Question

I vote a thumbs up and comment! Please fill out the sheet I posted pictures of, thank you! [my last question was answered incorrectly by

I vote a thumbs up and comment! Please fill out the sheet I posted pictures of, thank you! [my last question was answered incorrectly by someone who copy and pasted an answer that was posted by a different "expert" for a question different from mine, please do not do the same]

DATA: The East Division of Kensic Company manufactures a vital component that is used in one of Kensics major product lines. The East Division has been experiencing some difficulty in coordinating activities between its various departments, which has resulted in some shortages of the component at critical times. To overcome the shortages, the manager of East Division has decided to initiate a monthly budgeting system that is integrated between departments.

The first budget is to be for the second quarter of the current year (April, May and June). To assist in developing the budget figures, the divisional controller has accumulated the following information.

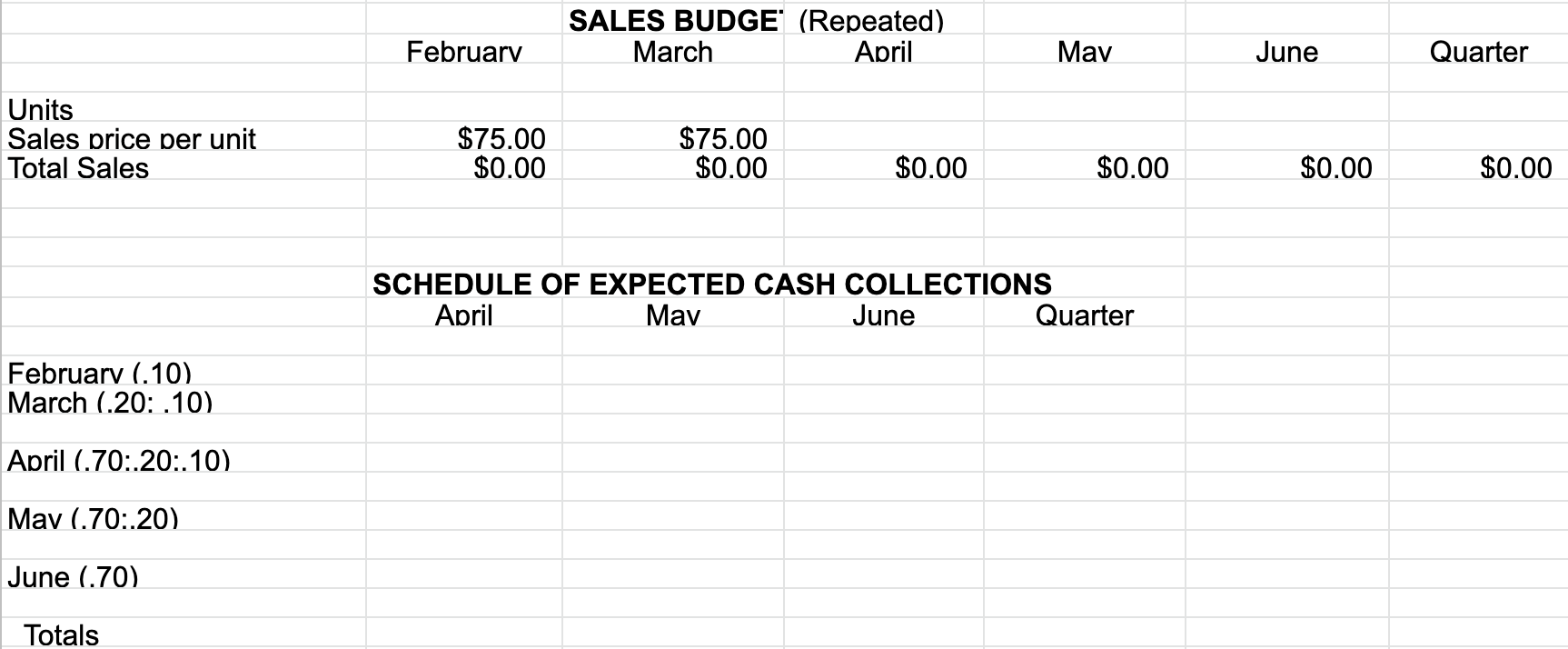

Sales: Sales through the first three months of the current year were 30,000 units. Actual sales in units for January, February, and March, and planned sales in units over the next five months, are given below:

January (actual) 6,000

February (actual) 10,000

March (actual) 14,000

April (planned) 20,000

May (planned) 34,000

June (planned) 51,000

July (planned) 45,000

August (planned) 30,000

In total, the East Division expects to produce and sell 250,000 units during the current year.

Direct Material: Two different materials are used in production of the component. Data regarding these materials are given below:

Material 208:

Materials per Finished Component: 4 pounds

Cost per pound: $5.00

Inventory at March 13: 46,000 pounds

Material 311:

Materials per Finished Component: 9 feet

Cost per foot: $2.00

Inventory at March 31: 69,000 feet

Material No. 208 is sometimes in short supply. Therefore, the East Division requires that enough of the material be on hand at the end of each month to provide for 50% of the following months production needs. Material No. 311 is easier to get, so only one-third of the following months production needs must be on hand at the end of each month.

Direct Labor: The East Division has three department through which the components must past before they are completed. Information relating to direct labor in these departments is given below:

Department: Shaping

Direct Labor Hours per Finished Component: .25

Cost per Direct Labor Hour: $18.00

Department: Assembly

Direct Labor Hours per Finished Component: .70

Cost per Direct Labor Hour: $16.00

Department: Finishing

Direct Labor Hours per Finished Component: .10

Cost per Direct Labor Hour: $20.00

Direct labor is adjusted to the workload each month.

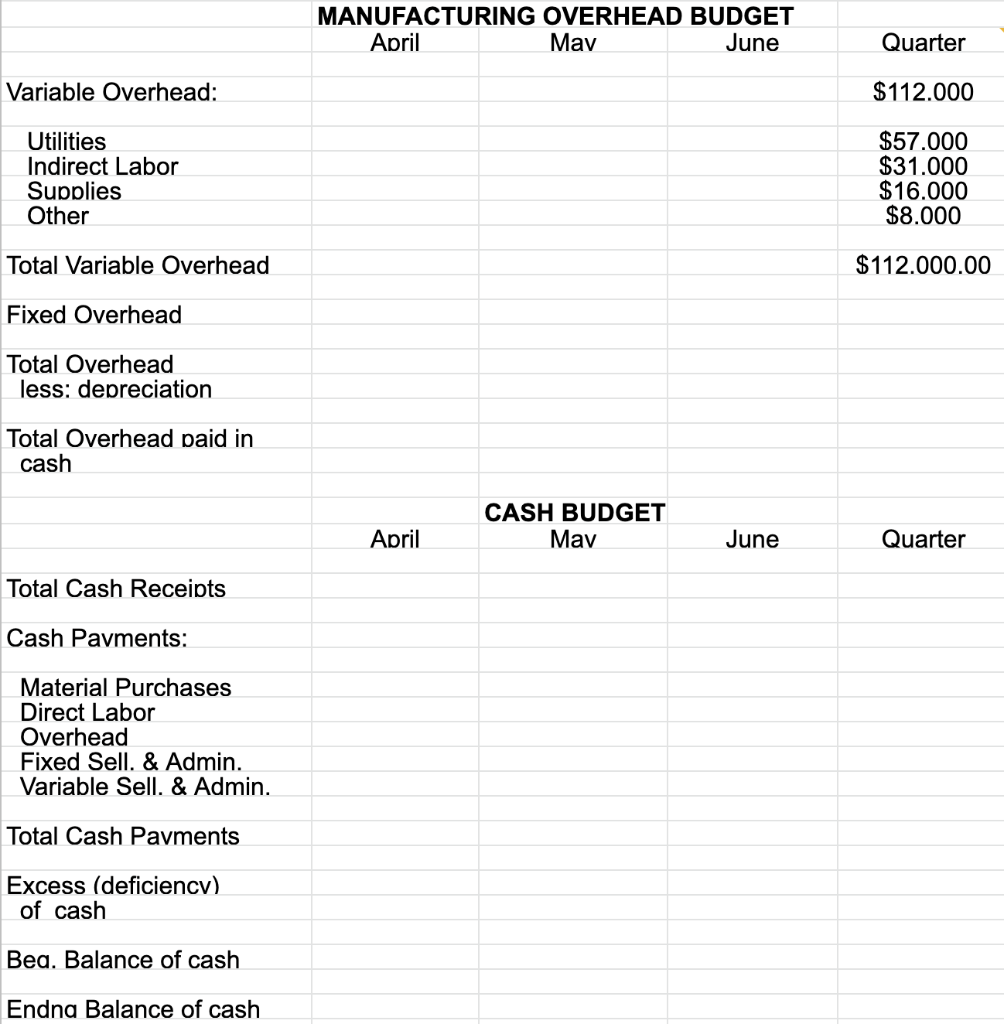

Manufacturing Overhead: East Division manufactured 32,000 components during the first three months of the current year. The actual variable overhead costs incurred during this three-month period are shown below. Each Divisions controller believes that the variable overhead costs incurred during the last nine months of the year will be at the same rate per component as experienced during the first three months.

Utilities $57,000

Indirect Labor $31,000

Supplies $16,000

Other $8,000

Total variable overhead $112,000

The East Division has planned fixed manufacturing overhead costs for the entire year as follows:

Supervision $872,000

Property Taxes $143,000

Depreciation $2,910,000

Insurance $631,000

Other $72,000

Total fixed manufacturing Overhead $4,628,000

Finished Goods Inventory: The desired monthly ending inventory of completed components is 20% of the next months estimated sales. The East Division has 4,000 units in the finished goods inventory on March 31.

Selling and Administrative Expenses: Selling and Administrative Expenses are budgeted at $400,000 per month plus 1% of total credit sales for the month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started