Question

I want the solution in the same way and with the same names. QI - A company purchases a machine on 1 July 2006 at

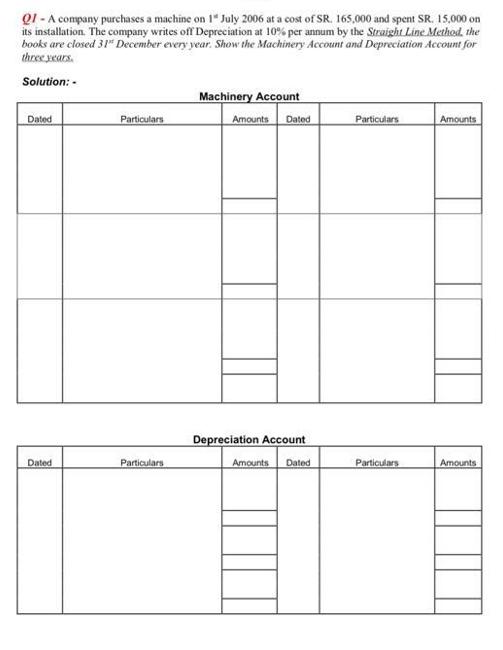

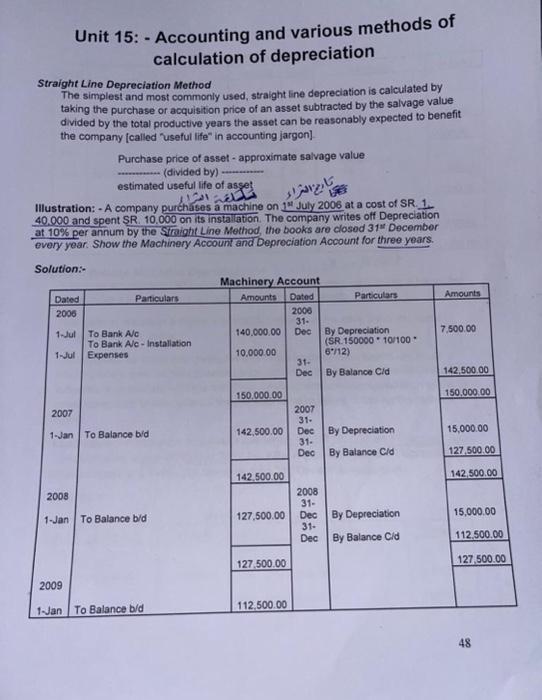

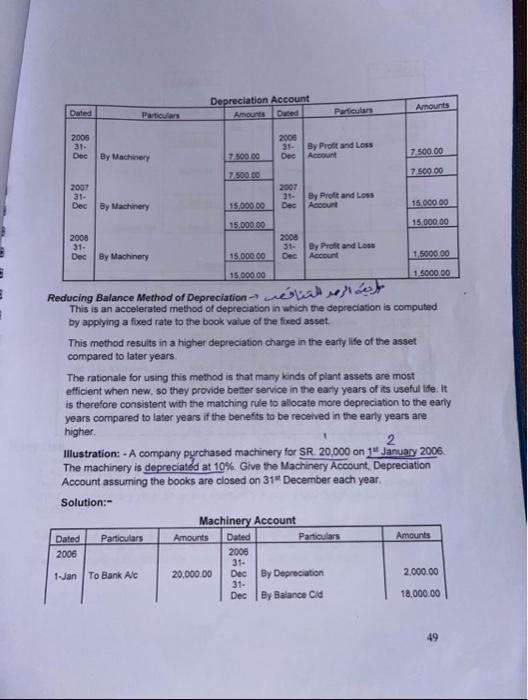

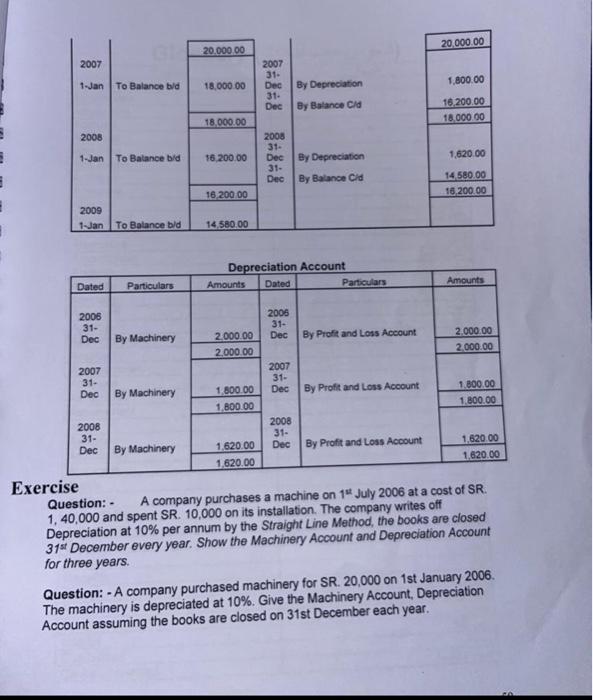

QI - A company purchases a machine on 1 July 2006 at a cost of SR. 165,000 and spent SR. 15,000 on its installation. The company writes off Depreciation at 10% per annum by the Straight Line Method, the books are closed 31 December every year. Show the Machinery Account and Depreciation Account for three years. Solution: Dated Dated Particulars Particulars Machinery Account Amounts Dated Depreciation Account Amounts Dated Particulars Particulars Amounts Amounts

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Reporting And Analysis

Authors: David Alexander, Ann Jorissen, Martin Hoogendoorn

8th Edition

978-1473766853, 1473766850

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App