I WANT THE ANSWERS TO BE BASED ON STATEMENT OF FINANCIAL POSITION AND STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME. WHICH I ATTACHED AT BELOW. I DONT WANT COPY AND PASTE WORK. PLS THANK YOU. I'M POSTING THIS FOR THE 3RD TIME. PLS HELP ME

QUESTIONS

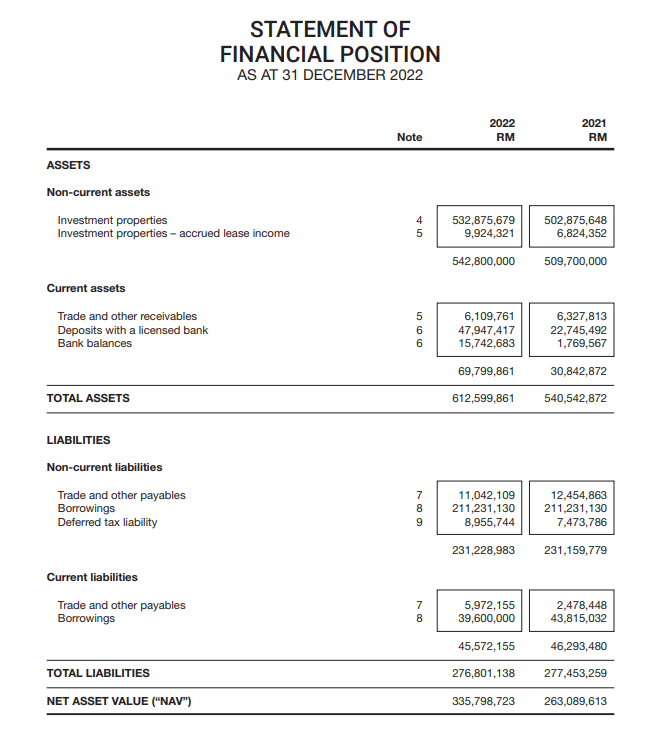

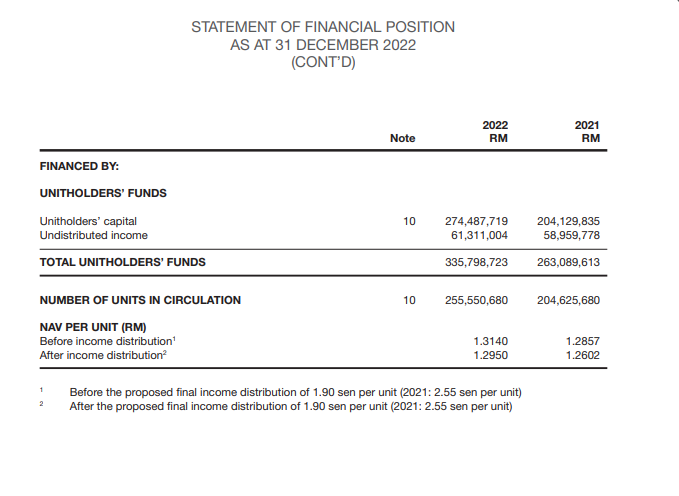

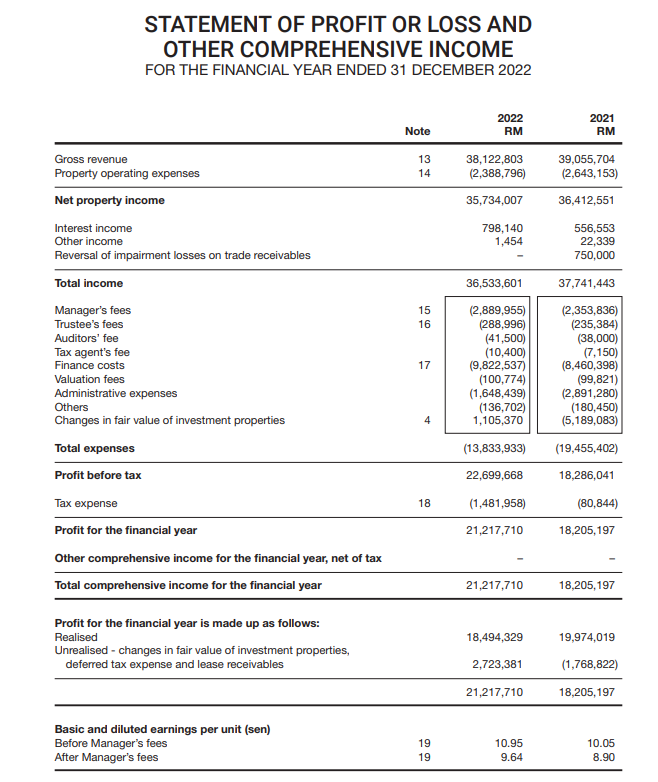

Based on Statement of Comprehensive Income and Statements of Financial Position, you need to calculate financial ratios (show your workings). Based on your calculation, interpret, and compare the performance for the year 2022 and the year 2021 based on the following categories of ratio:

| Liquidity: |

| i. Current ratio |

| ii. Quick ratio |

| Asset Management: |

| i. Inventory turnover |

| ii. Receivables turnover |

| iii. Total assets turnover |

| iv. Average collection period |

| Debt Management: |

| i. Total debt ratio |

| ii. Times interest earned ratio |

| Profitability: |

| i. Net profit margin |

| ii. Return on assets |

| iii. Return on equity |

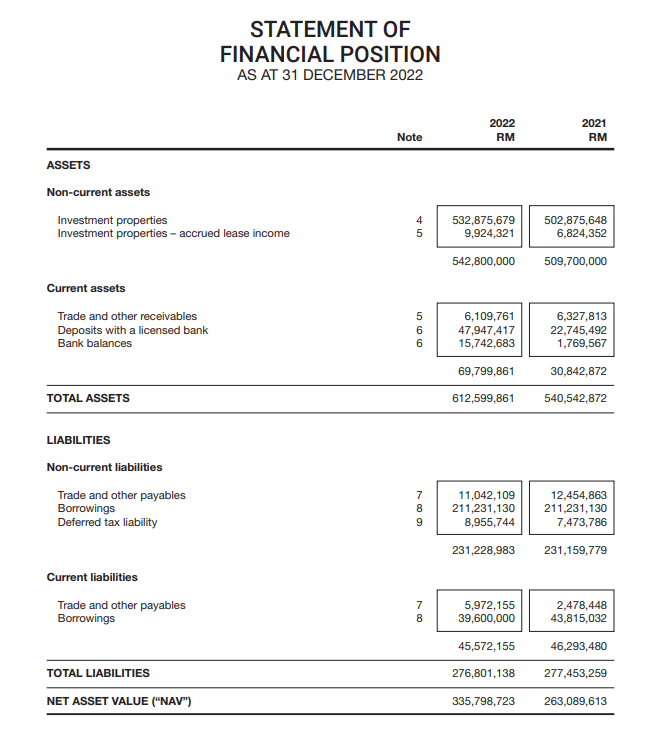

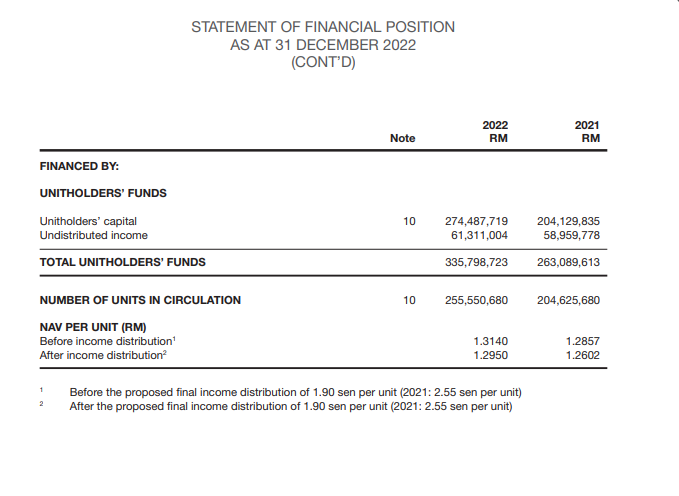

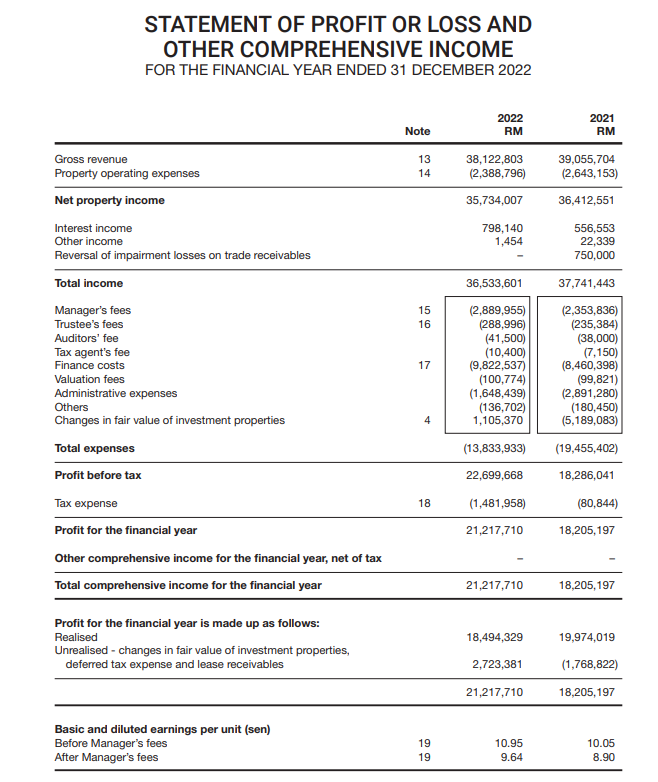

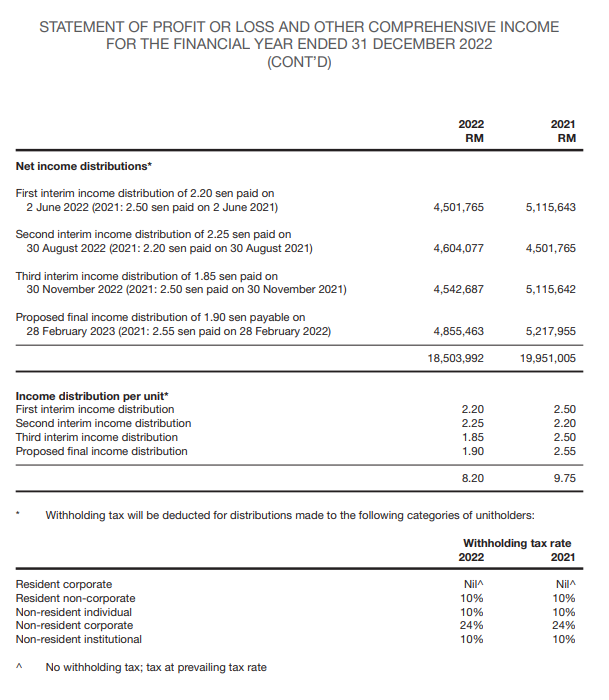

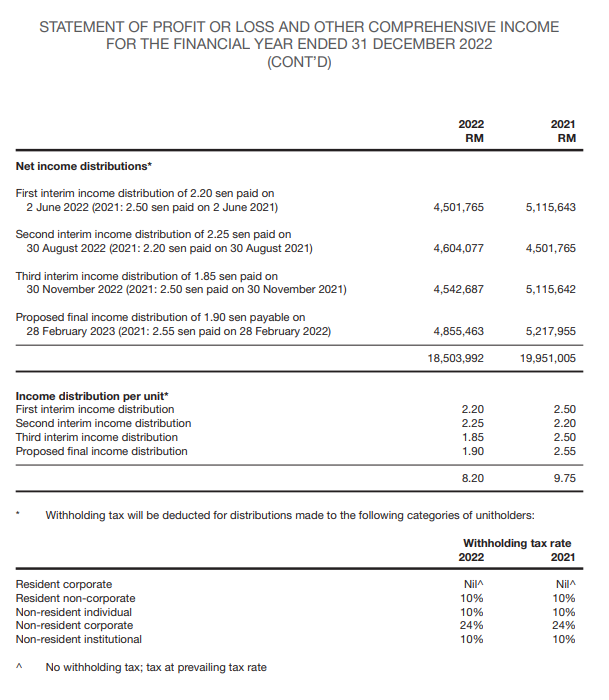

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 \begin{tabular}{rrrrr} & & 2022 & 2021 \\ & Note & RM & RM \\ \hline \end{tabular} ASSETS Non-current assets Investment properties Investment properties - accrued lease income Current assets LIABILITIES Non-current liabilities Trade and other payables Borrowings Deferred tax liability Current liabilities Trade and other payables Borrowings STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 (CONT'D) Before the proposed final income distribution of 1.90 sen per unit (2021: 2.55 sen per unit) After the proposed final income distribution of 1.90 sen per unit (2021: 2.55 sen per unit) STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 (CONT'D) 2022 ncome distribution per unit* First interim income distribution Second interim income distribution Third interim income distribution Proposed final income distribution \begin{tabular}{ll} 2.20 & 2.50 \\ 2.25 & 2.20 \\ 1.85 & 2.50 \\ 1.90 & 2.55 \\ \hline 8.20 & 9.75 \\ \hline \end{tabular} Withholding tax will be deducted for distributions made to the following categories of unitholders: STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 \begin{tabular}{rrrrr} & & 2022 & 2021 \\ & Note & RM & RM \\ \hline \end{tabular} ASSETS Non-current assets Investment properties Investment properties - accrued lease income Current assets LIABILITIES Non-current liabilities Trade and other payables Borrowings Deferred tax liability Current liabilities Trade and other payables Borrowings STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 (CONT'D) Before the proposed final income distribution of 1.90 sen per unit (2021: 2.55 sen per unit) After the proposed final income distribution of 1.90 sen per unit (2021: 2.55 sen per unit) STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2022 (CONT'D) 2022 ncome distribution per unit* First interim income distribution Second interim income distribution Third interim income distribution Proposed final income distribution \begin{tabular}{ll} 2.20 & 2.50 \\ 2.25 & 2.20 \\ 1.85 & 2.50 \\ 1.90 & 2.55 \\ \hline 8.20 & 9.75 \\ \hline \end{tabular} Withholding tax will be deducted for distributions made to the following categories of unitholders