Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You own a building that is expected to pay annual cash flows forever. If the building is worth $2200000, the cost of capital is

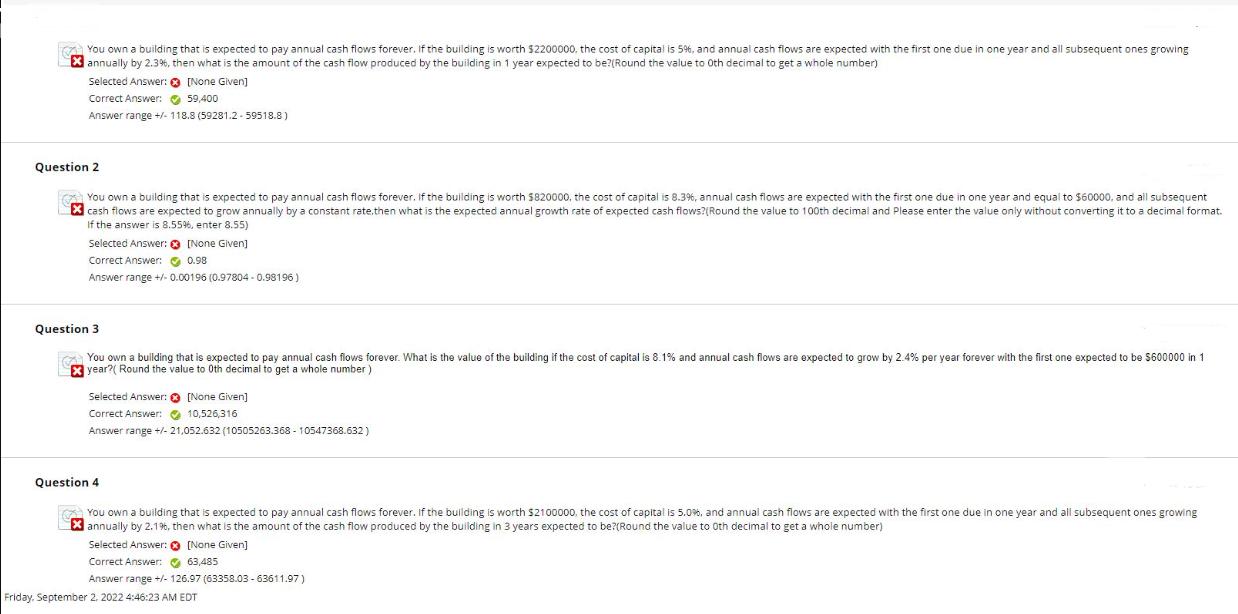

You own a building that is expected to pay annual cash flows forever. If the building is worth $2200000, the cost of capital is 5%, and annual cash flows are expected with the first one due in one year and all subsequent ones growing Xannually by 2.3% , then what is the amount of the cash flow produced by the building in 1 year expected to be? (Round the value to oth decimal to get a whole number) Selected Answer: [None Given] Correct Answer: 59,400 Answer range +/- 118.8 (59281.2 -59518.8) Question 2 You own a building that is expected to pay annual cash flows forever. If the building is worth $820000, the cost of capital is 8.3%, annual cash flows are expected with the first one due in one year and equal to $60000, and all subsequent Xcash flows are expected to grow annually by a constant rate.then what is the expected annual growth rate of expected cash flows?(Round the value to 100th decimal and Please enter the value only without converting it to a decimal format. If the answer is 8.55%, enter 8.55) Selected Answer: [None Given] Correct Answer: 0.98 Answer range +/- 0.00196 (0.97804-0.98196) Question 3 You own a building that is expected to pay annual cash flows forever. What is the value of the building if the cost of capital is 8.1% and annual cash flows are expected to grow by 2.4% per year forever with the first one expected to be $600000 in 1 X year?( Round the value to 0th decimal to get a whole number) Selected Answer: [None Given] Correct Answer: 10,526,316 Answer range +/- 21,052.632 (10505263.368-10547368.632) Question 4 You own a building that is expected to pay annual cash flows forever. If the building is worth $2100000, the cost of capital is 5.0%, and annual cash flows are expected with the first one due in one year and all subsequent ones growing Xannually by 2.1%, then what is the amount of the cash flow produced by the building in 3 years expected to be?(Round the value to 0th decimal to get a whole number) Selected Answer: [None Given] Correct Answer: 63,485 Answer range +/- 126.97 (63358.03-63611.97) Friday, September 2, 2022 4:46:23 AM EDT

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Solution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started