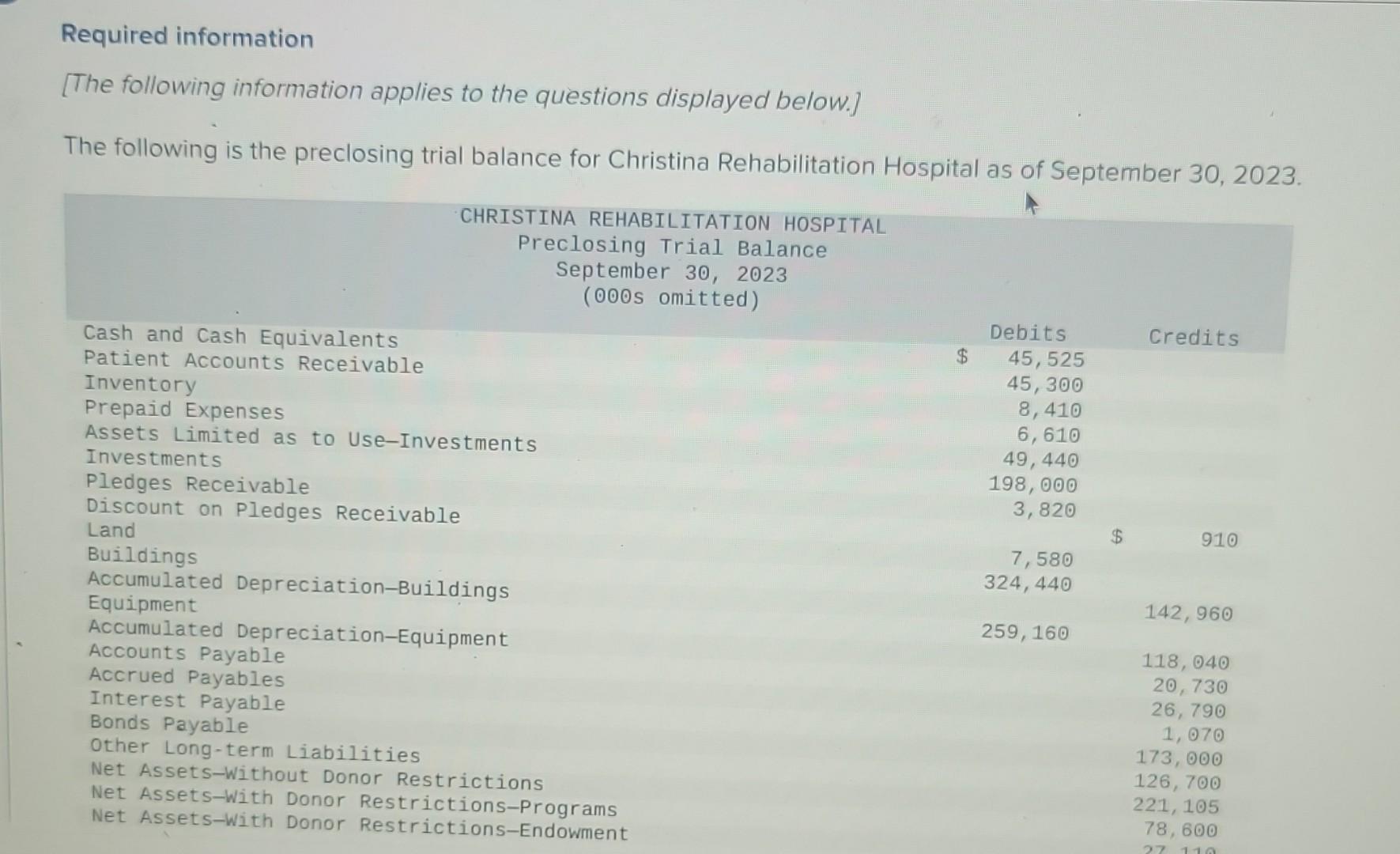

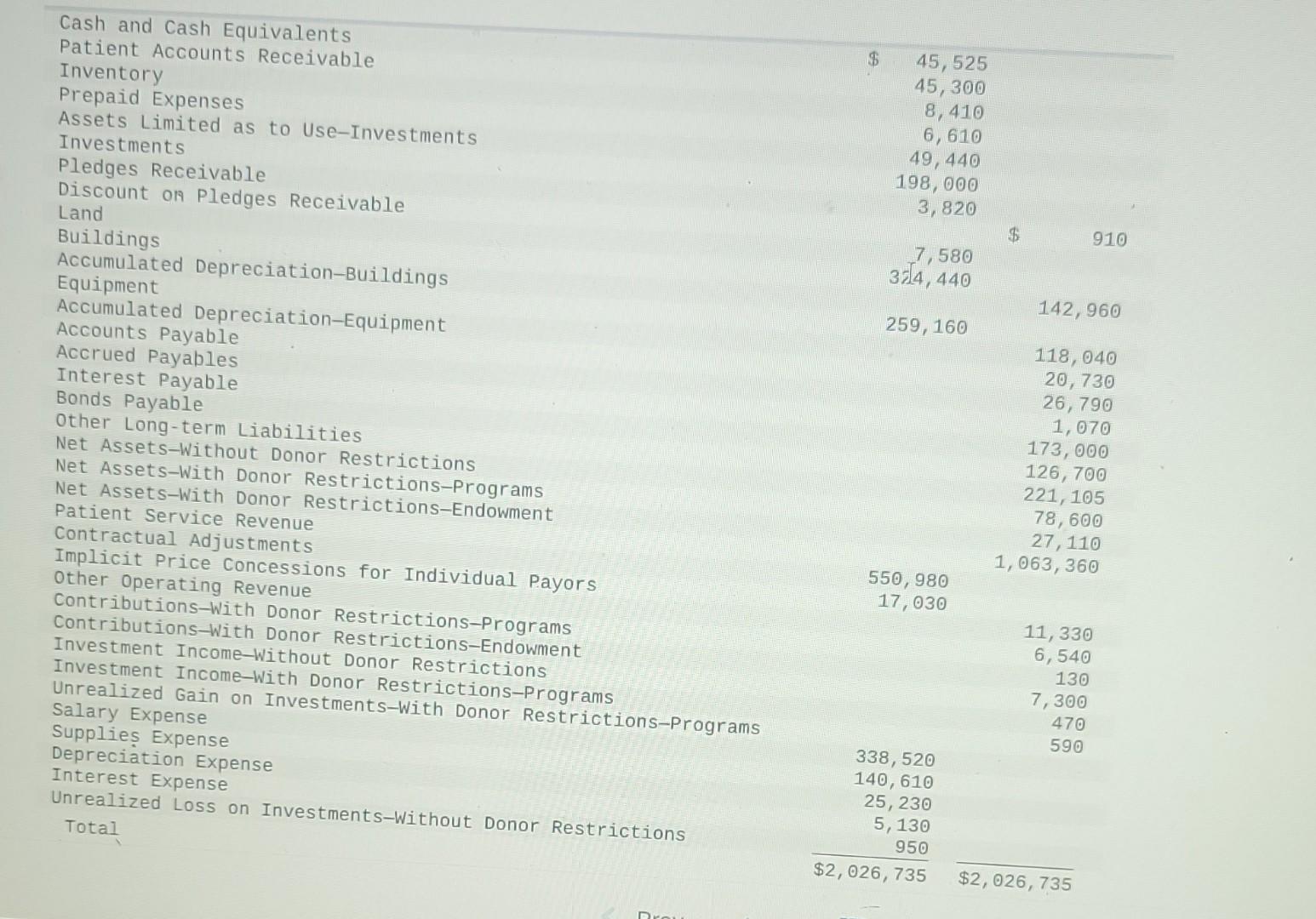

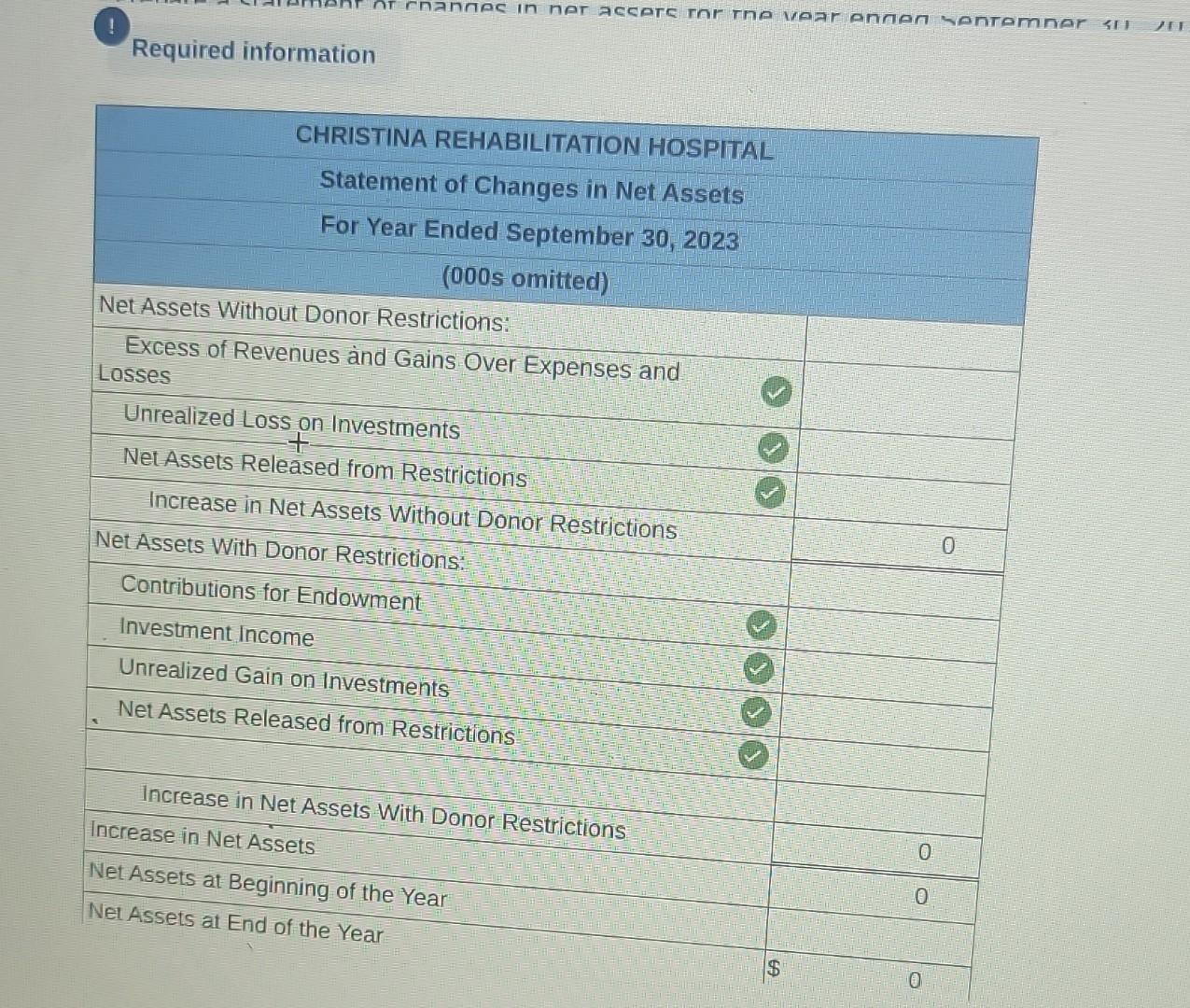

Required information [The following information applies to the questions displayed below.] The following is the preclosing trial balance for Christina Rehabilitation Hospital as of September 30,2023. Cash and Cash Equivalents Patient Accounts Receivable Inventory Prepaid Expenses Assets Limited as to Use-Investments Investments Pledges Receivable Discount of Pledges Receivable Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Accounts Payable Accrued Payables Interest Payable Bonds Payable Other Long-term Liabilities Net Assets-Without Donor Restrictions Net Assets-With Donor Restrictions-Programs Net Assets-With Donor Restrictions-Endowment Patient Service Revenue Contractual Adjustments Implicit Price Concessions for Individual Payors Other operating Revenue Contributions-With Donor Restrictions-Programs Contributions-With Donor Restrictions-Endowment Investment Income-Without Donor Restrictions Investment Income-With Donor Restrictions-Programs Unrealized Gain Salary Expense Supplies Expense Depreciation Expense Interest Expense Unrealized Loss on Investments-Without Donor Restrictions Total Required information For Year Ended September 30, 2023 (000s omitted) Revenue, Gains and Other Support Without Donor Restrictions: Required information Required information [The following information applies to the questions displayed below.] The following is the preclosing trial balance for Christina Rehabilitation Hospital as of September 30,2023. Cash and Cash Equivalents Patient Accounts Receivable Inventory Prepaid Expenses Assets Limited as to Use-Investments Investments Pledges Receivable Discount of Pledges Receivable Land Buildings Accumulated Depreciation-Buildings Equipment Accumulated Depreciation-Equipment Accounts Payable Accrued Payables Interest Payable Bonds Payable Other Long-term Liabilities Net Assets-Without Donor Restrictions Net Assets-With Donor Restrictions-Programs Net Assets-With Donor Restrictions-Endowment Patient Service Revenue Contractual Adjustments Implicit Price Concessions for Individual Payors Other operating Revenue Contributions-With Donor Restrictions-Programs Contributions-With Donor Restrictions-Endowment Investment Income-Without Donor Restrictions Investment Income-With Donor Restrictions-Programs Unrealized Gain Salary Expense Supplies Expense Depreciation Expense Interest Expense Unrealized Loss on Investments-Without Donor Restrictions Total Required information For Year Ended September 30, 2023 (000s omitted) Revenue, Gains and Other Support Without Donor Restrictions: Required informationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started