Answered step by step

Verified Expert Solution

Question

1 Approved Answer

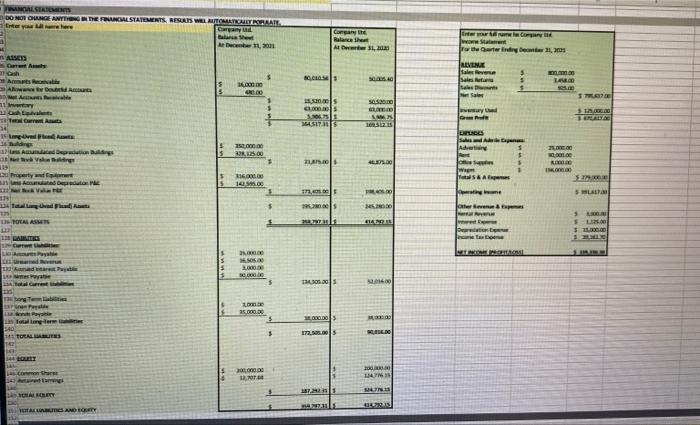

i want all fixed asset turnover ratio and current ratio and times interest earned and in second image i give the balance sheet so you

i want all fixed asset turnover ratio and current ratio and times interest earned and in second image i give the balance sheet so you can knows the values

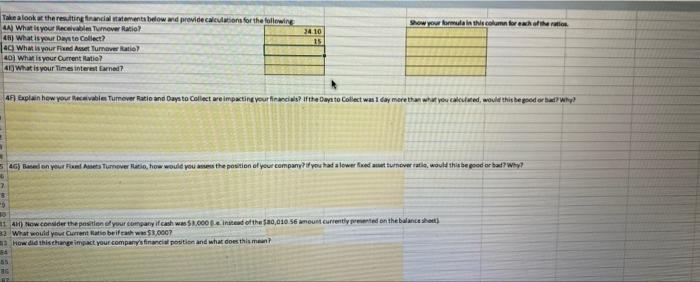

Take a look at the resulting financial statements below and provide calculations for the following 4A) What is your Receivable Turnover Ratio? Show your formula in this column for each of the ration 48) What is your Days to Collect? 24.10 15 4C) What is your Fixed Asset Turnover Ratio 40) What is your Current Ratio? 41) What is your Times interest Earned? 4F) Explain how your Receivables Tumover Ratio and Days to Collect are impacting your financials? If the Days to Collect was 1 day more than what you calculated, would this be good or bad? Why? 546) Based on your Fixed Assets Turnover Ratio, how would you assess the position of your company? if you had a lower fixed asset turnover ratio, would this be good or bad? Why? 7 8 -9 10 14H) Now consider the position of your company if cash was $1,000 instead of the $80,010 56 amount currently presented on the balance sheet) 32 What would your Current Ratio beifcash was $3,0007 How did this change impact your company's financial position and what does this mean? 84 65 12 FANGAL STATEMENTS DO NOT CHANGE ANYTHING IN THE FINANCIAL STATEMENTS, RESULTS WELL AUTOMATICALLY PORATE your Alle here Enter Carany d talasa Sheet At December 31, 201 ASSES Current Asses Cash Amarts Recati 16,000.00 48.00 Allowance the DA Ale y 12 Cha Total Care As SPOM 24 15 Long-Oved As 17 Aadated praction Buldings k Vake 20 Property and pent 123s Accurated Val 124 Total Long Uvd TOTAL ASSETS in LABLITES prete Las Payable Led Reve 132 Amed ar Les Payab 134 total Current b 134 bong Tamabilition Le Paya La Total Long-term r 14 TOTAL BITES 144 CRY as common-Shar 543 aming TOALETY TOTAL UNITIES AND EQUITY en SEI - 150,000.00 328125.00 314,000.00 142.595.00 21,000.00 16,505.00 1.000.00 30.000 de 1,000.00 15,000.00 300,000.00 13,707.00 $ 5 $ T $ Company the Ralance Sheat At 31, 2020 5000540 50,530.00 6300000 LANS 109.312.35 40.375.00 40.00 246,290.00 RIANDIS 5401600 M 800034 15,530.00 $ 1,000.00 364,517.31 2150 173,000 52000$ 32731 134,300.00 31.000.00 172,505.00$ 38724 427-31 002126 200.000.00 124761 SATS SERDYD Enter your full name Com www Statement For the Quarter Ending Decanter 21, 200 REVENUE 3 Sales Revenue Sales Reta Sales Sale away ad Prof OPGES Sabes Adverti Expe ques Wag Total S&A Exper pinge Other Revenue & Exp Exp Deprecation Expe e Tax Expone MET PCOME PRONA MUNG wandan LORD 25,000.00 2001.00 800.00 INOL STRAX E $12,000.00 SAPEALTO BOXE S SLALO $1.00 125.00 $ 15,000.00 S MALM WHEREF Take a look at the resulting financial statements below and provide calculations for the following 4A) What is your Receivable Turnover Ratio? Show your formula in this column for each of the ration 48) What is your Days to Collect? 24.10 15 4C) What is your Fixed Asset Turnover Ratio 40) What is your Current Ratio? 41) What is your Times interest Earned? 4F) Explain how your Receivables Tumover Ratio and Days to Collect are impacting your financials? If the Days to Collect was 1 day more than what you calculated, would this be good or bad? Why? 546) Based on your Fixed Assets Turnover Ratio, how would you assess the position of your company? if you had a lower fixed asset turnover ratio, would this be good or bad? Why? 7 8 -9 10 14H) Now consider the position of your company if cash was $1,000 instead of the $80,010 56 amount currently presented on the balance sheet) 32 What would your Current Ratio beifcash was $3,0007 How did this change impact your company's financial position and what does this mean? 84 65 12 FANGAL STATEMENTS DO NOT CHANGE ANYTHING IN THE FINANCIAL STATEMENTS, RESULTS WELL AUTOMATICALLY PORATE your Alle here Enter Carany d talasa Sheet At December 31, 201 ASSES Current Asses Cash Amarts Recati 16,000.00 48.00 Allowance the DA Ale y 12 Cha Total Care As SPOM 24 15 Long-Oved As 17 Aadated praction Buldings k Vake 20 Property and pent 123s Accurated Val 124 Total Long Uvd TOTAL ASSETS in LABLITES prete Las Payable Led Reve 132 Amed ar Les Payab 134 total Current b 134 bong Tamabilition Le Paya La Total Long-term r 14 TOTAL BITES 144 CRY as common-Shar 543 aming TOALETY TOTAL UNITIES AND EQUITY en SEI - 150,000.00 328125.00 314,000.00 142.595.00 21,000.00 16,505.00 1.000.00 30.000 de 1,000.00 15,000.00 300,000.00 13,707.00 $ 5 $ T $ Company the Ralance Sheat At 31, 2020 5000540 50,530.00 6300000 LANS 109.312.35 40.375.00 40.00 246,290.00 RIANDIS 5401600 M 800034 15,530.00 $ 1,000.00 364,517.31 2150 173,000 52000$ 32731 134,300.00 31.000.00 172,505.00$ 38724 427-31 002126 200.000.00 124761 SATS SERDYD Enter your full name Com www Statement For the Quarter Ending Decanter 21, 200 REVENUE 3 Sales Revenue Sales Reta Sales Sale away ad Prof OPGES Sabes Adverti Expe ques Wag Total S&A Exper pinge Other Revenue & Exp Exp Deprecation Expe e Tax Expone MET PCOME PRONA MUNG wandan LORD 25,000.00 2001.00 800.00 INOL STRAX E $12,000.00 SAPEALTO BOXE S SLALO $1.00 125.00 $ 15,000.00 S MALM WHEREF Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started