I WANT THIS FAST PLEASE

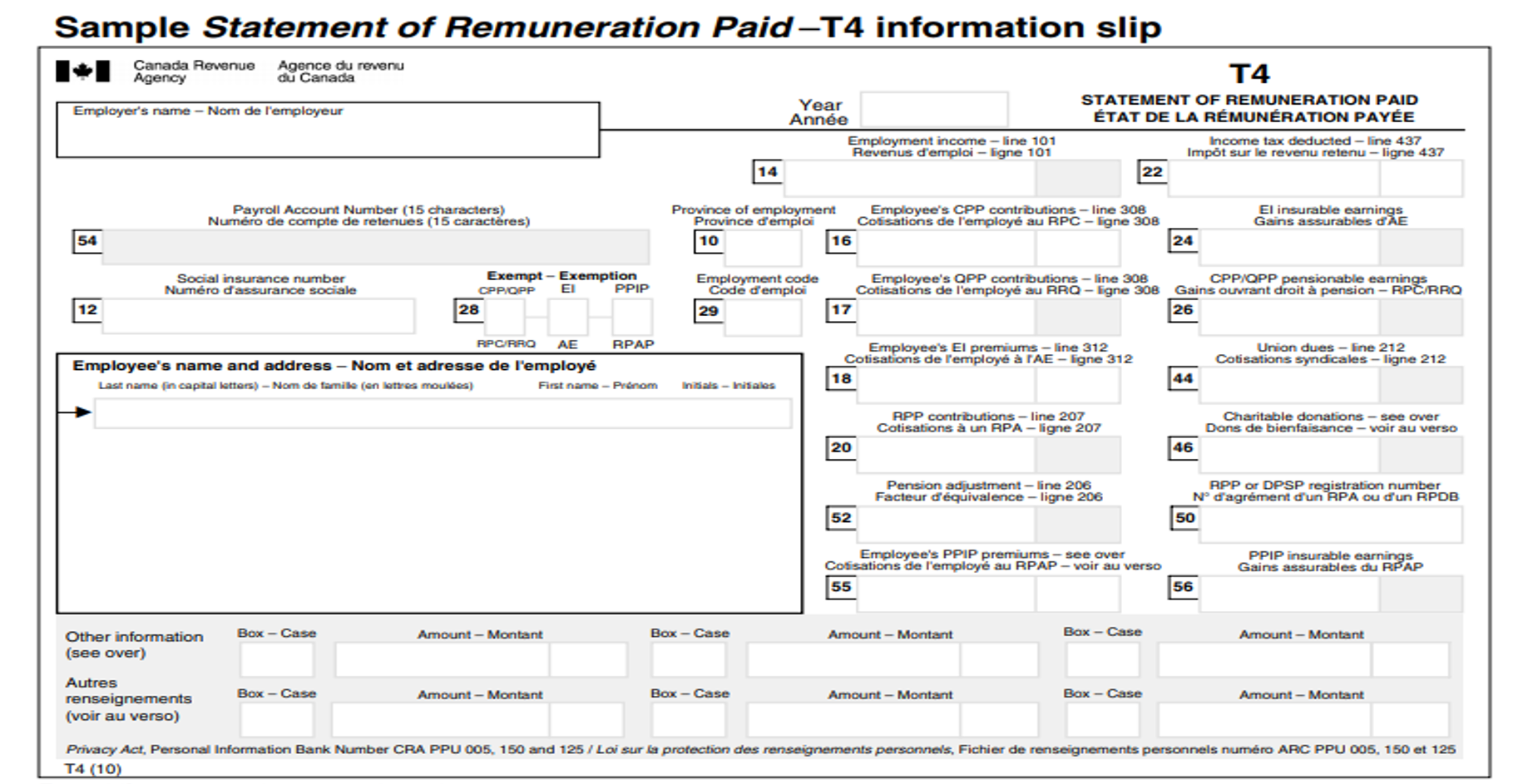

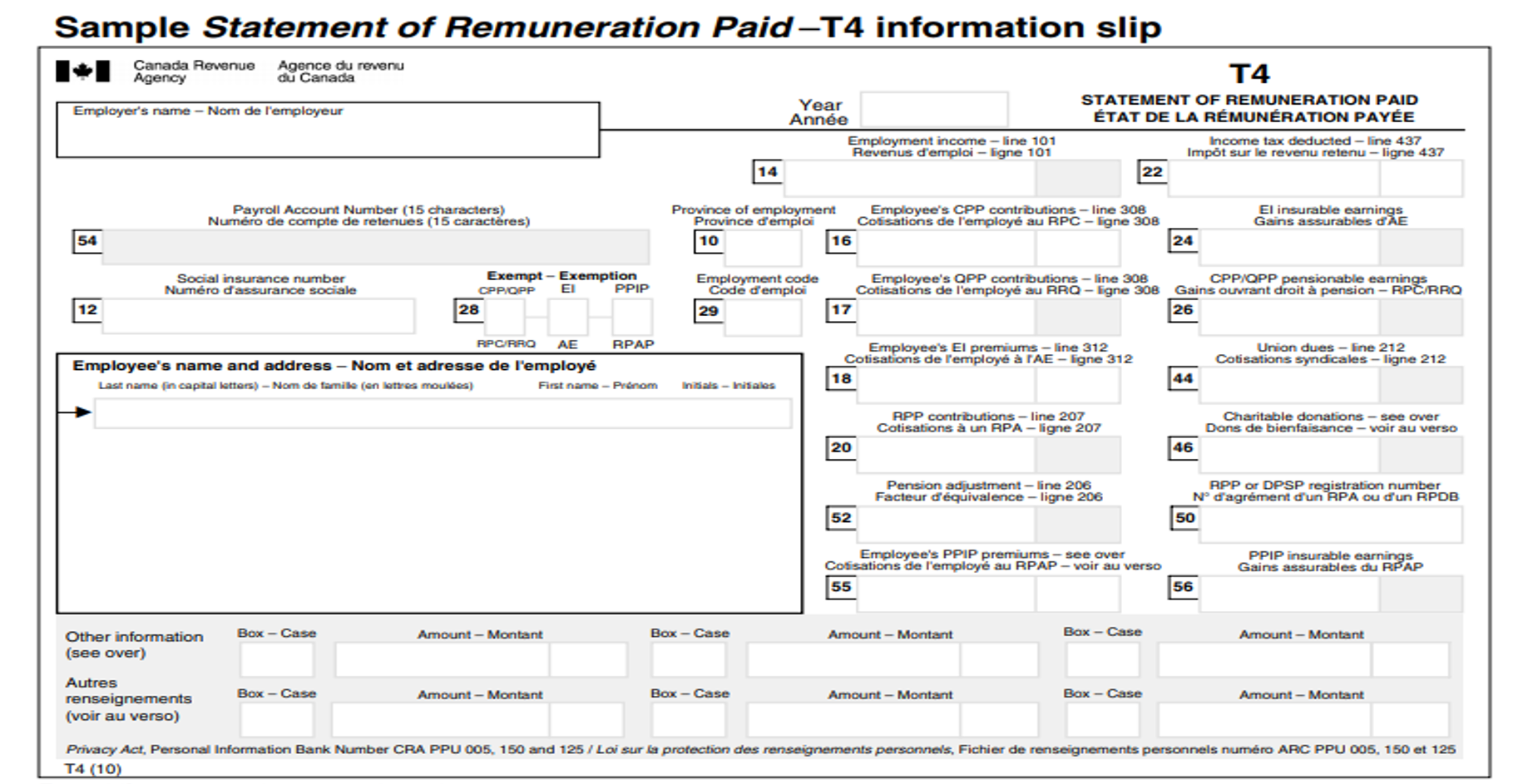

lot pay 6. Using the following information to fill out a T4 slip as if you are an employer. a business name CPP or QPP contributions of $1,127.36 an employee name and address El premiums of $415.15 123 456 789 as the employee's SIN union dues of $165.00 the tax year and the province of employment income tax of $2,917.68 employment income of $26,275.00 Sample Statement of Remuneration Paid-T4 information slip Canada Revenue Agency Agence du revenu du Canada Employer's name - Nom de l'employeur Year Anne Employment income-line 101 Revenus d'emploi - Egne 101 T4 STATEMENT OF REMUNERATION PAID TAT DE LA RMUNRATION PAYE Income tax deducted - line 437 Impt sur le revenu retenu - ligne 437 22 14 Payroll Account Number (15 characters) Numro de compte de retenues (15 caracteres) Province of employment Employee's CPP contributions - line 306 Province d'emploi Cotisations de l'employ au RPC - Egne 308 10 16 24 El insurable earnings Gains assurables d'AE 54 Social insurance number Numro d'assurance sociale Exempt - Exemption CPP/OPP PPIP 28 Employment code Code d'emploi 29 Employee's QPP contributions - line 308 Cotisations de l'employ au RRO-Egne 306 17 CPP/OPP pensionable earnings Gains ouvrant droit pension - RPCARRO 26 12 RPC/RRO AE RPAP Employee's name and address - Nom et adresse de l'employ Last name in capital letters) -Nom de familie (en lettres moules) First name - Prenom Employee's El premiums - line 312 Cotisations de l'employ TAE - Egne 312 18 Union dues - Ene 212 Cotisations syndicales - ligne 212 44 Indals-Insales RPP contributions-line 207 Cotisations un RPA-ligne 207 Charitable donations - see over Dons de bienfaisance - voir au verso 20 46 Pension adjustment-line 206 Facteur d'quivalence-ligne 206 RPP or DPSP registration number N d'agrment d'un RPA ou d'un BPDB 50 52 Employee's PPIP premiums - see over Cotisations de l'employ au BPAP - voir au verso 55 56 PPIP insurable earnings Gains assurables du RPAP Box - Case Amount - Montant Box - Case Amount - Montant Bax-Case Amount-Montant Other information (see over) Autres Box - Case renseignements Amount-Montant Box - Case Amount-Montant Bax - Case Amount-Montant (voir au verso) Privacy Act, Personal Information Bank Number CRA PPU 005, 150 and 125 / Loi sur la protection des renseignements personnels, Fichier de renseignements personnels numro ARC PPU 005, 150 et 125 T4 (10) lot pay 6. Using the following information to fill out a T4 slip as if you are an employer. a business name CPP or QPP contributions of $1,127.36 an employee name and address El premiums of $415.15 123 456 789 as the employee's SIN union dues of $165.00 the tax year and the province of employment income tax of $2,917.68 employment income of $26,275.00 Sample Statement of Remuneration Paid-T4 information slip Canada Revenue Agency Agence du revenu du Canada Employer's name - Nom de l'employeur Year Anne Employment income-line 101 Revenus d'emploi - Egne 101 T4 STATEMENT OF REMUNERATION PAID TAT DE LA RMUNRATION PAYE Income tax deducted - line 437 Impt sur le revenu retenu - ligne 437 22 14 Payroll Account Number (15 characters) Numro de compte de retenues (15 caracteres) Province of employment Employee's CPP contributions - line 306 Province d'emploi Cotisations de l'employ au RPC - Egne 308 10 16 24 El insurable earnings Gains assurables d'AE 54 Social insurance number Numro d'assurance sociale Exempt - Exemption CPP/OPP PPIP 28 Employment code Code d'emploi 29 Employee's QPP contributions - line 308 Cotisations de l'employ au RRO-Egne 306 17 CPP/OPP pensionable earnings Gains ouvrant droit pension - RPCARRO 26 12 RPC/RRO AE RPAP Employee's name and address - Nom et adresse de l'employ Last name in capital letters) -Nom de familie (en lettres moules) First name - Prenom Employee's El premiums - line 312 Cotisations de l'employ TAE - Egne 312 18 Union dues - Ene 212 Cotisations syndicales - ligne 212 44 Indals-Insales RPP contributions-line 207 Cotisations un RPA-ligne 207 Charitable donations - see over Dons de bienfaisance - voir au verso 20 46 Pension adjustment-line 206 Facteur d'quivalence-ligne 206 RPP or DPSP registration number N d'agrment d'un RPA ou d'un BPDB 50 52 Employee's PPIP premiums - see over Cotisations de l'employ au BPAP - voir au verso 55 56 PPIP insurable earnings Gains assurables du RPAP Box - Case Amount - Montant Box - Case Amount - Montant Bax-Case Amount-Montant Other information (see over) Autres Box - Case renseignements Amount-Montant Box - Case Amount-Montant Bax - Case Amount-Montant (voir au verso) Privacy Act, Personal Information Bank Number CRA PPU 005, 150 and 125 / Loi sur la protection des renseignements personnels, Fichier de renseignements personnels numro ARC PPU 005, 150 et 125 T4