Answered step by step

Verified Expert Solution

Question

1 Approved Answer

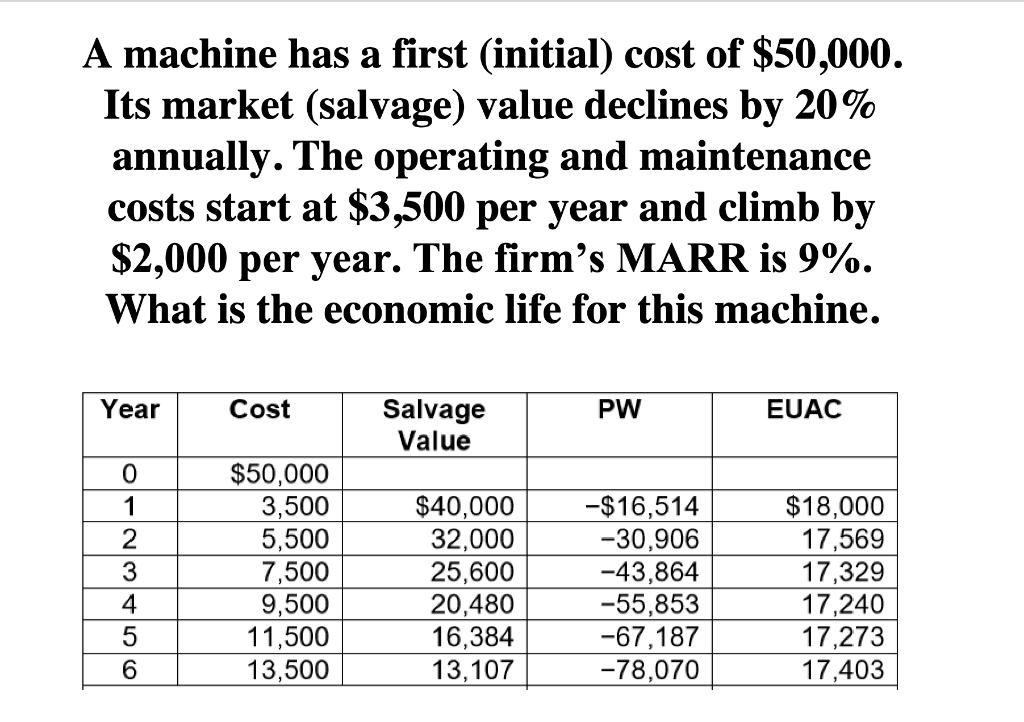

I understand that the answer to this question is 4 years because that's when the EUAC is at its lowest. I am wondering how to

I understand that the answer to this question is 4 years because that's when the EUAC is at its lowest. I am wondering how to calculate PW and EUAC by hand using equations without Excel. Don't need to do all of them just one example to get me started would be great thanks!

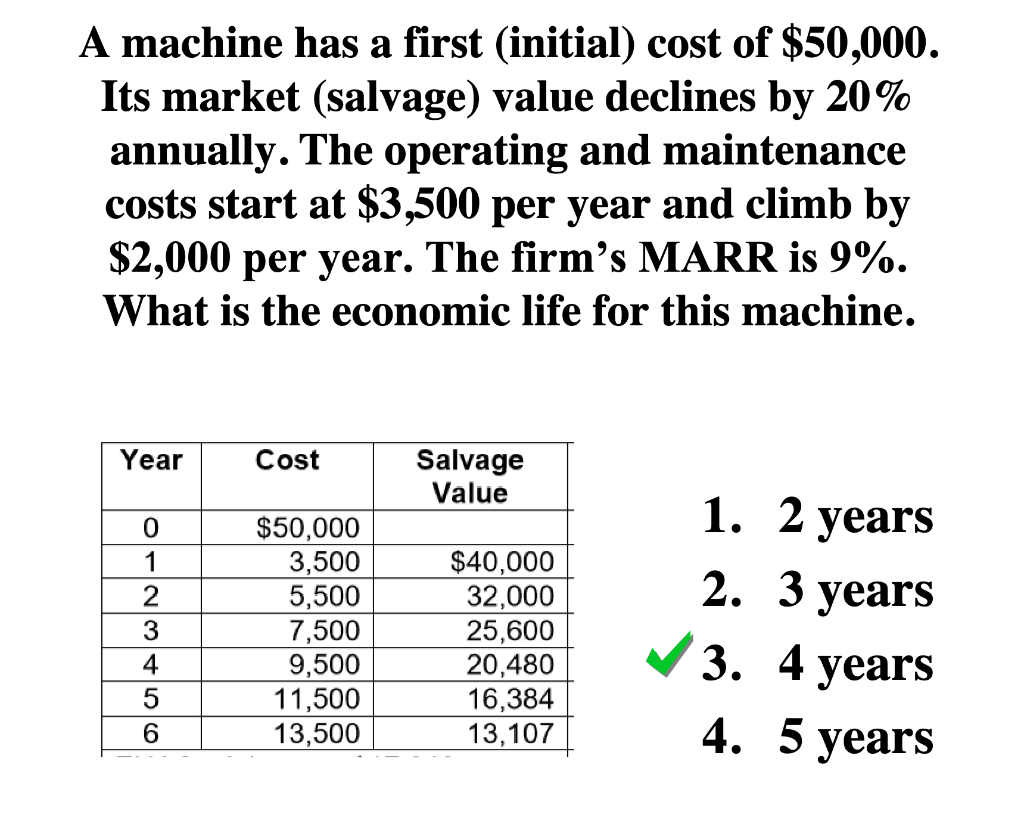

A machine has a first (initial) cost of $50,000. Its market (salvage) value declines by 20% annually. The operating and maintenance costs start at $3,500 per year and climb by \$2,000 per year. The firm's MARR is 9\%. What is the economic life for this machine. 1. 2 years 2. 3 years 3. 4 years 4. 5 years A machine has a first (initial) cost of $50,000. Its market (salvage) value declines by 20% annually. The operating and maintenance costs start at $3,500 per year and climb by \$2,000 per year. The firm's MARR is 9%. What is the economic life for this machine. A machine has a first (initial) cost of $50,000. Its market (salvage) value declines by 20% annually. The operating and maintenance costs start at $3,500 per year and climb by \$2,000 per year. The firm's MARR is 9\%. What is the economic life for this machine. 1. 2 years 2. 3 years 3. 4 years 4. 5 years A machine has a first (initial) cost of $50,000. Its market (salvage) value declines by 20% annually. The operating and maintenance costs start at $3,500 per year and climb by \$2,000 per year. The firm's MARR is 9%. What is the economic life for this machineStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started