I want full explanation on how to get these numbers( full calculation step by step) well written and organized

the answers attached are correct but I want to know how to get them

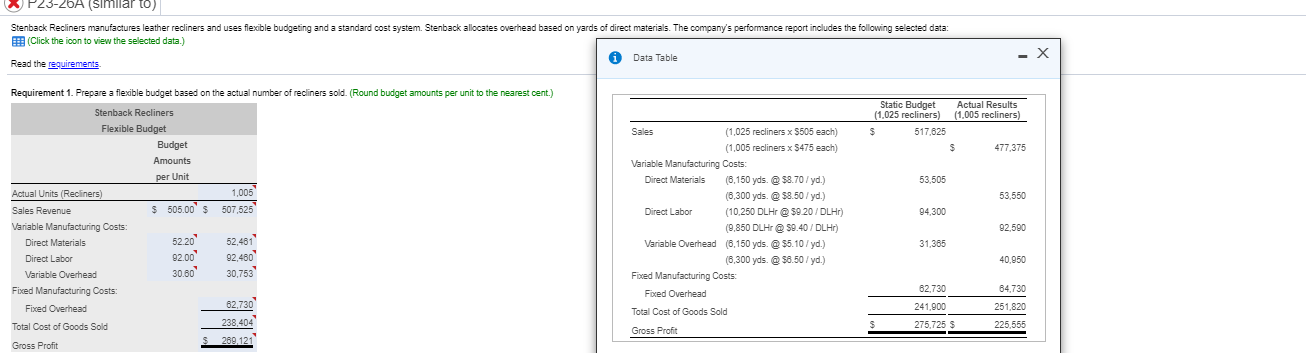

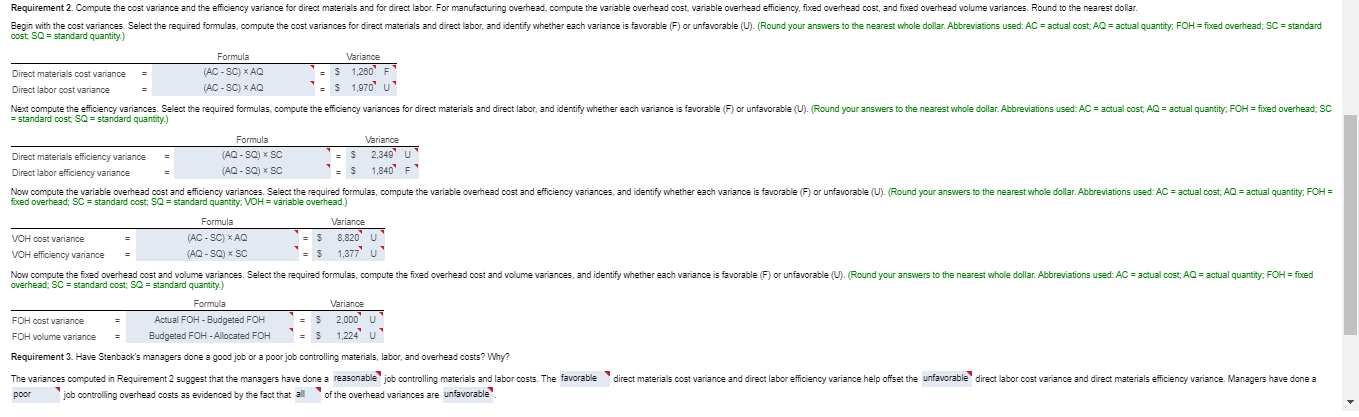

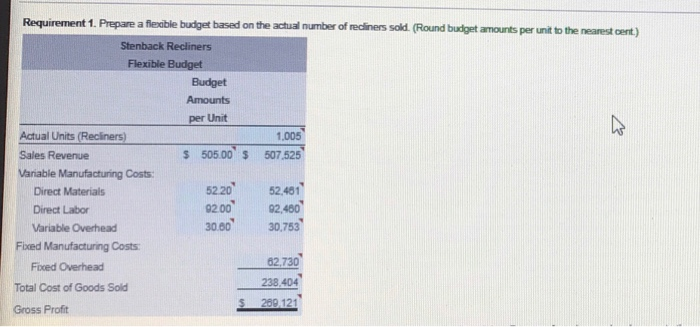

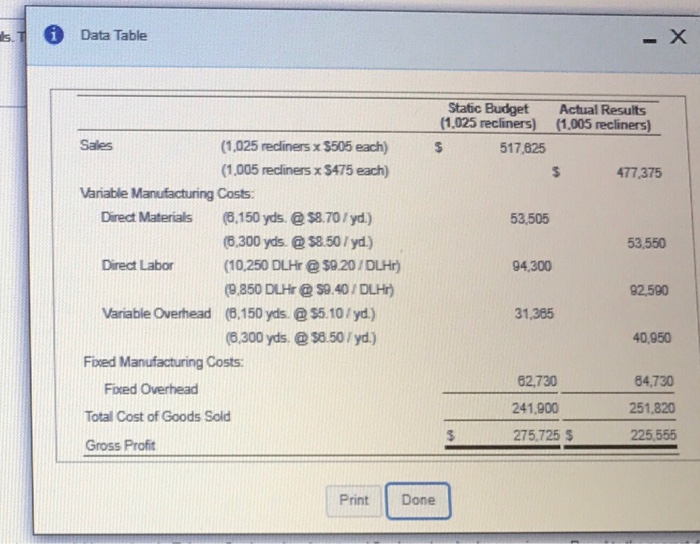

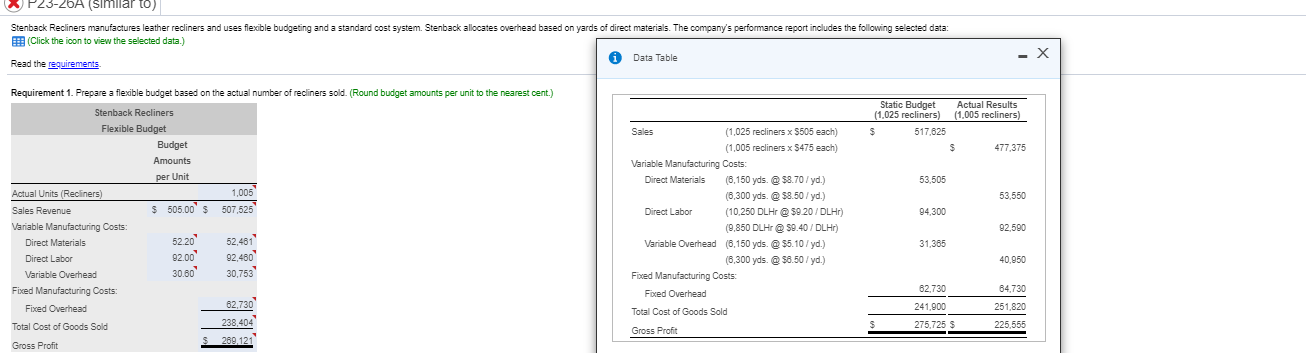

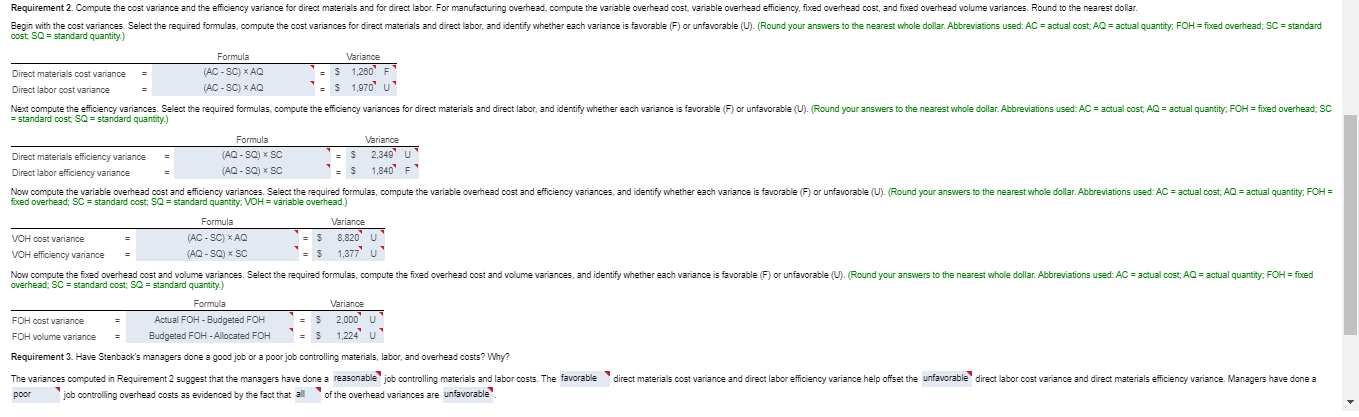

23-26A (similar to) Stenback Recliners manufactures leather recliners and uses flexible budgeting and a standard cost system. Stenback allocates overhead based on yards of direct materials. The company's performance report includes the following selected data: (Click the icon to view the selected data.) Data Table Read the requirements - X Static Budget (1.025 recliners) $ 517,625 Actual Results (1,005 recliners) $ 477,375 53,505 53,550 94,300 Requirement 1. Prepare a flexible budget based on the actual number of recliners sold. (Round budget amounts per unit to the nearest cent.) Stenback Recliners Flexible Budget Budget Amounts per Unit Actual Units (Recliners) 1,005 Sales Revenue $ 505.00 $ 507,525 Variable Manufacturing Costs: Direct Materials 52.20 Direct Labor 92.00 Variable Overhead 30.60 30,753 Fixed Manufacturing Costs: Fixed Overhead 62,730 Total Cost of Goods Sold 238,404 Gross Profit 269,121 Sales (1,025 recliners x 5505 each) (1,005 recliners x $475 each) Variable Manufacturing Costs: Direct Materials (6,150 yds @ $8.70 / yd.) (6,300 yds @ $8.50 / yd.) Direct Labor (10,250 DLHr $9.20 / DLHR) (9,850 DLH 59.40 / DLH) Variable Overhead (6.150 yds @ $5.10 / yd.) (6,300 yds $8.50 / yd.) Fixed Manufacturing Costs: Fixed Overhead Total Cost of Goods Sold 92,590 31,385 52.4819 92,480 40,950 84.730 62.730 241,000 275,725 $ 251,820 225,555 Gross Profit foed overhead: SC = standard cost: SQ = standard quantity VOHeat the required formulas, compute the variable overhead cost and efficiency variances, and identify whether each variance is favorable For unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost: A = actual quantity: FOH = Requirement 2. Compute the cost variance and the efficiency variance for direct materials and for direct labor. For manufacturing overhead, compute the variable overhead cost, variable overhead efficiency, fixed overhead cost, and fixed overhead volume variances. Round to the nearest dollar. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost: AQ = actual quantity: FOH = fixed overhead: SC - standard cost SQ = standard quantity.) Formula Variance Direct materials cost variance (AC-SC) XAQ = $ 1.260 F Direct labor cost variance (AC-SC) XAQ $ 1,970 Next compute the efficiency variances. Select the required formulas, compute the efficiency variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost, AQ = actual quantity: FOH = fixed overhead: SC = standard cost: SQ - standard quantity.) Formula Variance Direct materials efficiency variance (AQ - SQ)X SC $ 2,349 U Direct labor efficiency variance (AQ - SQ)X SC $ 1.840 F = $ Formula Variance VOH cost variance (AC-SC) X AQ = $ 8,820 V VOH efficiency variance (AQ - SQ) x SC 1,377' un Now compute the fixed overhead cost and volume variances. Select the required formulas, compute the fixed overhead cost and volume variances, and identify whether each variance is favorable (F) or unfavorable (U). (Round your answers to the nearest whole dollar. Abbreviations used: AC = actual cost: AQ = actual quantity: FOH = fixed overhead: SC = standard cost; SQ = standard quantity.) Formula Variance FOH cost variance Actual FOH - Budgeted FOH 2,000 FOH volume variance Budgeted FOH - Allocated FOH $ 1.224 u Requirement 3. Have Stenback's managers done a good job or a poor job controlling materials, labor, and overhead costs? Why? The variances computed in Requirement 2 suggest that the managers have done a reasonable job controlling materials and labor costs. The favorable poor job controlling overhead costs as evidenced by the fact that all of the overhead variances are unfavorable direct materials cost variance and direct labor efficiency variance help offset the unfavorable direct labor cost variance and direct materials efficiency variance Managers have done a Requirement 1. Prepare a flexible budget based on the actual number of rediners sold. (Round budget amounts per unit to the nearest cent) Stenback Recliners Flexible Budget Budget Amounts per Unit 1.005 507,525 $ 505.00 5 5220 Actual Units (Recliners) Sales Revenue Variable Manufacturing Costs: Direct Materials Direct Labor Variable Overhead Fixed Manufacturing Costs: Fixed Overhead 9200 52,481 92,480 30,753 30.00 62,730 238,404 Total Cost of Goods Sold 209 121 Gross Profit als. i Data Table -X Static Budget (1.025 recliners) $ 517,625 Actual Results (1,005 recliners) Sales 477,375 53,505 53,550 94,300 (1,025 recliners x $505 each) (1.005 recliners x $475 each) Variable Manufacturing Costs: Direct Materials (6.150 yds @ $8.70 / yd.) (6,300 yds @ $8.50 / yd.) Direct Labor (10,250 DLHY @59.20 / DLHr) (9,850 DLHr@59.40 / DLH) Variable Overhead (6.150 yds @ $5.10 / yd.) (6.300 yds @ $8.50 lyd.) Fixed Manufacturing Costs: Fixed Overhead Total Cost of Goods Sold Gross Profit 92,590 31,385 40,950 84,730 62,730 241.900 275.725 $ 251,820 225.555 $ Print Done