Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(i) Using the observed growth rate on DPS, determine the expected share price for Company B on 31 December 2021. (ii) Using the new dividend

(i) Using the observed growth rate on DPS, determine the expected share price for Company B on 31 December 2021.

(ii) Using the new dividend policy proposed by the finance director, determine the expected share price for Company B on 31 December 2021.

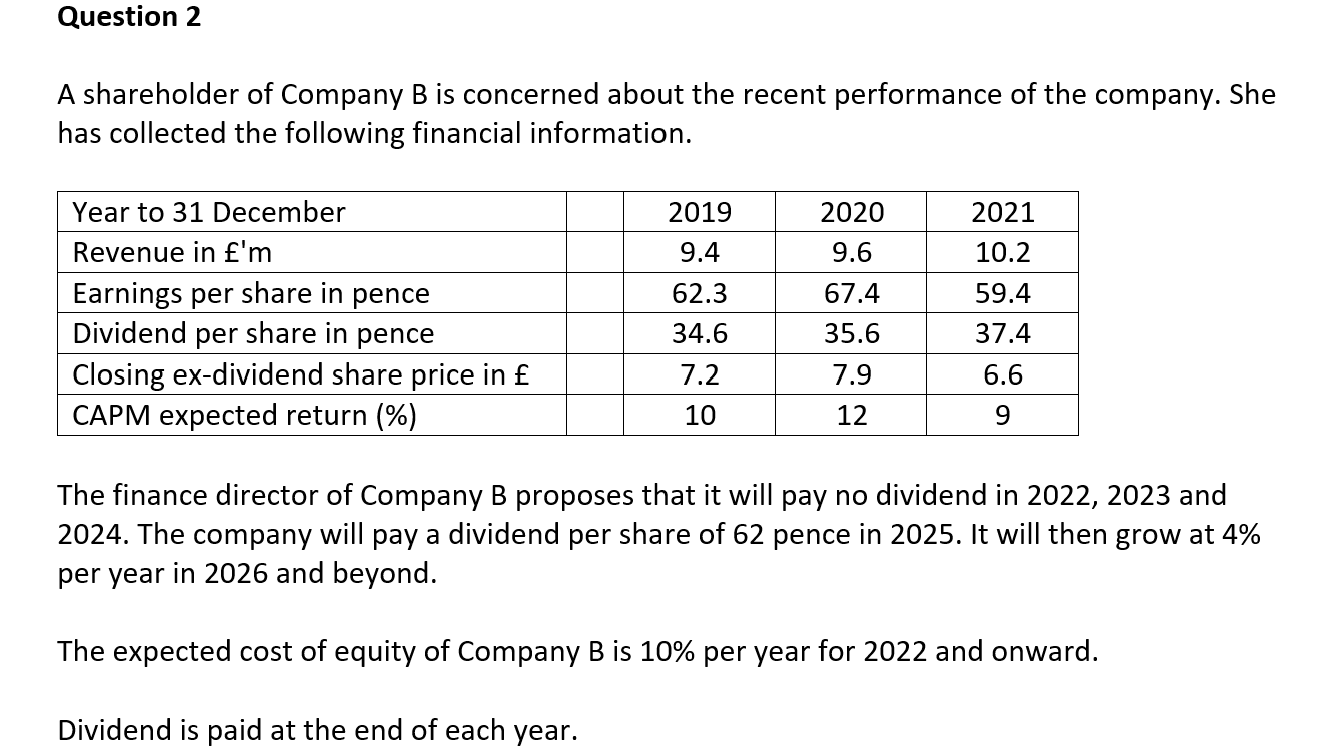

Question 2 A shareholder of Company B is concerned about the recent performance of the company. She has collected the following financial information. 2019 2020 2021 9.4 9.6 10.2 62.3 59.4 Year to 31 December Revenue in 'm Earnings per share in pence Dividend per share in pence Closing ex-dividend share price in CAPM expected return (%) 34.6 67.4 35.6 7.9 37.4 7.2 6.6 10 12 9 The finance director of Company B proposes that it will pay no dividend in 2022, 2023 and 2024. The company will pay a dividend per share of 62 pence in 2025. It will then grow at 4% per year in 2026 and beyond. The expected cost of equity of Company B is 10% per year for 2022 and onward. Dividend is paid at the end of each year. Question 2 A shareholder of Company B is concerned about the recent performance of the company. She has collected the following financial information. 2019 2020 2021 9.4 9.6 10.2 62.3 59.4 Year to 31 December Revenue in 'm Earnings per share in pence Dividend per share in pence Closing ex-dividend share price in CAPM expected return (%) 34.6 67.4 35.6 7.9 37.4 7.2 6.6 10 12 9 The finance director of Company B proposes that it will pay no dividend in 2022, 2023 and 2024. The company will pay a dividend per share of 62 pence in 2025. It will then grow at 4% per year in 2026 and beyond. The expected cost of equity of Company B is 10% per year for 2022 and onward. Dividend is paid at the end of each yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started