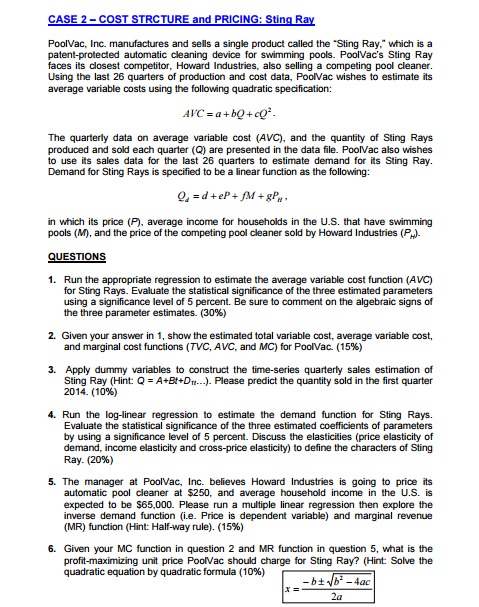

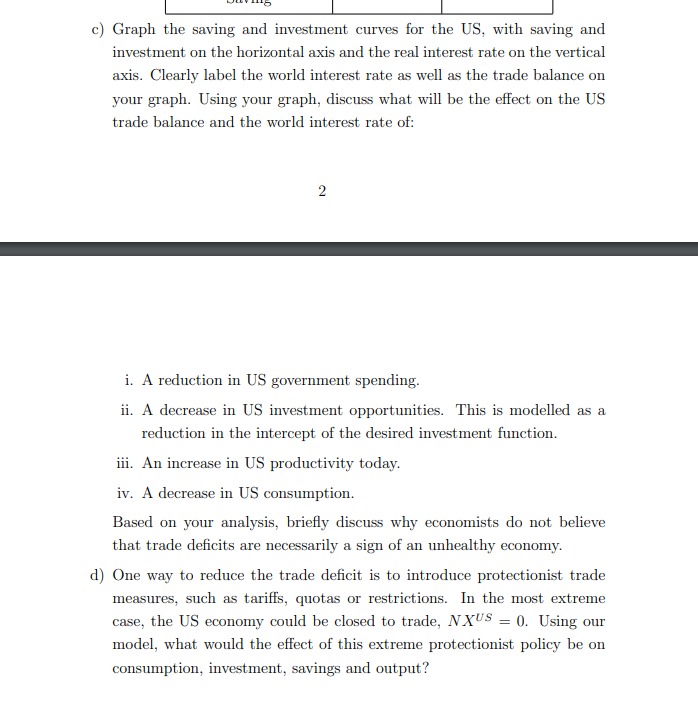

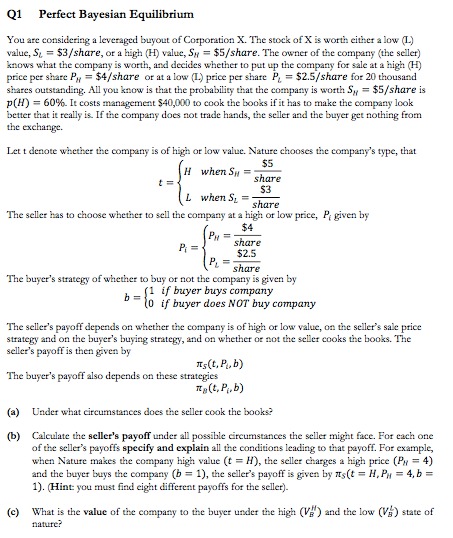

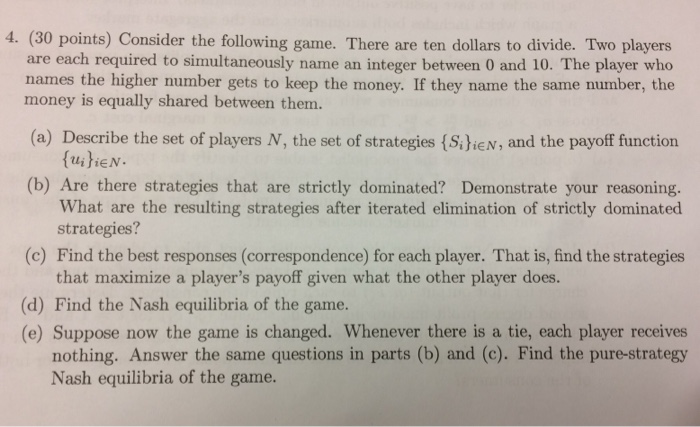

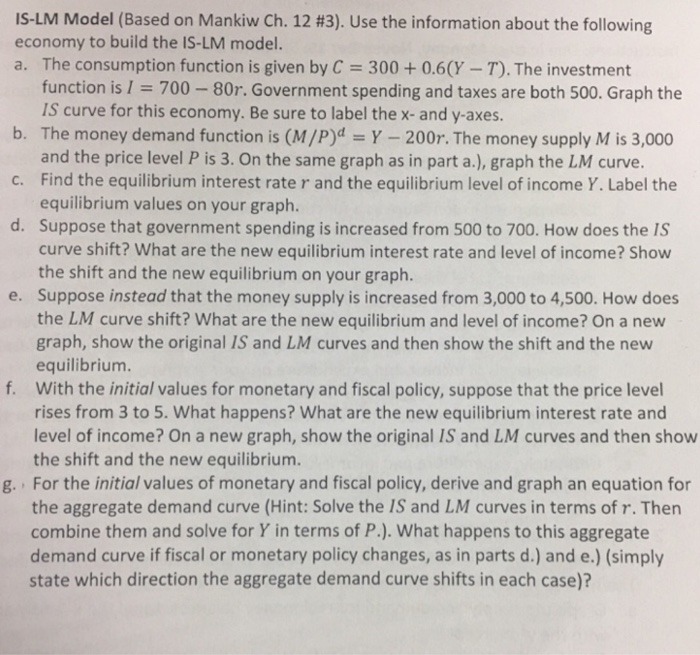

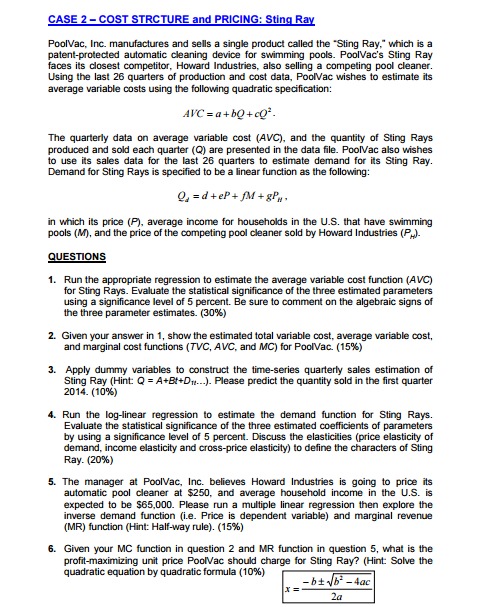

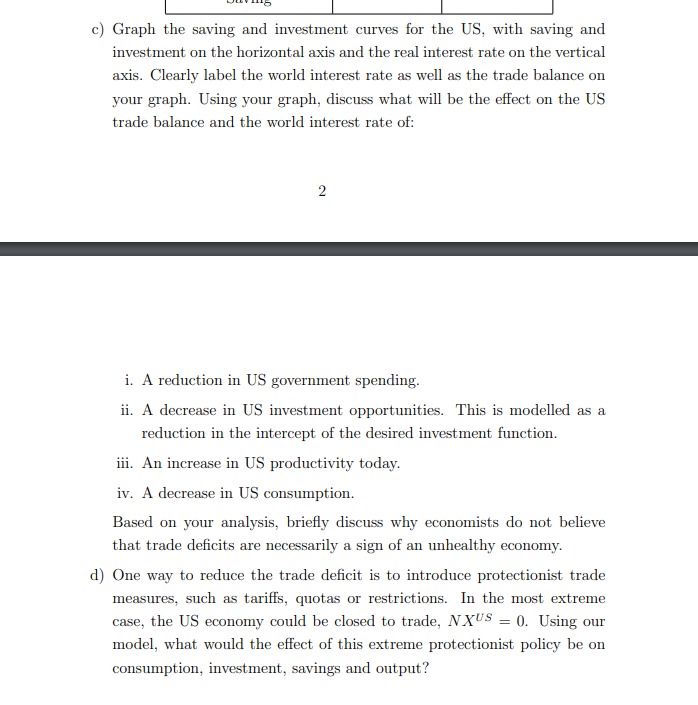

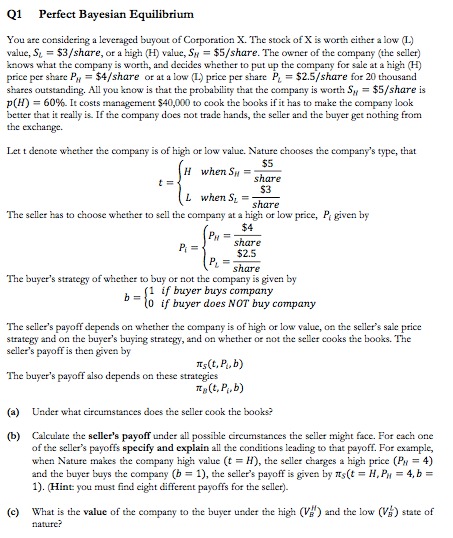

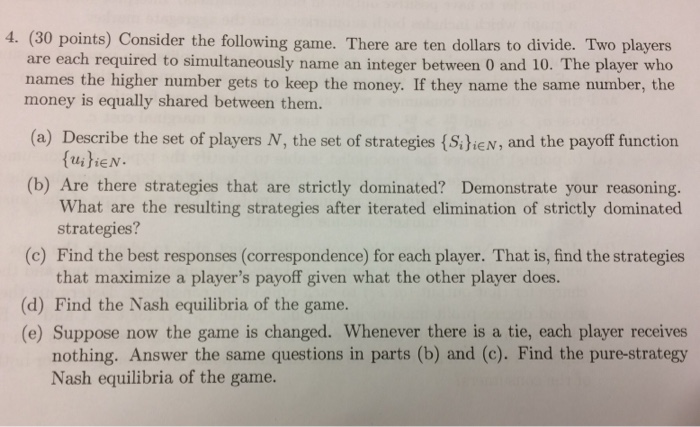

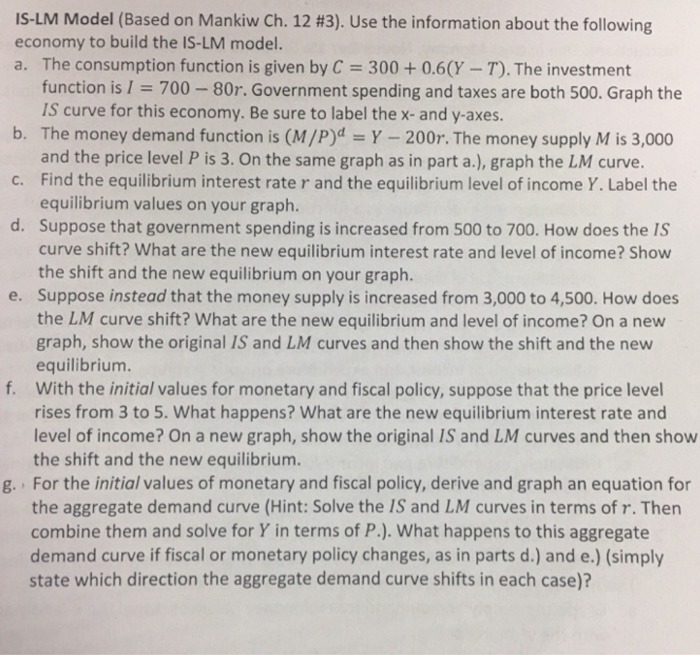

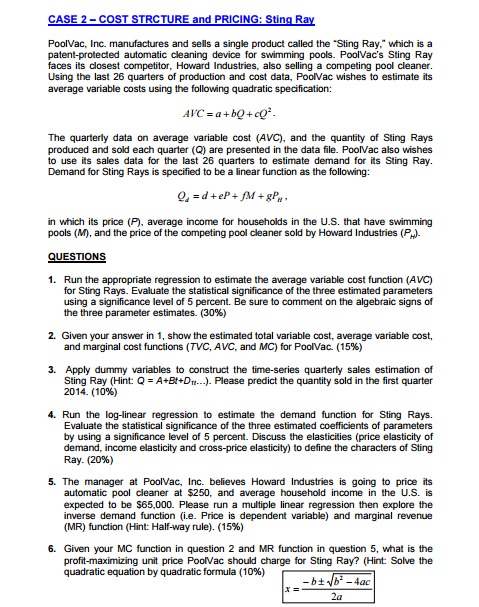

I \"ulna-.15 I I I c} Graph the saving and investment curves for the US, with saving and investment on the horizontal axis and the real interest rate on the vertical axis. Clearly label the world interest rate as well as the trade balance on your graph. Using your graph, discuss what will be the effect on the US trade balance and the world interest rate of: i. A reduction in US government spending. ii. A. decrease in US investment opportunities. This is modelled as a reduction in the intercept of the desired investment function. iii. An increase in US productivity today. iv. A decrease in US consumption. Based on your analysis, briey discuss why economists do not believe that trade decits are necessarily a sign of an unhealthy economy. d} Due way to reduce the trade decit is to introduce protectionist trade measures, such as tariffs, quotas or restrictions. In the most extreme case, the US economy could be closed to trade, NXUS = . Using our model, what would the effect of this extreme protectionist policy be on consumption, investment, savings and output? Q1 Perfect Bayesian Equilibrium You are considering a leveraged buyout of Corporation X. The stock of X is worth either a low (1.) value, 51 = $3/share, or a high (H) value, Sy = $5/share. The owner of the company (the seller) knows what the company is worth, and decides whether to put up the company for sale at a high (H) price per share Py = $4/share or at a low (L.) price per share P, = $2.5/share for 20 thousand shares outstanding. All you know is that the probability that the company is worth 5, = $5/share is p(H) = 60% It costs management $40,000 to cook the books if it has to make the company look better that it really is. If the company does not trade hands, the seller and the buyer get nothing from the exchange. Let t denote whether the company is of high or low value. Nature chooses the company's type, that H when S, = $5 share 53 L when S, = share The seller has to choose whether to sell the company at a high or low price, P given by $4 PH = share P . $2.5 share The buyer's strategy of whether to buy or not the company is given by b = [1 if buyer buys company 10 if buyer does NOT buy company The seller's payoff depends on whether the company is of high or low value, on the seller's sale price strategy and on the buyer's buying strategy, and on whether or not the seller cooks the books. The seller's payoff is then given by ITS (t, P. b) The buyer's payoff also depends on these strategies HA (t, PA.b) (a) Under what circumstances does the seller cook the books? (b) Calculate the seller's payoff under all possible circumstances the seller might face. For each one of the seller's payoffs specify and explain all the conditions leading to that payoff. For example, when Nature makes the company high value (t = H), the seller charges a high price (Py = 4) and the buyer bays the company (b = 1), the seller's payoff is given by my(t = H, Py = 4, b = 1). (Hint you must find eight different payoffs for the seller). (c) What is the value of the company to the buyer under the high (Vg ) and the low (Vy ) state of nature?4. (30 points) Consider the following game. There are ten dollars to divide. Two players are each required to simultaneously name an integer between 0 and 10. The player who names the higher number gets to keep the money. If they name the same number, the money is equally shared between them. (a) Describe the set of players N, the set of strategies { Silien, and the payoff function QuitiEN. (b) Are there strategies that are strictly dominated? Demonstrate your reasoning. What are the resulting strategies after iterated elimination of strictly dominated strategies? (c) Find the best responses (correspondence) for each player. That is, find the strategies that maximize a player's payoff given what the other player does. (d) Find the Nash equilibria of the game. (e) Suppose now the game is changed. Whenever there is a tie, each player receives nothing. Answer the same questions in parts (b) and (c). Find the pure-strategy Nash equilibria of the game.IS-LM Model (Based on Mankiw Ch. 12 #3). Use the information about the following economy to build the IS-LM model. a. The consumption function is given by C = 300 + 0.6(Y - ). The investment function is / = 700 - 80r. Government spending and taxes are both 500. Graph the IS curve for this economy. Be sure to label the x- and y-axes. b. The money demand function is (M/p) = Y - 200r. The money supply M is 3,000 and the price level P is 3. On the same graph as in part a.), graph the LM curve. c. Find the equilibrium interest rate r and the equilibrium level of income Y. Label the equilibrium values on your graph. d. Suppose that government spending is increased from 500 to 700. How does the IS curve shift? What are the new equilibrium interest rate and level of income? Show the shift and the new equilibrium on your graph. e. Suppose instead that the money supply is increased from 3,000 to 4,500. How does the LM curve shift? What are the new equilibrium and level of income? On a new graph, show the original IS and LM curves and then show the shift and the new equilibrium. f. With the initial values for monetary and fiscal policy, suppose that the price level rises from 3 to 5. What happens? What are the new equilibrium interest rate and level of income? On a new graph, show the original IS and LM curves and then show the shift and the new equilibrium. g. . For the initial values of monetary and fiscal policy, derive and graph an equation for the aggregate demand curve (Hint: Solve the IS and LM curves in terms of r. Then combine them and solve for Y in terms of P.). What happens to this aggregate demand curve if fiscal or monetary policy changes, as in parts d.) and e.) (simply state which direction the aggregate demand curve shifts in each case)?CASE 2 - COST STRCTURE and PRICING: Sting Ray PoolVac, Inc. manufactures and sells a single product called the "Sting Ray," which is a patent-protected automatic cleaning device for swimming pools. PoolVac's Sting Ray faces its closest competitor, Howard Industries, also selling a competing pool cleaner. Using the last 26 quarters of production and cost data, PoolVac wishes to estimate its average variable costs using the following quadratic specification: AVC =a+bQ+cq'. The quarterly data on average variable cost (AVC), and the quantity of Sting Rays produced and sold each quarter (Q) are presented in the data file. PoolVac also wishes to use its sales data for the last 26 quarters to estimate demand for its Sting Ray. Demand for Sting Rays is specified to be a linear function as the following: 0) = d + eP + fM + gPw. in which its price (P), average income for households in the U.S. that have swimming pools (M), and the price of the competing pool cleaner sold by Howard Industries (P,). QUESTIONS 1. Run the appropriate regression to estimate the average variable cost function (AVC) for Sting Rays. Evaluate the statistical significance of the three estimated parameters using a significance level of 5 percent. Be sure to comment on the algebraic signs of the three parameter estimates. (30%) 2. Given your answer in 1, show the estimated total variable cost, average variable cost, and marginal cost functions (7VC, AVC, and MC) for PoolVac. (15%) 3. Apply dummy variables to construct the time-series quarterly sales estimation of Sting Ray (Hint: Q = A+8+Dy...). Please predict the quantity sold in the first quarter 2014. (10%) 4. Run the log-linear regression to estimate the demand function for Sting Rays. Evaluate the statistical significance of the three estimated coefficients of parameters by using a significance level of 5 percent. Discuss the elasticities (price elasticity of demand, income elasticity and cross-price elasticity) to define the characters of Sting Ray. (20%) 5. The manager at PoolVac, Inc. believes Howard Industries is going to price its automatic pool cleaner at $250, and average household income in the U.S. is expected to be $65,000. Please run a multiple linear regression then explore the inverse demand function (i.e. Price is dependent variable) and marginal revenue (MR) function (Hint: Half-way rule). (15%) 6. Given your MC function in question 2 and MR function in question 5, what is the profit-maximizing unit price PoolVac should charge for Sting Ray? (Hint: Solve the quadratic equation by quadratic formula (10%) -btob - 4ac