Answered step by step

Verified Expert Solution

Question

1 Approved Answer

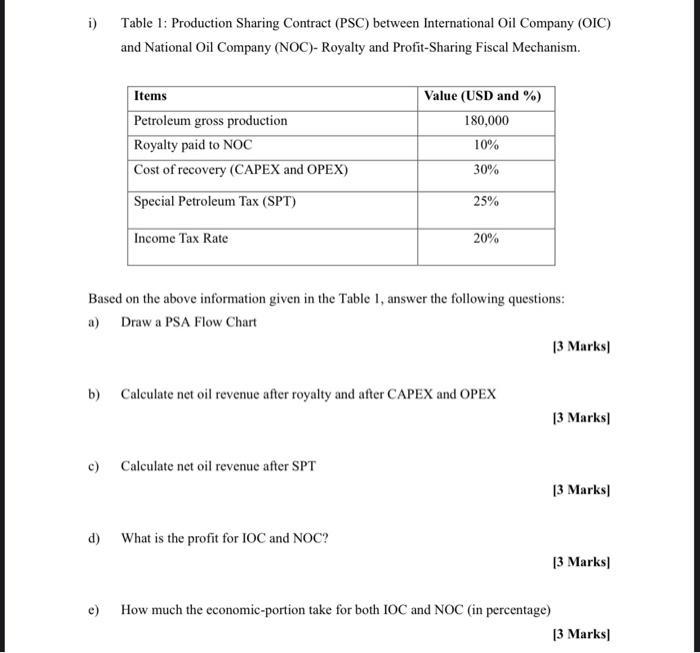

i) Table 1: Production Sharing Contract (PSC) between International Oil Company (OIC) and National Oil Company (NOC)- Royalty and Profit-Sharing Fiscal Mechanism. Items Petroleum

i) Table 1: Production Sharing Contract (PSC) between International Oil Company (OIC) and National Oil Company (NOC)- Royalty and Profit-Sharing Fiscal Mechanism. Items Petroleum gross production Royalty paid to NOC Cost of recovery (CAPEX and OPEX) Special Petroleum Tax (SPT) d) Income Tax Rate e) c) Calculate net oil revenue after SPT Based on the above information given in the Table 1, answer the following questions: a) Draw a PSA Flow Chart Value (USD and %) 180,000 10% 30% b) Calculate net oil revenue after royalty and after CAPEX and OPEX 25% What is the profit for IOC and NOC? 20% [3 marks] [3 Marks] [3 marks] [3 marks] How much the economic-portion take for both IOC and NOC (in percentage) [3 marks]

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Petroleum gross production 180000 Royalty paid to NOC 10 100 cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started