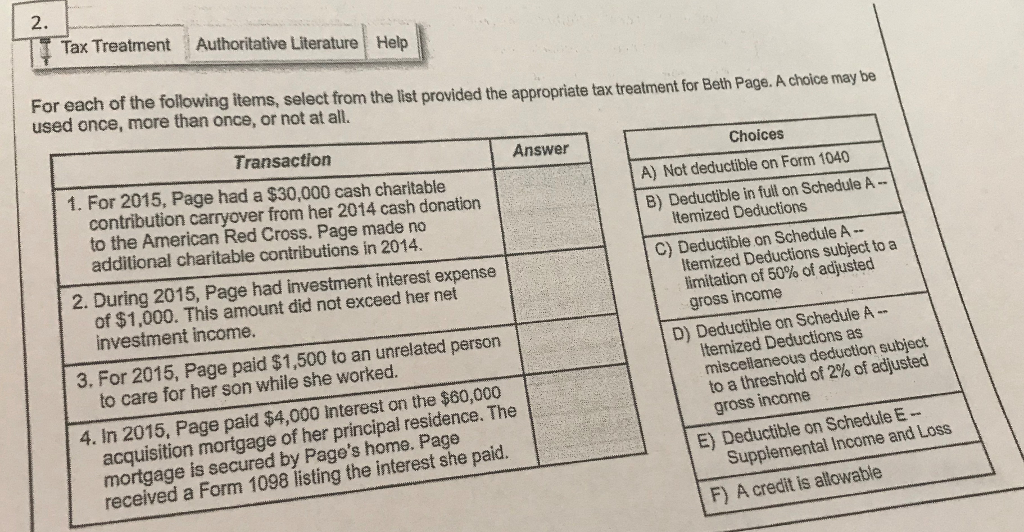

I Tax Treatment |Authoritative Literature Help For each of the following items, select from the list provided the appropriate tax treatment for Beth Page. A choice may be used once, more than once, or not at all. Choices Answer Transaction A) Not deductible on Form 1040 1. For 2015, Page had a $30,000 cash charitable B) Deductible in full on Schedule A -- contribution carryover from her 2014 cash donation Itemized Deductions to the American Red Cross. Page made no | C) Deductible on Schedule A -- additional charitable contributions in 2014. Itemized Deductions subject to a limitation of 50% of adjusted 2. During 2015, Page had investment interest expense gross income of $1,000. This amount did not exceed her net investment income. 3. For 2015, Page paid $1,500 to an unrelated person to care for her son while she worked. 4. In 2015, Page paid $4,000 Interest on the $60,000 D) Deductible on Schedule A -- Itemized Deductions as miscellaneous deduction subject to a threshold of 2% of adjusted gross income E) Deductible on Schedule E- Supplemental Income and Loss F) A credit is allowable acquisition mortgage of her principal residence. The mortgage is secured by Page's home. Page received a Form 1098 listing the interest she paid. I Tax Treatment |Authoritative Literature Help For each of the following items, select from the list provided the appropriate tax treatment for Beth Page. A choice may be used once, more than once, or not at all. Choices Answer Transaction A) Not deductible on Form 1040 1. For 2015, Page had a $30,000 cash charitable B) Deductible in full on Schedule A -- contribution carryover from her 2014 cash donation Itemized Deductions to the American Red Cross. Page made no | C) Deductible on Schedule A -- additional charitable contributions in 2014. Itemized Deductions subject to a limitation of 50% of adjusted 2. During 2015, Page had investment interest expense gross income of $1,000. This amount did not exceed her net investment income. 3. For 2015, Page paid $1,500 to an unrelated person to care for her son while she worked. 4. In 2015, Page paid $4,000 Interest on the $60,000 D) Deductible on Schedule A -- Itemized Deductions as miscellaneous deduction subject to a threshold of 2% of adjusted gross income E) Deductible on Schedule E- Supplemental Income and Loss F) A credit is allowable acquisition mortgage of her principal residence. The mortgage is secured by Page's home. Page received a Form 1098 listing the interest she paid