Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I totally need some help on this!! please help! Derrick Wells decided to start a dental practice. The first five transactions for the business follow.

I totally need some help on this!! please help!

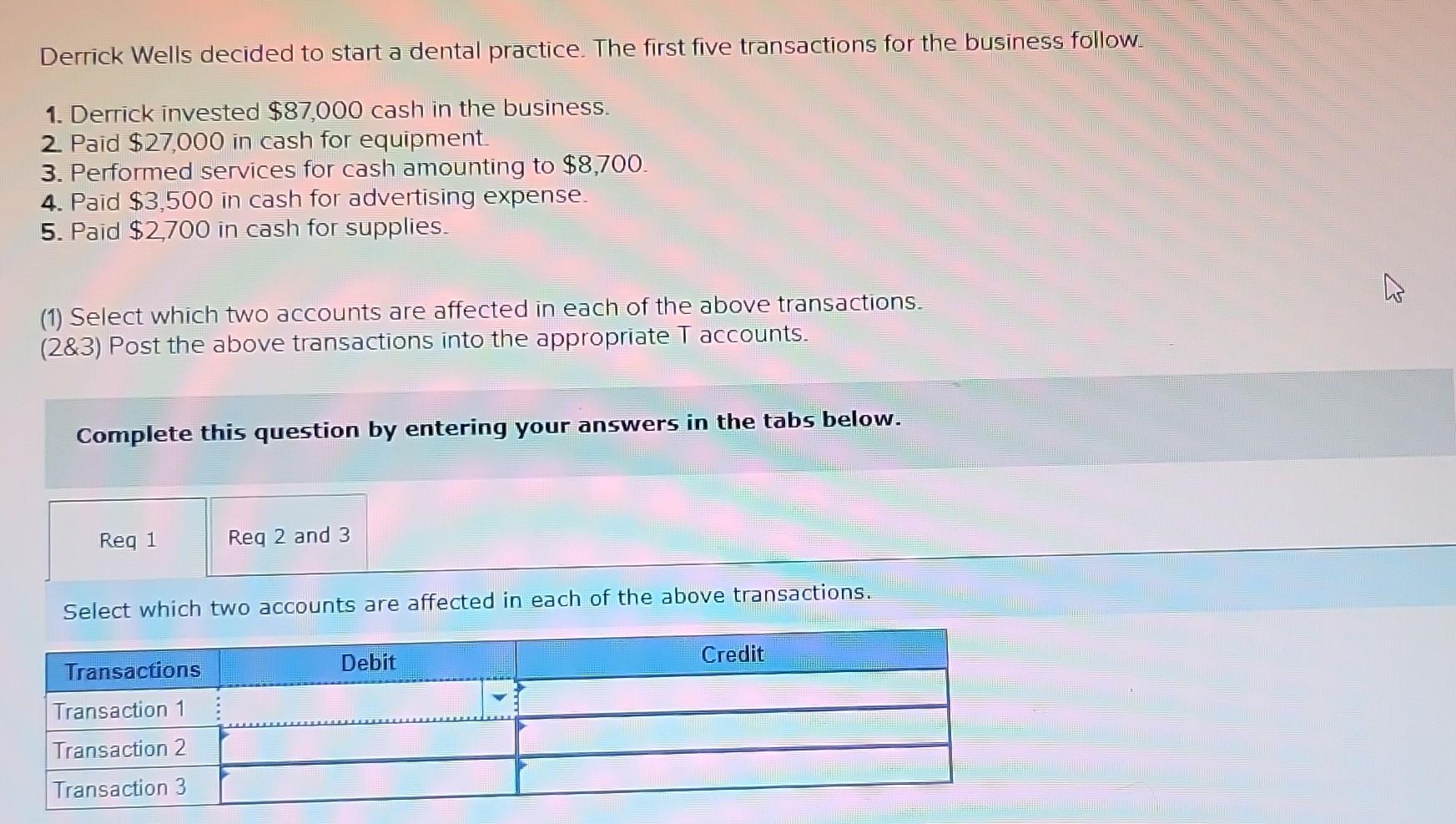

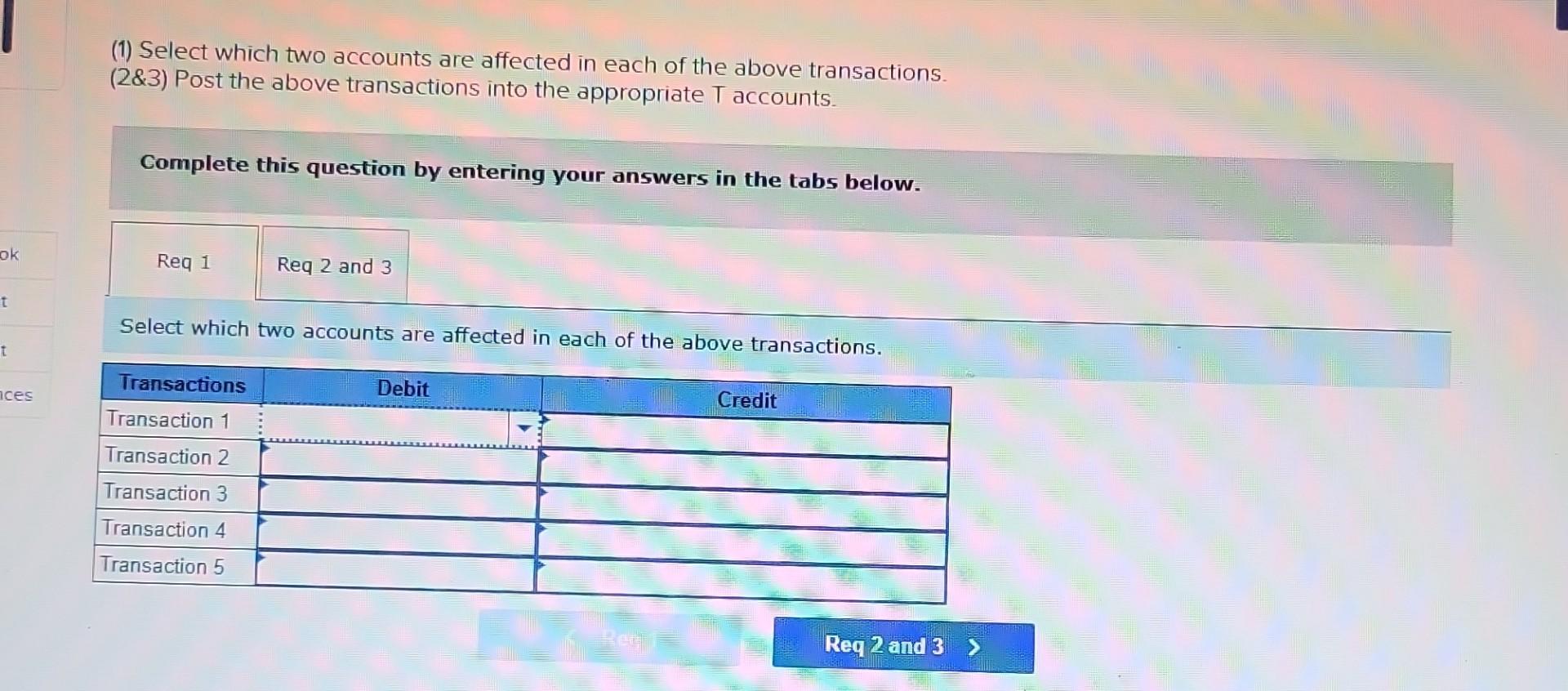

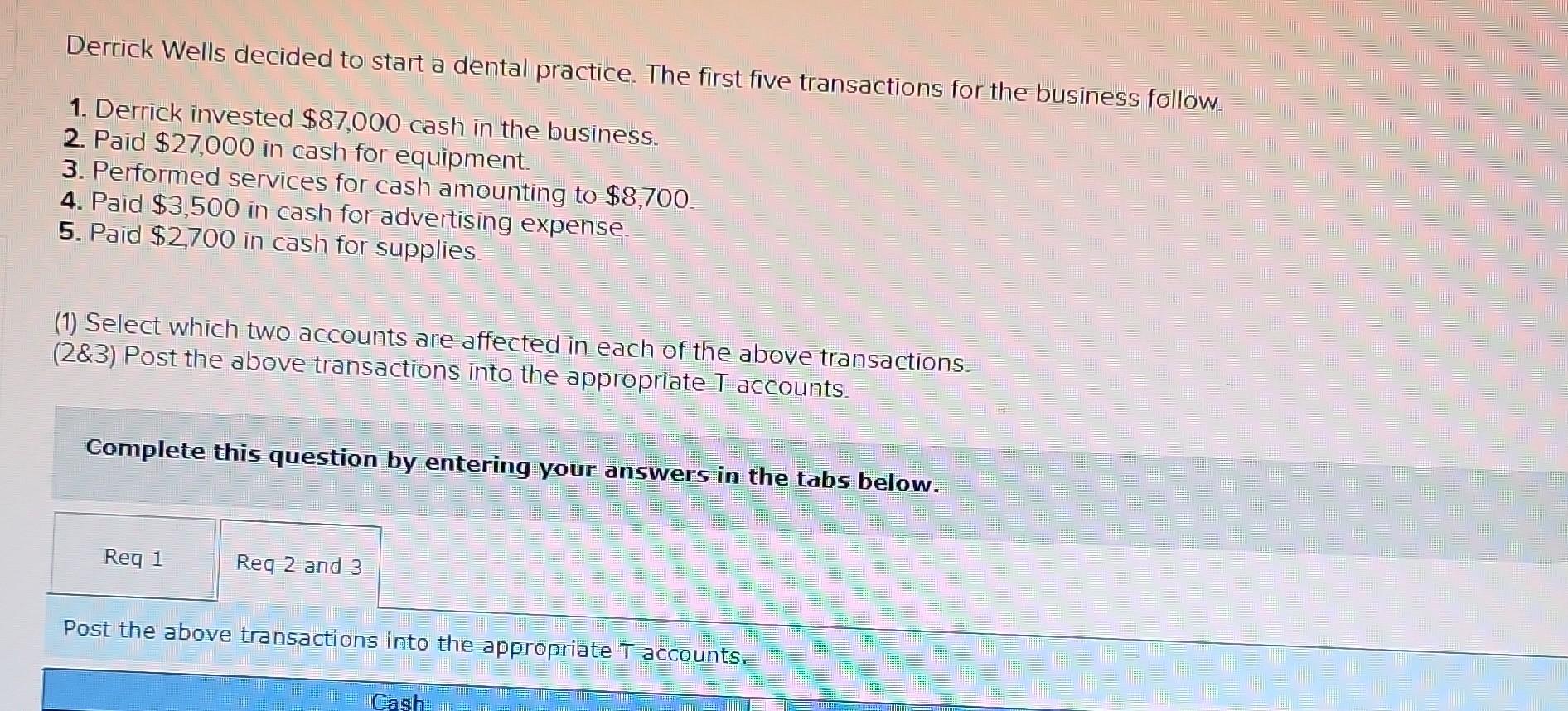

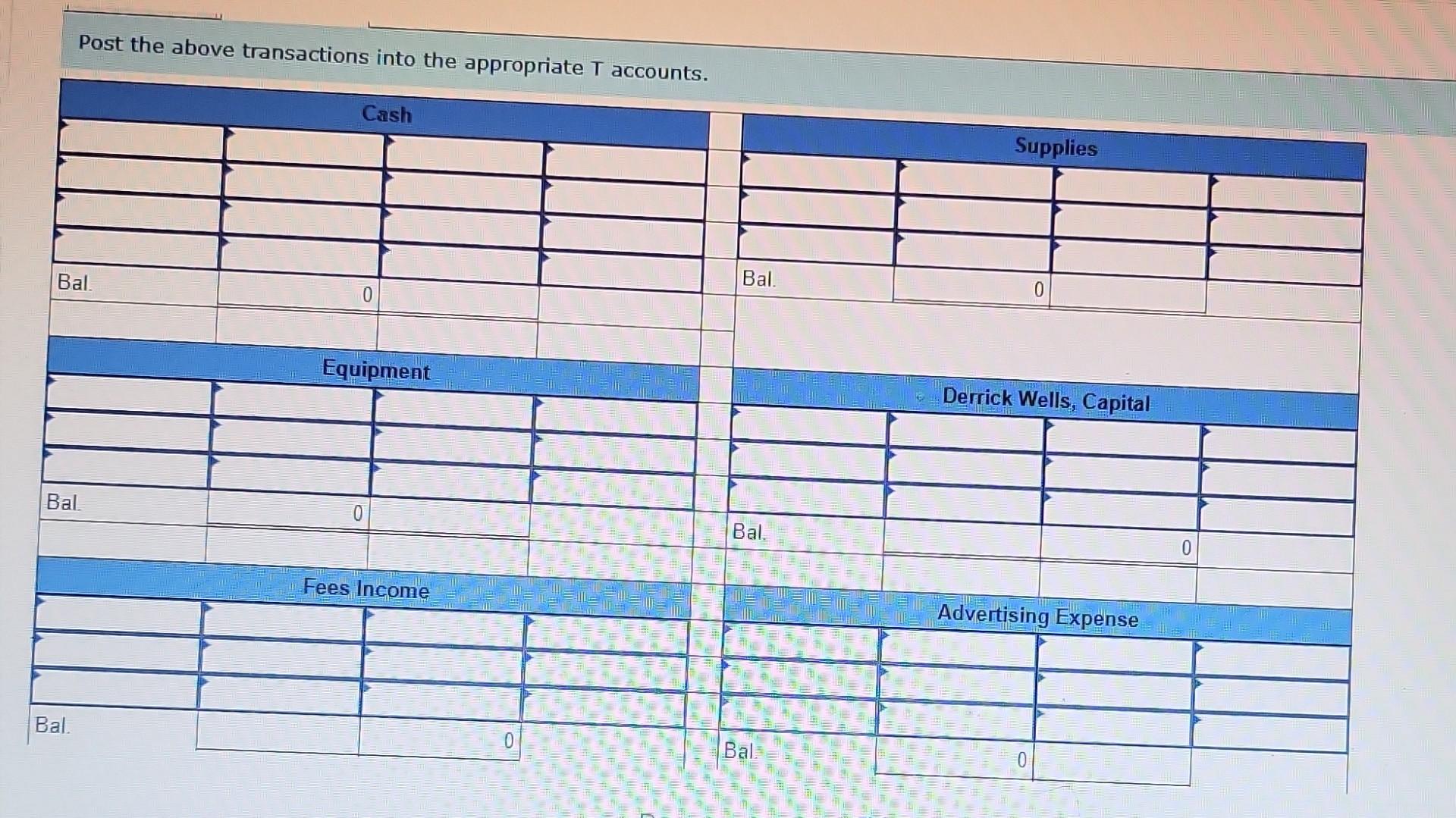

Derrick Wells decided to start a dental practice. The first five transactions for the business follow. 1. Derrick invested $87,000 cash in the business. 2. Paid $27,000 in cash for equipment. 3. Performed services for cash amounting to $8,700. 4. Paid $3,500 in cash for advertising expense. 5. Paid $2,700 in cash for supplies. (1) Select which two accounts are affected in each of the above transactions. (2\&3) Post the above transactions into the appropriate T accounts. Complete this question by entering your answers in the tabs below. Select which two accounts are affected in each of the above transactions. (1) Select which two accounts are affected in each of the above transactions. (2\&3) Post the above transactions into the appropriate T accounts. Complete this question by entering your answers in the tabs below. Select which two accounts are affected in each of the above transactions. Derrick Wells decided to start a dental practice. The first five transactions for the business follow. 1. Derrick invested $87,000 cash in the business. 2. Paid $27,000 in cash for equipment. 3. Performed services for cash amounting to $8,700. 4. Paid $3,500 in cash for advertising expense. 5. Paid $2,700 in cash for supplies. (1) Select which two accounts are affected in each of the above transactions. (2\&3) Post the above transactions into the appropriate T accounts. Complete this question by entering your answers in the tabs below. Post the above transactions into the appropriate T accounts. Post the above transactions into the appropriate T accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started