Question: I want the solution to be absolutely correct Q 2 : A financial advisor has recommended two possible mutual funds for investment: Fund A and

I want the solution to be absolutely correct

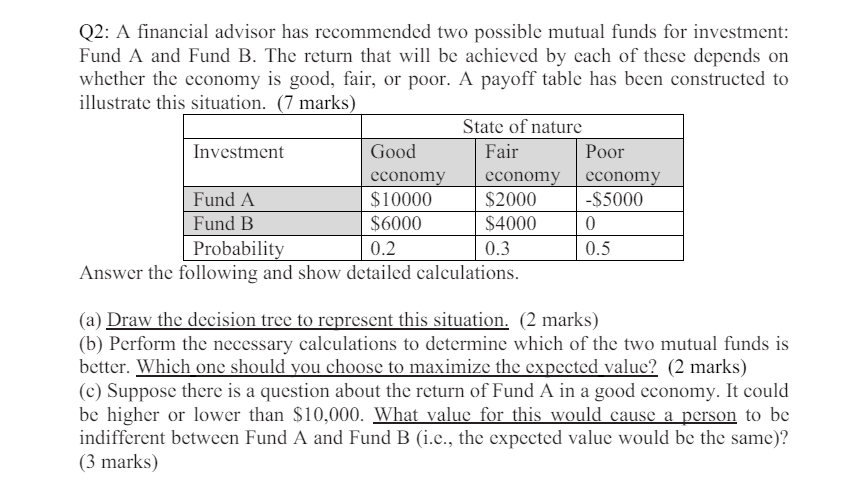

Q: A financial advisor has recommended two possible mutual funds for investment:

Fund A and Fund B The return that will be achieved by each of these depends on

whether the economy is good, fair, or poor. A payoff table has been constructed to

illustrate this situation. marks

Answer the following and show detailed calculations.

a Draw the decision tree to represent this situation. marks

b Perform the necessary calculations to determine which of the two mutual funds is

better. Which one should you choose to maximize the expected value? marks

c Suppose there is a question about the return of Fund A in a good economy. It could

be higher or lower than $ What value for this would cause a person to be

indifferent between Fund A and Fund B ie the expected value would be the same

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock