Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i think this answer isn't correct. is it correct? Is there any other solution? Chapter 16 Problem 11QP Done Homemade Dividends You own 1,000 shares

i think this answer isn't correct. is it correct? Is there any other solution?

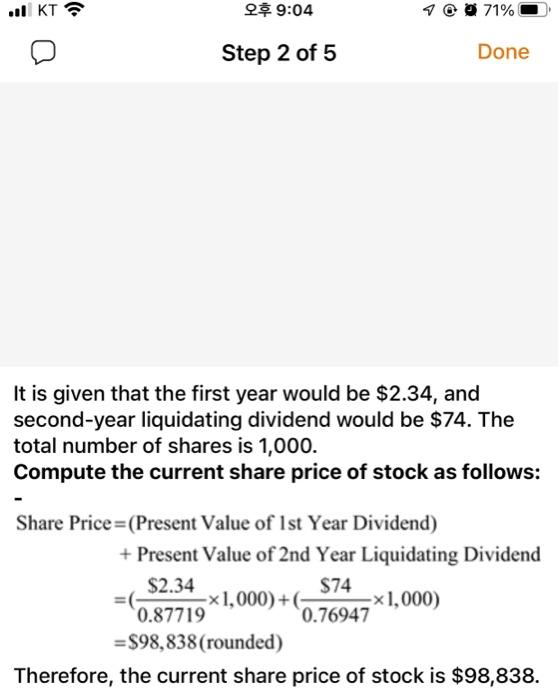

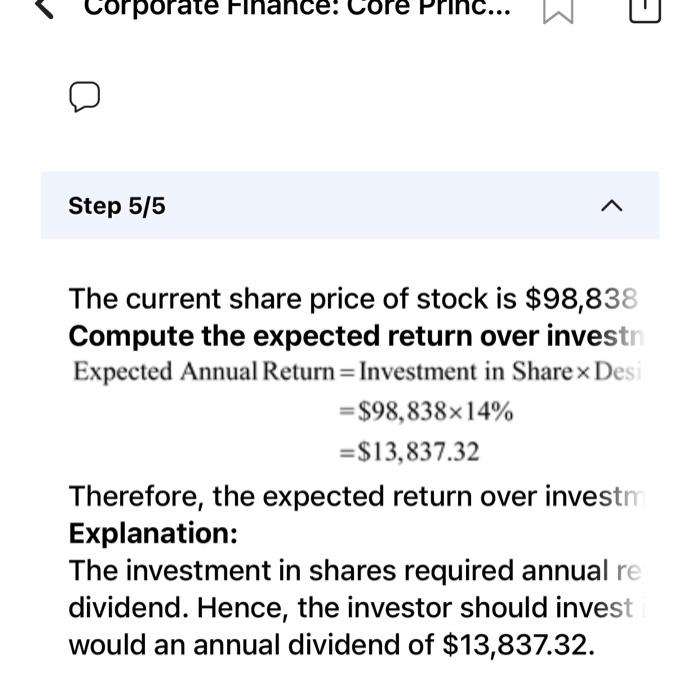

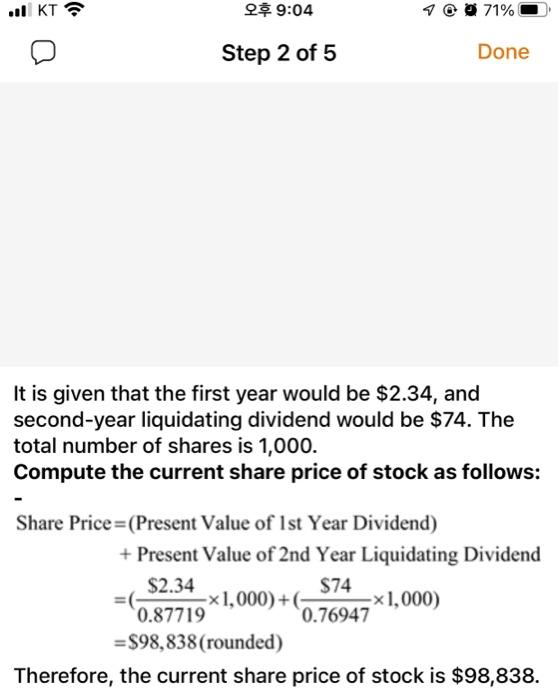

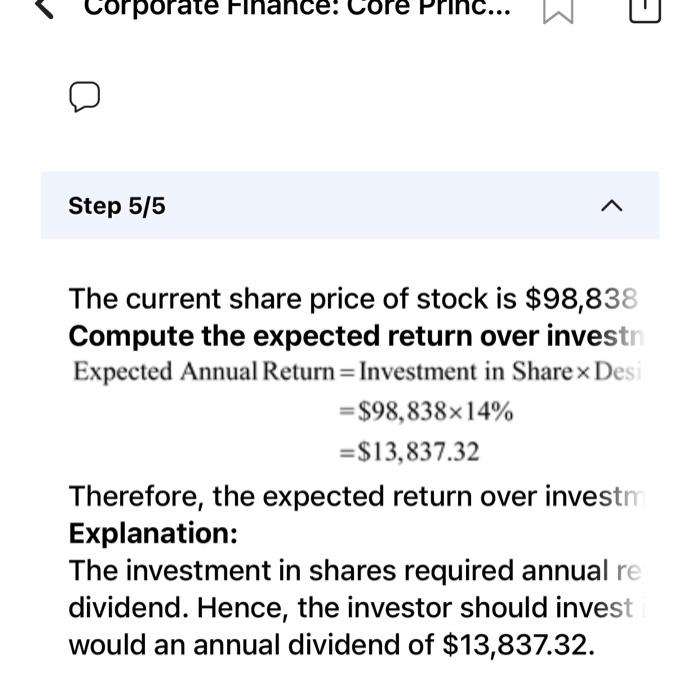

Chapter 16 Problem 11QP Done Homemade Dividends You own 1,000 shares of stock in Avondale Corporation. You will receive a $2.34 per share dividend in one year. In two years, the company will pay a liquidating dividend of $74 per share. The required return on the stock is 14 percent. What is the current share price of your stock (ignoring taxes)? If you would rather have equal dividends in each of the next two years, show how you can accomplish this by creating homemade dividends. (Hint: Dividends will be in the form of an annuity.) 11 KT :)) 9:04 0 71% Step 2 of 5 Done a It is given that the first year would be $2.34, and second-year liquidating dividend would be $74. The total number of shares is 1,000. Compute the current share price of stock as follows: Share Price =(Present Value of Ist Year Dividend) + Present Value of 2nd Year Liquidating Dividend $2.34 $74 -x1,000+ x1,000) 0.87719 0.76947 =$98,838(rounded) Therefore, the current share price of stock is $98,838. Corporate Finance! Core Princ... Step 5/5 The current share price of stock is $98,838 Compute the expected return over investn Expected Annual Return=Investment in Share x Desi =$98,838x14% =$13,837.32 Therefore, the expected return over investm Explanation: The investment in shares required annual re dividend. Hence, the investor should invest would an annual dividend of $13,837.32

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started