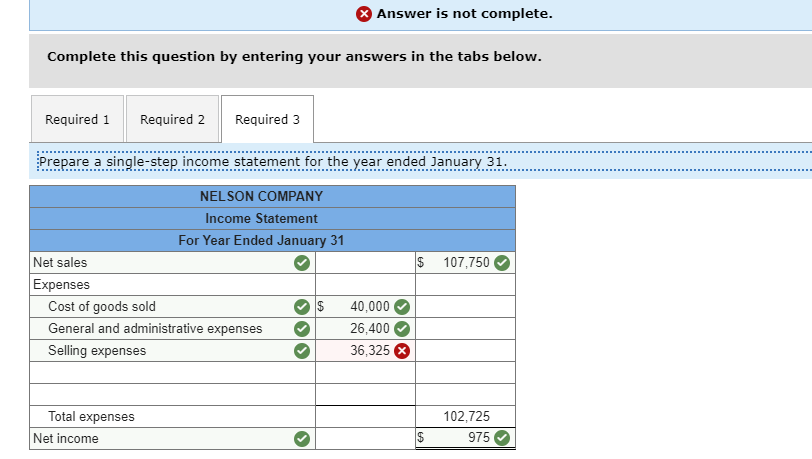

I think I'm missing something in selling expenses not sure what.NVM I answered it for myself

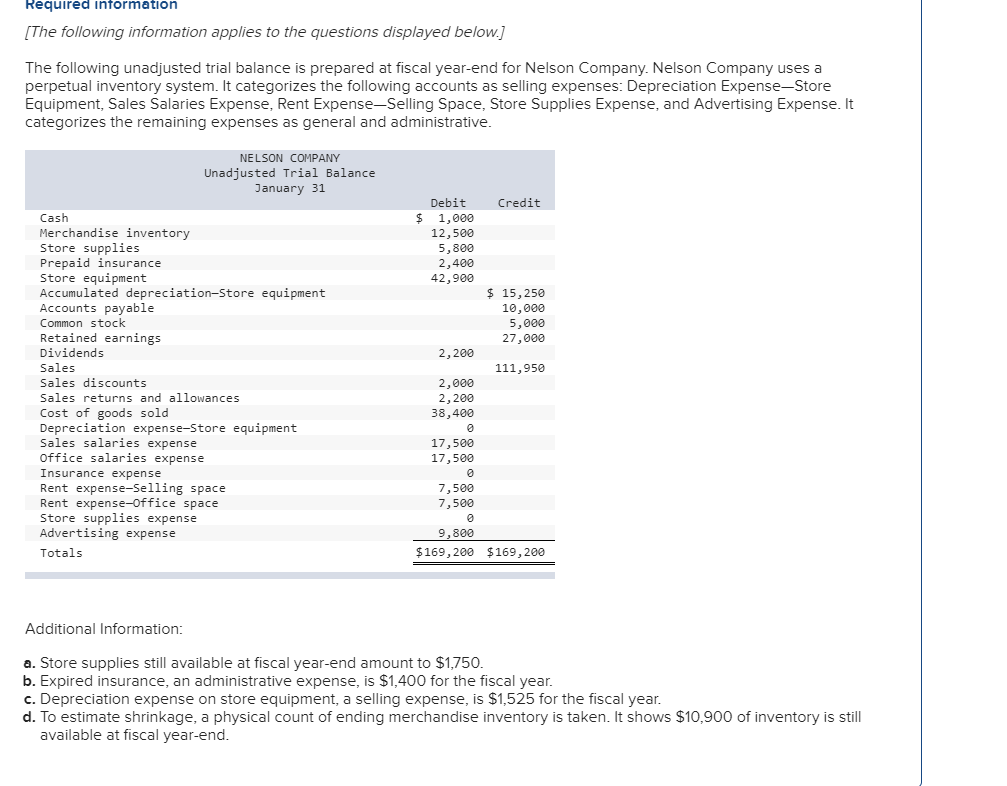

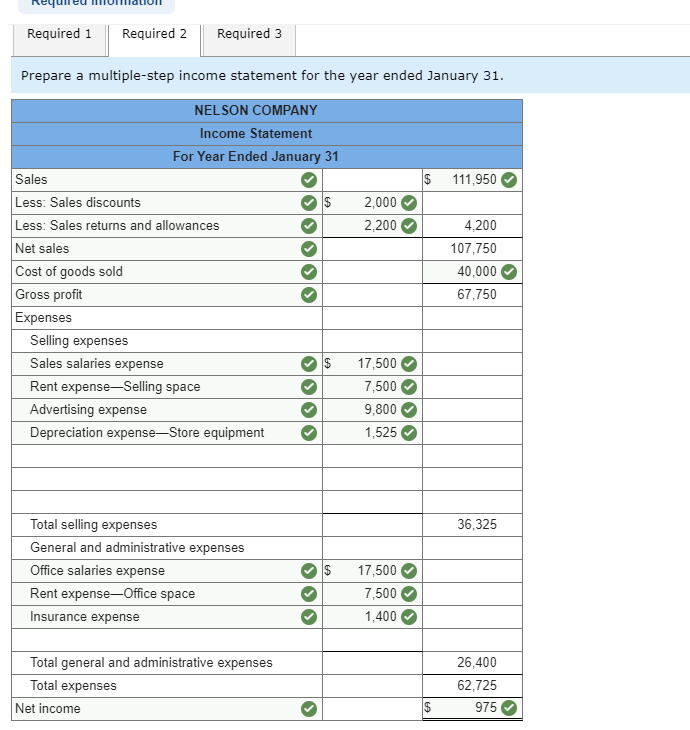

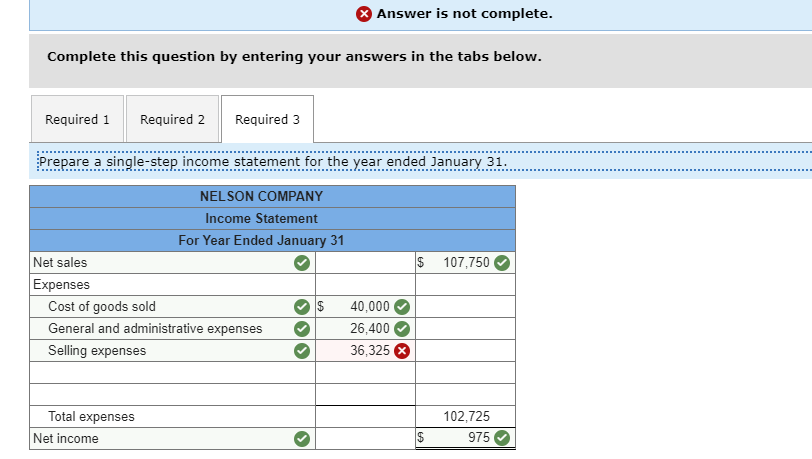

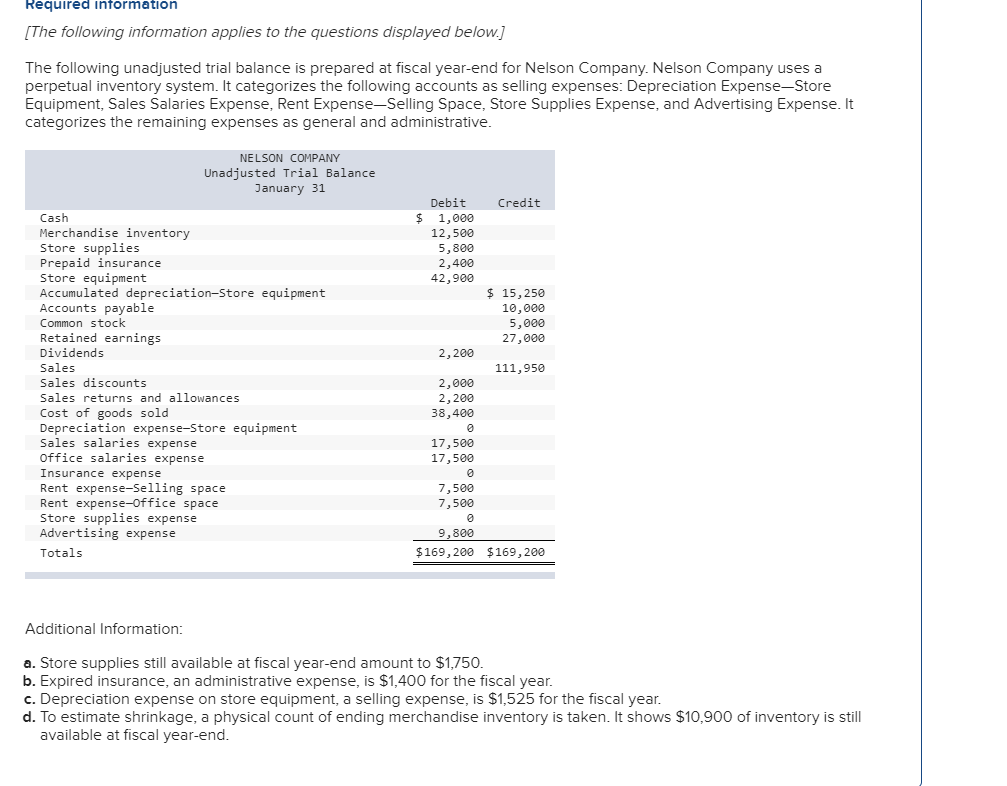

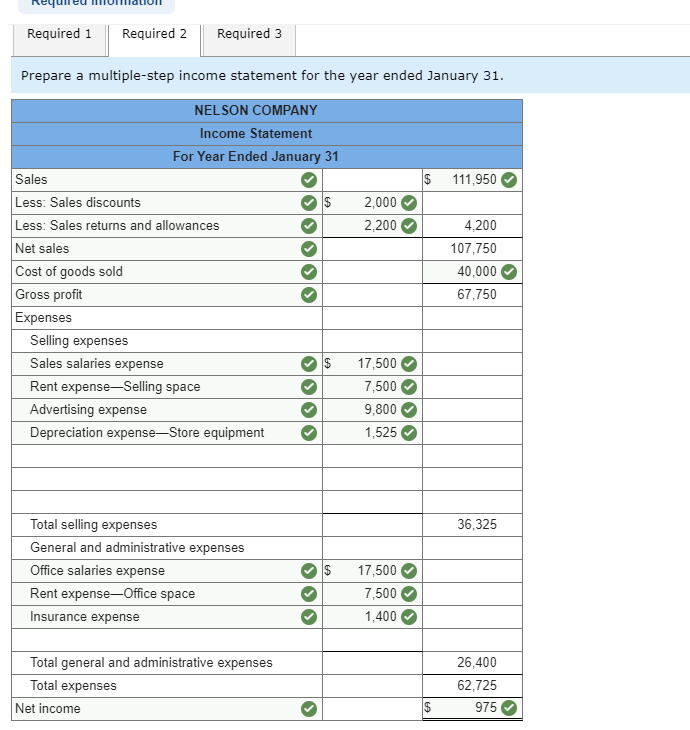

Required information [The following information applies to the questions displayed below.) The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson Company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. NELSON COMPANY Unadjusted Trial Balance January 31 Credit $ Debit 1,000 12,500 5,800 2,400 42,900 $ 15,250 10,000 5,000 27,000 2,200 111,95 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation-store equipment Accounts payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Sales salaries expense Office salaries expense Insurance expense Rent expense-Selling space Rent expense-office space Store supplies expense Advertising expense Totals 2,000 N00 2,200 38,400 17,500 17,500 7,500 7,500 9,800 $169,200 $169,200 Additional Information: a. Store supplies still available at fiscal year-end amount to $1,750. b. Expired insurance, an administrative expense, is $1,400 for the fiscal year. c. Depreciation expense on store equipment, a selling expense, is $1,525 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,900 of inventory is still available at fiscal year-end. Regulieu IIUITIALIUI Required 1 Required 2 Required 3 Prepare a multiple-step income statement for the year ended January 31. $ 111,950 2,000 2,200 NELSON COMPANY Income Statement For Year Ended January 31 Sales Less: Sales discounts Less: Sales returns and allowances Net sales Cost of goods sold Gross profit Expenses Selling expenses Sales salaries expense $ Rent expense-Selling space Advertising expense Depreciation expense-Store equipment 4,200 107,750 40,000 67,750 17,500 7,500 9,800 1,525 36,325 Total selling expenses General and administrative expenses Office salaries expense Rent expense-Office space Insurance expense $ 17,500 7,500 1,400 Total general and administrative expenses Total expenses Net income 26,400 62,725 975 $ Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a single-step income statement for the year ended January 31. $ 107,750 NELSON COMPANY Income Statement For Year Ended January 31 Net sales Expenses Cost of goods sold $ 40,000 General and administrative expenses 26,400 Selling expenses 36,325 x Total expenses Net income 102,725 975