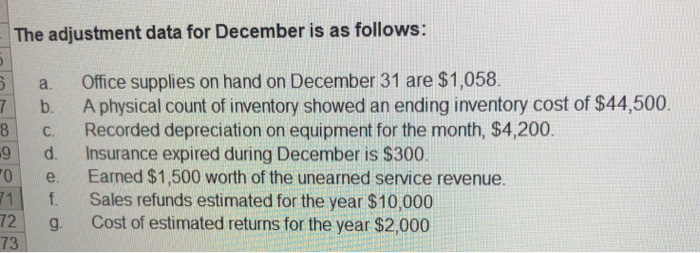

i understand how to do the journal, but i need help with the adjustment data and where to add it.

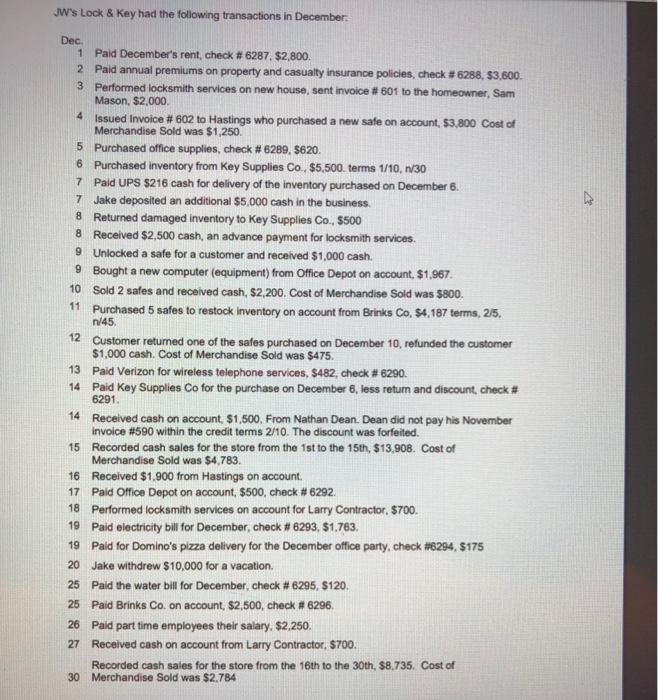

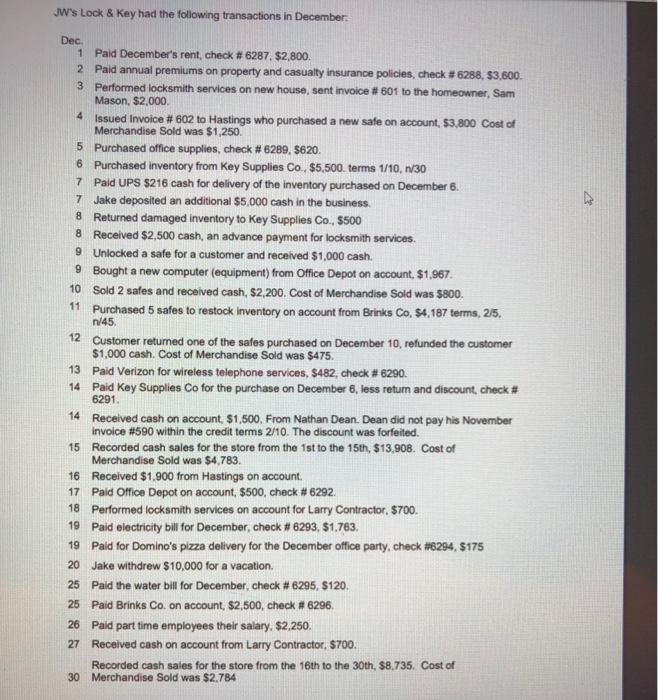

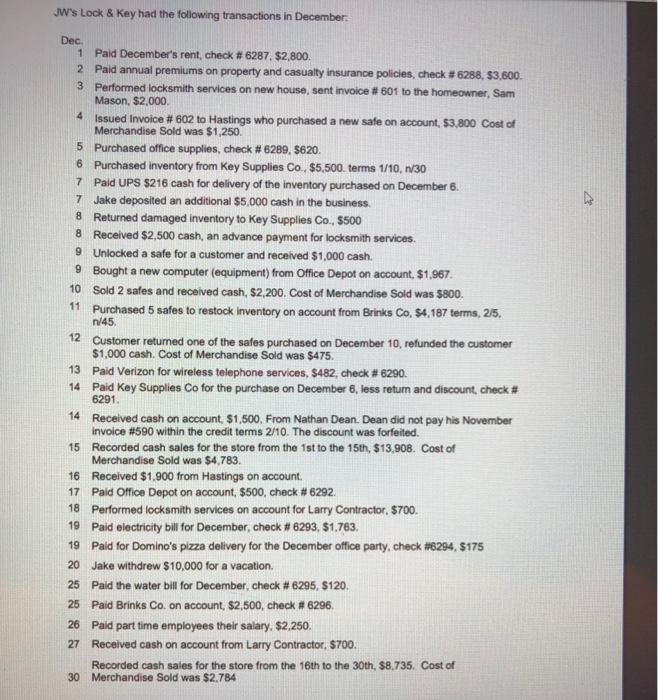

JW's Lock & Key had the following transactions in December: 4 Dec. 1 Paid December's rent, check # 6287. $2,800 2 Paid annual premiums on property and casualty insurance policies, check #6288, 53,600. 3 Performed locksmith services on new house, sent invoice #601 to the homeowner, Sam Mason, $2,000 Issued Invoice # 602 to Hastings who purchased a new safe on account, $3,800 Cost of Merchandise Sold was $1,250. 5 Purchased office supplies, check #6289, 5620. 6 Purchased inventory from Key Supplies Co., $5,500. terms 1/10, 1/30 7 Paid UPS $216 cash for delivery of the inventory purchased on December 6. 7 Jake deposited an additional $5,000 cash in the business. 8 Returned damaged inventory to Key Supplies Co., $500 8 Received $2,500 cash, an advance payment for locksmith services. 9 Unlocked a safe for a customer and received $1,000 cash. 9 Bought a new computer (equipment) from Office Depot on account, $1,967 10 Sold 2 safes and received cash, $2,200. Cost of Merchandise Sold was $800. 11 Purchased 5 safes to restock inventory on account from Brinks Co, S4,187 terms, 215, n/45 12 Customer returned one of the safes purchased on December 10, refunded the customer $1,000 cash. Cost of Merchandise Sold was $475. 13 Paid Verizon for wireless telephone services, $482, check # 6290. 14 Paid Key Supplies Co for the purchase on December 6, less return and discount, check # 6291. 14 Received cash on account, $1,500, From Nathan Dean. Dean did not pay his November invoice #590 within the credit terms 2/10. The discount was forfeited. 15 Recorded cash sales for the store from the 1st to the 15th, $13,908. Cost of Merchandise Sold was $4.783. 16 Received $1,900 from Hastings on account. 17 Paid Office Depot on account, $500, check # 6292. 18 Performed locksmith services on account for Larry Contractor. $700. 19 Paid electricity bill for December, check # 6293, S1,763. 19 Paid for Domino's pizza delivery for the December office party, check #6294, S175 20 Jake withdrew $10,000 for a vacation. 25 Paid the water bill for December, check # 6295, $120. 25 Paid Brinks Co. on account, $2,500, check # 6296. 26 Paid part time employees their salary, $2,250, 27 Received cash on account from Larry Contractor, $700. Recorded cash sales for the store from the 16th to the 30th, $8,735. Cost of 30 Merchandise Sold was $2,784 The adjustment data for December is as follows: 5 a. b. 7 8 C. d. Office supplies on hand on December 31 are $1,058. A physical count of inventory showed an ending inventory cost of $44,500 Recorded depreciation on equipment for the month, $4,200. Insurance expired during December is $300. Earned $1,500 worth of the unearned service revenue. Sales refunds estimated for the year $10,000 Cost of estimated returns for the year $2,000 e. f. FO 71 72 73 g. General Journal Accounts & Explanations PAGE 37 CREDIT DATE PR DEBIT JW's Lock & Key had the following transactions in December: 4 Dec. 1 Paid December's rent, check # 6287. $2,800 2 Paid annual premiums on property and casualty insurance policies, check #6288, 53,600. 3 Performed locksmith services on new house, sent invoice #601 to the homeowner, Sam Mason, $2,000 Issued Invoice # 602 to Hastings who purchased a new safe on account, $3,800 Cost of Merchandise Sold was $1,250. 5 Purchased office supplies, check #6289, 5620. 6 Purchased inventory from Key Supplies Co., $5,500. terms 1/10, 1/30 7 Paid UPS $216 cash for delivery of the inventory purchased on December 6. 7 Jake deposited an additional $5,000 cash in the business. 8 Returned damaged inventory to Key Supplies Co., $500 8 Received $2,500 cash, an advance payment for locksmith services. 9 Unlocked a safe for a customer and received $1,000 cash. 9 Bought a new computer (equipment) from Office Depot on account, $1,967 10 Sold 2 safes and received cash, $2,200. Cost of Merchandise Sold was $800. 11 Purchased 5 safes to restock inventory on account from Brinks Co, S4,187 terms, 215, n/45 12 Customer returned one of the safes purchased on December 10, refunded the customer $1,000 cash. Cost of Merchandise Sold was $475. 13 Paid Verizon for wireless telephone services, $482, check # 6290. 14 Paid Key Supplies Co for the purchase on December 6, less return and discount, check # 6291. 14 Received cash on account, $1,500, From Nathan Dean. Dean did not pay his November invoice #590 within the credit terms 2/10. The discount was forfeited. 15 Recorded cash sales for the store from the 1st to the 15th, $13,908. Cost of Merchandise Sold was $4.783. 16 Received $1,900 from Hastings on account. 17 Paid Office Depot on account, $500, check # 6292. 18 Performed locksmith services on account for Larry Contractor. $700. 19 Paid electricity bill for December, check # 6293, S1,763. 19 Paid for Domino's pizza delivery for the December office party, check #6294, S175 20 Jake withdrew $10,000 for a vacation. 25 Paid the water bill for December, check # 6295, $120. 25 Paid Brinks Co. on account, $2,500, check # 6296. 26 Paid part time employees their salary, $2,250, 27 Received cash on account from Larry Contractor, $700. Recorded cash sales for the store from the 16th to the 30th, $8,735. Cost of 30 Merchandise Sold was $2,784 The adjustment data for December is as follows: 5 a. b. 7 8 C. d. Office supplies on hand on December 31 are $1,058. A physical count of inventory showed an ending inventory cost of $44,500 Recorded depreciation on equipment for the month, $4,200. Insurance expired during December is $300. Earned $1,500 worth of the unearned service revenue. Sales refunds estimated for the year $10,000 Cost of estimated returns for the year $2,000 e. f. FO 71 72 73 g. General Journal Accounts & Explanations PAGE 37 CREDIT DATE PR DEBIT