Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i want the answer for d and e Question 1 An equity analyst is valuing a listed company that is expected to generate EBIT from

i want the answer for d and e

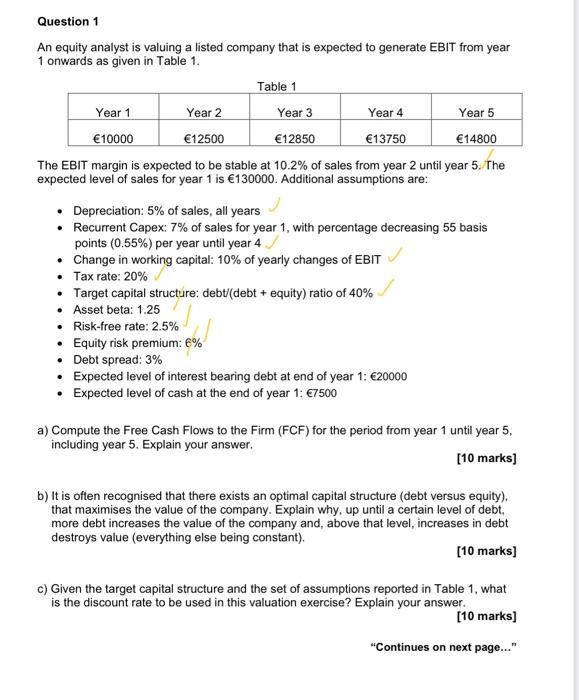

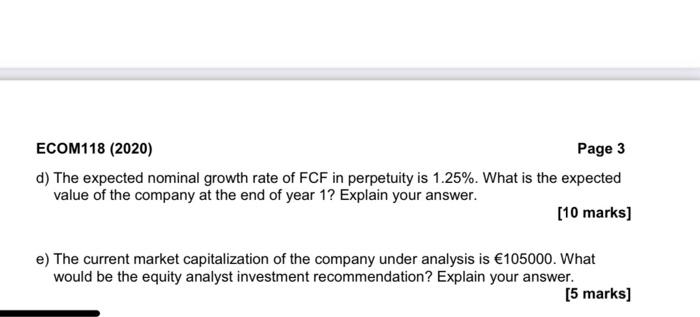

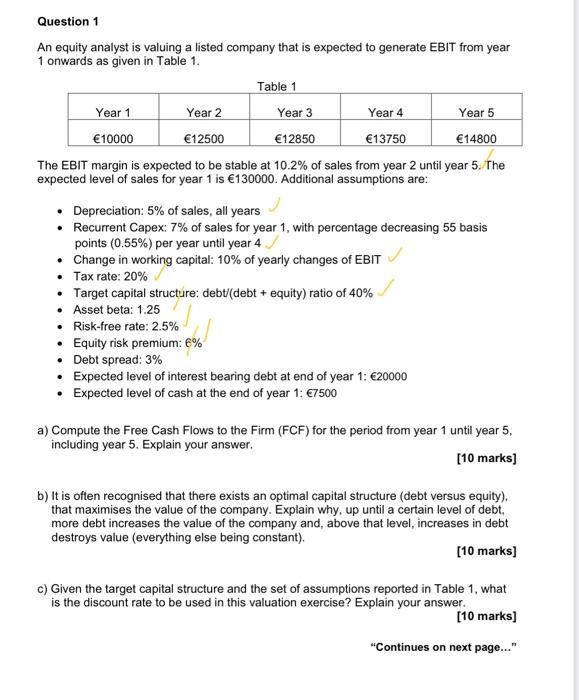

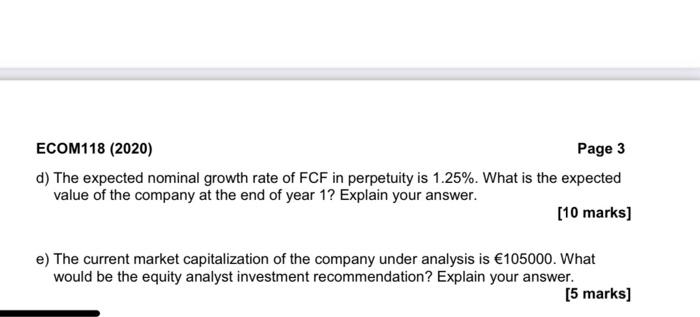

Question 1 An equity analyst is valuing a listed company that is expected to generate EBIT from year 1 onwards as given in Table 1. Table 1 Year 1 Year 2 Year 3 Year 4 Year 5 10000 12500 12850 13750 14800 The EBIT margin is expected to be stable at 10.2% of sales from year 2 until year 5. The expected level of sales for year 1 is 130000. Additional assumptions are: Depreciation: 5% of sales, all years Recurrent Capex: 7% of sales for year 1, with percentage decreasing 55 basis points (0.55%) per year until year 4 Change in working capital: 10% of yearly changes of EBIT Tax rate: 20% Target capital structure: debt (debt + equity) ratio of 40% Asset beta: 1.25 Risk-free rate: 2.5% Equity risk premium: 6% Debt spread: 3% Expected level of interest bearing debt at end of year 1: 20000 Expected level of cash at the end of year 1: 7500 a) Compute the Free Cash Flows to the Firm (FCF) for the period from year 1 until year 5, including year 5. Explain your answer. [10 marks] b) It is often recognised that there exists an optimal capital structure (debt versus equity), that maximises the value of the company. Explain why, up until a certain level of debt. more debt increases the value of the company and, above that level, increases in debt destroys value (everything else being constant). [10 marks) c) Given the target capital structure and the set of assumptions reported in Table 1, what is the discount rate to be used in this valuation exercise? Explain your answer. [10 marks) "Continues on next page..." ECOM118 (2020) Page 3 d) The expected nominal growth rate of FCF in perpetuity is 1.25%. What is the expected value of the company at the end of year 1? Explain your answer. (10 marks) e) The current market capitalization of the company under analysis is 105000. What would be the equity analyst investment recommendation? Explain your answer. [5 marks) ECOM118 (2020) Page 3 d) The expected nominal growth rate of FCF in perpetuity is 1.25%. What is the expected value of the company at the end of year 1? Explain your answer. (10 marks) e) The current market capitalization of the company under analysis is 105000. What would be the equity analyst investment recommendation? Explain your answer. [5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started