I want the solution to requirement 4 and the missing parts of requirement 3. Thank you

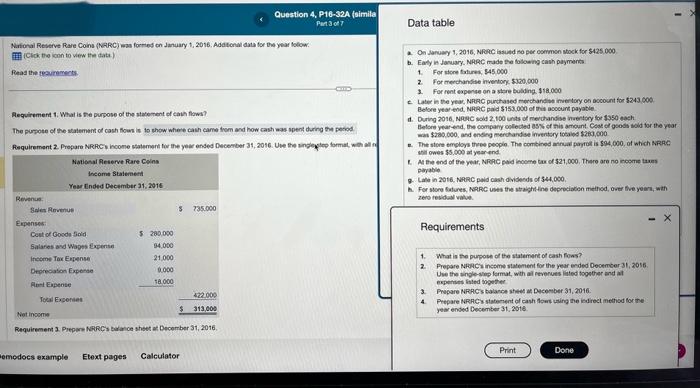

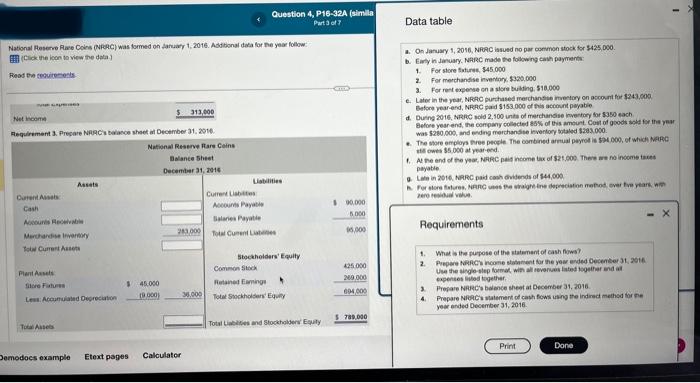

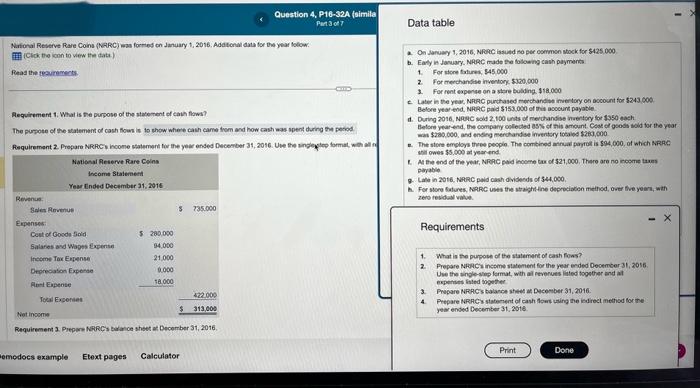

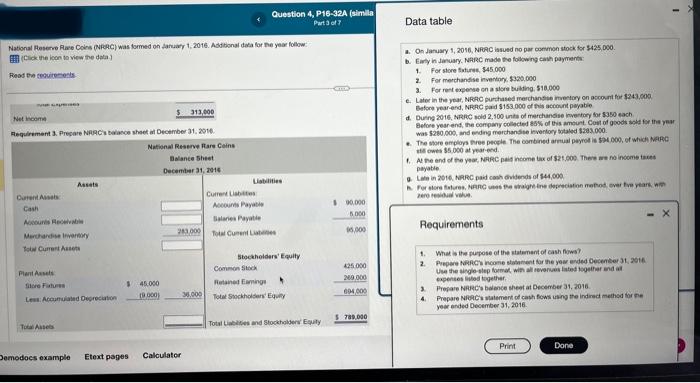

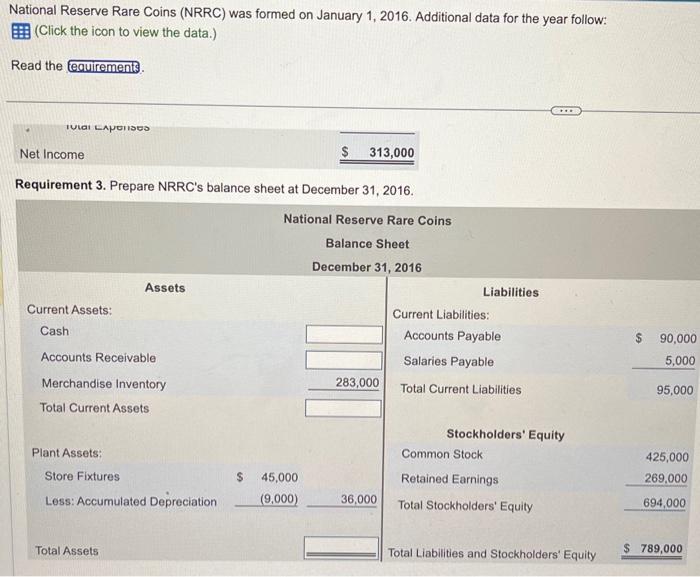

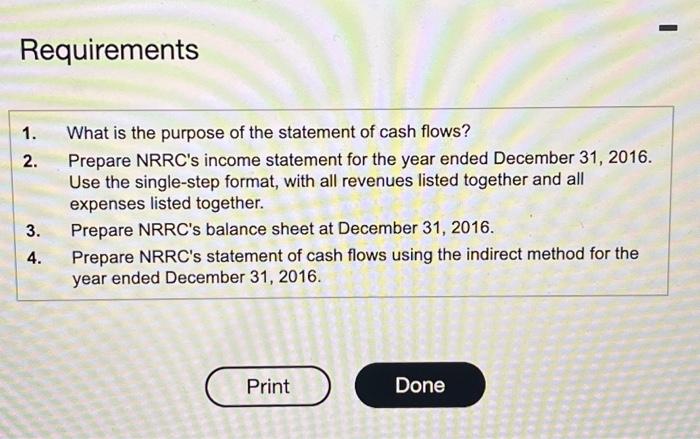

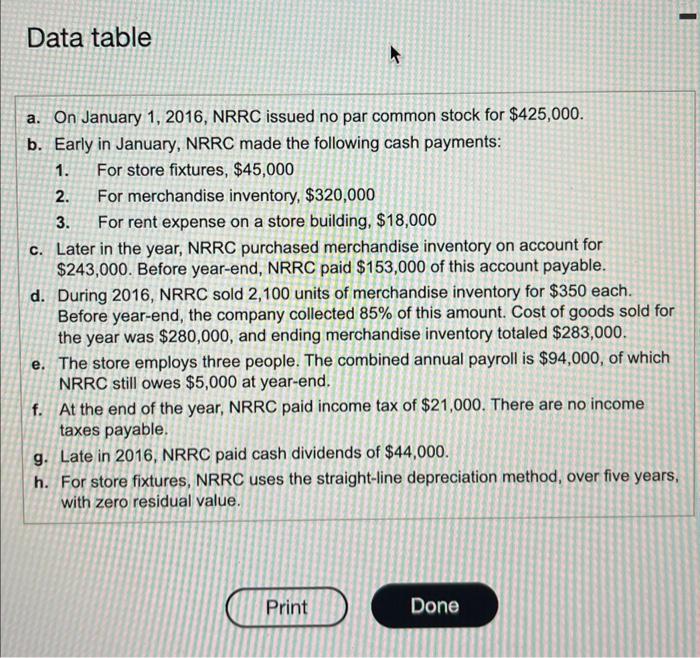

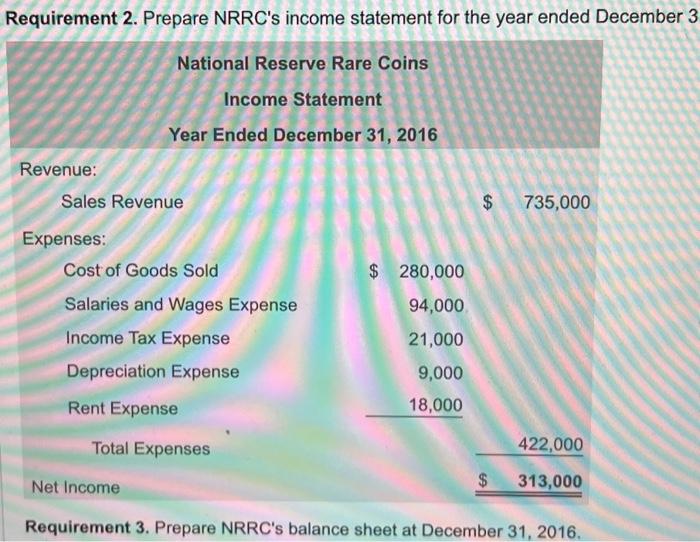

Nirtonal Reserve Rare Cons (NARC) wan forred on danuary 1, 2016. Adatonal data for twe year folow. (Cick the ionn to view the cata.) a. On danuary 1, 2016, NFotC issuatd so per common stock for \$125 ooo. Read the tyaurements. b. Eady is Javuary. NPRC made the toboung cash payments. 1. For sione fatures, 545000 2. For merchandse invertong sico,000 2. For rent experse on a stere bulding. 118.000 c. Late in the yeac. NPRC purthased mprohardise invertory oo docount foe $243. 906 . Belore yeat end. NHAC pard $153.000 of thit acocunt payatle. Aequirement 1. What is the purpose of the statenent of caih flows? The purpete of the statement of cash fous is to show where cash came trom and how cash was spent during the pecod. Requirement 2. Propare NRFUC s ncone statement for the year ensed Decomber 31, 2016. Une the singey weo format, with atl in d. During 2016, Nplec sold 2,160 unts of merchandise nuentory for 1350 each e. The store employs theee peopin. The combinpd atnual paryoli is 594,000 , of which ARAe sill owes is, 000 al yearend. 2. M bwe tnd of te year, NFPC paid inoome tar of 321,000, There are no roome tares payable 9. Lale in 20t6. NPRC paid oash d visende of $44,000. 9. For store Gatures, NaRe uses the straight Hine deoreciaben method, onte five yeard, wath zeno iesidal value. Requirements 1. What is the pupose of the statement of cash fows? 2. Prepare NHOCCA inceme statement for the year ended Deotmber 31,2016 . Uve the angle-she lemat, with ai revenues lited together and at expetises histed wogether 3. Phepare NRRC s bularce shees at Decenber 31,2016 . year ended Cocember 31, 2016. Requirement 3. Prepore NFRCis Burialoe shset at Decomber 31, 2016. H. HA (Cick the icon to view the dota] Fleod the ceviremets. Fheod twe swouiterents: a. On Jahuary 1, 2016. NP9C iasued no par commse stock for 3425, 090. b. Eary in Javuary. NFICC made the folowing cavh payments: 1. For store taturen, $45000 2. For merchandise inventoy, $320,000 3. For rett expense on a store bulthg: 513.000 c. Later in the yoat, NFPC purchased merchancte imvetory on accomt for $243,900 Bafore year-end, NFPCC paid \$153,000 of thes accomnt peyable d. Buine 2015, NFRPC sold 2,900 unite of marchandise invertory for 5350 each 4. The sore employs tree people. The combined armual peyrot is fot oog, ef which wepe ntlf ewes is ooo at year-end. 1. A the end of the yea. NHrC pais neome tax of \$21,900. Thee are no noome tacet payable 9. Lhe in 2616. Warec paid cosh divends of 144,006 gere iesioual vitua. Requirements 1. What is the pupose of the statenant of cash nowws? 1. Fhe is te pupose of the tatenant of cash hows? copenses entod tegether. 3. Preqare NRRCC's bence sheot at December 31, 2016. 3. Preale NrdzC's baence theot at orcemeer 31 , 2016. Prepare NigiCi natement of cath fs yeor anded December 31, 2016. National Reserve Rare Coins (NRRC) was formed on January 1, 2016. Additional data for the year follow: (Click the icon to view the data.) Read the Requirement 3. Prepare NRRC's balance sheet at December 31. 2016. Requirements 1. What is the purpose of the statement of cash flows? 2. Prepare NRRC's income statement for the year ended December 31, 2016. Use the single-step format, with all revenues listed together and all expenses listed together. 3. Prepare NRRC's balance sheet at December 31, 2016. 4. Prepare NRRC's statement of cash flows using the indirect method for the year ended December 31, 2016. a. On January 1, 2016, NRRC issued no par common stock for $425,000. b. Early in January, NRRC made the following cash payments: 1. For store fixtures, $45,000 2. For merchandise inventory, $320,000 3. For rent expense on a store building, $18,000 c. Later in the year, NRRC purchased merchandise inventory on account for $243,000. Before year-end, NRRC paid $153,000 of this account payable. d. During 2016, NRRC sold 2,100 units of merchandise inventory for $350 each. Before year-end, the company collected 85% of this amount. Cost of goods sold for the year was $280,000, and ending merchandise inventory totaled $283,000. e. The store employs three people. The combined annual payroll is $94,000, of which NRRC still owes $5,000 at year-end. f. At the end of the year, NRRC paid income tax of $21,000. There are no income taxes payable. g. Late in 2016, NRRC paid cash dividends of $44,000. h. For store fixtures, NRRC uses the straight-line depreciation method, over five years, with zero residual value. Requirement 3. Prepare NRRC's balance sheet at December 31, 2016