Answered step by step

Verified Expert Solution

Question

1 Approved Answer

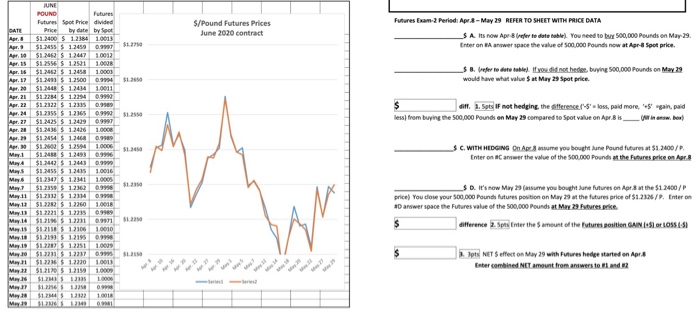

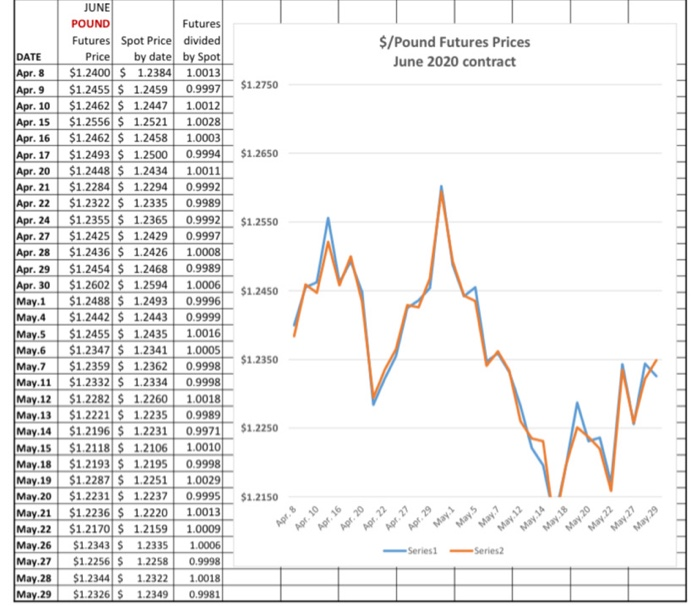

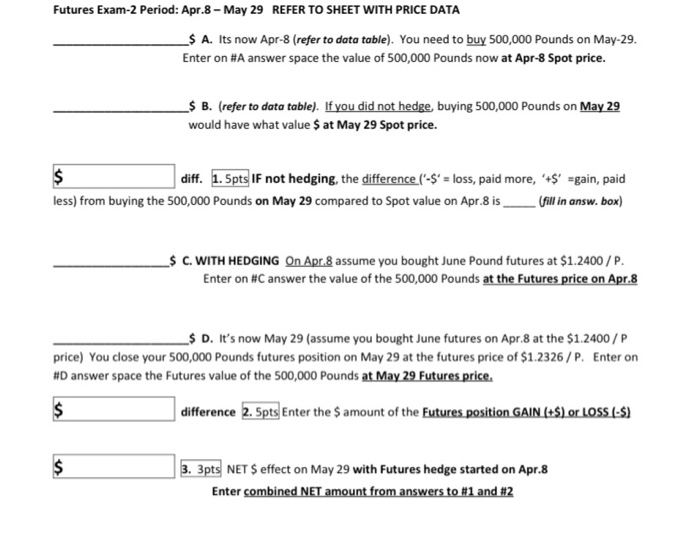

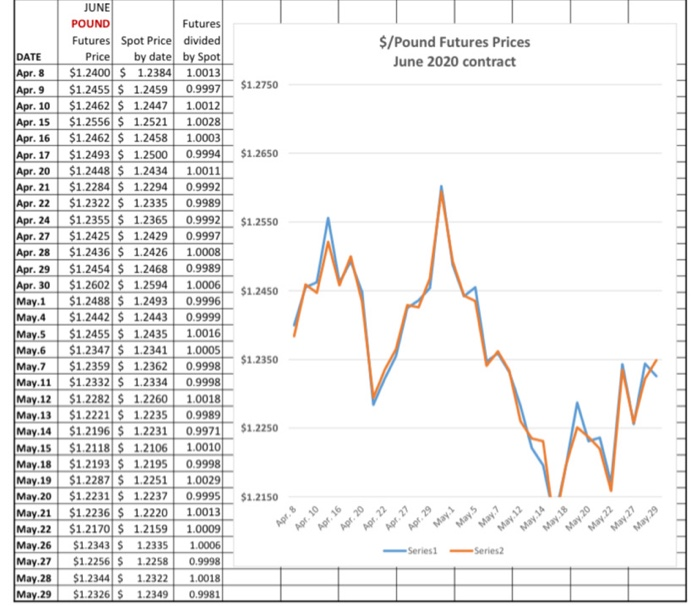

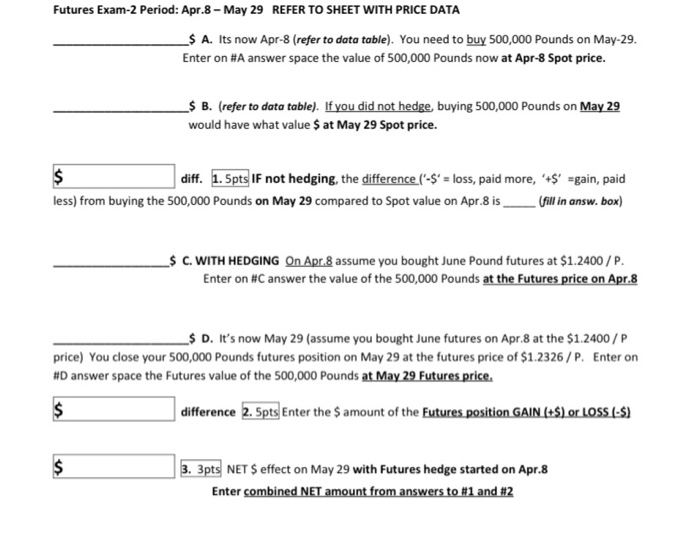

i tried uploading seperately. im able to send an email if its still blurry. S/Pound Futures Prices June 2020 contract Futures Excam-2 Period: Apr 8

i tried uploading seperately. im able to send an email if its still blurry.

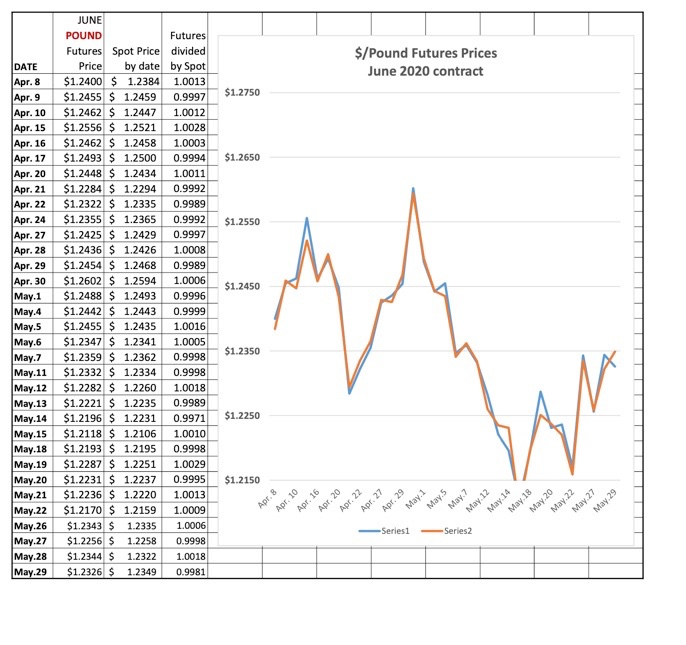

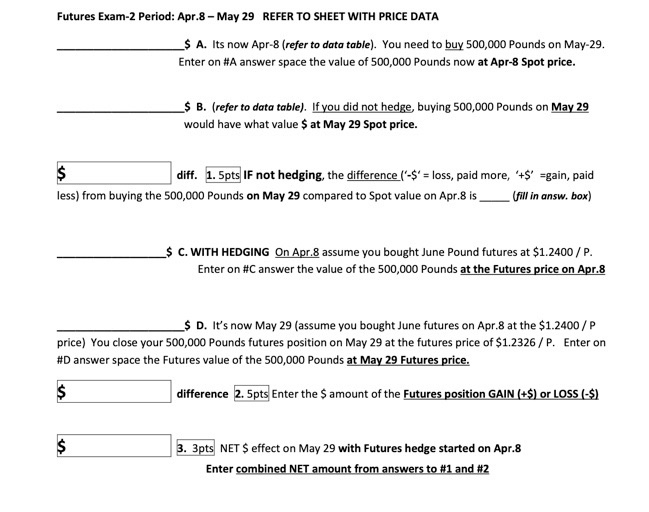

S/Pound Futures Prices June 2020 contract Futures Excam-2 Period: Apr 8 - May 29 REFER TO SHEET WITH PRICE DATA S A. Its now Apr refer to date table. You need to buy 500,000 Pounds on May 29. Enter on Hanower pace the value of 500.000 Pounds now at Apr & Spot price $123 1.000 _$ B. refer to dete sable. If you did not bedre buying 500,000 Pounds on May 29 would have what values at May 23 Spot price. $123 $12 diff. 1. Spts if not hedging the difference I loss, paid more. '' gain, paid less) from buying the 500,000 Pounds on May 29 compared to Spot value on Apr.Bis inw.br JUNE POUND Futures Future Spot Price divided DATU Price by date by Sot Apr. $1.2000 $ 1.2384 1.000.5 A, $1.2455 $ 1.2459 0.9997 $1.2452 S 12447 10012 $1.2556 S 12531 1.000 $1.20025 12458 Apr. 17 $1.29 $ 1.2500 AM 0 $1.243 S 12434 1.0011 21 $1.224 $ 1.2294 0.990 Apr. 22 $1.2322 12335 0.959 $12355 S 1 2165 Apr. 21 $1.2425 $ 1.2439 09 A. $1.2436 $ 1.2426 1.000 A $1.2454 $ 1.2468 0910 A $1.2602 S 1.2594 1.000 May 1 $1.2488 $ 1.2493 May $1.2442 $ 1.2443 0.99 My $1.2455 1245 10016 $1234) S 1.2341 1000 May $1.2350 $ 1.2362 $1.2012 5 12134 May 13 $122025 12260 1.0018 May 1B $1.2221 $ 1.2235 May 14 $121 12231 May 15 51211 S 1 2106 1.0010 512191 12195 0.999 May 19 $123 1.221 May 0512211 1.2217 . May 51.22 $ 1.2220 1.0011 May 22 5121205 1.2159 May $12MS1213 10000 May $126522 May $1.294512322 100 My $ C. WITH HEDGING On Ap.me you bought lune Pound futures at $1.3400/P. Enter on answer the value of the 500.000 Pounds at the Futures prke on Apr S D. It's now May 23 (nume you bought are futures on Apr 3 at the $1.2400/P prices You close your 500.000 Pounds futures position on May 23 at the future price of $1.2326 / Enter on # answer space the Futures value of the 500,000 Pounds at May 29 Futures price $ difference 2. Splitter the amount of the stures position GAINLES.OLOSSALSA 2. pts NETS effect on May 29 with Futures hedge started on Apr.8 Enter combined NET amount from answers to Band 22 $/Pound Futures Prices June 2020 contract $1.2750 $1.2650 $1.2550 $1.2450 DATE Apr. 8 Apr. 9 Apr. 10 Apr. 15 Apr. 16 Apr. 17 Apr. 20 Apr. 21 Apr. 22 Apr. 24 Apr. 27 Apr. 28 Apr. 29 Apr. 30 May.1 May.4 May.5 May.6 May.7 May.11 May.12 May.13 May.14 May.15 May.18 May.19 May.20 May.21 May.22 May.26 May.27 May.28 May.29 JUNE POUND Futures Futures Spot Price divided Price by date by Spot $1.2400 $ 1.2384 1.0013 $1.2455 $ 1.2459 0.9997 $1.2462 $ 1.2447 1.0012 $1.2556 $ 1.2521 1.0028 $1.2462 $ 1.2458 1.0003 $1.2493 $ 1.2500 0.9994 $1.2448 $ 1.2434 1.0011 $1.2284 $ 1.2294 0.9992 $1.2322 $ 1.2335 0.9989 $1.2355 $ 1.2365 0.9992 $1.2425 $ 1.2429 0.9997 $1.2436 $ 1.2426 1.0008 $1.2454 $ 1.2468 0.9989 $1.2602 $ 1.2594 1.0006 $1.2488 $ 1.2493 0.9996 $1.2442 $ 1.2443 0.9999 $1.2455 $ 1.2435 1.0016 $1.2347 $ 1.2341 1.0005 $1.2359 $ 1.2362 0.9998 $1.2332 $ 1.2334 0.9998 $1.2282 $ 1.2260 1.0018 $1.2221 $ 1.2235 0.9989 $1.2196 $ 1.2231 0.9971 $1.2118 $ 1.2106 1.0010 $1.2193 $ 1.2195 0.9998 $1.2287 $ 1.2251 1.0029 $1.2231 $ 1.2237 0.9995 $1.2236 $ 1.2220 1.0013 $1.2170 $ 1.2159 1.0009 $1.2343 $ 1.2335 1.0006 $1.2256 S 1.2258 0.9998 $1.2344 $ 1.2322 1.0018 $1.2326 $ 1.2349 0.9981 $1.2350 $1.2250 $1.2150 Apr. 8 Apr. 10 Apr. 22 Apr. 20 Apr. 29 May.s May 27 Apr. 16 Apr. 27 May. 1 May 29 Series1 -Series2 May 7 May 12 May 14 May 18 May 20 May 22 Futures Exam-2 Period: Apr.8 - May 29 REFER TO SHEET WITH PRICE DATA $ A. Its now Apr-8 (refer to data table). You need to buy 500,000 Pounds on May-29. Enter on #A answer space the value of 500,000 Pounds now at Apr-8 Spot price. _$ B. (refer to data table). If you did not hedge, buying 500,000 Pounds on May 29 would have what value $ at May 29 Spot price. $ diff. 1. Spts IF not hedging the difference (-$' = loss, paid more, '+$' =gain, paid less) from buying the 500,000 Pounds on May 29 compared to spot value on Apr.8 is (fill in answ. box) $ C. WITH HEDGING On Apr.8 assume you bought June Pound futures at $1.2400 / P. Enter on #C answer the value of the 500,000 Pounds at the Futures price on Apr.8 _$ D. It's now May 29 (assume you bought June futures on Apr.8 at the $1.2400/P price) You close your 500,000 Pounds futures position on May 29 at the futures price of $1.2326/P. Enter on #D answer space the Futures value of the 500,000 Pounds at May 29 Futures price. $ difference 2. Spts Enter the $ amount of the Futures position GAIN (+$) or LOSS (-$) $ 3. 3pts NET $ effect on May 29 with Futures hedge started on Apr.8 Enter combined NET amount from answers to #1 and #2 $/Pound Futures Prices June 2020 contract 0.9997 $1.2750 $1.2650 $1.2550 $1.2450 JUNE POUND Futures Futures Spot Price divided DATE Price by date by Spot Apr. 8 $1.2400 $ 1.2384 1.0013 Apr. 9 $1.2455 $ 1.2459 Apr. 10 $1.2462 $ 1.2447 1.0012 Apr. 15 $1.2556 $ 1.2521 1.0028 Apr. 16 $1.2462 $ 1.2458 1.0003 Apr. 17 $1.2493 $ 1.2500 0.9994 Apr. 20 $1.2448 $ 1.2434 1.0011 Apr. 21 $1.2284 $ 1.2294 0.9992 Apr. 22 $1.2322 $ 1.2335 0.9989 Apr. 24 $1.2355 $ 1.2365 0.9992 Apr. 27 $1.2425 $ 1.2429 0.9997 Apr. 28 $1.2436 $ 1.2426 1.0008 Apr. 29 $1.2454 $ 1.2468 0.9989 Apr. 30 $1.2602 $ 1.2594 1.0006 May. 1 $1.2488 $ 1.2493 0.9996 May.4 $1.2442 $ 1.2443 0.9999 May 5 $1.2455 $ 1.2435 1.0016 May.6 $1.2347 $ 1.2341 1.0005 May.7 $1.2359 $ 1.2362 0.9998 May. 11 $1.2332 $ 1.2334 0.9998 May 12 $1.2282 $ 1.2260 1.0018 May 13 $1.2221 $ 1.2235 0.9989 May.14 $1.2196 $ 1.2231 0.9971 May.15 $1.2118 $ 1.2106 1.0010 May.18 $1.2193 $ 1.2195 0.9998 May 19 $1.2287 $ 1.2251 1.0029 May.20 $1.2231 $ 1.2237 0.9995 May.21 $1.2236 $ 1.2220 1.0013 May.22 $1.2170 $ 1.2159 1.0009 May.26 $1.2343 $ 1.2335 1.0006 May.27 $1.2256 $ 1.2258 0.9998 May.28 $1.2344 $ 1.2322 1.0018 May 29 $1.2326 $ 1.2349 0.9981 $1.2350 $1.2250 $1.2150 Apr. 10 Apr. 29 Apr. 27 May 18 May.29 Apr. 8 May 12 May 14 Apr 16 Apr. 20 Apr. 22 May 1 May 5 May.7 May 20 May 22 May.27 Series1 Series2 Futures Exam-2 Period: Apr.8 - May 29 REFER TO SHEET WITH PRICE DATA $ A. Its now Apr-8 (refer to data table). You need to buy 500,000 Pounds on May-29. Enter on #A answer space the value of 500,000 Pounds now at Apr-8 Spot price. _$ B. (refer to data table). If you did not hedge buying 500,000 Pounds on May 29 would have what value $ at May 29 Spot price. $ diff. 1. 5pts IF not hedging, the difference (-$* = loss, paid more, '+$' =gain, paid less) from buying the 500,000 Pounds on May 29 compared to Spot value on Apr.8 is ____ (fill in answ. box) $ C. WITH HEDGING On Apr.8 assume you bought June Pound futures at $1.2400 / P. Enter on #C answer the value of the 500,000 Pounds at the Futures price on Apr.8 $ D. It's now May 29 (assume you bought June futures on Apr.8 at the $1.2400 / P price) You close your 500,000 Pounds futures position on May 29 at the futures price of $1.2326 / P. Enter on #D answer space the Futures value of the 500,000 Pounds at May 29 Futures price. $ difference 2. Spts Enter the $ amount of the Futures position GAIN (+8) or LOSS (-8) $ 3. 3pts NET $ effect on May 29 with Futures hedge started on Apr.8 Enter combined NET amount from answers to #1 and #2 S/Pound Futures Prices June 2020 contract Futures Excam-2 Period: Apr 8 - May 29 REFER TO SHEET WITH PRICE DATA S A. Its now Apr refer to date table. You need to buy 500,000 Pounds on May 29. Enter on Hanower pace the value of 500.000 Pounds now at Apr & Spot price $123 1.000 _$ B. refer to dete sable. If you did not bedre buying 500,000 Pounds on May 29 would have what values at May 23 Spot price. $123 $12 diff. 1. Spts if not hedging the difference I loss, paid more. '' gain, paid less) from buying the 500,000 Pounds on May 29 compared to Spot value on Apr.Bis inw.br JUNE POUND Futures Future Spot Price divided DATU Price by date by Sot Apr. $1.2000 $ 1.2384 1.000.5 A, $1.2455 $ 1.2459 0.9997 $1.2452 S 12447 10012 $1.2556 S 12531 1.000 $1.20025 12458 Apr. 17 $1.29 $ 1.2500 AM 0 $1.243 S 12434 1.0011 21 $1.224 $ 1.2294 0.990 Apr. 22 $1.2322 12335 0.959 $12355 S 1 2165 Apr. 21 $1.2425 $ 1.2439 09 A. $1.2436 $ 1.2426 1.000 A $1.2454 $ 1.2468 0910 A $1.2602 S 1.2594 1.000 May 1 $1.2488 $ 1.2493 May $1.2442 $ 1.2443 0.99 My $1.2455 1245 10016 $1234) S 1.2341 1000 May $1.2350 $ 1.2362 $1.2012 5 12134 May 13 $122025 12260 1.0018 May 1B $1.2221 $ 1.2235 May 14 $121 12231 May 15 51211 S 1 2106 1.0010 512191 12195 0.999 May 19 $123 1.221 May 0512211 1.2217 . May 51.22 $ 1.2220 1.0011 May 22 5121205 1.2159 May $12MS1213 10000 May $126522 May $1.294512322 100 My $ C. WITH HEDGING On Ap.me you bought lune Pound futures at $1.3400/P. Enter on answer the value of the 500.000 Pounds at the Futures prke on Apr S D. It's now May 23 (nume you bought are futures on Apr 3 at the $1.2400/P prices You close your 500.000 Pounds futures position on May 23 at the future price of $1.2326 / Enter on # answer space the Futures value of the 500,000 Pounds at May 29 Futures price $ difference 2. Splitter the amount of the stures position GAINLES.OLOSSALSA 2. pts NETS effect on May 29 with Futures hedge started on Apr.8 Enter combined NET amount from answers to Band 22 $/Pound Futures Prices June 2020 contract $1.2750 $1.2650 $1.2550 $1.2450 DATE Apr. 8 Apr. 9 Apr. 10 Apr. 15 Apr. 16 Apr. 17 Apr. 20 Apr. 21 Apr. 22 Apr. 24 Apr. 27 Apr. 28 Apr. 29 Apr. 30 May.1 May.4 May.5 May.6 May.7 May.11 May.12 May.13 May.14 May.15 May.18 May.19 May.20 May.21 May.22 May.26 May.27 May.28 May.29 JUNE POUND Futures Futures Spot Price divided Price by date by Spot $1.2400 $ 1.2384 1.0013 $1.2455 $ 1.2459 0.9997 $1.2462 $ 1.2447 1.0012 $1.2556 $ 1.2521 1.0028 $1.2462 $ 1.2458 1.0003 $1.2493 $ 1.2500 0.9994 $1.2448 $ 1.2434 1.0011 $1.2284 $ 1.2294 0.9992 $1.2322 $ 1.2335 0.9989 $1.2355 $ 1.2365 0.9992 $1.2425 $ 1.2429 0.9997 $1.2436 $ 1.2426 1.0008 $1.2454 $ 1.2468 0.9989 $1.2602 $ 1.2594 1.0006 $1.2488 $ 1.2493 0.9996 $1.2442 $ 1.2443 0.9999 $1.2455 $ 1.2435 1.0016 $1.2347 $ 1.2341 1.0005 $1.2359 $ 1.2362 0.9998 $1.2332 $ 1.2334 0.9998 $1.2282 $ 1.2260 1.0018 $1.2221 $ 1.2235 0.9989 $1.2196 $ 1.2231 0.9971 $1.2118 $ 1.2106 1.0010 $1.2193 $ 1.2195 0.9998 $1.2287 $ 1.2251 1.0029 $1.2231 $ 1.2237 0.9995 $1.2236 $ 1.2220 1.0013 $1.2170 $ 1.2159 1.0009 $1.2343 $ 1.2335 1.0006 $1.2256 S 1.2258 0.9998 $1.2344 $ 1.2322 1.0018 $1.2326 $ 1.2349 0.9981 $1.2350 $1.2250 $1.2150 Apr. 8 Apr. 10 Apr. 22 Apr. 20 Apr. 29 May.s May 27 Apr. 16 Apr. 27 May. 1 May 29 Series1 -Series2 May 7 May 12 May 14 May 18 May 20 May 22 Futures Exam-2 Period: Apr.8 - May 29 REFER TO SHEET WITH PRICE DATA $ A. Its now Apr-8 (refer to data table). You need to buy 500,000 Pounds on May-29. Enter on #A answer space the value of 500,000 Pounds now at Apr-8 Spot price. _$ B. (refer to data table). If you did not hedge, buying 500,000 Pounds on May 29 would have what value $ at May 29 Spot price. $ diff. 1. Spts IF not hedging the difference (-$' = loss, paid more, '+$' =gain, paid less) from buying the 500,000 Pounds on May 29 compared to spot value on Apr.8 is (fill in answ. box) $ C. WITH HEDGING On Apr.8 assume you bought June Pound futures at $1.2400 / P. Enter on #C answer the value of the 500,000 Pounds at the Futures price on Apr.8 _$ D. It's now May 29 (assume you bought June futures on Apr.8 at the $1.2400/P price) You close your 500,000 Pounds futures position on May 29 at the futures price of $1.2326/P. Enter on #D answer space the Futures value of the 500,000 Pounds at May 29 Futures price. $ difference 2. Spts Enter the $ amount of the Futures position GAIN (+$) or LOSS (-$) $ 3. 3pts NET $ effect on May 29 with Futures hedge started on Apr.8 Enter combined NET amount from answers to #1 and #2 $/Pound Futures Prices June 2020 contract 0.9997 $1.2750 $1.2650 $1.2550 $1.2450 JUNE POUND Futures Futures Spot Price divided DATE Price by date by Spot Apr. 8 $1.2400 $ 1.2384 1.0013 Apr. 9 $1.2455 $ 1.2459 Apr. 10 $1.2462 $ 1.2447 1.0012 Apr. 15 $1.2556 $ 1.2521 1.0028 Apr. 16 $1.2462 $ 1.2458 1.0003 Apr. 17 $1.2493 $ 1.2500 0.9994 Apr. 20 $1.2448 $ 1.2434 1.0011 Apr. 21 $1.2284 $ 1.2294 0.9992 Apr. 22 $1.2322 $ 1.2335 0.9989 Apr. 24 $1.2355 $ 1.2365 0.9992 Apr. 27 $1.2425 $ 1.2429 0.9997 Apr. 28 $1.2436 $ 1.2426 1.0008 Apr. 29 $1.2454 $ 1.2468 0.9989 Apr. 30 $1.2602 $ 1.2594 1.0006 May. 1 $1.2488 $ 1.2493 0.9996 May.4 $1.2442 $ 1.2443 0.9999 May 5 $1.2455 $ 1.2435 1.0016 May.6 $1.2347 $ 1.2341 1.0005 May.7 $1.2359 $ 1.2362 0.9998 May. 11 $1.2332 $ 1.2334 0.9998 May 12 $1.2282 $ 1.2260 1.0018 May 13 $1.2221 $ 1.2235 0.9989 May.14 $1.2196 $ 1.2231 0.9971 May.15 $1.2118 $ 1.2106 1.0010 May.18 $1.2193 $ 1.2195 0.9998 May 19 $1.2287 $ 1.2251 1.0029 May.20 $1.2231 $ 1.2237 0.9995 May.21 $1.2236 $ 1.2220 1.0013 May.22 $1.2170 $ 1.2159 1.0009 May.26 $1.2343 $ 1.2335 1.0006 May.27 $1.2256 $ 1.2258 0.9998 May.28 $1.2344 $ 1.2322 1.0018 May 29 $1.2326 $ 1.2349 0.9981 $1.2350 $1.2250 $1.2150 Apr. 10 Apr. 29 Apr. 27 May 18 May.29 Apr. 8 May 12 May 14 Apr 16 Apr. 20 Apr. 22 May 1 May 5 May.7 May 20 May 22 May.27 Series1 Series2 Futures Exam-2 Period: Apr.8 - May 29 REFER TO SHEET WITH PRICE DATA $ A. Its now Apr-8 (refer to data table). You need to buy 500,000 Pounds on May-29. Enter on #A answer space the value of 500,000 Pounds now at Apr-8 Spot price. _$ B. (refer to data table). If you did not hedge buying 500,000 Pounds on May 29 would have what value $ at May 29 Spot price. $ diff. 1. 5pts IF not hedging, the difference (-$* = loss, paid more, '+$' =gain, paid less) from buying the 500,000 Pounds on May 29 compared to Spot value on Apr.8 is ____ (fill in answ. box) $ C. WITH HEDGING On Apr.8 assume you bought June Pound futures at $1.2400 / P. Enter on #C answer the value of the 500,000 Pounds at the Futures price on Apr.8 $ D. It's now May 29 (assume you bought June futures on Apr.8 at the $1.2400 / P price) You close your 500,000 Pounds futures position on May 29 at the futures price of $1.2326 / P. Enter on #D answer space the Futures value of the 500,000 Pounds at May 29 Futures price. $ difference 2. Spts Enter the $ amount of the Futures position GAIN (+8) or LOSS (-8) $ 3. 3pts NET $ effect on May 29 with Futures hedge started on Apr.8 Enter combined NET amount from answers to #1 and #2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started